|

|

Polished Diamond Prices Decline in September

RapNet Diamond Index (RAPI) for 1ct. Diamonds -4.7% in 3Q

Oct 7, 2014 9:42 AM

By Rapaport

|

|

|

RAPAPORT... PRESS RELEASE, October 7, 2014, New York ... Polished diamond prices fell in September as manufacturers were placed under increased pressure by tight liquidity and large inventories. There is steady U.S. and Chinese diamond demand but buyers are facing price sensitive consumers and are pushing for higher discounts. A buyers’ market prevails ahead of the holiday shopping season as prices continue to soften.

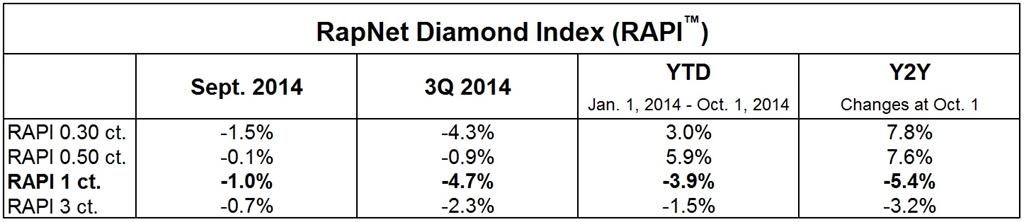

The RapNet Diamond Index (RAPI™) for 1-carat laboratory-graded diamonds fell 1 percent during September. RAPI for 0.30-carat diamonds declined 1.5 percent, while RAPI for 0.50-carat diamonds dropped by 0.1 percent. RAPI for 3-carat diamonds fell 0.7 percent during the month.

RAPI for all sizes fell during the third quarter, including 0.30-carat to 0.49-carat diamonds, which had been a strong item in the past two years. Buyers have shifted to lower-quality, larger pointer-size diamonds.

Copyright © by Martin Rapaport

According to the Rapaport Monthly Report – October 2014: “Buyers’ Market,” polished prices were influenced by both supply and demand factors.

There was a notable increase of goods available in the market, primarily as the Gemological Institute of America (GIA) continues to work through its backlog and release more goods in time for the holiday season. RapNet – Rapaport’s Diamond Trading Network witnessed an 11 percent increase in the volume of diamonds listed on the trading platform during September.

The September Hong Kong Jewellery and Gem Fair brought strong visitor traffic but buyers were looking for specific items to fill orders and avoided making large inventory purchases. Suppliers who lowered their prices sold well. The show signaled that there is good demand for 0.50-0.90 ct. GIA dossiers but profitability is low for these goods, while demand for 0.30-carat to 0.49-carat diamonds has softened. High-end large diamonds are weak and there has been a general shift away from D-F, IF-VVS diamonds toward lower colors and clarities in all sizes.

Rough trading slowed in September following aggressive rough buying in July and August. Manufacturers have ramped up their factory output in order to have their polished inventory ready before the Diwali break that begins on October 23. Rough was trading at discounts to De Beers prices on the secondary market before the October sight, which takes place from October 6 to 10. The October sight is expected to be relatively small with De Beers expected to maintain relatively stable prices until the end of the year as prices on the secondary market soften.

Polished suppliers are hoping the fourth quarter holiday season will improve diamond trading and help ease liquidity concerns. However, there is no indication of a turnaround in trading conditions for now. Buyers sense that suppliers are under pressure to improve their cash flow and are accordingly pushing for higher discounts. Following a weak third quarter, the trade enters the holiday shopping season in an environment that clearly favors buyers.

Read the attached Rapaport Monthly Report, "Buyers’ Market," at www.diamonds.net/report or email: specialreports@diamonds.net.

Rapaport Media Contacts: media@diamonds.net

U.S.: Sherri Hendricks +1-702-893-9400;

International: Lisa Miller +1-718-521-4976;

Mumbai: Manisha Mehta +91-97699-30065

About the Rapaport RapNet Diamond Index (RAPI™): The RAPI is based on the average asking price in hundred $/ct. for the top 25 quality 1 ct. round diamonds (D-H, IF-VS2, RapSpec-2 and better) with GIA grading reports offered for sale on RapNet – Rapaport Diamond Trading Network. The RAPI is provided for various sizes. www.RAPNET.com has daily listings of over 1.39 million diamonds valued over $7.95 billion and 13,736 members in 85 countries.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added value services that support the development of fair, transparent, efficient, and competitive diamond and jewelry markets. Established in 1978, the Rapaport Magazine is the primary source of diamond price and market information. Group activities include Rapaport Information Services providing research, analysis and news; RapNet – the world's largest diamond trading network; Rapaport Laboratory Services provides GIA gemological services in India, Belgium and Israel; and Rapaport Trading and Auction Services specializing in recycled diamonds and jewelry. The Group supports over 20,000 clients in 118 countries and employs 200 people with offices in New York, Las Vegas, Antwerp, Ramat Gan, Mumbai, Surat, Dubai and Hong Kong. Additional information is available at www.Diamonds.net.

Martin Rapaport (Publisher) grants limited permission to use copyrighted data appearing in this press release in and in conjunction with journalistic copy, reporting or articles concerning diamond pricing and information in graph or data presentation format only. The following credit notice must appear alongside, underneath, or in close proximity to any use of the copyrighted data: “Used with permission of Rapaport USA, Inc. Copyright © Martin Rapaport. All rights reserved.”

|

|

|

|

|

|

|

|

|

|

Tags:

De Beers, diamonds, Rapaport, RAPI, RapNet

|

|

|

|

|

|

|

|

|

|

|

|

|