|

The yo-yo is a simple toy that was invented by the ancient Greeks in 500BC. The yo-yo is thrown downwards, hits the end of the string, winds up the string toward the hand, then it is grabbed, ready to be thrown again. The word “yo-yo” has as many as 12 times more synonyms than antonyms. Perhaps the best synonyms are “blowing hot and cold” and “sudden change in behavior.” As for the antonyms, the best words, I think, are “persist” and “continue.” In a world where we get bombarded with information 24/7, we all tend to translate this information and use it toward building a scenario that we follow with our actions. This, of course, is the DNA of traders, who are very quick on their feet. It is also a common characteristic of many economists, stock market and foreign-exchange market professionals as well. Geo-political situations change at an unprecedented pace and people trade in nanoseconds. Reacting to news and announcements sometimes overshadows the cause and a deeper understanding of the issue at hand. We diamond traders have frequently been through yo-yo-type situations. We also exhibit these yo-yo tendencies as we are all part of a trading business. Perhaps that explains why our exuberance turns into disinterest very quickly. The market currently seems to be at a low point. Going forward, I am betting that the situation and the industry mood will only get better from here. A Question of Liquidity Our industry does not have sophisticated liquid markets that allow for a quick exit or entry into diamonds. In that respect it is quite similar to most industries, save those industries trading in financial instruments. The industry is also very dependent upon consumer demand, which is more consistent and usually growing. The recent deluge of industry news articles about banks pulling out of financing the industry, deep discounts being offered by dealers who lack liquidity and irresponsible remarks by a few people that do not want to honor their debts to Antwerp Diamond Bank (ADB), can be mistakenly perceived to mean that the bubble has burst. But that is not the case. The announcement of the ADB wind-down did not suddenly cause this condition. It is a scenario that has been gradually building up and is likely to be faced in any business. The current liquidity challenge facing the industry can actually be split into three phenomena, which have coalesced to create the current environment. These phenomena are the reduction in bank financing, business profitability and increases in inventory. Let us try to understand each of these phenomena individually. Reduction in Bank Financing Before the financial crisis, the diamond industry had traditionally been financed globally by two main specialist banks – ABN Amro and ADB. There were also multiple Indian banks operating in India and overseas and a handful of Israeli banks in Israel and the U.S. Diamond industry financing has always been a very profitable business stream for banks. These banks were always keen to support the clients and sometimes ad-hoc credit arrangements were even made within minutes through a phone call. Banks preferred to keep companies like their captive clients. ABN Amro enjoyed being the prime lender to the industry for many years. For this very reason certain banks historically had, and still do have, an exclusivity condition. Standard Chartered Bank actively entered the diamond financing business in 2009 and started picking up some prime clients, much to the dislike of Victor Van Der Kwast, the then head of the diamond and jewelry group at ABN Amro, among other bankers. The facts behind the current concerns need to be clearly understood: - ADB is shutting its doors after almost 80 years of diamond financing due to the government bailout of parent company KBC Group following the financial crisis of 2008/2009. ADB was identified as a “non-core asset” for KBC, which was directed to sell their non-core assets as part of the bailout terms.

- ADB’s current loan book is about $1.5 billion, but had been as much as $2 billion not too long ago.This reduction gradually occurred during the past nine months, after the announcement of its buyout by Yinren, which finally fell through last month.

- ABN Amro has gone through a similar process of downsizing, due to the government bailout and as of late is going through an IPO process. As part of their regular processes, they de-risked and optimized their lending portfolio through consolidation to keep their “good” assets through selective adjustments in certain businesses.

- Standard Chartered has selectively reduced its loans to balance their share of the market. However, as I was informed by a key person from the bank, Standard Chartered will continue to work closely with and support its clients for their business needs.

- Standard Chartered Bank remains the largest industry player and will continue to be.

- Bank Leumi, which had branches in Israel and the U.S., is being replaced by various non-traditional lenders in the U.S.

- Other banks in Israel and India have not expressed any intention to pull out.

As Erik Jens, head of diamond and jewelry at ABN Amro, has frequently maintained, “there is always money available for good clients.” Business Profitability Since 2010, the industry witnessed price stabilization followed by two stressful years (2012 to 2013) for mid-stream cutters and polishers, who were squeezed between higher rough prices and lower polished prices, mainly due to a crack-down of conspicuous consumption in China. The writing was on the wall. In the words of an industry banker to rough producers, “We are not in [the] business of financing your clients’ losses…” Key bankers (including ABN Amro and Standard Chartered) started restricting their exposure slowly, but firmly, to get their diamond industry clients to focus on earnings rather than revenue and to retain more of their earnings within their businesses. This approach helped wholesalers to regain traction in their businesses, which started showing stable profitability from the fourth quarter of 2013 and onwards. The year 2014 had an interesting start. ALROSA, in association with Bain and Company, projected a price increase of 2 percent to 3 percent in rough, whereas other analysts estimated that rough prices rose about 4 percent. Des Kilalea, a leading mining industry analyst at Royal Bank of Canada, believes that prices actually increased by about 7 percent to 8 percent by August. So what generated the price increases that exceeded even the highest expectations of the producers? Inventory Increases Chinese retailers had a good fourth quarter of 2013 and started to replenish their inventories, especially in the 4-grainers (1-carat) of lower colors and in dossiers below 1-carat, in preparation for growth. The industry increased the production of these qualities; however, labs could not cope with the deluge of stones, resulting in a huge backlog of product worth over $2.5 billion, according to certain estimates early this year. This meant that although the goods in the pipeline peaked, there was severe scarcity in the availability of lab-graded goods. This resulted in sharp price increases for polished diamonds during the first quarter. Diamantaires took cues from these increases and happily paid higher prices for the rough, resulting in an average rough price increase of over 7 percent. However, the rough that produced pointers and larger polished actually showed increases of well above 10 percent. Recently, the situation at the grading laboratories has eased considerably, bringing greater available supply to the market. This resulted in an inventory buildup of goods that were unfortunately bought at the higher prices. Retailers, in the meantime, had moved to lower price points due to higher prices coupled with slower sales by luxury retailers in China and to Chinese tourists overseas. This resulted in larger inventories and weakening polished prices as people had to deal with their own financial commitments. On the bright side, retail in the U.S. remained firm as it did in other Asian and Gulf markets. The possible manner in which this stock situation could evolve, under normal conditions, is: - It is now estimated that, current GIA and the other labs have a total backlog worth about $1.5 billion.

- The amount of new submissions has recently dropped, with grading capacity well exceeding the fresh intake of rough diamonds that will be polished and sent for grading.

- This GIA stock overload is expected to drop to $500 million sometime in the first quarter of 2015, provided the new submissions stay at the current lower levels of intake.

- This should release about $1 billion of available graded goods to the market, and eventually loosen liquidity as soon as the excess inventory is sold and paid for.

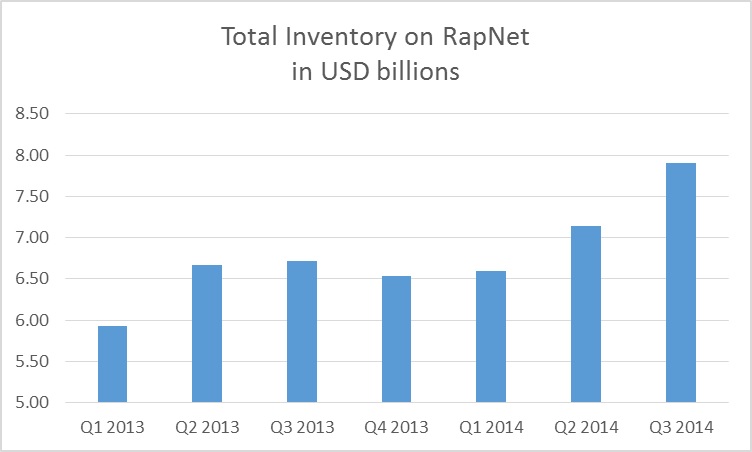

- Those who follow Rapaport will have realized that the value of listings on the RapNet trading network are at an all-time high of close to $8 billion.

- The industry will self-correct mainly through more prudent purchases and I would estimate that another $500 million of inventory will turn into money quickly.

- The estimated stock movement is shown below:

Source: Rapaport Bouncing Back The industry needs to look forward as to how the wind-down of ADB will unfold, as well as work toward a resolution of the liquidity scenario. Let us first understand the macro picture. The banking scenario could play out as follows: - The collective lending by ADB in the Hong Kong, Singapore/Dubai and Mumbai centers is about $400 million and should be settled in full.

- These loans should be wound down by the end of 2015 as these locations are being shut down.

- In effect, the ADB book will reduce from about $1.5 billion to about $1.1 billion, with most of the outstanding loans left in Antwerp.

- ADB’s diamond lending in Antwerp will be absorbed by KBC. Sources at KBC have indicated that these accounts will be treated like all other corporate lending in Belgium and so reductions, if any, would be gradual.

- $500 million is needed to settle pre-shipment or import finance liabilities, as purchases drop from current levels and less borrowing occurs.

- The growth will also come from new banks entering the industry, mainly in southern Africa and Dubai. We can expect additional funding of about $400 million within six months from these banks.

- The sale of the $1.5 billion excess inventory will be effected by reduced rough intake by the industry, which will improve cash flow, thus offsetting the above impact.

- After the industry has realized all of the above, it will be left with about $1 billion for additional rough purchases.

- The adjustment will be reflected in a reduction in the net monthly rough purchase, over a 6-month period, of about $150 million per month.

- After the price adjustment expected in both the rough and polished markets, profits will be pushed back into the industry.

- Over a period of time KBC/ADB will be able to exit the business.

These views, however, are at a macro level and there will be mismatches in specific centers, or with particular clients. Like in any industry, consolidation will be painful. The industry needs to consider more structured finance programs, similar to those that exist in other industries. These can be considered good stepping stones for new bankers, who can gain valuable industry exposure as they start to lend to the industry. Conclusions In the short term, with careful handling and patience shown by stakeholders, the industry will be able to return to a firm footing within six to nine months. Rough diamonds are a finite product and demand will exceed supply in the coming years. The wholesale pipeline, as a result of the challenges faced since 2008, has become extremely efficient with focused industry players. Competition is driving innovation in product offerings which continue to draw the attention of consumers. The presence of ADB and their managerial expertise as committed partners with the industry will be sorely missed. I believe that a gradual wind-down will have a minimal impact in the longer term. It will also focus the attention of all industry stakeholders on the need to ensure that the middle of the pipeline remains profitable to ensure growth and maintain the confidence of the bankers. A situation like this will also open an opportunity for bankers with good balance sheets to enter the industry and pick up top clientele, which is usually difficult to do. While there may be the possibility of a few specific micro issues, the industry will continue to prosper. The industry and its committed bankers are well aware that a “good” client is not just someone with a high turnover, but, more importantly, is someone who has a sound business model, a balanced distribution, is focused on profitability, acts responsibly, meets all compliance requirements and is well-governed. In this new world order of compliance where bankers are fined billions of dollars, the industry has responded by improving reporting and creating better transparency and robust management systems as required by clients, suppliers and bankers. We should practice introspectiveness and move toward attaining greater stability in our businesses in the long term, against the flow of the yo-yo.

Rapaport News is not responsible for, and does not endorse, the content of any third-party source. This content has not been prepared by Rapaport and has been provided by a third-party. It has been provided as additional information for our clients.

|