|

RAPAPORT... Expectations are rising for next week’s Las Vegas shows. The various diamond and jewelry trade events that take place each year toward the end of May tend to signal the mood of the highly important U.S. market. That message affects all aspects of the diamond distribution chain.

By many accounts, diamond trading is not expected to boom at this year’s shows. However, the shows are expected to restore some confidence within the trade. After all, U.S. diamond demand has been stable in a weak global market place in 2014-15.

That should not be taken lightly given that the U.S. accounted for an estimated 45 percent of global consumer diamond jewelry demand in 2014, according to De Beers. More importantly, the U.S. is projected to maintain its market share through 2018, despite continued growth in China and India.

Diamond market sentiment has been weak as those emerging markets have experienced some growing pains this year and last. While growth in China stimulated industry growth in previous years, its apparent slowdown has naturally influenced an industry slowdown. The trade has consequently turned [back] to the U.S. for support. As the quintessential mature market, the U.S. tends to remain fairly constant, giving an appearance of underperforming in good times, and outperforming in weaker market conditions.

In truth, there remain some questions about the state of the U.S. diamond and jewelry market. While the positive accounts have been largely anecdotal from within the trade, reports from the retail sector have been mixed. Certainly Christmas was disappointing and government data suggests that jewelry sales have consistently fallen below previous year levels each month since October.

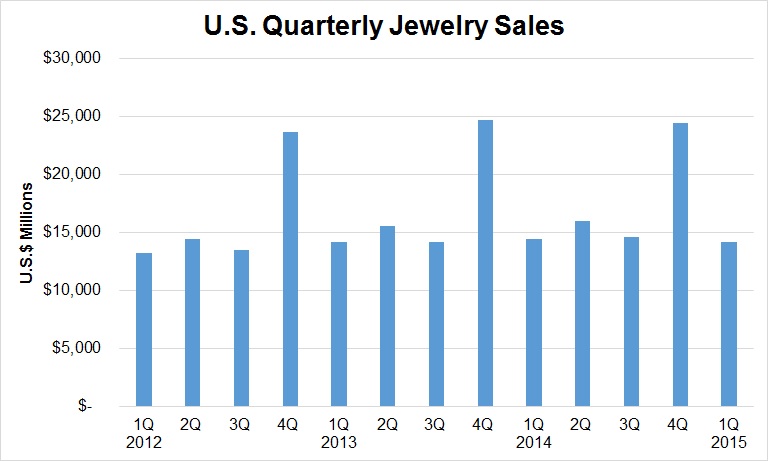

U.S. jewelry sales fell 1.1 percent year on year to $24.4 billion in the fourth quarter of 2014, and by 1.5 percent to $14.2 billion in the first quarter of this year, according to Rapaport estimates based on government data (see graph). Sales in specialty jewelry stores fell 5.6 percent to $6.3 billion in the first quarter, separate government data showed.

Rapaport calculations based on government data. Rapaport calculations based on government data.The numbers are far from encouraging. Some have suggested that the value of sales are down but volume is up as consumers are shifting to lower price points. It’s not clear whether volume has in fact increased as there are no official reports available to confirm the premise.

What is recognized is that the U.S. market is weighted toward smaller, lower-quality diamonds. The trade tends to refer to I1 to I2 clarity diamonds as “American” items, while De Beers estimated that about 75 percent of goods sold in the U.S. by volume are small sizes below 0.18 carats. Approximately 15 percent of goods sold are 0.18-carat to 0.99-carat sizes, and the remainder are larger than 1-carat in size. In contrast, about two-thirds of total diamond jewelry sales in China consist of those medium-size, 0.18-carat to 0.99-carat diamonds, according to De Beers.

The disparity in the U.S. signals a continued shift toward lower price points, particularly as middle income households remain under pressure despite the economic recovery. Stephen Lussier, De Beers executive vice president of marketing, acknowledged in a March 2015 interview with Rapaport News that middle-income households in the U.S. continue to be frugal but the market is being lifted by strength in the bridal sector and by affluent consumers who earn more than $150,000 a year.

Declining retail jewelry sales suggest that the core middle-income U.S. consumers are opting for lower diamond content in their jewelry purchases, perhaps with the exception of bridal. Non-diamond related jewelry sales appear to be more robust. Gold jewelry demand in the U.S. rose 4 percent to 22.4 tonnes in the first quarter of 2015, according to the World Gold Council, while a recent survey by National Jeweler, which is owned by Jewelers of America, showed that average silver jewelry sales increased 17 percent in 2014.

Still, there are mixed reports out there. Blue Nile noted weak demand from its high-end customers with declining sales of products priced above $50,000 during its first quarter that ended April 5.

Perhaps next week’s scheduled earnings release from Signet Jewelers and Tiffany & Co. will shed further light on such trends. The market will be waiting to hear from the respective jewelers about which of its lines are selling and which segments are strong, or weak.

However, while those comments and reports will be telling, the market will gain far more from observations and conversations in Las Vegas. The shows very much provide an opportunity for U.S. jewelry wholesalers and retailers to find stock for the rest of the year, and for jewelry manufacturers to showcase their designs that cater specifically to the U.S. market.

Diamantaires will be hoping both wholesalers and retailers will be looking to build some inventory for the rest of the year. After all, the first quarter diamond buying to replenish inventory sold during the Christmas season didn’t happen this year as it usually does. The weak government data hints at why that was the case.

U.S. independent jewelry retailers, at least, are managing with lower inventory levels and are no longer building up excess stock as they did in the past. They have had to focus on holding the right type of inventory as they have wrestled with lower margins since the 2008 downturn, Lussier explained.

However, there is a sense that they might now need goods for the rest of the year. After all, many will already be thinking of the upcoming Christmas shopping season, planning what lines to focus on for the various segments of the market.

Whether that will happen in Vegas remains to be seen. There is generally a lot of traffic and activity around the diamond pavilion at the JCK show, and there’s no reason that this shouldn’t be the case this year.

However, the first indicators about the state of the U.S. market will start at the Couture and JCK Luxury shows, which will signal how the high end is shaping up. The wider JCK show will subsequently point to how general retailers are interacting with their jewelry wholesale suppliers, perhaps most importantly in the bridal sections.

Consequently, the most important measure of a successful show for diamond dealers should not be the volume of trading conducted, but the prospects of doing business thereafter. That at least is what this writer will be looking out for in conversations with jewelry wholesalers, retailers and diamantaires in the coming weeks. After all, the U.S. has been good relative to other markets, even if it hasn’t been great. Therefore, one cannot underestimate the importance of the U.S. in what is expected to remain a tough global environment moving forward.

The writer can be contacted at avi@diamonds.net.

Follow Avi on Twitter: @AviKrawitz and on LinkedIn.

This article is an excerpt from a market report that is sent to Rapaport members on a weekly basis. To subscribe, go to www.diamonds.net/weeklyreport/ or contact your local Rapaport office.Copyright © 2015 by Martin Rapaport. All rights reserved. Rapaport USA Inc., Suite 100 133 E. Warm Springs Rd., Las Vegas, Nevada, USA. +1.702.893.9400.Disclaimer: This Editorial is provided solely for your personal reading pleasure. Nothing published by The Rapaport Group of Companies and contained in this report should be deemed to be considered personalized industry or market advice. Any investment or purchase decisions should only be made after obtaining expert advice. All opinions and estimates contained in this report constitute Rapaport`s considered judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Thank you for respecting our intellectual property rights. |