|

|

Rapaport TradeWire April 14, 2016

Apr 14, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

April 14, 2016

|

|

|

Rough markets firm as De Beers sells $660M in sales

cycle 3 (April) following $617M in cycle 2 (Feb.) Steady mid-single-digit

premiums for many De Beers boxes. Dealers speculating on over-priced big stone

rough but demand for larger polished is weak. Polished markets slowing. China

clamping down on overseas luxury purchases with 15% tax on jewelry imports by

“daigou” tourist shoppers and online buyers. Chow Tai Fook 3Q sales -26%

impacted by Chinese tourists moving purchases overseas. LVMH 1Q watch &

jewelry revenue +7% to $884M. Dominion 2015 revenue -21% to $721M, loss of $34M

vs. profit of $67M. U.S. Feb. polished imports +0.3% to $1.8B, polished exports

+10% to $2B.

|

|

| Diamonds |

1,151,181 |

| Value |

$7,896,534,093 |

| Carats |

1,256,535 |

| Average Discount |

-28.16% |

www.rapnet.com

|

|

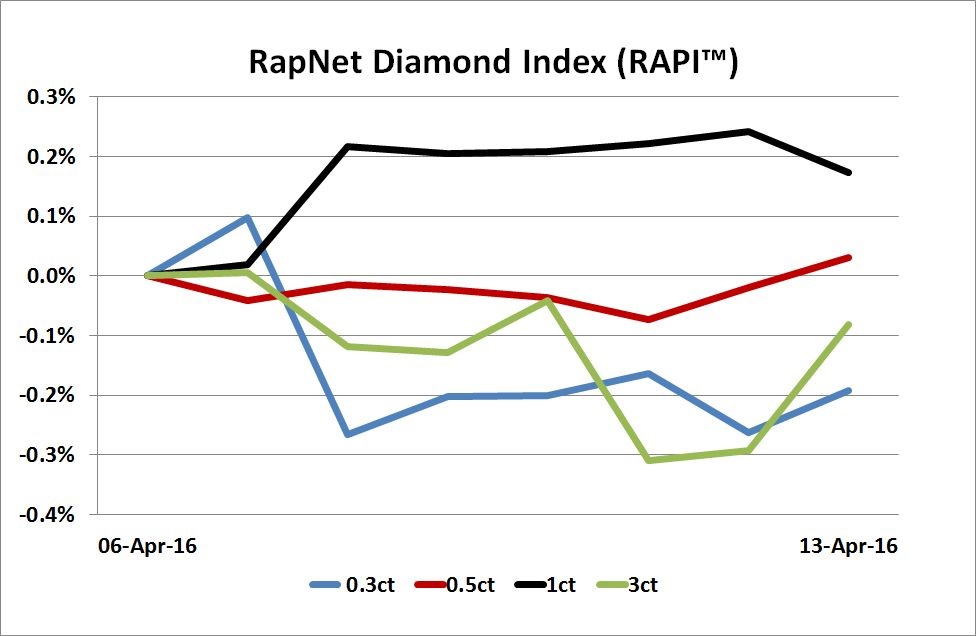

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

So far, 2016 has seen significantly stronger rough diamond demand than that experienced at the end of 2015 as the actions taken by the industry continue to have a positive effect.

So far, 2016 has seen significantly stronger rough diamond demand than that experienced at the end of 2015 as the actions taken by the industry continue to have a positive effect.

Philippe Mellier, CEO of De Beers, on the miner’s latest rough sales increase

|

|

|

|

MARKETS

|

|

|

|

| |

United

States:

Polished trading slows in April. Steady demand

for bread-and-butter 0.30 to 1.99 ct., G-J, SI-I2 diamonds. Suppliers holding

prices firm while buyers find it difficult to fill specific orders...

Belgium: The market is stable. Good dealer demand for

specialty items such as fancy color and certain fancy shape diamonds. Pears and

ovals steady, cushions slower and princess cuts weak...

Israel: Polished trading cautious amid tough market for

large diamonds. Sluggish activity in April with dealers ready to take vacation

during 7-day Passover holiday (April 22-28)...

India:

Trading slowed in the past two weeks after

positive first quarter. Buyers resisting higher prices for new polished supply.

Good Far East demand for GIA dossiers with some shortages in RapSpec A2

diamonds...

Hong

Kong: Polished demand is order specific and there is

very little buying for inventory. Fancy colors doing better than colorless

stones with good demand for rare pink and blue diamonds...

Click here for deeper analysis

|

|

|

|

|

|

INSIGHTS

|

|

|

|

| |

Will Upbeat Rough Demand Slow the Diamond Market Recovery?

Rough diamond trading was surprisingly upbeat in April given that polished demand is restrained and inventory levels continue to rise. After a good first quarter, in which rough and polished trading was driven by restocking of the midstream, concern deepened this month that an oversupply of polished diamonds will pressure the market…

Click here to continue reading

|

|

|

|

INDUSTRY

|

|

|

|

| |

De Beers April Sales Rise to $660M

De Beers reported sales of

rough diamonds jumped to $660 million in its April cycle as stability in both

polished prices and wholesale activity supported solid demand.

De Beers reported sales of

rough diamonds jumped to $660 million in its April cycle as stability in both

polished prices and wholesale activity supported solid demand.

Sales were 7% above the February second-cycle

revenue, which was revised up to $617 million. The result compares with an

estimated $536 million of sales recorded in the third sight a year ago and is

also significantly stronger than the sights in the second half of 2015,

according to Rapaport News records.

Amid strong demand in the

first quarter, De Beers increased prices by low single-digit percentages.

|

| |

China Hikes Taxes on Informal Jewelry Imports

Chinese authorities have moved

to crack down on a "gray" market in luxury imports by raising taxes

on jewelry and watches.

Chinese authorities have moved

to crack down on a "gray" market in luxury imports by raising taxes

on jewelry and watches.

The government increased tariffs on watches ordered from

abroad to 60% from 30% and on jewelry to 15% from 10% effective from April 8, according to a Reuters report.

The measures are directed at individual shoppers

– known as ‘daigous’ – who bring suitcases full of luxury goods into the

country and then resell them in person or online.

|

| |

Indian Jewelers End Six-Week Strike

Indian jewelers called off a strike against a 1% tax after

about six weeks amid signs that the government will not budge on the new excise

duty.

Indian jewelers called off a strike against a 1% tax after

about six weeks amid signs that the government will not budge on the new excise

duty.

At least 90% of jewelers around the country returned

to work April 13 but negotiations between the All India Gems & Jewellery

Trade Federation and the government continue, a spokesperson for the industry body

said.

The end of the strike comes at an opportune time ahead of

the festival of Akshaya Tritiya on May 9, which Indians mark by buying gold.

|

| |

U.S. Polished Exports Leap in February

The U.S. trade in polished

diamonds showed an uptick in February as exports jumped 10%, while imports were

steady.

The U.S. trade in polished

diamonds showed an uptick in February as exports jumped 10%, while imports were

steady.

Imports of cut diamonds nudged up 0.3% year on

year to $1.75 billion, with the average price rising 4.6% to $2,273 per carat.

Inbound shipments by weight fell 4%.

Polished diamond exports, meanwhile, jumped 10%

to $1.97 billion despite a decrease in total volume as the average price per

carat soared 39% to $1,537 per carat.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Pink Diamond Tops Sotheby’s Geneva Billing

Sotheby’s expects to sell a

15.38 carat "supremely rare" pink diamond for $28 million to $38 million

(CHF 27.2 million to CHF 36.9 million) at an auction in Geneva next month.

Sotheby’s expects to sell a

15.38 carat "supremely rare" pink diamond for $28 million to $38 million

(CHF 27.2 million to CHF 36.9 million) at an auction in Geneva next month.

The pear-shape, type IIa diamond known as the

“Unique Pink” will go under the hammer at the Magnificent Jewels and Noble

Jewels auction May 17. It is the largest fancy vivid pink pear-shaped diamond

to be offered at auction.

|

| |

Chow Tai Fook’s Sales Hit by China, Hong Kong Downturn

Chow

Tai Fook reported quarterly same-store sales from China and Hong Kong plunged

as a weaker consumer sentiment and the region’s economic slowdown dampened

performance.

Chow

Tai Fook reported quarterly same-store sales from China and Hong Kong plunged

as a weaker consumer sentiment and the region’s economic slowdown dampened

performance.

Same-store revenues dived 26% in the fourth

fiscal quarter that ended March 31, the Hong Kong-based jewelry retailer said, with

total sales dropping 26%, or 22% ex-currency. Gem-set jewelry sales fell 23%.

|

| |

U.S. Jewelry Store Revenues Hit High in February

U.S. jewelry store sales in a seasonally-strong February surpassed the highest level the month has seen in years as shoppers ploughed $2.66 billion in specialist retailers.

U.S. jewelry store sales in a seasonally-strong February surpassed the highest level the month has seen in years as shoppers ploughed $2.66 billion in specialist retailers.

Sales in the month that includes Valentine’s Day jumped 7.7% from a year ago, according to the U.S. Census Bureau. The increase appears to validate an upward trend seen in an earlier data release that showed a 4.5% rise in jewelry and watch revenues across all retail outlets in February.

|

| |

LVMH’s 1Q Jewelry & Watch Revenue Rises

LVMH Moët Hennessy Louis

Vuitton’s watch and jewelry sales jumped 7% in the first quarter driven by the Bulgari brand and the company's connected

smartwatch.

LVMH Moët Hennessy Louis

Vuitton’s watch and jewelry sales jumped 7% in the first quarter driven by the Bulgari brand and the company's connected

smartwatch.

With sales of $884.1 million (EUR 774 million),

watches and jewelry was the luxury group’s joint fastest-growing business group

by revenue in the three months to March 31, alongside perfumes and cosmetics.

|

| |

New Zealand, U.S. Growth Boosts Michael Hill's Sales

Michael Hill reported revenue

jumped 9.1% year on year to $320.2 million (AUD 420.8 million) in its first

three fiscal quarters as sales advanced in each of its regional divisions.

Michael Hill reported revenue

jumped 9.1% year on year to $320.2 million (AUD 420.8 million) in its first

three fiscal quarters as sales advanced in each of its regional divisions.

Total same-store sales rose 5.1% in the nine

months to March 31, the New Zealand-based jeweler said. The biggest same-store

revenue increase in local currency terms was recorded on the home turf, at 6.5%,

while the U.S. registered the fastest growth in all sales with a 29% surge.

|

|

|

|

MINING

|

|

|

|

| |

Dominion Swings to Loss in Fiscal 2016

Dominion Diamond Corporation

declared a net loss in fiscal 2016. This was due to a weaker diamond market coupled with

lower gem prices throughout the year, which cut revenue from the company's two

Canadian mines.

Dominion Diamond Corporation

declared a net loss in fiscal 2016. This was due to a weaker diamond market coupled with

lower gem prices throughout the year, which cut revenue from the company's two

Canadian mines.

The

company recorded a $38.8 million loss over a year to January 31, compared with

a profit of $73.6 million in fiscal 2015. Sales dived 21% to $720.6 million as

revenue from the Ekati mine that the company owns outright slid 18% and the

Diavik pit, where Dominion has a 40% ownership, suffered a 27% drop.

|

| |

Lucapa’s Lulo Mine Posts Record 1Q Sales

Lucapa Diamond

Company said quarterly diamond sales from its Lulo project in Angola hit a

record after the largest diamond in the

nation’s history fetched a staggering $16 million.

Lucapa Diamond

Company said quarterly diamond sales from its Lulo project in Angola hit a

record after the largest diamond in the

nation’s history fetched a staggering $16 million.

Revenue in the three months to March 31 surged

to $23.1 million, which is more than double the total sales for 2015, with the

average price catapulting to $11,983 per carat from a sale of 1,931 carats.

Sales at the Lulo Diamond Project commenced in the second quarter of last year.

|

| |

India Plans Diamond-Mine Auction Debut

India is set to auction off a

diamond mine for the first time, according to a Reuters report that cited

India’s mines secretary Balvinder Kumar.

India is set to auction off a

diamond mine for the first time, according to a Reuters report that cited

India’s mines secretary Balvinder Kumar.

The Indian state of Madhya Pradesh in the center

of the country plans to float tenders for the auction of the 136-hectare

Hatupur block, with the process likely to be completed in “about forty days,”

according to the report. The mine has 604,336 tonnes of mineral

resources.

|

|

|

|

GENERAL

|

|

|

|

| |

Bain Predicts Luxury Uptick

Demand for personal luxury

goods in the U.S. and China is set for resurgence next year, lifting growth in

the $285 billion (EUR 250 billion) market that hit a trough in 2016, according

to a Reuters report.

Demand for personal luxury

goods in the U.S. and China is set for resurgence next year, lifting growth in

the $285 billion (EUR 250 billion) market that hit a trough in 2016, according

to a Reuters report.

Luxury sales will grow about 1% at constant

exchange rates this year compared with a 1.5% increase in 2015, the news agency

reported, citing Bain & Co. Over the next five years, the personal luxury goods industry will

grow 2% to 3% per annum.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Mining stocks strengthened this past week as investor confidence was buoyed by De Beers latest increase in rough sales. The diamond producer's parent, Anglo American (+30%), led the rises, followed by Petra Diamonds (+15%) and Rio Tinto (+15%). Several U.S. stocks dipped, headed by Nordstrom (-5%) and JC Penney (-4.9%), in a week that saw disappointing nationwide retail figures for March. In the Far East, Chow Tai Fook advanced 8.1% despite reporting a large quarterly sales decline.

View the detailed industry stock report.

| |

Apr. 14 (10:49 GMT) |

Apr. 7 (10:47 GMT) |

Chng. |

|

| $1 = Euro |

0.89 |

0.88 |

0.01 |

|

| $1 = Rupee |

66.59 |

66.56 |

0.0 |

|

| $1 = Israel Shekel |

3.79 |

3.78 |

0.01 |

|

| $1 = Rand |

14.53 |

15.20 |

-0.67 |

|

| $1 = Canadian Dollar |

1.28 |

1.31 |

-0.03 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,240.18 |

$1,236.41 |

$3.77 |

0.3% |

| Platinum |

$991.00 |

$954.50 |

$36.50 |

3.8% |

| Silver |

$16.12 |

$15.18 |

$0.94 |

6.2% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

25,626.75 |

24,685.42 |

941.33 |

3.8% |

| Dow Jones |

17,908.28 |

17,716.05 |

192.23 |

1.1% |

| FTSE |

6,360.00 |

6,162.13 |

197.87 |

3.2% |

| Hang Seng |

21,337.81 |

20,266.05 |

1,071.76 |

5.3% |

| S&P 500 |

2,082.42 |

2,066.66 |

15.76 |

0.8% |

| Yahoo! Jewelry |

1,124.51 |

1,087.12 |

37.39 |

3.4% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Trading slowed in the past two weeks after

positive first quarter. Buyers resisting higher prices for new polished supply.

Good Far East demand for GIA dossiers with some shortages in RapSpec A2

diamonds. U.S. demand stable. Domestic Indian demand cautious. Jewelry

retailers end strike ahead of popular gold buying season.

Rough trading steady with De Beers boxes selling at mid-single-digit premiums

on the secondary market.

Read the Polished Diamond Trading Report

|

|

|

Advertisements

|

|

|

Advertisements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|