|

In-Depth

The Melee Market

Used as accents or for pavé, melee is an integral part of the diamond market.

By Zainab Morbiwala

Melee has always been an important player in the diamond market, accenting jewelry and creating sparkling pavé. Over the past 15 years, melee has become even more important to the diamond jewelry market as halo settings in engagement rings have been one of the most popular styles of the moment. In addition, as diamond jewelry has become more design oriented and as consumers have become more cost conscious, tiny melee diamonds have allowed for the creation of larger-scale designs that have big impact at a more affordable price.

Known to be the largest producer of polished diamonds, India is also the largest producer of melee. “Of the total melee production in the world, 90 percent of melee is estimated to be cut in India,” says Vipul Shah, from the Gem and Jewellery Export Promotion Council of India (GJEPC). Surat leads the country in manufacturing melee, accounting for 90 percent of the total produced.

YOU MUST HAVE JAVASCRIPT ENABLED TO VIEW THE SLIDESHOW

These very small diamonds have their own language that defines their size. Commonly referred to as “diamond chips” by consumers, melee diamonds are a staple in the industry, especially in designer jewelry. The term “melee” refers to a group of small diamonds and traces its origins to the French word mêlée, which means “mixed.” Melee can range in size from as small as 0.001, which is 1000th of a carat, to 0.15 carats, measuring approximately 0.6 mm to 3.5 mm in diameter. In the Indian trade, melee from 0.001 carats to 0.025 carats is called stars. The average number of pieces per carats in stars ranges from 40 pieces to 333 pieces. Stones in sizes ranging from

0.12 carats to 0.15 carats are classified as coarse melee. (See chart on next page.)

Melee is measured using diamond sieves, which are high-precision measuring instruments that consist of round metallic plates with precisely sized holes, shown below. Sieve sizes ranges from 000 to +16. Sieve sets can also be manufactured in quarter increments.

The history of India and the manufacturing of melee, says Vipul Shah, can be traced to 1962, when the government of India allowed the import of rough diamonds for cutting and polishing purposes. Initially, India cut and polished the lower-priced small diamonds like stars. Manish Jain, chairman, All India Gems and Jewellery Trade Federation (GJF) explains, “From the late 1990s through the turn of this century, as India’s cutting expertise improved, and Indian cutting factories began to use increasing amounts of state-of-the-art technology, it became apparent that the quality differential enjoyed by other major cutting centers had been eroded. It made sense for the big miners to have Indian cutting facilities process melee, as they could also add the most value to this segment.”

Elaborating on the factors that make India the biggest destination for cutting and polishing melee, Mark Gershburg, founder and chief executive officer (CEO) of Gemological Science International (GSI), notes, “The new cutting machines and advanced technologies improved the quality of the small stones and increased the quantity.” Furthermore, India’s labor costs are lower than in other countries.

|

|

Copyright © by Martin Rapaport

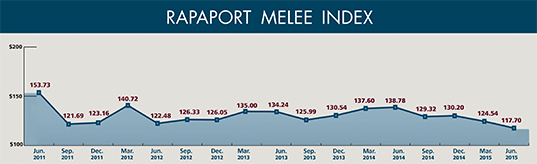

The Rapaport Melee Index (RMITM ) is an average price of multiple qualities of assorted diamonds sold through Rapaport Auctions on a consistent basis and reflects price trends for diamonds below 0.15 carats.

|

Workers are trained to cut and polish all rough diamonds by industry groups such as the India Diamond Institute (IDI). Seventy percent of the workforce of India is engaged in cutting melee, according to Vipul Shah. The sorting and grading of melee is considered to be a work of art, as tiny diamonds have to be not only sieved, but also sorted. The use of high-tech machines from Russia and Israel has replaced manual methods, but, overall, melee cutting is still considered to be labor intensive.

According to GJEPC, the top Indian companies that are engaged in the business of cutting melee are Kiran Gems Pvt. Ltd., Sheetal Diamonds Ltd., Rosy Blue, Mahendra Brothers Exports Pvt. Ltd., Dimexon Diamonds Ltd. and Asian Star Co. Ltd.

Melee, like other rough, is sourced from miners, including De Beers, ALROSA, Rio Tinto, Dominion Diamond Corporation and other African mines. Though there is no lack of supply of rough for melee, Vipul Shah believes that due to the current economic scenario, the cutting of melee or any other diamond is not high on yielding profitability. “The raw material prices have gone up, but due to recessionary trends in the global market, the polished or finished goods prices have not increased by that value, which has eroded the profitability in business,” he explains. Jain points out that profitability varies from market to market and quality to quality.

Dinesh Lakhani, director, Kiran Gems Pvd. Ltd., notes that production costs have undergone “a sea change in the past five years, increasing about three times to what it was back then.” Vipul Shah offers several explanations for the increase, including inflation and wage increases, the use of high-value modern machines and the interest and depreciation costs of those machines.

Still, the most basic challenge India faces, Gershburg says, is “the rupee against the dollar as this affects the cost of the rough production and then finally, the polished prices.”

“The melee range is witnessing a positive demand. There is a good movement seen even in better clarity melee,” says Dinesh Navadia, president, Surat Diamond Association (SDA), adding, “the business from melee is better compared to the production of larger-size diamonds.” He attributes greater demand for the use of melee in “more complicated jewelry designs,” noting, “Melee fits in perfectly with trendy designs.”

Moreover, Lakhani comments, “As per the current condition, with business for melee improving, our business strategy has been to manufacture melee, which is comparatively more profitable than stars with regard to cut and make.” However, regarding profitability, he cautions, “There is an industrywide profitability challenge. There are pressures across every product category. But melee has relatively less pressure, and sales are smooth. With melee, the stock levels are under control and the receivables cycle is much faster.”

Vipul Shah cites a healthy demand for melee in Europe, the Middle East, the U.S., China and the domestic Indian market. Navadia says the highest demand for melee is from Hong Kong and Bangkok in Asia, followed by the U.S., because customers there like intricately designed jewelry that often incorporates melee. Jain explains, “Size is not the differentiator. The price points for any given size are what determine what does or does not sell in a particular market. The U.S. consumes most of the lower qualities, although, of course, there are specific U.S. customers who take high-end goods.”

According to Sanjay Shah, director, Gold Star Diamond Pvt. Ltd., currently, the price of melee is soft compared to the past few months, down by around 5 percent. “Melee demand has been very soft,” he says, “and while we have seen price increases in other sizes and larger goods, melee has been soft or stable. Given that production has been greater than demand and demand for jewelry is price-driven is perhaps the reason that the price of melee is not keeping pace with the increase in the price of other diamonds.” He believes that prices are expected to remain stable for now.

Over the past few years, stars have surpassed the prices of melee, but recently the gap between the two has lessened. Given the adjusted price differential, the preference of melee over stars has increased for customers at large.

At one time there were few provisions for the grading of melee diamonds, but recently, as the industry has become more attuned to the issue of synthetic diamonds, laboratories like GSI, International Gemological Institute (IGI) and Gemmological Institute of India (GII) have begun to grade melee diamonds. Testing melee has certain issues — it can sell for less than what it costs to test it.

Vipul Shah points out that because of its size, melee presents a “more worrying ethical issue” regarding the mixing of synthetic with natural diamonds. “There are a few instances that we have come across. The GJEPC, with the support of the Bharat Diamond Bourse (BDB), has established the Diamond Detection and Research Center (DDRC), which set up its operation first in Mumbai and Surat. The records indicate that the instances of synthetics being found have gone down. With the availability of this facility, unscrupulous people now have the fear of being caught. With time, the illegal practice will decrease even further.” Lakhani adds, “The matter is serious, but should not be blown out of proportion. Instead, thoughtful measures should be implemented. At Kiran Gems, we ensure that our pipeline is untouched through implementing control measures at various checkpoints, but we have no control once the goods are sold. So, there should be standards to be followed throughout the entire pipeline to ensure the natural sanctity of the diamonds, subject to a third-party audit. It is even more important at the B2C levels — the retail counters — where the consumer comes into contact with the product category and the whole industry.”

Highlighting the reason for the unfair practices, Sanjay Shah explains, “Yes, it is a major problem and the main reason being that small manufacturers are not able to make a profit from polishing natural diamonds. This is forcing them to look to other avenues and, unfortunately, turning to synthetics is one of the avenues. There is no doubt that there is a large supply of rough diamonds in which synthetics can be mixed in. Not specifically melee, but mainly coming from China and in small sizes. Most goods that are polished are -6.5 and with the scarcity of machines to detect synthetics at a lower level, the goods can easily be mixed in with natural diamonds. It is a major concern and unfortunately, we are not fighting it jointly. GJEPC should come out in support of synthetics and identifying that there is a market for same, rather than looking at people who are dealing in synthetics as criminals. We should have some norms set by which we not only create awareness in consumers’ minds, but assist those who wish to produce synthetic stones, so they can sell them as such.”

To give a boost to the overall business of diamonds in India, which includes the manufacturing of melee, Vipul Shah identifies a few areas where the industry would like the government of India to be of help. “The government of India can support this industry by taking quick actions on the following requests: implementing of the recently announced Special Notified Zone (SNZ) for diamonds in the country and introducing the Presumptive Taxation regime for the Indian diamond industry besides working on the import duty structure for natural and lab-grown diamonds and ensuring direct and continuous availability of raw materials.” As the dynamics of the jewelry industry move to becoming more trend-driven, the demand for melee is strong and experts feel that it will remain so permanently. “It is difficult to pinpoint which sizes in melee would do well, but overall, the response to melee has always been positive,” sums up Navadia. “However, what needs to be looked into is how the production of melee can yield better margins and profitability for the manufacturer. The reason I say so is because the price of melee has not increased on par with the increase of other diamonds in larger sizes,” he concludes.Article from the Rapaport Magazine - August 2015. To subscribe click here.

|

|