|

|

Rapaport TradeWire April 13, 2017

Apr 13, 2017 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

April 13, 2017

|

|

|

Diamond trading quiet, with many dealers closed during the Passover and Easter holidays. U.S. brick-and-mortar retail under pressure from rise in online shopping as Credit Suisse reports record 2,880 general stores shut in 1Q. Further planned department store closures expected to impact diamond inventory movement. Francisco Partners invests $140M in online jeweler James Allen. Asia Pacific turning a corner with Chow Tai Fook 4Q same-store sales +12% in China, +4% in Hong Kong & Macau. LVMH 1Q jewelry & watch sales +14% to $932M. Dominion FY2017 sales -21% to $571M, operating loss of $57M vs. profit of $8M. ALROSA March sales +1% to $567M. U.S. Feb. polished imports -15% to $1.5B.

|

|

| Diamonds |

1,252,860 |

| Value |

$7,588,988,734 |

| Carats |

1,349,962 |

| Average Discount |

-30.07% |

www.rapnet.com

|

|

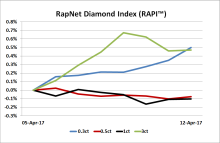

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

We continue to observe stable demand in almost all categories of rough diamonds, which is a confirmation of the optimism of market participants shown during the jewelry exhibition in Hong Kong.

We continue to observe stable demand in almost all categories of rough diamonds, which is a confirmation of the optimism of market participants shown during the jewelry exhibition in Hong Kong.

Yury Okoyomov, vice president of Alrosa.

|

|

|

|

INDUSTRY

|

|

|

|

| |

Alrosa March Sales Beat Expectations

Alrosa saw steady demand for most categories of its rough diamond supply in March, pushing sales above its projected figures for the first quarter. Sales grew 1% year on year to $566.6 million during the month, with analysts at VTB Capital noting this was 12% higher than expected. Rough sales totaled $554.2 million, and polished sales closed at $12.4 million. During the first quarter, rough sales came to approximately $1.3 billion, about in line with last year.

Alrosa saw steady demand for most categories of its rough diamond supply in March, pushing sales above its projected figures for the first quarter. Sales grew 1% year on year to $566.6 million during the month, with analysts at VTB Capital noting this was 12% higher than expected. Rough sales totaled $554.2 million, and polished sales closed at $12.4 million. During the first quarter, rough sales came to approximately $1.3 billion, about in line with last year.

|

| |

DPA, Signet, De Beers Working on ‘Project Assure’

The Diamond Producers Association (DPA) has launched “Project Assure” to design and implement an independent “Diamond Screening Device Performance Test Protocol.” The protocol is scheduled to be in place in the fourth quarter of 2017. Signet Jewelers and De Beers are supporting the project and participating in its steering committee, which will set up an advisory board comprising diamond and jewelry trade associations. An independent testing laboratory will implement the protocol and solicit companies that produce diamond-screening machines to send their devices for testing.

The Diamond Producers Association (DPA) has launched “Project Assure” to design and implement an independent “Diamond Screening Device Performance Test Protocol.” The protocol is scheduled to be in place in the fourth quarter of 2017. Signet Jewelers and De Beers are supporting the project and participating in its steering committee, which will set up an advisory board comprising diamond and jewelry trade associations. An independent testing laboratory will implement the protocol and solicit companies that produce diamond-screening machines to send their devices for testing.

|

| |

Kiran Gems Cuts Loose US, HK Subsidiaries

Surat-based Kiran Gems has offloaded a number of subsidiaries as part of a group-wide restructuring effort. The diamond manufacturer’s US-based jewelry operations – Kiran Jewels Inc., Unique Design, SDIL, and Prestige – will operate as independent entities, as will polished-diamond operation Kiran Export Hong Kong. Kiran Gems first announced its reorganizing process in September of last year, when it spun off its Belgium operation, Kiran Exports.

Surat-based Kiran Gems has offloaded a number of subsidiaries as part of a group-wide restructuring effort. The diamond manufacturer’s US-based jewelry operations – Kiran Jewels Inc., Unique Design, SDIL, and Prestige – will operate as independent entities, as will polished-diamond operation Kiran Export Hong Kong. Kiran Gems first announced its reorganizing process in September of last year, when it spun off its Belgium operation, Kiran Exports.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Chow Tai Fook Shows Long-Awaited Sales Gains

Chow Tai Fook saw positive retail sales growth in the fiscal fourth quarter that ended March 31. Jewelry retail sales in mainland China increased 16%, with same-store sales rising 12% during the period. Retail sales in Hong Kong and Macau grew 1%, and same-store sales rose 4%. Growth was driven by gold products; gem-set jewelry sales rose 5% in mainland China but fell 17% in the municipalities due to a decline in the average selling price. Chow Tai Fook’s e-commerce sales spiked 85% in the mainland.

Chow Tai Fook saw positive retail sales growth in the fiscal fourth quarter that ended March 31. Jewelry retail sales in mainland China increased 16%, with same-store sales rising 12% during the period. Retail sales in Hong Kong and Macau grew 1%, and same-store sales rose 4%. Growth was driven by gold products; gem-set jewelry sales rose 5% in mainland China but fell 17% in the municipalities due to a decline in the average selling price. Chow Tai Fook’s e-commerce sales spiked 85% in the mainland.

|

| |

Bulgari Boosts LVMH Jewelry, Watch Performance

LVMH Moët Hennessy Louis Vuitton’s watch and jewelry sales grew 14% in the first quarter as its Bulgari brand continued to gain market share. The luxury house reported double-digit growth across all its divisions, with watch and jewelry sales rising to $931.7 million from $820.4 million a year earlier. Comparable-store sales for the unit grew 11% at constant exchange rates. Its other businesses, including leather products, perfumes and wines, all posted strong increases.

LVMH Moët Hennessy Louis Vuitton’s watch and jewelry sales grew 14% in the first quarter as its Bulgari brand continued to gain market share. The luxury house reported double-digit growth across all its divisions, with watch and jewelry sales rising to $931.7 million from $820.4 million a year earlier. Comparable-store sales for the unit grew 11% at constant exchange rates. Its other businesses, including leather products, perfumes and wines, all posted strong increases.

|

| |

Equity Firm Buys Major Stake in James Allen

Online diamond retailer James Allen has received a $140 million equity investment from Francisco Partners. The investment gives the private-equity firm a near-50% stake in the New York-based R2Net, which owns James Allen, valuing the e-commerce company at just under $300 million, Israeli newspaper Globes reported. The companies did not disclose the terms of the deal or how the money would be used, except to say the investment would accelerate James Allen’s rapid expansion.

Online diamond retailer James Allen has received a $140 million equity investment from Francisco Partners. The investment gives the private-equity firm a near-50% stake in the New York-based R2Net, which owns James Allen, valuing the e-commerce company at just under $300 million, Israeli newspaper Globes reported. The companies did not disclose the terms of the deal or how the money would be used, except to say the investment would accelerate James Allen’s rapid expansion.

|

|

|

|

MINING

|

|

|

|

| |

Dominion Optimistic Despite Sales Decline

Dominion Diamond Corporation sales fell 21% to $571 million in the fiscal year that ended January 31, as the miner continues to undergo a strategic review that might result in the sale of the company. Dominion reported an operating loss of $56.6 million, compared to a profit of $8 million the previous year. However, management offered a positive view of its prospects for the next three years, driven by a ramp-up of high-value production at the Ekati mine. In March, Dominion rejected a $1.1 billion takeover bid from the Washington Companies, and subsequently formed a committee to review strategic alternatives.

Dominion Diamond Corporation sales fell 21% to $571 million in the fiscal year that ended January 31, as the miner continues to undergo a strategic review that might result in the sale of the company. Dominion reported an operating loss of $56.6 million, compared to a profit of $8 million the previous year. However, management offered a positive view of its prospects for the next three years, driven by a ramp-up of high-value production at the Ekati mine. In March, Dominion rejected a $1.1 billion takeover bid from the Washington Companies, and subsequently formed a committee to review strategic alternatives.

|

| |

Letšeng Mine Yields 114ct. Diamond

Gem Diamonds has found a 114-carat rough diamond at its Letšeng mine in Lesotho. The discovery of the D-color, type-II stone follows a drop in recovery of large diamonds at the mine, which yielded only five stones above 100 carats last year compared with 11 in 2015. Letšeng is considered one of the highest-value diamond mines by average price per carat, producing four of the 20 largest gem-quality white diamonds in history since Gem Diamonds acquired it in 2006.

Gem Diamonds has found a 114-carat rough diamond at its Letšeng mine in Lesotho. The discovery of the D-color, type-II stone follows a drop in recovery of large diamonds at the mine, which yielded only five stones above 100 carats last year compared with 11 in 2015. Letšeng is considered one of the highest-value diamond mines by average price per carat, producing four of the 20 largest gem-quality white diamonds in history since Gem Diamonds acquired it in 2006.

|

| |

Sales Steady at Lulo Diamond Mine

The latest rough diamond sale from Angola’s Lulo alluvial mine garnered $2.5 million, Lucapa Diamond Company reported. A parcel containing 1,919 carats of rough fetched an average of $1,317 per carat at the sale, which was Lulo’s third this year. So far, gross proceeds from Lulo for 2017 total $13.2 million at an average price of $2,055 per carat. The next sale will include a 92-carat, D-color diamond from the mine.

The latest rough diamond sale from Angola’s Lulo alluvial mine garnered $2.5 million, Lucapa Diamond Company reported. A parcel containing 1,919 carats of rough fetched an average of $1,317 per carat at the sale, which was Lulo’s third this year. So far, gross proceeds from Lulo for 2017 total $13.2 million at an average price of $2,055 per carat. The next sale will include a 92-carat, D-color diamond from the mine.

|

| |

Sierra Leone Delays 709ct. Rough Sale

The government of Sierra Leone has pushed back the schedule for selling a 709.41-carat rough diamond to give bidders more time to take part. Potential buyers can view the diamond until May 10 at the Bank of Sierra Leone in Freetown, with bids opening the following day. The process was previously scheduled to end on April 6. A local artisanal miner, Pastor Emmanuel A. Momoh, found the diamond last month in the Kono district, and the stone was presented to Sierra Leone’s president.

The government of Sierra Leone has pushed back the schedule for selling a 709.41-carat rough diamond to give bidders more time to take part. Potential buyers can view the diamond until May 10 at the Bank of Sierra Leone in Freetown, with bids opening the following day. The process was previously scheduled to end on April 6. A local artisanal miner, Pastor Emmanuel A. Momoh, found the diamond last month in the Kono district, and the stone was presented to Sierra Leone’s president.

|

|

|

|

GENERAL

|

|

|

|

| |

AGS Honors Former President Cathy Calhoun

The American Gem Society (AGS) has presented former head Cathy Calhoun (pictured, right) with its prestigious Robert M. Shipley Award for her service to the organization and the wider industry. Calhoun, of Calhoun Jewelers, served as AGS president between 2010 and 2012, overseeing its full takeover of AGS Laboratories. She serves on several boards, including that of the Jewelers Mutual Insurance Company. She received the award during the annual AGS Conclave in Hollywood, California.

The American Gem Society (AGS) has presented former head Cathy Calhoun (pictured, right) with its prestigious Robert M. Shipley Award for her service to the organization and the wider industry. Calhoun, of Calhoun Jewelers, served as AGS president between 2010 and 2012, overseeing its full takeover of AGS Laboratories. She serves on several boards, including that of the Jewelers Mutual Insurance Company. She received the award during the annual AGS Conclave in Hollywood, California.

|

| |

Signet Opens Larger Non-Merchandise Warehouse

Signet Jewelers has expanded its facility for distributing non-merchandise items like jewelry boxes and other store supplies. The expansion adds 56,000 square feet to the Barberton, Ohio, center, bringing its total space to 134,000 square feet. The move consolidates all the non-merchandise supply needs of Signet’s approximately 3,000 US stores into one central location. Enlarging the warehouse has tripled its available inbound and outbound capacity and will enable the company to increase employment at the facility from 40 to 58 workers by year-end.

Signet Jewelers has expanded its facility for distributing non-merchandise items like jewelry boxes and other store supplies. The expansion adds 56,000 square feet to the Barberton, Ohio, center, bringing its total space to 134,000 square feet. The move consolidates all the non-merchandise supply needs of Signet’s approximately 3,000 US stores into one central location. Enlarging the warehouse has tripled its available inbound and outbound capacity and will enable the company to increase employment at the facility from 40 to 58 workers by year-end.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Global markets ended the week relatively flat with investors waiting to see if the positive momentum from the first quarter will be maintained. Far East jewelers led the gains after Chow Tai Fook (+6.9%) reported positive retail sales growth for the first time in three years. Mining shares declined with Mountain Province (-32%) losing the most ground and continuing its volatility seen since the start of the year.

View the detailed industry stock report

| |

Apr 13, 2017 (11:45 GMT) |

Apr 6, 2017 (12:58 GMT) |

Chng. |

|

| $1 = Euro |

0.94 |

0.94 |

0.00 |

|

| $1 = Rupee |

64.44 |

64.55 |

-0.11 |

|

| $1 = Israel Shekel |

3.65 |

3.64 |

0.01 |

|

| $1 = Rand |

13.58 |

13.84 |

-0.26 |

|

| $1 = Canadian Dollar |

1.32 |

1.34 |

-0.02 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,286.60 |

$1,253.12 |

$33.48 |

2.7% |

| Platinum |

$971.00 |

$954.75 |

$16.25 |

1.7% |

| Silver |

$18.46 |

$18.23 |

$0.23 |

1.3% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

29,461.45 |

29,927.34 |

-465.89 |

-1.6% |

| Dow Jones |

20,591.86 |

20,648.15 |

-56.29 |

-0.3% |

| FTSE |

7,311.43 |

7,304.24 |

7.19 |

0.1% |

| Hang Seng |

24,261.66 |

24,273.72 |

-12.06 |

0.0% |

| S&P 500 |

2,344.93 |

2,352.95 |

-8.02 |

-0.3% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Polished trading quiet, with very few foreign buyers in Mumbai due to the Passover and Easter holidays. Local dealers also more cautious than in previous weeks. Rupee-dollar exchange rate volatility (-4% since March 1 to INR 64.5/$1) adding to caution. Liquidity tight among small manufacturers. Large factories maintaining near-full-capacity polished production.

Read the Polished Diamond Trading Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|