|

|

Rapaport TradeWire July 7, 2016

Jul 7, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

July 7, 2016

|

|

|

Diamond

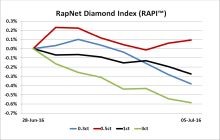

markets weak as U.S. dealers take vacation. Polished prices softening with June

RAPI 1 ct. -0.5%, 0.30 ct. -1.6%, 0.50 ct. -0.4%, 3 ct. -2.4%. Yuan currency cut

to 5-year low (6.69/$1) may impact Chinese jewelry imports and tourist

spending. Global 2015 rough production -4% to $13.9B, volume +2% to 127.4M

cts., average price -6% to $109/ct. Dominion lowers 2016 Ekati production plan -16%

to 4.7M cts after $19M fire damage. Petra sells 121.26 ct. Cullinan rough for

$6M ($49,480/ct.) to Nemesis International and Golden Yellow Diamonds. U.S. May

polished imports +2% to $3.1B, polished exports -1% to $1.4B.

|

|

| Diamonds |

1,206,152 |

| Value |

$7,961,138,543 |

| Carats | 1,293,426 |

| Average Discount |

-29.78% |

www.rapnet.com

|

|

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

Manual methods of cutting, polishing, manufacturing and designing of gems and jewelry need to be substituted with high-end machines and software.

Manual methods of cutting, polishing, manufacturing and designing of gems and jewelry need to be substituted with high-end machines and software.

D.S. Rawat, secretary general of the Associated Chambers of Commerce & Industry of India, calls for better working conditions in the country's gems and jewelry trade.

|

|

|

|

MARKETS

|

|

|

|

| |

United States: Market quiet with

dealers on vacation and NY Diamond Dealers Club closed from July 1 to 11. Some

U.S. buyers in India and Israel looking for bargains during slow period…

Belgium: Sentiment relatively

weak. Some improvement since Hong Kong show but polished prices continue to

soften. Suppliers trying to hold out until August vacation period…

Israel: Polished trading slow.

Dealers uncertain about future raise expectations for bourse initiatives to

improve trading. Difficult to compete with Indian suppliers on commercial goods

as prices soften and profit margins tighten…

India: Sentiment relatively

weak since Hong Kong show. Trading slow during summer months with few foreign

buyers in Mumbai. Domestic Indian demand cautious with subdued expectations for

IIJS Mumbai show (August 4 to 8)…

Hong Kong: Market remains

challenging with retailers consolidating on sluggish consumer sentiment and

slower tourist traffic. China better than Hong Kong but Chinese buyers cautious

as yuan currency weakens to five-year low (6.69/$1)…

Click here for deeper analysis

|

|

|

|

|

|

RAPAPORT STATEMENT

|

|

|

|

| |

Diamond Prices Slide in June

Polished diamond prices fell in June and sentiment softened after relatively weak Las Vegas and Hong Kong shows. Steady U.S. demand is supporting the market but overall demand is sluggish. Brexit, the U.S. election and continued weakness in China’s luxury sector are fueling uncertainty...

Click here to read statement

|

|

|

|

INDUSTRY

|

|

|

|

| |

Russia Gains as Global Diamond Output Falls

Global rough

diamond production fell 4.2% to $13.88 billion in 2015 recording its first

annual decline in three years, Kimberley Process data showed. Output by volume

increased 2.1% to 127.4 million carats, while the average price of production

dropped 6.2% to $108.96 per carat. Russia extended its lead over Botswana

as the world’s largest producer.

Global rough

diamond production fell 4.2% to $13.88 billion in 2015 recording its first

annual decline in three years, Kimberley Process data showed. Output by volume

increased 2.1% to 127.4 million carats, while the average price of production

dropped 6.2% to $108.96 per carat. Russia extended its lead over Botswana

as the world’s largest producer.

|

| |

ABN AMRO Sees Rough Prices Declining

Rough diamond

prices are likely to fall as “fragile” consumer demand for jewelry does not

justify higher prices, ABN AMRO said in a report. A surge in rough prices so

far this year is not sustainable and may have resulted from traders’

opportunistic behavior, the researchers explained.

Rough diamond

prices are likely to fall as “fragile” consumer demand for jewelry does not

justify higher prices, ABN AMRO said in a report. A surge in rough prices so

far this year is not sustainable and may have resulted from traders’

opportunistic behavior, the researchers explained.

|

| |

Shrenuj Defends Position After Asset Seizure

Shrenuj &

Co is seeking legal advice to challenge an order obtained by ICICI Bank to

seize its assets and prevent senior management from leaving India. ICICI in May

appointed a receiver on Shrenuj Far East Limited, the diamond manufacturer’s Hong Kong subsidiary. The bank then pursued an order to add Shrenuj’s Indian

inventory to its control. Shrenuj assured the Bombay Stock Exchnage the

situation will not significantly affect the business.

Shrenuj &

Co is seeking legal advice to challenge an order obtained by ICICI Bank to

seize its assets and prevent senior management from leaving India. ICICI in May

appointed a receiver on Shrenuj Far East Limited, the diamond manufacturer’s Hong Kong subsidiary. The bank then pursued an order to add Shrenuj’s Indian

inventory to its control. Shrenuj assured the Bombay Stock Exchnage the

situation will not significantly affect the business.

|

| |

U.S. Polished Imports Rise

U.S.

polished diamond imports increased 2.3% year on year to $3.09 billion in May, typically

the country's strongest month when goods arrive for the Las Vegas shows.

Polished exports declined 1.1% to $1.37 billion, leaving net polished imports

5.1% higher at $1.72 billion. The U.S.

net diamond account jumped 11 percent to $1.82 billion for the month.

U.S.

polished diamond imports increased 2.3% year on year to $3.09 billion in May, typically

the country's strongest month when goods arrive for the Las Vegas shows.

Polished exports declined 1.1% to $1.37 billion, leaving net polished imports

5.1% higher at $1.72 billion. The U.S.

net diamond account jumped 11 percent to $1.82 billion for the month.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Tanishq Gains in Gold-Buying Season

Titan

Company expects its flagship Tanishq brand gained market share during the

Akshaya Tritiya weekend in May, traditionally a time for buying gold. Sales

grew while some competitors declined as much as 30%, the company said. The brand

had a decent June fiscal quarter despite losing 15 trading days due to a nationwide jewelers’ strike. Stricter rules about presenting

identity cards when buying jewelry also impacted sales, Titan

said.

Titan

Company expects its flagship Tanishq brand gained market share during the

Akshaya Tritiya weekend in May, traditionally a time for buying gold. Sales

grew while some competitors declined as much as 30%, the company said. The brand

had a decent June fiscal quarter despite losing 15 trading days due to a nationwide jewelers’ strike. Stricter rules about presenting

identity cards when buying jewelry also impacted sales, Titan

said.

|

| |

Birks Group Returns to Profit

Birks Group

swung to a profit of $5.4 million in fiscal 2016 versus a loss of $8.6 million the previous year. Comparable store sales advanced 3%

even as total revenue fell 5.2% to $285.8 million, weighed by the strengthening of the U.S. dollar against its Canadian counterpart. The performance was driven by new

store designs, new collections and marketing campaigns, Birks explained.

Birks Group

swung to a profit of $5.4 million in fiscal 2016 versus a loss of $8.6 million the previous year. Comparable store sales advanced 3%

even as total revenue fell 5.2% to $285.8 million, weighed by the strengthening of the U.S. dollar against its Canadian counterpart. The performance was driven by new

store designs, new collections and marketing campaigns, Birks explained.

|

|

|

|

MINING

|

|

|

|

| |

Large Cullinan Diamond Fetches $6M

Petra

Diamonds sold a 121.26-carat rough diamond for $6 million in June. A joint venture between Nemesis International and

Golden Yellow Diamonds bought the diamond for $49,480 per carat. The diamond was recovered at

the Cullinan mine in South Africa.

Petra

Diamonds sold a 121.26-carat rough diamond for $6 million in June. A joint venture between Nemesis International and

Golden Yellow Diamonds bought the diamond for $49,480 per carat. The diamond was recovered at

the Cullinan mine in South Africa. |

| |

Dominion Cuts Ekati Forecast, CFO to Leave

Dominion Diamond

Corporation lowered its production guidance at the Ekati mine for this fiscal

year to 4.7 million carats from 5.6 million carats previously planned. The mine’s processing plant is

shutting for three months following a fire with repairs estimated at $19.3

million.

Dominion Diamond

Corporation lowered its production guidance at the Ekati mine for this fiscal

year to 4.7 million carats from 5.6 million carats previously planned. The mine’s processing plant is

shutting for three months following a fire with repairs estimated at $19.3

million.

The miner also announced the departure of chief financial officer Ron

Cameron, effective July 15. Cara

Allaway, currently vice-president

group controller, will temporarily fill the role until Dominion finds a

permanent replacement.

|

| |

De Beers Allowed to Flood Snap Lake

De Beers received

permission to flood the tunnels of the Snap Lake mine in Canada’s Northwest

Territories after suspending operations due to poor market conditions.

The company is considering whether to sell, close, re-open or continue

suspension at the mine, which it put onto care and maintenance in December. The

mine yielded 1.2 million carats in 2015 but hasn't made money since production began in 2008, according to a Reuters report.

De Beers received

permission to flood the tunnels of the Snap Lake mine in Canada’s Northwest

Territories after suspending operations due to poor market conditions.

The company is considering whether to sell, close, re-open or continue

suspension at the mine, which it put onto care and maintenance in December. The

mine yielded 1.2 million carats in 2015 but hasn't made money since production began in 2008, according to a Reuters report.

|

| |

Lucapa Weighs Floating on London’s AIM

Lucapa

Diamond Company is considering a listing on London's Alternative Investment

Market. The move comes after the company said it is expanding its operations

and seeking the kimberlite source of large stones recovered at its Lulo

alluvial mine in Angola. Lucapa said the UK’s Brexit vote has not impacted investor

interest in the possible listing.

Lucapa

Diamond Company is considering a listing on London's Alternative Investment

Market. The move comes after the company said it is expanding its operations

and seeking the kimberlite source of large stones recovered at its Lulo

alluvial mine in Angola. Lucapa said the UK’s Brexit vote has not impacted investor

interest in the possible listing.

|

| |

Gemfields to Hike Ruby Output

Gemfields

has secured $65 million of debt financing which will be used to ramp up ruby

production and for general expenses. The loan facilities will enable Gemfields

to expand its Montepuez operations in Mozambique to 20 million carats a year after

recovering 8.4 million carats in the fiscal year that ended June 30, 2015.

Gemfields

has secured $65 million of debt financing which will be used to ramp up ruby

production and for general expenses. The loan facilities will enable Gemfields

to expand its Montepuez operations in Mozambique to 20 million carats a year after

recovering 8.4 million carats in the fiscal year that ended June 30, 2015.

|

|

|

|

GENERAL

|

|

|

|

| |

London Bourse 'Well Placed' to Cope With Brexit

The London

Diamond Bourse (LDB) said it is in a strong position to cope with Brexit

because of its access to a bonded warehouse enabling duty-free trading.

However, the dive in the pound’s value – falling to a 31-year low against the

dollar this week – makes life harder for London dealers

because they buy diamonds in dollars and sell in sterling, said Victoria McKay, LDB’s chief operating officer.

The London

Diamond Bourse (LDB) said it is in a strong position to cope with Brexit

because of its access to a bonded warehouse enabling duty-free trading.

However, the dive in the pound’s value – falling to a 31-year low against the

dollar this week – makes life harder for London dealers

because they buy diamonds in dollars and sell in sterling, said Victoria McKay, LDB’s chief operating officer.

|

| |

Report Cites Poor Pay in India Gem Trade

India’s

gem and jewelry industry is suffering from a labor shortage driven by

rock-bottom pay and dangerous working conditions, according to a report by the

Associated Chambers of Commerce & Industry of India and the Thought

Arbitrage Research Institute. Salaries in India’s gem and jewelry sector are

half of those in other industries as they stand at an average of $3,740 (INR 252,000) per

year versus $7,550 in pharmaceuticals, $7,330 in capital goods and $6,574

in electronics, the report said.

India’s

gem and jewelry industry is suffering from a labor shortage driven by

rock-bottom pay and dangerous working conditions, according to a report by the

Associated Chambers of Commerce & Industry of India and the Thought

Arbitrage Research Institute. Salaries in India’s gem and jewelry sector are

half of those in other industries as they stand at an average of $3,740 (INR 252,000) per

year versus $7,550 in pharmaceuticals, $7,330 in capital goods and $6,574

in electronics, the report said.

|

| |

Trump Ring Fetches $300K at Auction

A Harry

Winston engagement ring given by Donald Trump to Marla Maples in 1991 sold for

$300,000, or $40,268 per carat, at an auction in New York. The emerald-cut,

7.45-carat diamond ring went to an unnamed private collector. The selling price

was at the low end of the pre-sale estimate set by Joseph DuMouchelle, the

Birmingham, Michigan-based auction house that sold the ring.

A Harry

Winston engagement ring given by Donald Trump to Marla Maples in 1991 sold for

$300,000, or $40,268 per carat, at an auction in New York. The emerald-cut,

7.45-carat diamond ring went to an unnamed private collector. The selling price

was at the low end of the pre-sale estimate set by Joseph DuMouchelle, the

Birmingham, Michigan-based auction house that sold the ring.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Birks Group (+574%) skyrocketed from a relatively low base after reporting positive results. U.S. retail stocks were otherwise generally stable. In the Far East, Chow Sang Sang (+11%) and Luk Fook (+14%) jumped. Peregrine Diamonds (+15%) was the strongest of the mining stocks after promising findings from an assessment at its Chidliak Diamond Project in Canada.

View the detailed industry stock report

| |

Jul 7 (13:01 GMT) |

Jun 30 (12:01 GMT) |

Chng. |

|

| $1 = Euro |

0.90 |

0.90 |

0.00 |

|

| $1 = Rupee |

67.39 |

67.51 |

-0.12 |

|

| $1 = Israel Shekel |

3.88 |

3.85 |

0.03 |

|

| $1 = Rand |

14.65 |

14.81 |

-0.15 |

|

| $1 = Canadian Dollar |

1.29 |

1.30 |

0.00 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,361.70 |

$1,317.28 |

$44.42 |

3.4% |

| Platinum |

$1,087.50 |

$1,001.26 |

$86.24 |

8.6% |

| Silver |

$19.92 |

$18.38 |

$1.54 |

8.4% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

27,201.49 |

26,999.72 |

201.77 |

0.7% |

| Dow Jones |

17,918.62 |

17,694.68 |

223.94 |

1.3% |

| FTSE |

6,552.62 |

6,357.09 |

195.53 |

3.1% |

| Hang Seng |

20,706.92 |

20,794.37 |

-87.45 |

-0.4% |

| S&P 500 |

2,099.73 |

2,070.77 |

28.96 |

1.4% |

| Yahoo! Jewelry |

940.97 |

947.06 |

-6.09 |

-0.6% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Sentiment relatively

weak since Hong Kong show. Trading slow during summer months with few foreign

buyers in Mumbai. Domestic Indian demand cautious with subdued expectations for

IIJS Mumbai show (August 4 to 8). Sellers willing to compromise on price able

to sell as buyers push for deeper discounts. Manufacturing steady after

rough buying slowed slightly in June. Jewelers concerned post-Brexit gold rally

will slow sales and add to costs.

Read the Polished Diamond Trading Report |

|

|

Advertisements

|

|

|

Advertisements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|