|

|

Rapaport TradeWire January 21, 2016

Jan 21, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

January 21, 2016

|

|

|

Polished prices firm due

to shortages. Rough demand improving as manufacturers try to fill gaps in

supply amid unconfirmed reports that De Beers has cut prices 5-7% at Jan.

sight. Demand is cautious due to weak global economy and plunging stock markets:

Dow -10% (Jan. 1-20), oil slumps below $30. Low expectations for Lunar New Year

as China’s 2015 GDP growth slows to 6.9%. Christmas retail season softer than first

reported as Tiffany Nov.-Dec. sales -6% to $961M. India Dec. polished exports

-17% to $1.2B, rough imports +2% to $1.5B. Rio Tinto 4Q production +50% to 4.3M

cts., Simon Trott replaces Jean-Marc Lieberherr as diamond chief.

|

|

| Diamonds |

1,065,756 |

| Value |

$7,943,642,792 |

| Carats |

1,222,034 |

| Average Discount |

-27.82% |

www.rapnet.com

|

|

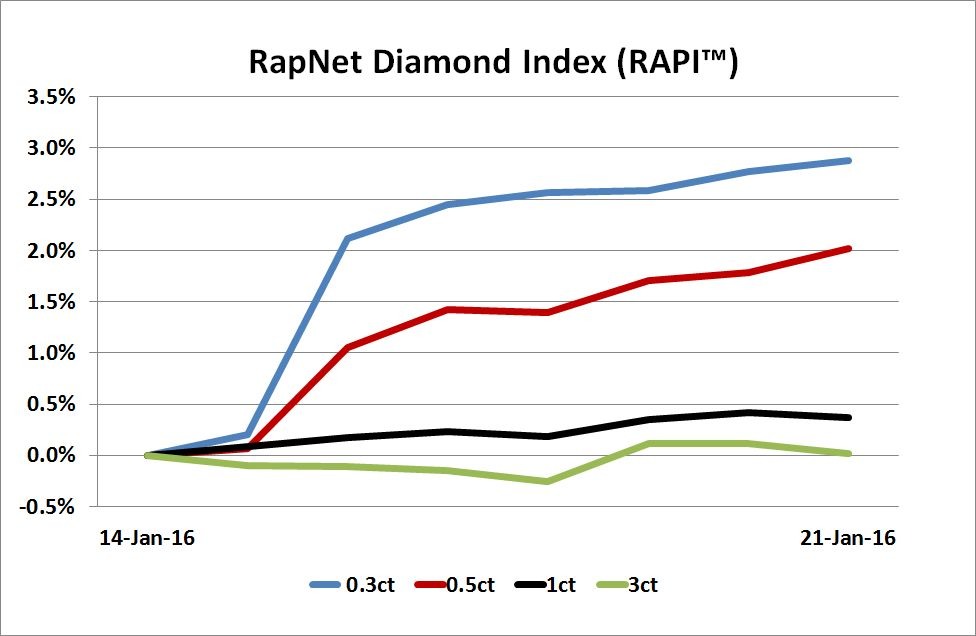

| The RapNet Diamond Index (RAPI) is the average price for the top 25 diamond qualities (D-H, IF-VS2). It is based on the 10 best priced diamonds for each quality. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

After such a difficult year, it seems that there are some reasons to be cautiously optimistic as 2016 begins, and we may be starting to recover some of the lost momentum.

After such a difficult year, it seems that there are some reasons to be cautiously optimistic as 2016 begins, and we may be starting to recover some of the lost momentum.

De Beers CEO Philippe Mellier in a speech at the sight in Gaborone this week

|

|

|

|

MARKETS

|

|

|

|

| |

United States: Mood improving and

dealers are looking for select goods. Liquidity is tight. Suppliers giving

higher discounts for cash deals, while buyers are insisting on credit terms...

Belgium: Dealers gaining in

confidence as polished prices firm. Shortages supporting prices with no substantial

rise in demand ahead of Chinese New Year. U.S. demand stable...

Hong Kong: Dealers filling

last-minute orders before the market shuts down for the Chinese New Year Spring

Festival (Feb. 8)...

India: Greater optimism about

the market as prices firm due to shortages. Trading improved since Diwali.

Suppliers still concerned about China as Chinese New Year demand is very soft...

Israel: Rising dealer confidence.

Polished prices firming due to limited availability of fine-cut goods and some

U.S. post-holiday and Chinese New Year demand...

Click here to continue reading

|

|

|

|

INDUSTRY

|

|

|

|

| |

Rapaport Releases Annual Price Statistics Report 2015

The Rapaport Group released its annual Diamond Price

Statistics Report for 2015, evaluating the performance of polished diamond prices.

The report provides an in-depth analysis of the trends in polished diamond

prices during the past year and it compares the price changes of specific

diamond categories.

The Rapaport Group released its annual Diamond Price

Statistics Report for 2015, evaluating the performance of polished diamond prices.

The report provides an in-depth analysis of the trends in polished diamond

prices during the past year and it compares the price changes of specific

diamond categories.

The Rapaport Diamond Price Statistics Report charts the progression of polished

diamond prices and indexes in various sizes throughout the year and across a

period of up to 37 years. In doing so, the report provides a complete study of

the history and current standing of the global diamond market.

To purchase the report, please visit: http://store.rapaport.com/

|

| |

India’s Polished Exports -17% in December

India’s polished diamond exports slumped 17% year

on year to $1.2 billion in December, according to provisional data from the Gem

& Jewellery Export Promotion Council. By volume, polished exports dropped 5%

to 1.9 million carats. Polished imports plummeted 46% to $239 million, leaving

net exports 4.6% lower at $964.3 million.

India’s polished diamond exports slumped 17% year

on year to $1.2 billion in December, according to provisional data from the Gem

& Jewellery Export Promotion Council. By volume, polished exports dropped 5%

to 1.9 million carats. Polished imports plummeted 46% to $239 million, leaving

net exports 4.6% lower at $964.3 million.

Rough diamond imports increased 2.4% to $1.47

billion and rough exports fell 7.3% to $99.6 million, leaving net imports 3.2%

higher at $1.37 billion. India’s net diamond account, which is calculated as

the difference between net polished exports and net rough imports, was negative

$402.2 million, compared with negative $313.4 million in December 2014.

|

| |

Leo Schachter Hires Sales VP

Polished diamond manufacturer

Leo Schachter Diamonds has appointed Frederick Goldman’s senior vice president

Joseph Green as its new executive VP of sales.

Polished diamond manufacturer

Leo Schachter Diamonds has appointed Frederick Goldman’s senior vice president

Joseph Green as its new executive VP of sales.

In his new role, Green is responsible for the development of the De Beers sightholder’s business supplying diamonds to independent retailers.

Green was senior vice-president at jewelry maker

Frederick Goldman for eight years. He

was also a VP at Ritani, a jewelry designer and manufacturer.

|

| |

Borsa Istanbul, WDM Sign Pact

Turkish exchange Borsa Istanbul signed an

agreement with the World Diamond Mark Foundation (WDM) to “institutionalize”

diamond trading in Turkey and other markets with which the bourse is connected.

Turkish exchange Borsa Istanbul signed an

agreement with the World Diamond Mark Foundation (WDM) to “institutionalize”

diamond trading in Turkey and other markets with which the bourse is connected.

The deal “cements the cooperation” between the

diversified Istanbul bourse and the WDM, the WDM said.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Tiffany’s Holiday Sales -6%

Tiffany & Co. reported

global sales in the two months to December 31 dropped 6% year on year to $961

million as a stronger U.S. dollar coupled with weaker tourist spending hit

revenue. The jeweler cut its guidance for full-year net earnings.

Tiffany & Co. reported

global sales in the two months to December 31 dropped 6% year on year to $961

million as a stronger U.S. dollar coupled with weaker tourist spending hit

revenue. The jeweler cut its guidance for full-year net earnings.

Even at constant exchange rate, worldwide sales

fell 3% during the 2015 holiday season as declines in the Americas and Asia

Pacific offset growth in Japan and Europe. Comparable-store sales worldwide

slid 5% ex-currency.

In the U.S., lower foreign-tourist spending in

New York and certain other markets in the country exacerbated the sales drop.

Total sales slumped 7% year on year to $505 million. Ex-currency, the dip was 5%

and comparable-store sales fell 8%.

|

| |

U.S. Jewelry Store Sales Rise in November

U.S. specialty jewelry store

sales rose 3.6% year on year to $2.6 billion in November, according to

provisional figures from the U.S. Census Bureau.

Sales in the first 11

months of 2015 fell 1% year on year to $24.69 billion.

U.S. specialty jewelry store

sales rose 3.6% year on year to $2.6 billion in November, according to

provisional figures from the U.S. Census Bureau.

Sales in the first 11

months of 2015 fell 1% year on year to $24.69 billion.

Total retail and food services

sales in the U.S. increased 1.6% to $448.58 billion in November, adjusted for

seasonal fluctuations.

|

| |

U.S. Holiday Sales +3%

U.S. holiday sales rose 3%

year on year to $626.1 billion despite unforeseen weather conditions and an

“extreme deflationary retail environment,” according to the National Retail

Federation (NRF). This total growth in retail revenue, which includes online

sales, lags the NRF’s 3.7-percent increase forecast for the season.

U.S. holiday sales rose 3%

year on year to $626.1 billion despite unforeseen weather conditions and an

“extreme deflationary retail environment,” according to the National Retail

Federation (NRF). This total growth in retail revenue, which includes online

sales, lags the NRF’s 3.7-percent increase forecast for the season.

Non-store holiday sales grew 9% to $105 billion. Retail sales in December – excluding

automobiles, gas stations and restaurants – increased 3.1% on an unadjusted

basis.

|

| |

U.S. Jewelry Prices Fall in December

The U.S. consumer price index

(CPI) for jewelry fell 0.4% in December from a month ago, according to the

Bureau of Labor Statistics. The inflation reading was 1% lower from a year

earlier.

The U.S. consumer price index

(CPI) for jewelry fell 0.4% in December from a month ago, according to the

Bureau of Labor Statistics. The inflation reading was 1% lower from a year

earlier.

The December CPI for watches slipped 1.6% from a

month ago and rose 0.8% from a year earlier, according to the U.S. labor data.

The CPI for all urban consumers declined 0.1% in December on a seasonally

adjusted basis.

|

|

|

|

MINING

|

|

|

|

| |

Rio Tinto’s 4Q Production +50%

Rio Tinto reported diamond

production surged 50% year on year to 4.3 million carats in the fourth quarter

that ended December 31.

Rio Tinto reported diamond

production surged 50% year on year to 4.3 million carats in the fourth quarter

that ended December 31.

The Argyle pit in the remote

East Kimberley region of Western Australia produced 3.4 million carats in the

three months, an 86-percent jump from a year ago. Production at the miner’s

Diavik mine in Canada slipped 3% to 899,000 carats.

Rio Tinto’s full-year

production for 2015 grew 25% to 17.4 million carats, below its guidance of 18 million carats issued on October 16. Total diamond production in 2016 is

forecast at 21 million carats, a 21-percent increase on 2015.

|

| |

Rockwell Diamonds’ 3Q Revenue -63%

Rockwell Diamonds reported

revenue decreased 63% year on year to $4.9 million (CAD 7.1 million) in the

third quarter that ended November 30 as diamond prices around the world dropped

and a fatality at the Remhoogte plant in South Africa caused a two-week

shutdown at the mine.

Rockwell Diamonds reported

revenue decreased 63% year on year to $4.9 million (CAD 7.1 million) in the

third quarter that ended November 30 as diamond prices around the world dropped

and a fatality at the Remhoogte plant in South Africa caused a two-week

shutdown at the mine.

The loss for the quarter nearly doubled to $6.4

million compared with the same period last year. Rough diamond sales declined

60% to $4.8 million, while beneficiation income – revenue from a deal with

polished-diamond manufacturer Diacore – slumped 89% to $106,606. The average

price per carat sold increased 16% to $1,328.

|

| |

Diavik Production -3% in 2015

Recovery levels from the Diavik

Diamond Mine in Canada fell 3% year on year to 1.5 million carats in the fourth

quarter that ended December 31, part-owner Dominion Diamond Corporation

reported. A 9-percent drop in processing volumes to 0.46% contributed to the

decline in extraction.

Recovery levels from the Diavik

Diamond Mine in Canada fell 3% year on year to 1.5 million carats in the fourth

quarter that ended December 31, part-owner Dominion Diamond Corporation

reported. A 9-percent drop in processing volumes to 0.46% contributed to the

decline in extraction.

Full-year recovery in 2015 fell 9% to 6.4

million carats, which was below the planned 7 million carats, Dominion said. Results

released by Dominion, which owns 40% of Diavik, are on a 100-percent basis. Rio

Tinto controls the remaining interest in the mine.

The companies plan to produce 7 million carats

at the mine in 2016, a 9% increase over the output in 2015. Together, they plan

to mine 2.1 million tonnes and process the same amount this year, according to

a preliminary plan.

|

| |

Rio Tinto’s Diamond Head to Depart

Jean-Marc Lieberherr, the

managing director of Rio Tinto’s diamonds business, is to leave the company as

part of a restructuring of the miner's diamonds and minerals product group.

Jean-Marc Lieberherr, the

managing director of Rio Tinto’s diamonds business, is to leave the company as

part of a restructuring of the miner's diamonds and minerals product group.

Lieberherr, who has held the position for two and a half years, will be replaced by Simon Trott, Rio Tinto said. Lieberherr had been with the company for ten years. Trott is currently managing director

of Rio Tinto’s salt and uranium businesses and will retain these

responsibilities.

|

| |

Lucapa’s Lulo Sales Hit Quarterly Record

Lucapa Diamond Company

reported revenues of $5.6 million (AUD 8.1 million) from three sales of

diamonds from the Lulo Diamond Project in Angola in the fourth quarter that

ended December 31.

Lucapa Diamond Company

reported revenues of $5.6 million (AUD 8.1 million) from three sales of

diamonds from the Lulo Diamond Project in Angola in the fourth quarter that

ended December 31.

The figure was the highest quarterly sales

result achieved by the miner to date, the company said. The average selling price was $1,468

per carat, the highest since mining commenced in January 2015.

|

|

|

|

GENERAL

|

|

|

|

| |

Rolex Exec. Elected JSA Chair

The board of the Jewelers’

Security Alliance (JSA) elected Rolex Watch U.S.A.’s chief executive officer

Stewart Wicht as its chairperson for a three-year term.

The board of the Jewelers’

Security Alliance (JSA) elected Rolex Watch U.S.A.’s chief executive officer

Stewart Wicht as its chairperson for a three-year term.

Wicht’s election was announced at a JSA annual

luncheon in New York on January 9. He

replaces Adam Heyman, who also served three years.

|

| |

WJA Chooses International Board

The Women's Jewelry

Association (WJA) elected Brandee Dallow, director of Rio Tinto Diamonds’ North

America representative office, as president of the WJA’s international board of

directors. Jenny Luker of Platinum Guild International will take on the president-elect

role. Dallow succeeds Andrea Hansen of LuxeIntelligence, who served for two

years in the position.

The Women's Jewelry

Association (WJA) elected Brandee Dallow, director of Rio Tinto Diamonds’ North

America representative office, as president of the WJA’s international board of

directors. Jenny Luker of Platinum Guild International will take on the president-elect

role. Dallow succeeds Andrea Hansen of LuxeIntelligence, who served for two

years in the position.

Two men have been elected to

the WJA board for the first time in the organization’s history: Craig Danforth

of the Gemological Institute of America as international affairs co-chair and

Benjamin Smithee of The Smithee Group, education chair.

|

| |

Three Convictions in Hatton Garden Heist

Three members of a gang were convicted in connection with a $20 million

(GBP 14 million) heist in London’s Hatton Garden diamond district, The

Guardian reported January 14.

Three members of a gang were convicted in connection with a $20 million

(GBP 14 million) heist in London’s Hatton Garden diamond district, The

Guardian reported January 14.

Carl Wood of Cheshunt, Hertfordshire; William Lincoln of Bethnal Green, east

London; and Hugh Doyle, of Enfield, north London, were found guilty by a court

in London January 14, the U.K. daily said.

A group of men drilled through a 50 centimeter-thick concrete wall to break

into the Hatton Garden Safe Deposit vault over the Easter weekend in 2015, the

report said. Some $12.8 million of the loot has not been recovered yet. A key

gang member nicknamed “Basil,” captured on camera with a wig of red hair, is

still at large.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Industry stocks suffered this past week as

global markets tumbled. U.S. retail declines were led by Birks Group (-22%), while

Tiffany fell 7.3% on disappointing holiday sales. Chow Sang Sang (-6.1%) headed

the Far East drops. Mining stocks were mixed, with declines led by Rockwell

(-16%) on poor 3Q results. Lypsa Gems (+27.5%) led the drops in India.

View the detailed industry stock report.

| |

Jan. 21 (11:45 GMT) |

Jan. 14 (11:45 GMT) |

Chng. |

|

| $1 = Euro |

0.92 |

0.91 |

0.002 |

|

| $1 = Rupee |

67.99 |

67.49 |

0.5 |

|

| $1 = Israel Shekel |

3.97 |

3.94 |

0.03 |

|

| $1 = Rand |

16.69 |

16.62 |

0.07 |

|

| $1 = Canadian Dollar |

1.45 |

1.44 |

0.01 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,099.25 |

$1,092.25 |

$7.00 |

0.6% |

| Platinum |

$818.26 |

$844.88 |

-$26.62 |

-3.2% |

| Silver |

$14.03 |

$14.09 |

-$0.06 |

-0.4% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

23,962.21 |

24,772.97 |

-810.76 |

-3.3% |

| Dow Jones |

15,766.74 |

16,151.41 |

-384.67 |

-2.4% |

| FTSE |

5,697.07 |

5,842.17 |

-145.10 |

-2.5% |

| Hang Seng |

18,542.15 |

19,817.41 |

-1,275.26 |

-6.4% |

| S&P 500 |

1,859.33 |

1,890.28 |

-30.95 |

-1.6% |

| Yahoo! Jewelry |

969.60 |

981.65 |

-12.05 |

-1.2% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Greater optimism about

the market as prices firm due to shortages. Trading improved since Diwali.

Suppliers still concerned about China as Chinese New Year demand is very soft. Weak

emerging markets weighing on sentiment with rupee sinking below INR 68/$ to

near record lows. Weak currency reducing domestic demand, but helping exports. Rough

improving during sight week as manufacturers are slightly increasing polished

production to fill shortages.

Read the Polished Diamond Trading Report

|

|

|

Advertisements

|

|

|

Advertisements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|