|

|

Rapaport TradeWire March 9, 2017

Mar 9, 2017 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

March 9, 2017

|

|

|

Dealers optimistic about short-term demand following

improved trading at the Hong Kong show. Buyers did better than sellers as suppliers

were willing to compromise on price in order to generate liquidity and reduce

inventory before new better-quality polished production becomes available. Chinese

demand changing and competing with U.S. market for lower-price-point SI-I1

goods, leaving IF-VVS weak. Signet Jewelers 2016 sales -2% to $6.4B, profit +16%

to $543M. Belgium Feb. polished exports -15% to $1.4B, rough imports -32% to

$908M. GIA discovers large parcel of undisclosed CVD synthetics mixed with

natural melee at Mumbai lab. Russia confirms Sergey Ivanov as new ALROSA CEO. |

|

| Diamonds |

1,228,325 |

| Value |

$7,504,133,823 |

| Carats |

1,318,582 |

| Average Discount |

-30.34% |

www.rapnet.com

|

|

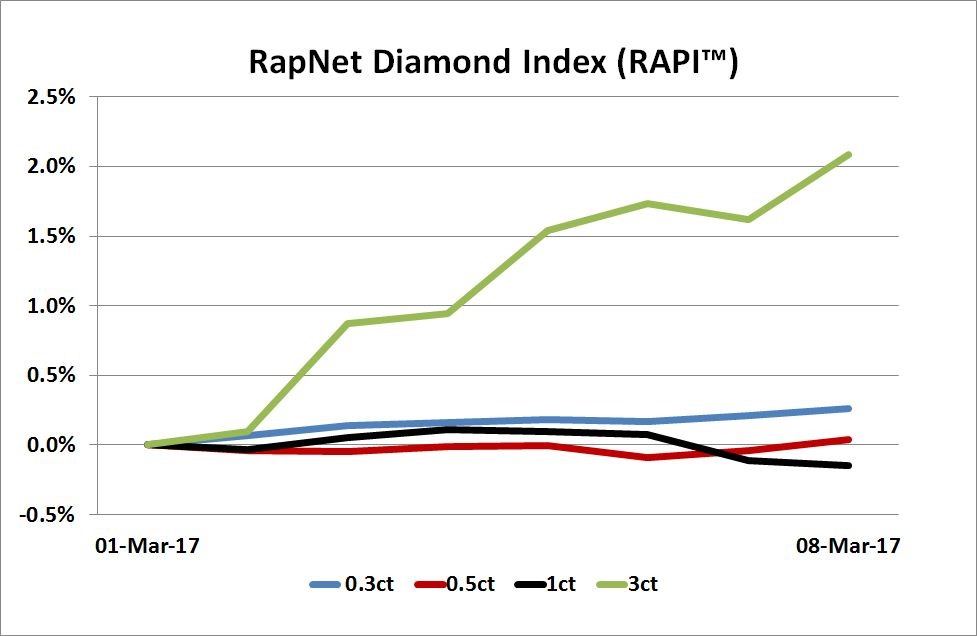

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

When people say, ‘I'm not going to buy diamonds because it has a bad rap,’ think of the two-plus million people in Botswana who are going to be affected by their decision.

When people say, ‘I'm not going to buy diamonds because it has a bad rap,’ think of the two-plus million people in Botswana who are going to be affected by their decision.

William Lamb, CEO of Lucara Diamond Corporation, in an interview with Bloomberg.

|

|

|

|

MARKETS

|

|

|

|

| |

United

States: Polished trading stable with positive momentum from

the Hong Kong show. Steady demand for 1 ct., G-J, VS-SI diamonds…

Belgium: Positive sentiment as trading improved at the Hong

Kong show. Dealers optimistic about short-term rise in polished trading

after slow start to the year…

Israel:

Dealers more optimistic after Hong Kong show. Good

Indian demand for I-K colors…

India: Polished market stable as dealers returned from positive

Hong Kong show. Dealers optimistic about the U.S. and hopeful the Chinese

market is starting to improve…

Hong

Kong: Positive mood as dealers focus on follow-up after

the show. Good dealer demand for loose diamonds which were more liquid than

finished jewelry at the show…

Click here for deeper analysis |

|

|

|

INSIGHTS

|

|

|

|

| |

5 Lessons from the Hong Kong Show

The Hong Kong show was better than expected for the diamond trade, as Chinese jewelers were looking for goods after being absent from the market for some time. But while exhibitors were simply happy to be doing business again, conditions ultimately favored buyers...

Click here to continue reading

|

|

|

|

INDUSTRY

|

|

|

|

| |

GIA Finds Significant Undisclosed Synthetics

The Gemological Institute of America (GIA) recently

uncovered an unusually large number of undisclosed synthetic diamonds mixed in

with natural melee diamonds, the lab confirmed. A parcel of 323 melee diamonds

with an average size of 0.014 to 0.015 carats was found to contain 101 chemical

vapor deposition (CVD) synthetic stones at the GIA’s Mumbai lab. The goods had

been submitted to the GIA’s Melee Analysis Service, which made the discovery.

The Gemological Institute of America (GIA) recently

uncovered an unusually large number of undisclosed synthetic diamonds mixed in

with natural melee diamonds, the lab confirmed. A parcel of 323 melee diamonds

with an average size of 0.014 to 0.015 carats was found to contain 101 chemical

vapor deposition (CVD) synthetic stones at the GIA’s Mumbai lab. The goods had

been submitted to the GIA’s Melee Analysis Service, which made the discovery.

|

| |

Court Upholds Leviev Win Against Julius Klein

A New York federal judge upheld an arbitration ruling in

favor of diamond magnate Lev Leviev (pictured) in a long-running

dispute with the Julius Klein Group. The judge ordered Julius Klein and four of its principals to pay $142 million to LGC USA Holdings, an

affiliate of the Leviev Group of Companies, according to Leviev’s firm. This is

in addition to more than $66 million that has already been paid – amounting to

a total award of $209 million.

A New York federal judge upheld an arbitration ruling in

favor of diamond magnate Lev Leviev (pictured) in a long-running

dispute with the Julius Klein Group. The judge ordered Julius Klein and four of its principals to pay $142 million to LGC USA Holdings, an

affiliate of the Leviev Group of Companies, according to Leviev’s firm. This is

in addition to more than $66 million that has already been paid – amounting to

a total award of $209 million.

|

| |

India Braces for Ban on Large Cash Deals

India’s ban on high-value cash transactions could damage

rural gold demand or spur growth in the black market, the World Gold Council

(WGC) warned. From April 1, the government will cap cash purchases at $4,493

(INR 300,000) as it continues its attempts to transform the nation’s economy

into one based more on electronic transactions. Consumers in rural

India do not necessarily have access to checks and electronic payments, the WGC

pointed out.

India’s ban on high-value cash transactions could damage

rural gold demand or spur growth in the black market, the World Gold Council

(WGC) warned. From April 1, the government will cap cash purchases at $4,493

(INR 300,000) as it continues its attempts to transform the nation’s economy

into one based more on electronic transactions. Consumers in rural

India do not necessarily have access to checks and electronic payments, the WGC

pointed out.

|

| |

Belgium’s Polished Exports Decline

Belgium’s diamond-trade statistics for February made for

somber reading, as data from the Antwerp World Diamond Centre (AWDC) showed a

slowdown in both polished and rough shipments. Polished exports slid 15% year on year to $1.35 billion. The average price of exports fell 2% to

$2,551 per carat. Rough imports fell 32% to $908.2 million, while

rough exports declined 15% to $1.09 billion.

Belgium’s diamond-trade statistics for February made for

somber reading, as data from the Antwerp World Diamond Centre (AWDC) showed a

slowdown in both polished and rough shipments. Polished exports slid 15% year on year to $1.35 billion. The average price of exports fell 2% to

$2,551 per carat. Rough imports fell 32% to $908.2 million, while

rough exports declined 15% to $1.09 billion.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Signet Jewelers Cautious for 2017 as Sales Decline

Signet Jewelers' sales fell 5% to $2.27 billion

during the fourth quarter, as the retailer continues to adapt to a challenging retail

environment and weak mall traffic. The company expects same-store sales to

decline by low-to-mid-single digits in the coming year as it adjusts to

competitive pricing in the jewelry sector and changing consumer behavior.

Same-store sales declined 4.5% in the fourth quarter, which ended January 28.

Net income grew 9% to $297.5 million due to reduced expenses and lower taxes.

Signet Jewelers' sales fell 5% to $2.27 billion

during the fourth quarter, as the retailer continues to adapt to a challenging retail

environment and weak mall traffic. The company expects same-store sales to

decline by low-to-mid-single digits in the coming year as it adjusts to

competitive pricing in the jewelry sector and changing consumer behavior.

Same-store sales declined 4.5% in the fourth quarter, which ended January 28.

Net income grew 9% to $297.5 million due to reduced expenses and lower taxes.

|

| |

Michael Hill Okays Phil Taylor as CEO

Australia-based jeweler Michael Hill has appointed Phil

Taylor as its chief executive officer, the company announced on Monday.

Taylor (pictured) had been interim CEO since August of last

year, following the exit of longstanding company head Mike Parsell. Michael

Hill’s board has been impressed by the new perspectives and decisive action

evident since Taylor was appointed acting CEO, company chair Emma Hill said.

Australia-based jeweler Michael Hill has appointed Phil

Taylor as its chief executive officer, the company announced on Monday.

Taylor (pictured) had been interim CEO since August of last

year, following the exit of longstanding company head Mike Parsell. Michael

Hill’s board has been impressed by the new perspectives and decisive action

evident since Taylor was appointed acting CEO, company chair Emma Hill said.

|

| |

Charles & Colvard, Helzberg Expand Retail Deal

Charles & Colvard will double the number of Helzberg

Diamonds stores where its moissanite jewelry is available, under an extension

of its arrangement with the Warren Buffett-owned retailer. The moissanite provider began supplying products to Helzberg’s ecommerce site in 2013 and later

expanded the partnership to some of the jeweler’s retail stores.

Charles & Colvard will double the number of Helzberg

Diamonds stores where its moissanite jewelry is available, under an extension

of its arrangement with the Warren Buffett-owned retailer. The moissanite provider began supplying products to Helzberg’s ecommerce site in 2013 and later

expanded the partnership to some of the jeweler’s retail stores. |

|

|

|

MINING

|

|

|

|

| |

Ivanov Confirmed as ALROSA Chief

Russia’s government has appointed Sergey Ivanov as president

of ALROSA for a three-year term, according to an official statement. Ivanov is

the son of a former Kremlin-administration head and currently serves as senior

vice president of Sberbank, having previously headed insurer SOGAZ. He will

replace Andrey Zharkov, who has been ALROSA’s president since 2015 and is set

to leave just over a year before his contract’s May 2018 end date.

Russia’s government has appointed Sergey Ivanov as president

of ALROSA for a three-year term, according to an official statement. Ivanov is

the son of a former Kremlin-administration head and currently serves as senior

vice president of Sberbank, having previously headed insurer SOGAZ. He will

replace Andrey Zharkov, who has been ALROSA’s president since 2015 and is set

to leave just over a year before his contract’s May 2018 end date. |

| |

Resource Estimate Drops for Argyle Mine

Rio Tinto has lowered its estimate of the mineral resources

available at its Argyle diamond mine in Australia, as the company reconsiders

its plans to extend the project. Estimated mineral resources fell 66% to

15 million tonnes in 2016, compared with the previous year, the miner said.

Mineral resources are the quantity of material in a mine that has reasonable

prospects for being extracted economically.

Rio Tinto has lowered its estimate of the mineral resources

available at its Argyle diamond mine in Australia, as the company reconsiders

its plans to extend the project. Estimated mineral resources fell 66% to

15 million tonnes in 2016, compared with the previous year, the miner said.

Mineral resources are the quantity of material in a mine that has reasonable

prospects for being extracted economically. |

| |

All Parcels Sell at Gahcho Kué Tender

Mountain Province sold 277,646 carats of rough diamonds at

its second tender of production from the recently launched Gahcho Kué mine in

Canada. The company sold all the parcels of diamonds on offer, including those

it had held over from its January sale due to India’s liquidity crisis. While

that previous sale of 49,420 carats fetched $6.3 million at an average price of

$127 per carat, the miner did not disclose the dollar value of its second

tender.

Mountain Province sold 277,646 carats of rough diamonds at

its second tender of production from the recently launched Gahcho Kué mine in

Canada. The company sold all the parcels of diamonds on offer, including those

it had held over from its January sale due to India’s liquidity crisis. While

that previous sale of 49,420 carats fetched $6.3 million at an average price of

$127 per carat, the miner did not disclose the dollar value of its second

tender.

|

| |

Lucapa’s Lulo Rough Sale Fetches $7M

Lucapa Diamond Company sold $6.9 million (AUD 9.1 million)

worth of rough diamonds at a recent tender of goods from its Lulo mine in

Angola. The parcel of 1,552 carats went for an average of $4,446 per carat. The

sale featured a 227-carat, D-color, type-IIa diamond recovered last month at

Lulo, but the company said it would not disclose the selling price for commercial

reasons. The sale brings total proceeds from Lulo rough diamonds to $10.7

million since the start of 2017.

Lucapa Diamond Company sold $6.9 million (AUD 9.1 million)

worth of rough diamonds at a recent tender of goods from its Lulo mine in

Angola. The parcel of 1,552 carats went for an average of $4,446 per carat. The

sale featured a 227-carat, D-color, type-IIa diamond recovered last month at

Lulo, but the company said it would not disclose the selling price for commercial

reasons. The sale brings total proceeds from Lulo rough diamonds to $10.7

million since the start of 2017.

|

|

|

|

GENERAL

|

|

|

|

| |

Dehres Targets North American Market

High-end diamond and jewelry supplier Dehres has opened an

office in Canada as it eyes expansion in the North American market. Sandy Ray,

Dehres’s managing director for Canada, launched the base in Vancouver last

week, in collaboration with local diamantaire Melvin Moss. Complementing the

firm’s existing offices in Hong Kong and Shanghai, the new outpost will mainly

target upmarket Canadian and U.S.-based retailers and wholesalers, the company

said.

High-end diamond and jewelry supplier Dehres has opened an

office in Canada as it eyes expansion in the North American market. Sandy Ray,

Dehres’s managing director for Canada, launched the base in Vancouver last

week, in collaboration with local diamantaire Melvin Moss. Complementing the

firm’s existing offices in Hong Kong and Shanghai, the new outpost will mainly

target upmarket Canadian and U.S.-based retailers and wholesalers, the company

said.

|

| |

Diamond Club West Coast Picks President

Moshe Salem has been elected president of Diamond Club West

Coast (DCWC), according to the World Federation of Diamond Bourses

(WFDB). Mervyn Hahn and Kalpesh Jhaveri were voted in as vice

presidents, and Rahul Parikh took on the role of treasurer. The position of secretary went to Aaron Spicker, while Doron Auslander, Tony Ayvazian, Eli Fish, Vatche

Shirikjian and Vipul Udani were selected as directors. DCWC is an affiliate of

the WFDB.

Moshe Salem has been elected president of Diamond Club West

Coast (DCWC), according to the World Federation of Diamond Bourses

(WFDB). Mervyn Hahn and Kalpesh Jhaveri were voted in as vice

presidents, and Rahul Parikh took on the role of treasurer. The position of secretary went to Aaron Spicker, while Doron Auslander, Tony Ayvazian, Eli Fish, Vatche

Shirikjian and Vipul Udani were selected as directors. DCWC is an affiliate of

the WFDB. |

| |

ALROSA to Unveil Synthetics Detector

ALROSA will launch its synthetic-diamond detector in May at

the Mediterranean Gemmological and Jewellery Conference in Syracuse, Italy. The

portable machine screens loose polished diamonds and jewelry, identifying

synthetics as well as treated stones or simulants. Three gemologists will

test the machine with 50 samples of natural, treated and synthetic diamonds on

May 11 and 12.

ALROSA will launch its synthetic-diamond detector in May at

the Mediterranean Gemmological and Jewellery Conference in Syracuse, Italy. The

portable machine screens loose polished diamonds and jewelry, identifying

synthetics as well as treated stones or simulants. Three gemologists will

test the machine with 50 samples of natural, treated and synthetic diamonds on

May 11 and 12.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Mining stocks fell this week, led by Anglo American (-13%), as metal prices dropped. U.S. retail stocks were mainly down, largely tracking the Dow Jones. Luk Fuk (+4.8%) headed otherwise mixed Far East stocks, while European luxury shares mostly increased, led by Swatch Group (+1.6%).

View the detailed industry stock report

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Polished market stable as dealers returned from positive

Hong Kong show. Dealers optimistic about the U.S. and hopeful the Chinese

market is starting to improve. Good demand for GIA dossiers, especially SIs. A

lot of imperfect goods (milky or black-spotted) on the market. Steady rough

demand as major manufacturers raise production levels.

Read the Polished Diamond Trading Report

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|