|

|

Polished Diamond Prices Slide in September

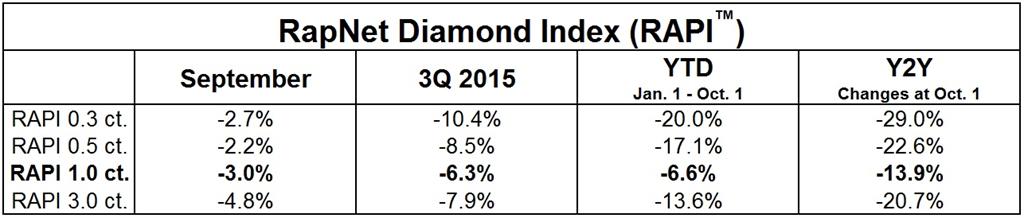

RapNet Diamond Index (RAPI™) for 1ct. GIA-Graded Diamonds -6.3% in 3Q

Oct 13, 2015 5:00 AM

By Rapaport News

|

|

|

RAPAPORT... Diamond suppliers are under pressure as polished prices fell further in September. According to the Rapaport Monthly Report – October 2015, U.S. demand is steady as the holiday season approaches but Chinese buyers are restrained due to a slowdown in economic growth in China and Hong Kong.

Wholesale and retail buyers are avoiding excess inventory and buying to fill existing orders. Suppliers are holding large inventories that are difficult to sell in the current weak market. At the same time, there is a shortage of SI-clarity diamonds that are in strong demand for the U.S. market, while manufacturers have reduced production by 30 percent to 50 percent this year due to high rough prices. There are opportunities for buyers with cash but there is no urgency to buy goods.

The RapNet Diamond Index (RAPI™) for 1-carat, GIA-graded diamonds dropped 3 percent in September. RAPI for 0.30-carat diamonds declined 2.7 percent, while RAPI for 0.50-carat diamonds slipped 2.2 percent. RAPI for 3-carat diamonds fell 4.8 percent during the month. The third quarter saw RAPI for 1-carat diamonds decline by 6.3 percent while the index on October 1 was down 13.9 percent from a year ago.

© Copyright 2015, Martin Rapaport

The Rapaport Monthly Report demonstrates that polished trading activity improved after the July / August vacation period but is still well below 2014 levels. The Hong Kong Jewellery and Gem Fair signaled that the recent Chinese stock market slump and the government’s anti-corruption campaign is having a lasting negative impact on discretionary spending. Jewelry retail sales during the National Day Golden Week that began on October 1 were weak and expectations are low for the important Chinese New Year in February.

Consistent U.S. consumer demand is providing stability and compensating for weak demand in other markets. U.S. jewelry retail sales increased by low single-digit percentage points since the beginning of 2015 and the trend is expected to continue throughout the Christmas shopping season. U.S. consumer confidence improved in September despite recent stock market losses.

Rough diamond trading remains difficult as manufacturers have reduced production until the November Diwali break. ALROSA reduced rough prices by 8 percent to 10 percent in September, following similar cuts by De Beers the previous month. Sightholders deferred a large volume of rough again at the October De Beers sight estimated at $200M.

There are very few fresh goods coming into the market. Manufacturers hope that jewelers will reduce their inventories during the upcoming holiday season, stimulating stronger demand in the first quarter of 2016. Despite weak market conditions, such expectations have helped lift the mood in the diamond trade after a quiet third quarter.

# # #

Purchase the attached Rapaport Monthly Report at www.diamonds.net/report or email: specialreports@diamonds.net.

Rapaport Media Contacts: media@diamonds.net

U.S.: Sherri Hendricks +1-702-893-9400

International: Gabriella Laster +1-718-521-4976

Mumbai: Manisha Mehta +91-97699-30065

About the Rapaport RapNet Diamond Index (RAPI™): The RAPI is based on the average asking price in hundred $/ct. of the 10 best priced diamonds, for the top 25 quality round diamonds (D-H, IF-VS2, RapSpec-A3 and better) offered for sale on RapNet – Rapaport Diamond Trading Network. The RAPI is provided for various sizes. www.RapNet.com has daily listings of over 1.3 million diamonds valued at more than $8.5 billion. Additional information is available at www.Diamonds.net.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added value services that support the development of fair, transparent, competitive and efficient diamond and jewelry markets. Established in 1978, the Rapaport Price List is the primary source of diamond price and market information. Group activities include Rapaport Information Services, Rapaport Magazine, and Diamonds.net, providing research, analysis and news; RapNet – the world’s largest diamond trading network; Rapaport Laboratory Services provides GIA gemological services in India, Belgium and Israel; and Rapaport Trading and Auction Services specializing in recycled diamonds and jewelry. The Group supports over 20,000 clients in 118 countries and employs 220 people with offices in New York, Las Vegas, Antwerp, Ramat Gan, Mumbai, Surat, Dubai and Hong Kong. Additional information is available at www.Diamonds.net.

Martin Rapaport (Publisher) grants limited permission to use copyrighted data appearing in this press release in and in conjunction with journalistic copy, reporting or articles concerning diamond pricing and information in graph or data presentation format only. The following credit notice must appear alongside, underneath, or in close proximity to any use of the copyrighted data: “Used with permission of Rapaport USA, Inc. Copyright © Martin Rapaport. All rights reserved.”

|

|

|

|

|

|

|

|

|

|

Tags:

Alrosa, De Beers, diamonds, Hong Kong, jewellery, Jewelry, Rapaport, Rapaport News

|

|

|

|

|

|

|

|

|

|

|

|

|