|

|

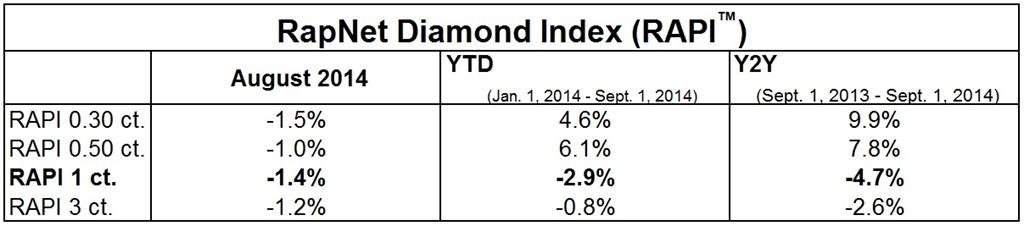

Polished Diamond Prices Continue to Decline in August

RapNet Diamond Index (RAPI) for 1ct. Diamonds -1.4%

Sep 8, 2014 10:32 AM

By Rapaport

|

|

|

RAPAPORT... PRESS RELEASE, September 8, 2014, New York ... Polished diamond prices declined in August as trading slowed and liquidity tightened in the manufacturing centers. Buyers avoided making large inventory purchases in advance of the September Hong Kong Jewellery and Gem Fair, yet suppliers are maintaining low expectations for the show.

The RapNet Diamond Index (RAPI™) for 1-carat laboratory-graded diamonds fell 1.4 percent during August. RAPI for 0.30-carat diamonds declined 1.5 percent, while RAPI for 0.50-carat diamonds decreased 1 percent. RAPI for 3-carat diamonds fell 1.2 percent during the month.

Copyright © by Martin Rapaport

According to the Rapaport Monthly Report – September 2014: “Large Inventory, Tight Liquidity,” polished markets were quiet with Belgian and Israeli dealers taking vacation through most of August. There was steady U.S. demand for commercial-quality, SI-I2 clarity diamonds. Demand for Gemological Institute of America (GIA) dossiers slowed from previous months but remained fairly robust. The GIA improved its turnaround time of grading diamonds, which has contributed to higher inventory levels ahead of the holiday season.

Rough trading slowed and prices softened on the secondary market in August following the relatively big De Beers sight. Mining companies posted significant profit growth in the first half of 2014 due to high rough prices and a larger volume of supply. In addition to large polished inventories, manufacturers currently have significant quantities of rough inventory, which has further pressured their liquidity. Rough buying is expected to slow further in September.

Diamond manufacturers have low expectations for next week’s Hong Kong show. Buyers are pushing for higher discounts as suppliers seek to raise liquidity levels amid concerns about reduced bank credit. Cash buyers are getting significant discounts. Dealers and manufacturers are hoping the show will help to ease their liquidity pressures and deplete some excess inventory, while they attempt to reverse the downtrend in polished prices that has been evident in the past few months.

Read the attached Rapaport Monthly Report, "Large Inventory, Tight Liquidity," at www.diamonds.net/report or email: specialreports@diamonds.net.

Rapaport Media Contacts: media@diamonds.net

U.S.: Sherri Hendricks +1-702-893-9400;

International: Lisa Miller +1-718-521-4976;

Mumbai: Manisha Mehta +91-97699-30065

About the Rapaport RapNet Diamond Index (RAPI™): The RAPI is based on the average asking price in hundred $/ct. for the top 25 quality 1 ct. round diamonds (D-H, IF-VS2, RapSpec-2 and better) with GIA grading reports offered for sale on RapNet – Rapaport Diamond Trading Network. The RAPI is provided for various sizes. www.RAPNET.com has daily listings of over 1.16 million diamonds valued over $7.4 billion and 13,523 members in 84 countries.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added value services that support the development of fair, transparent, efficient, and competitive diamond and jewelry markets. Established in 1978, the Rapaport Magazine is the primary source of diamond price and market information. Group activities include Rapaport Information Services providing research, analysis and news; RapNet – the world's largest diamond trading network; Rapaport Laboratory Services provides GIA gemological services in India, Belgium and Israel; and Rapaport Trading and Auction Services specializing in recycled diamonds and jewelry. The Group supports over 20,000 clients in 118 countries and employs 200 people with offices in New York, Las Vegas, Antwerp, Ramat Gan, Mumbai, Surat, Dubai and Hong Kong. Additional information is available at www.Diamonds.net.

Martin Rapaport (Publisher) grants limited permission to use copyrighted data appearing in this press release in and in conjunction with journalistic copy, reporting or articles concerning diamond pricing and information in graph or data presentation format only. The following credit notice must appear alongside, underneath, or in close proximity to any use of the copyrighted data: “Used with permission of Rapaport USA, Inc. Copyright © Martin Rapaport. All rights reserved.”

|

|

|

|

|

|

|

|

|

|

Tags:

De Beers, diamonds, Jewelry, Rapaport, Signet, Tiffany

|

|

|

|

|

|

EGL

|

|

Sep 12, 2014 12:43AM

By Stephen Christodoulou

|

|

AT LAST SOMEONE HAS SPOKEN PUBLICLY, CONGRATULATIONS TO RAPNET ON TRYING TO EEDUACATE THE DEALERS (THEY ALL KNEW THE GRADING WAS OFF BUT NEVER SAY ANYTHING, ESPACIALLY TO THEIR CLIENTS).

|

|

|

|

|

|

|

|

|

|

|