|

|

Rapaport TradeWire July 14, 2016

Jul 14, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

July 14, 2016

|

|

|

Market seasonally quiet.

Prices stable but financial pressure mounting as polished inventory grows. Inventory

levels increased significantly in 1H amid aggressive rough buying and sluggish

polished demand. Profit margins and liquidity tightening as activity slowed in

July. Share placement values ALROSA at $7.5B as government reportedly sells

10.9% stake for $818M. Okavango 1H rough sales +23% to $284M, volume +35% to

1.75M cts., average price -9% to $162/ct. Petra, Ekapa merge Kimberley mining operations.

Belgium June polished exports -17% to $1.2B, rough imports -11% to $945M. Chow

Tai Fook 1Q China sales -13%, HK / Macau sales -22%.

|

|

| Diamonds |

1,226,470 |

| Value |

$7,967,552,000 |

| Carats | 1,311,985 |

| Average Discount |

-30.19% |

www.rapnet.com

|

|

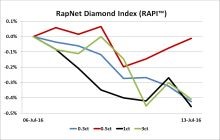

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

The only way forward for diamond companies to attract affordable funding — given the current slim margins — is that companies acting in the so-called midstream become more corporate.

The only way forward for diamond companies to attract affordable funding — given the current slim margins — is that companies acting in the so-called midstream become more corporate.

Pierre De Bosscher, director of De Bosscher Consulting, and former CEO of the Antwerp Diamond Bank (ADB)

|

|

|

|

MARKETS

|

|

|

|

| |

United States: Trading quiet with many dealers still on vacation. Activity expected to remain slow through July / August summer period. Steady demand for better-quality, RapSpec A2 diamonds…

Belgium: Sentiment weak as dealers anticipate slow trading throughout 2H. Suppliers preparing for vacation before bourses officially close from August 1 to 22…

Israel: Polished trading slow ahead of August summer vacation. U.S. demand stable with some post-Vegas orders and goods sent on memo…

India: Manufacturer inventory rising as dealers avoid extra supply. Liquidity tight after strong rough buying in 1H. Some polished suppliers offering higher discounts looking to boost transactions and improve cash flow…

Hong Kong: Polished trading weak on slower consumer jewelry demand across Greater China. Major retailers consolidating stores after aggressive decade-long expansion…

Click here for deeper analysis

|

|

|

|

FIVE-MINUTE INTERVIEW

|

|

|

|

| |

Stuller Hedging its Bet on Synthetics

Rapaport News caught up with Stanley Zale, vice-president of diamonds and gemstones at Stuller, to discuss some of the bold moves Stuller has made this year and the group’s perspective on the retail jewelry market.

Click here to read the interview |

|

|

|

INDUSTRY

|

|

|

|

| |

Sarine Sees Market Turnaround

Sarine

Technologies, a supplier of equipment used in diamond manufacturing, expects

second-quarter revenue to jump as improved market sentiment boosted sales of

its mapping systems. Sales increased to more than $20 million in the second

quarter that ended June 30, implying a surge of at least 39% over a year ago.

The company expects to report higher profit when it releases full results for

the period in the coming month.

Sarine

Technologies, a supplier of equipment used in diamond manufacturing, expects

second-quarter revenue to jump as improved market sentiment boosted sales of

its mapping systems. Sales increased to more than $20 million in the second

quarter that ended June 30, implying a surge of at least 39% over a year ago.

The company expects to report higher profit when it releases full results for

the period in the coming month.

|

| |

Okavango 1H Rough Sales Soar

Okavango

Diamond Company’s sales jumped 23% to $284 million in the first half after the

volume of rough supplied grew 35% to 1.75 million carats – its highest level since sales began in late 2013. The average price achieved across its auctions

fell 9% to $162 per carat during the period. The Botswana parastatal said rough

prices recovered in the first quarter but eased back since then as demand has

softened.

Okavango

Diamond Company’s sales jumped 23% to $284 million in the first half after the

volume of rough supplied grew 35% to 1.75 million carats – its highest level since sales began in late 2013. The average price achieved across its auctions

fell 9% to $162 per carat during the period. The Botswana parastatal said rough

prices recovered in the first quarter but eased back since then as demand has

softened.

|

| |

Belgium Diamond Trade Slumps in June

Belgium’s

diamond trade declined in June with polished exports down 17% to $1.15 billion

and polished imports declining 12% to $1.22 billion. Rough imports fell 11% to

$945.3 million and rough exports slid 16% to $959.8 million, reversing a surge

in May. Belgium’s June net diamond account swung to negative $64.4 million

versus positive $62.7 million a year earlier, meaning total imports of rough

and polished exceeded exports during the month.

Belgium’s

diamond trade declined in June with polished exports down 17% to $1.15 billion

and polished imports declining 12% to $1.22 billion. Rough imports fell 11% to

$945.3 million and rough exports slid 16% to $959.8 million, reversing a surge

in May. Belgium’s June net diamond account swung to negative $64.4 million

versus positive $62.7 million a year earlier, meaning total imports of rough

and polished exceeded exports during the month.

|

| |

Rio Tinto Unveils Red Diamond Coin

Rio Tinto unveiled

the first coin that features a rare red diamond from its Argyle mine in Western

Australia. Known as the Kimberley Treasure, the coin has a price tag of

$762,280 (AUD 1 million) and is being touted by the miner as an investment

piece. The coin is made from one kilogram of 99.99% fine gold and features a

radiant-cut, 0.54-carat red diamond from the Argyle mine.

Rio Tinto unveiled

the first coin that features a rare red diamond from its Argyle mine in Western

Australia. Known as the Kimberley Treasure, the coin has a price tag of

$762,280 (AUD 1 million) and is being touted by the miner as an investment

piece. The coin is made from one kilogram of 99.99% fine gold and features a

radiant-cut, 0.54-carat red diamond from the Argyle mine.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Chow Tai Fook Revenue Falls

Chow Tai

Fook’s sales continued to decline in the first fiscal quarter that ended June

30 due to weak consumer sentiment in Hong Kong and Macau and a drop in tourist

arrivals from Mainland China. In Hong Kong and Macau, retail revenue plunged

22% and same-store sales slid 20%. The group’s retail sales in Mainland China

fell 13% and same-store sales slumped 17%.

Chow Tai

Fook’s sales continued to decline in the first fiscal quarter that ended June

30 due to weak consumer sentiment in Hong Kong and Macau and a drop in tourist

arrivals from Mainland China. In Hong Kong and Macau, retail revenue plunged

22% and same-store sales slid 20%. The group’s retail sales in Mainland China

fell 13% and same-store sales slumped 17%.

|

| |

Famed Jeweler Tivol Dies at 92

Legendary

jewelry retailer Harold Tivol, chairman of Kansas City-based Tivol, died aged

92, The Kansas City Star reported. Born in Kansas City, Tivol

started his career working in his father Charles Tivol's store and later took

over the reins. He oversaw the company’s growth and received prestigious

accolades including the American Gem Society’s Triple Zero award.

Legendary

jewelry retailer Harold Tivol, chairman of Kansas City-based Tivol, died aged

92, The Kansas City Star reported. Born in Kansas City, Tivol

started his career working in his father Charles Tivol's store and later took

over the reins. He oversaw the company’s growth and received prestigious

accolades including the American Gem Society’s Triple Zero award.

|

|

|

|

MINING

|

|

|

|

| |

ALROSA Share Sale Raises $818M

Russia

raised approximately $818 million (RUB 52.2 billion) from its sale of a 10.9% stake in

ALROSA, The Wall Street Journal reported. The government priced the

shares at RUB 65 each, a discount of 3.8% to the closing price at the time of

the sale. The Russian Direct Investment Fund, Russia’s sovereign wealth fund,

and its co-investors bought about half of the shares on offer, the report said.

Russia

raised approximately $818 million (RUB 52.2 billion) from its sale of a 10.9% stake in

ALROSA, The Wall Street Journal reported. The government priced the

shares at RUB 65 each, a discount of 3.8% to the closing price at the time of

the sale. The Russian Direct Investment Fund, Russia’s sovereign wealth fund,

and its co-investors bought about half of the shares on offer, the report said.

|

| |

Petra, Ekapa Combine Kimberley Operations

Petra

Diamonds and Ekapa Mining agreed to merge their operations in South Africa's

Kimberley region in a bid to extend mining in the historic diamond-mining area.

As part of the deal, Petra’s Kimberley Underground mines, Ekapa’s tailings

operations, the Kimberley Miners Forum and the Kimberley Mines tailings

operations have been combined. The venture is 75.9% owned by

Petra and its Black Economic Empowerment partners with the remaining 24.1% held

by Ekapa Mining.

Petra

Diamonds and Ekapa Mining agreed to merge their operations in South Africa's

Kimberley region in a bid to extend mining in the historic diamond-mining area.

As part of the deal, Petra’s Kimberley Underground mines, Ekapa’s tailings

operations, the Kimberley Miners Forum and the Kimberley Mines tailings

operations have been combined. The venture is 75.9% owned by

Petra and its Black Economic Empowerment partners with the remaining 24.1% held

by Ekapa Mining.

|

| |

Stornoway Raises $63M Ahead of Renard Production

Stornoway

Diamond Corporation raised $63.3 million (CAD 82.7 million) after shareholders

exercised their rights to purchase warrants before they expired on July 8. The

funds will be used to complete construction of the Renard mine where ore

processing is scheduled to start in September and commercial production is

projected for December. The Ottawa-located mine has probable reserves of 22.3 million carats and a 14-year projected

lifespan.

Stornoway

Diamond Corporation raised $63.3 million (CAD 82.7 million) after shareholders

exercised their rights to purchase warrants before they expired on July 8. The

funds will be used to complete construction of the Renard mine where ore

processing is scheduled to start in September and commercial production is

projected for December. The Ottawa-located mine has probable reserves of 22.3 million carats and a 14-year projected

lifespan.

|

| |

Rockwell Back in the Black After Restructuring

Rockwell

Diamonds swung to a profit of $438,000 (CAD 570,000) in its first fiscal

quarter from a loss of $4 million (CAD 5.2 million) a year earlier. The

improvement followed a strategic review that saw the company sell its Angola operation

and place one of its South Africa mines on care and maintenance. Rough diamond

sales surged 46% to $9.3 million (CAD 12.1 million) and costs were cut by 25%.

Rockwell expects rough prices to remain stable but trading to slow during the

ongoing “historically quiet” second fiscal quarter.

Rockwell

Diamonds swung to a profit of $438,000 (CAD 570,000) in its first fiscal

quarter from a loss of $4 million (CAD 5.2 million) a year earlier. The

improvement followed a strategic review that saw the company sell its Angola operation

and place one of its South Africa mines on care and maintenance. Rough diamond

sales surged 46% to $9.3 million (CAD 12.1 million) and costs were cut by 25%.

Rockwell expects rough prices to remain stable but trading to slow during the

ongoing “historically quiet” second fiscal quarter.

|

| |

Record Angola Diamond Lifts Lucapa Sales

Lucapa

Diamond Company‘s revenue spiked to $26.2 million versus $2.9 million a year

earlier having sold a 404-carat diamond recovered at the Lulo mine in Angola

for $16 million (AUD 22.5 million). The average price of the company’s total sales

soared to $5,686 per carat during the period, compared with $976 per carat a

year ago. Excluding the 404-carat stone, the average price achieved was $2,421

per carat.

Lucapa

Diamond Company‘s revenue spiked to $26.2 million versus $2.9 million a year

earlier having sold a 404-carat diamond recovered at the Lulo mine in Angola

for $16 million (AUD 22.5 million). The average price of the company’s total sales

soared to $5,686 per carat during the period, compared with $976 per carat a

year ago. Excluding the 404-carat stone, the average price achieved was $2,421

per carat.

|

| |

ALROSA’s Nyurba Unit Unearths 214-Ct. Diamond

ALROSA

recovered a 214.65-carat diamond from Nyurbinskoye placer deposit, the second

such special stone found in the area in the past two months. The company said the

diamond measures 42.11mm x 34.26mm x 16.07mm, is translucent with a grey hue

and classified it as a 4 black clivage/makeable grey rough diamond. The Nyurbinskoye placer

deposit is located near the Nyurbinskaya mine, where ALROSA found a 241-carat

diamond with similar characteristics in June.

ALROSA

recovered a 214.65-carat diamond from Nyurbinskoye placer deposit, the second

such special stone found in the area in the past two months. The company said the

diamond measures 42.11mm x 34.26mm x 16.07mm, is translucent with a grey hue

and classified it as a 4 black clivage/makeable grey rough diamond. The Nyurbinskoye placer

deposit is located near the Nyurbinskaya mine, where ALROSA found a 241-carat

diamond with similar characteristics in June.

|

|

|

|

GENERAL

|

|

|

|

| |

De Beers Launches Beneficiation Program

De Beers has

partnered with the South African government and the country’s diamond-cutting

industry to launch the ‘Enterprise Development Project for Diamond

Beneficiators’ project. The company will supply rough to five

historically disadvantaged South African diamond cutters and help them develop

to possibly become De Beers accredited buyers and eventually sightholders.

De Beers has

partnered with the South African government and the country’s diamond-cutting

industry to launch the ‘Enterprise Development Project for Diamond

Beneficiators’ project. The company will supply rough to five

historically disadvantaged South African diamond cutters and help them develop

to possibly become De Beers accredited buyers and eventually sightholders.

|

| |

JCK Show to Move Back to The Venetian in 2019

The JCK and

Luxury shows in Las Vegas will return to the Sands Expo and Convention Center

in 2019. The shows were until 2010 located at the Sands, which is part of The

Venetian and The Palazzo resorts, but were moved to the Manadalay Bay hotel

complex. The shows, which typically take place in early June, will

remain at Mandalay Bay for the next two years.

The JCK and

Luxury shows in Las Vegas will return to the Sands Expo and Convention Center

in 2019. The shows were until 2010 located at the Sands, which is part of The

Venetian and The Palazzo resorts, but were moved to the Manadalay Bay hotel

complex. The shows, which typically take place in early June, will

remain at Mandalay Bay for the next two years.

|

| |

Antwerp Fair Opens Doors to Foreign Exhibitors

Belgium’s

diamond industry is inviting overseas companies for the first time to

participate in the Antwerp Diamond Trade Fair. The eighth edition of

‘BrilliAnt’ will take place from January 29 to 31 at the Antwerp Diamond

Kring’s trading hall. Organizers will consider applications on a first-come,

first-served basis and will only accept companies which are members of a bourse

affiliated with the World Federation of Diamond Bourses.

Belgium’s

diamond industry is inviting overseas companies for the first time to

participate in the Antwerp Diamond Trade Fair. The eighth edition of

‘BrilliAnt’ will take place from January 29 to 31 at the Antwerp Diamond

Kring’s trading hall. Organizers will consider applications on a first-come,

first-served basis and will only accept companies which are members of a bourse

affiliated with the World Federation of Diamond Bourses.

|

| |

Israel Changes Format for Diamond Week

The next

edition of the International Diamond Week in Israel will see a new format, with the Israel Diamond Exchange (IDE) aiming to attract people from a

wider range of bourses around the world. Trading will take place on the floor

of the bourse in Ramat Gan from Monday, February 13, to Wednesday, February 15,

while the final day on Thursday, February 16, will be left

open for individual meetings, free tours and other activities organized by the

IDE.

The next

edition of the International Diamond Week in Israel will see a new format, with the Israel Diamond Exchange (IDE) aiming to attract people from a

wider range of bourses around the world. Trading will take place on the floor

of the bourse in Ramat Gan from Monday, February 13, to Wednesday, February 15,

while the final day on Thursday, February 16, will be left

open for individual meetings, free tours and other activities organized by the

IDE.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Jewelry retailers led the increases as most stock indices tracked by Rapaport News climbed this week. Signet (+8.2%) recovered some lost ground after its share price plunged in the previous two months as did Tiffany (+4.6%). The major Hong Kong retailers made similar gains despite Chow Tai Fook (+5.8%) reporting a continued slide in its sales during its first fiscal quarter.

View the detailed industry stock report

| |

Jul 14 (13:01 GMT) |

Jul 7 (13:01 GMT) |

Chng. |

|

| $1 = Euro |

0.90 |

0.90 |

0.00 |

|

| $1 = Rupee |

66.87 |

67.39 |

-0.52 |

|

| $1 = Israel Shekel |

3.85 |

3.88 |

-0.03 |

|

| $1 = Rand |

14.25 |

14.65 |

-0.41 |

|

| $1 = Canadian Dollar |

1.29 |

1.29 |

0.00 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,321.75 |

$1,361.70 |

-$39.95 |

-2.9% |

| Platinum |

$1,085.55 |

$1,087.50 |

-$1.95 |

-0.2% |

| Silver |

$20.08 |

$19.92 |

$0.16 |

0.8% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

27,942.11 |

27,201.49 |

740.62 |

2.7% |

| Dow Jones |

18,372.12 |

17,918.62 |

453.50 |

2.5% |

| FTSE |

6,699.81 |

6,552.62 |

147.19 |

2.2% |

| Hang Seng |

21,561.06 |

20,706.92 |

854.14 |

4.1% |

| S&P 500 |

2,152.43 |

2,099.73 |

52.70 |

2.5% |

| Yahoo! Jewelry |

969.25 |

940.97 |

28.28 |

3.0% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Manufacturer inventory rising as dealers avoid extra supply. Liquidity tight after strong rough buying in 1H. Some polished suppliers offering higher discounts looking to boost transactions and improve cash flow. U.S. trading quiet during vacation period. China steady, Hong Kong slow. Domestic Indian demand sluggish. Manufacturing stable but rough demand declined since De Beers June sight.

Read the Polished Diamond Trading Report |

|

|

Advertisements

|

|

|

Advertisements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|