|

|

Rapaport TradeWire January 12, 2017

Jan 12, 2017 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

January 12, 2017

|

|

|

Diamond demand uncertain as U.S. jewelers

report weak holiday sales. Signet disappoints as Nov.-Dec. sales -5% to $1.9B with

fewer transactions, higher average price, and technical glitches on ecommerce

channel. Mall traffic slow with department stores discounting heavily to

attract customers. Macy’s, J.C. Penney jewelry outpaces sluggish overall

performance. Rising expectations for Chinese New Year after Chow Tai Fook 3Q

retail sales +7% in China, -6% in Hong Kong. Steady rough demand expected at

next week’s De Beers sight as manufacturers raise production for 1Q stock

replenishment. ALROSA 2016 sales

+26% to $4.5B. U.S. Nov. polished imports -2% to $1.6B, exports +25% to $1.7B.

|

|

| Diamonds |

1,258,800 |

| Value |

$7,663,568,584 |

| Carats |

1,343,922 |

| Average Discount |

-29.95% |

www.rapnet.com

|

|

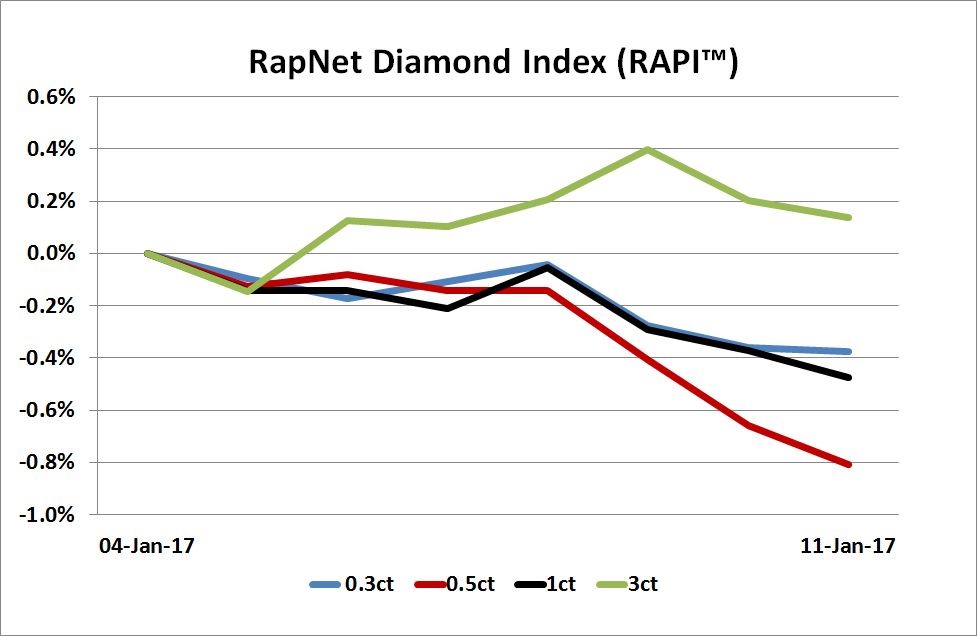

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

Signet’s holiday faced a perfect storm of retail pressure from jewelry-industry trends, competitor promotions, Sterling ecommerce execution, U.K. macro factors and weak mall traffic.

Signet’s holiday faced a perfect storm of retail pressure from jewelry-industry trends, competitor promotions, Sterling ecommerce execution, U.K. macro factors and weak mall traffic.

Nomura analyst Simeon Siegel

|

|

|

|

MARKETS

|

|

|

|

| |

United

States: Polished market stable

as dealers return from Christmas break. Diamond trading expected to improve as

jewelers replenish stock sold during holiday period…

Belgium: Trading quiet as dealers

return from vacation. Cautious mood after polished prices softened in December

and as banks restrict funding to local traders…

Israel:

Stable market with

steady Far East demand ahead of Chinese New Year season. U.S. demand slow as

buyers return from holiday…

India: Sentiment weak. Holiday sales to U.S. slower

than usual with estimates of small decline. Steady demand for 0.30-1.50 ct.,

VS1-SI2, RapSpec A3 diamonds but D-F, IF weaker…

Hong

Kong: Diamond trading slow

with manufacturers and wholesalers closing for Chinese New Year holiday. Retail

sentiment improving ahead of the Jan. 28 festival with growth in mainland China

expected from last year’s low base…

Click here for deeper analysis |

|

|

|

FIVE-MINUTE INTERVIEW

|

|

|

|

| |

Undisclosed Synthetics Reaching Epidemic Levels

Joseph Kuzi, director of

Diamond Services, warns that undisclosed

synthetics are more widespread than the industry realizes. As technology

advances and production of lab-grown diamonds increases, the trade must raise

its vigilance about the issue if it is to protect the future of the natural

diamond industry, Kuzi emphasized in a recent interview with Rapaport News...

Click here to continue reading

|

|

|

|

INDUSTRY

|

|

|

|

| |

Sarine Sales Jump Indian Liquidity Hurdle

Sarine Technologies expects fourth-quarter revenue grew

significantly as sentiment improved in the Indian diamond manufacturing sector.

The company projected sales surpassed $18 million during the final three

months of 2016, which would imply a 45% jump from a year ago. Sentiment in

India was strong during the quarter despite the impact of demonetization on

liquidity levels, Sarine explained.

Sarine Technologies expects fourth-quarter revenue grew

significantly as sentiment improved in the Indian diamond manufacturing sector.

The company projected sales surpassed $18 million during the final three

months of 2016, which would imply a 45% jump from a year ago. Sentiment in

India was strong during the quarter despite the impact of demonetization on

liquidity levels, Sarine explained.

|

| |

India Approves Diamond-Futures Trading

The Securities and Exchange Board of India (SEBI) gave

its in-principle approval to trading in diamond futures. Transactions on the

Indian Commodity Exchange (ICEX) are expected to launch in March once certain additional regulatory

approvals have been obtained. Investors will

be able to trade in three categories of diamond futures: 0.30 carats, 0.50

carats and 1 carat. India’s government gave its go-ahead to the plans in

September.

The Securities and Exchange Board of India (SEBI) gave

its in-principle approval to trading in diamond futures. Transactions on the

Indian Commodity Exchange (ICEX) are expected to launch in March once certain additional regulatory

approvals have been obtained. Investors will

be able to trade in three categories of diamond futures: 0.30 carats, 0.50

carats and 1 carat. India’s government gave its go-ahead to the plans in

September.

|

| |

Households Unaware of 80% Rise in Jewelry Value

Vintage jewelry gained more than 80% in value in the past

decade, with many owners not realizing how much money they are sitting on,

U.K.-based auction house Bonhams said. Jewelry from the Art Deco period in the

1920s and 1930s and pieces from the Belle Epoque era from 1890 to 1915 have

appreciated 88% since 2006, the company said, citing Art Market Research.

Jewelry from the post-war era jumped 70% in value.

Vintage jewelry gained more than 80% in value in the past

decade, with many owners not realizing how much money they are sitting on,

U.K.-based auction house Bonhams said. Jewelry from the Art Deco period in the

1920s and 1930s and pieces from the Belle Epoque era from 1890 to 1915 have

appreciated 88% since 2006, the company said, citing Art Market Research.

Jewelry from the post-war era jumped 70% in value.

|

| |

U.S. Diamond Trade Slows in November

U.S. polished diamond imports slipped 2% to $1.59 billion

in November, while polished exports grew 25% to $1.7 billion, government

data revealed. Rough imports more than doubled to $72.3 million, while exports jumped to $73.2 million from $19.8 million. The net

diamond account was negative $107.9 million compared with positive $248.9

million a year ago, as more diamonds left the country than came in during the

period.

U.S. polished diamond imports slipped 2% to $1.59 billion

in November, while polished exports grew 25% to $1.7 billion, government

data revealed. Rough imports more than doubled to $72.3 million, while exports jumped to $73.2 million from $19.8 million. The net

diamond account was negative $107.9 million compared with positive $248.9

million a year ago, as more diamonds left the country than came in during the

period.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Ecommerce Gains Leave Retail Stores in the Cold

Initial holiday sales data from across the retail sector pointed

to a tough season, with department stores reporting declines due to a shift

toward online shopping. Macy’s and J.C. Penney both posted revenue drops

but noted jewelry sales were relatively strong. Kohl’s holiday sales also fell.

Researchers at RetailNext backed up this verdict, reporting bricks-and-mortar

sales fell 10%, while ComScore said online sales jumped 12%.

Initial holiday sales data from across the retail sector pointed

to a tough season, with department stores reporting declines due to a shift

toward online shopping. Macy’s and J.C. Penney both posted revenue drops

but noted jewelry sales were relatively strong. Kohl’s holiday sales also fell.

Researchers at RetailNext backed up this verdict, reporting bricks-and-mortar

sales fell 10%, while ComScore said online sales jumped 12%.

Image: Kan Wu

|

| |

Signet Reports Bleak Holiday Season

Signet Jewelers’ sales fell 5.1% to $1.94 billion in November

and December as the company observed overall weakness in the jewelry market.

Ecommerce sales slipped 2.4% because enhancements to Signet’s online selling

platform failed to cope with the higher levels of holiday traffic. In-store

sales were more in line with the mid-single digit decline seen across the

jewelry industry over the holiday, the company said. Signet’s same-store

sales fell 4.6% during the period.

Signet Jewelers’ sales fell 5.1% to $1.94 billion in November

and December as the company observed overall weakness in the jewelry market.

Ecommerce sales slipped 2.4% because enhancements to Signet’s online selling

platform failed to cope with the higher levels of holiday traffic. In-store

sales were more in line with the mid-single digit decline seen across the

jewelry industry over the holiday, the company said. Signet’s same-store

sales fell 4.6% during the period.

|

| |

Richemont Sales Hint at High-End Rebound

Richemont reported sales at its jewelry maisons jumped 9%

to $1.86 billion (EUR 1.75 billion) in the third fiscal quarter which included

the holiday season. The maisons, which comprise luxury brands Cartier and

Van Cleef & Arpels, drove an overall improved performance by the group, while

sales at its specialist watchmakers fell 2%. Group revenue advanced 6% to $3.29

billion, with sales in Asia-Pacific rising 10%, while the Americas grew 8%

and Europe climbed 3%.

Richemont reported sales at its jewelry maisons jumped 9%

to $1.86 billion (EUR 1.75 billion) in the third fiscal quarter which included

the holiday season. The maisons, which comprise luxury brands Cartier and

Van Cleef & Arpels, drove an overall improved performance by the group, while

sales at its specialist watchmakers fell 2%. Group revenue advanced 6% to $3.29

billion, with sales in Asia-Pacific rising 10%, while the Americas grew 8%

and Europe climbed 3%.

|

| |

Chow Tai Fook Sales Signal China Recovery

Chow Tai Fook said retail sales in mainland China

increased 7% in the third fiscal quarter that ended December 31, while

same-store sales advanced 4%. However, revenue from Hong Kong and Macau fell 6%

with same-store sales down 2%. Gold sales outperformed gem-set jewelry in

both regions as gold prices rose during the period. The results signal a

turnaround from the double-digit declines reported in the past two years when the

jeweler was hit by a slowdown in China's economy and fewer tourist arrivals in

Hong Kong.

Chow Tai Fook said retail sales in mainland China

increased 7% in the third fiscal quarter that ended December 31, while

same-store sales advanced 4%. However, revenue from Hong Kong and Macau fell 6%

with same-store sales down 2%. Gold sales outperformed gem-set jewelry in

both regions as gold prices rose during the period. The results signal a

turnaround from the double-digit declines reported in the past two years when the

jeweler was hit by a slowdown in China's economy and fewer tourist arrivals in

Hong Kong.

|

| |

Weak U.S. Sales Inhibit Michael Hill Growth

Australia-based Michael Hill reported group sales

increased 5.7% to $240.3 million (AUD 328.1 million) in the first fiscal half ending

December 31, despite its sluggish performance in the U.S. Global same-store

sales increased 1%. Sales generated at Michael Hill-branded stores in Australia

increased 3%, while revenue in Canada jumped 18%. Sales in New Zealand declined 1.3%. However, U.S. sales slid 5.9% as the company attempts to revive

growth there under new regional head Brett Halliday.

Australia-based Michael Hill reported group sales

increased 5.7% to $240.3 million (AUD 328.1 million) in the first fiscal half ending

December 31, despite its sluggish performance in the U.S. Global same-store

sales increased 1%. Sales generated at Michael Hill-branded stores in Australia

increased 3%, while revenue in Canada jumped 18%. Sales in New Zealand declined 1.3%. However, U.S. sales slid 5.9% as the company attempts to revive

growth there under new regional head Brett Halliday.

|

|

|

|

MINING

|

|

|

|

| |

ALROSA Sales Rise as Rough Demand Returns

ALROSA’s diamond sales jumped 26% to $4.49 billion in

2016, reflecting a recovery in the rough market. The increase came despite a

slowdown in the final two months when India's demonetization policy impacted

liquidity for small rough diamonds. ALROSA's December sales totaled $176.3

million, with rough revenue of $173 million and polished sales of $3.3 million. This compares with combined sales of $255.2 million recorded in

November.

ALROSA’s diamond sales jumped 26% to $4.49 billion in

2016, reflecting a recovery in the rough market. The increase came despite a

slowdown in the final two months when India's demonetization policy impacted

liquidity for small rough diamonds. ALROSA's December sales totaled $176.3

million, with rough revenue of $173 million and polished sales of $3.3 million. This compares with combined sales of $255.2 million recorded in

November.

|

| |

Angola Mine Claims Highest-Value Diamonds

Lucapa Diamond Company claimed its Lulo mine in Angola

achieved the highest price per carat for any run-of-mine diamond production in

the world in 2016. Sales reached $51 million at an average price of $2,983 per carat, the

miner reported. The mine produced 269 ‘special’ rough diamonds, weighing 10.8

carats or more, compared with 86 a year ago. Total diamond output more than

doubled to 19,833 carats from 8,394 carats in 2015.

Lucapa Diamond Company claimed its Lulo mine in Angola

achieved the highest price per carat for any run-of-mine diamond production in

the world in 2016. Sales reached $51 million at an average price of $2,983 per carat, the

miner reported. The mine produced 269 ‘special’ rough diamonds, weighing 10.8

carats or more, compared with 86 a year ago. Total diamond output more than

doubled to 19,833 carats from 8,394 carats in 2015.

|

|

|

|

GENERAL

|

|

|

|

| |

Sotheby’s Combines Luxury Categories

Sotheby’s launched a luxury and lifestyle division

uniting its jewelry, watches, wine, cars and ‘experiences’ categories. The auction

house appointed seasoned auctioneer Marteen ten Holder managing director of the

new unit. Ten Holder (pictured) brings experience in each of

the categories to the role. He will move to New York from London, where he was

most recently managing director of Sotheby’s operations in Europe, the Middle

East, India and Africa.

Sotheby’s launched a luxury and lifestyle division

uniting its jewelry, watches, wine, cars and ‘experiences’ categories. The auction

house appointed seasoned auctioneer Marteen ten Holder managing director of the

new unit. Ten Holder (pictured) brings experience in each of

the categories to the role. He will move to New York from London, where he was

most recently managing director of Sotheby’s operations in Europe, the Middle

East, India and Africa.

|

| |

Dhamani Selected to Retail Argyle Pink Diamonds

Rio Tinto named Dubai-based jeweler Dhamani to its

exclusive list of ‘select ateliers’ for Argyle pink diamonds, granting it

access to the miner’s supply of rare stones. Dhamani launched a new line of

pink-diamond jewelry, the DPINK Collection, which mostly comprise diamonds from

Rio Tinto's Argyle mine in Australia. ‘Select ateliers’ are companies that Rio

Tinto has entrusted with retailing Argyle pink diamonds not sold through Rio

Tinto’s main annual tender.

Rio Tinto named Dubai-based jeweler Dhamani to its

exclusive list of ‘select ateliers’ for Argyle pink diamonds, granting it

access to the miner’s supply of rare stones. Dhamani launched a new line of

pink-diamond jewelry, the DPINK Collection, which mostly comprise diamonds from

Rio Tinto's Argyle mine in Australia. ‘Select ateliers’ are companies that Rio

Tinto has entrusted with retailing Argyle pink diamonds not sold through Rio

Tinto’s main annual tender.

|

| |

MJSA Raises the Bar for Bespoke Jewelry

Manufacturing Jewelers & Suppliers of America (MJSA)

has launched a program to improve the consumer experience when buying

custom-made jewelry. The group set up the Council of Custom Jewelers as part of

the initiative to advance the art of custom-jewelry design and consumers’

appreciation of it. MJSA will also establish a basic definition of custom

jewelry and promote a system for classifying custom-designed projects.

Manufacturing Jewelers & Suppliers of America (MJSA)

has launched a program to improve the consumer experience when buying

custom-made jewelry. The group set up the Council of Custom Jewelers as part of

the initiative to advance the art of custom-jewelry design and consumers’

appreciation of it. MJSA will also establish a basic definition of custom

jewelry and promote a system for classifying custom-designed projects.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Disappointing U.S. holiday sales prompted heavy losses among retail stocks, with Kohl's (-21%) enduring the biggest slide. JCPenney (-17%), Macy's (-16%) and Signet (-11%) also fell sharply after sluggish performances during the crucial season. Hong Kong retail gained on improved results from Chow Tai Fook (+6%) and signs of a recovery in the Chinese market. It was also a relatively strong week for European retail stocks as Richemont (+17%) reported promising results.

View the detailed industry stock report

| |

Jan 12, 2017 (12:53 GMT) |

Jan 5, 2017 (13:41 GMT) |

Chng. |

|

| $1 = Euro |

0.94 |

0.95 |

-0.01 |

|

| $1 = Rupee |

67.97 |

67.89 |

0.08 |

|

| $1 = Israel Shekel |

3.82 |

3.85 |

-0.03 |

|

| $1 = Rand |

13.46 |

13.62 |

-0.16 |

|

| $1 = Canadian Dollar |

1.31 |

1.33 |

-0.02 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,204.73 |

$1,173.83 |

$30.90 |

2.6% |

| Platinum |

$986.80 |

$958.20 |

$28.60 |

3.0% |

| Silver |

$16.92 |

$16.57 |

$0.35 |

2.1% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

27,247.16 |

26,878.24 |

368.92 |

1.4% |

| Dow Jones |

19,954.28 |

19,942.16 |

12.12 |

0.1% |

| FTSE |

7,285.86 |

7,200.59 |

85.27 |

1.2% |

| Hang Seng |

22,829.02 |

22,456.69 |

372.33 |

1.7% |

| S&P 500 |

2,275.32 |

2,270.75 |

4.57 |

0.2% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Stable market with

steady Far East demand ahead of Chinese New Year season. U.S. demand slow as

buyers return from holiday. Domestic market still feeling effect of

demonetization. Major retailers with organized credit and electronic payment

facilities doing relatively well. Large manufacturers raising production as

U.S. post-holiday orders begin. Small factories feeling liquidity squeeze

remain closed. Steady production of dossiers and 1 ct., while manufacturing of

small goods is slow.

Read the Polished Diamond Trading Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|