|

|

Rapaport TradeWire May 5, 2016

May 5, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

May 5, 2016

|

|

|

Polished market slow with April 1 ct. RAPI

-0.3%; 0.30 ct. -1.3%. Steady U.S. demand raises expectations for Las Vegas

shows. Chinese jewelry sales steady during May Day holiday but Hong Kong hurt

by fewer tourists. Hong Kong 1Q polished imports -13% to $4.2B, exports -8% to

$3.2B. U.S. March jewelry sales +4% to

$4.1B but retail consolidation deepens as JBT reports 323 jewelry businesses closed

in 1Q. India

March polished exports +4% to $1.8B, rough imports -5% to $1.4B. Lucara

1Q revenue +71% to $51M, profit +185% to $17M. Lesedi la Rona 1,109 ct. rough

sale expected to exceed $70M ($63,120/ct.) at Sotheby’s London on June 29. Pawnbrokers Cash America

and First Cash to merge.

|

|

| Diamonds |

1,176,437 |

| Value |

$8,016,696,801 |

| Carats |

1,270,409 |

| Average Discount |

-28.55% |

www.rapnet.com

|

|

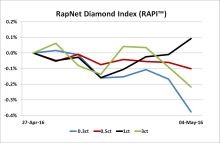

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

Every aspect of this auction is unprecedented. Not only is the rough superlative in size and quality, but no rough even remotely of this scale has ever been offered before at public auction.

Every aspect of this auction is unprecedented. Not only is the rough superlative in size and quality, but no rough even remotely of this scale has ever been offered before at public auction.

David Bennett, worldwide chairman of Sotheby’s jewelry division, on the upcoming auction of the 1,109-carat Lesedi La Rona in June

|

|

|

|

MARKETS

|

|

|

|

| |

United States: Polished trading

quiet. New York wholesalers filling orders but not buying for inventory. Steady

demand for 0.50 to 2.50 ct., G-J, VS2-SI2 RapSpec A2 diamonds…

Belgium: Activity muted with

trading cut short due to Thursday’s Ascension Day public holiday. Concern

demand is weaker than usual for this time of year…

Israel: Polished market

quieter than earlier in the year. Dealers focused on U.S. market with rising

expectations for upcoming Las Vegas shows…

India: Polished trading slowing. Dealers anticipate quieter market

through May school vacation period. Sentiment relatively positive with

expectations 2016 will be better than last year…

Hong Kong: Dealer and jewelry

wholesale markets quiet following May 1 Labor Day celebration. Retailers note

slight improvement in jewelry sales during the holiday but fewer Chinese

tourist arrivals...

Click here for deeper analysis

|

|

|

|

INDUSTRY

|

|

|

|

| |

Diamond Prices Soften with Weaker Global Demand

Polished diamond trading

slowed in April due to sluggish demand at the start of a seasonally quiet

period. Sentiment weakened as the positive momentum from the first quarter

failed to gain traction. Supplies significantly increased due to high rough

sales and polished production in the first quarter.

Polished diamond trading

slowed in April due to sluggish demand at the start of a seasonally quiet

period. Sentiment weakened as the positive momentum from the first quarter

failed to gain traction. Supplies significantly increased due to high rough

sales and polished production in the first quarter.

The RapNet Diamond Index (RAPI™) for 1-carat,

GIA-graded diamonds slipped 0.3% in April. RAPI for 0.30-carat diamonds fell

1.3% and RAPI for 0.50-carat diamonds also declined 0.3%. RAPI for 3-carat

diamonds dropped 2.2%.

RAPI for 1-carat diamonds rose 1.2% in the first

four months of the year, but is still down 4.6% from a year ago.

|

| |

Fancy Blue Diamond Prices Outpace Yellows, Pinks

Fancy blue diamond prices outperformed their

yellow and pink counterparts in the first quarter, according to the Fancy Color

Diamond Foundation.

Fancy blue diamond prices outperformed their

yellow and pink counterparts in the first quarter, according to the Fancy Color

Diamond Foundation.

Prices of fancy blue gems rose 1.7% sequentially

in the three months compared with a 1.8% drop seen in fancy yellow stones.

Fancy pink diamonds nudged up 0.3%. Overall, fancy-color prices were down 0.1% over

the previous quarter.

|

| |

Lesedi La Rona Assigned $70M+ Auction Price Tag

The world’s second-largest gem-quality rough

diamond in history is expected to fetch “in excess of” $70 million at a Sotheby’s auction in London.

The world’s second-largest gem-quality rough

diamond in history is expected to fetch “in excess of” $70 million at a Sotheby’s auction in London.

The 1,109-carat Lesedi La Rona, mined by Lucara

Diamond Corp. last November, will go under the hammer

at a standalone auction on June 29. The auction will be preceded by a

viewing at Sotheby’s New York on May 7 and at Sotheby’s London from June 18 to

28.

The Gemological Institute of America said the

rough diamond has “top color and transparency” and a “limpid” appearance

commonly associated with type-IIa gems.

|

| |

Singapore Diamond Investment Exchange Launches

Trading has started on the Singapore Diamond Investment

Exchange (SDiX), the world’s “first” commodity exchange for physically-settled diamonds.

Trading has started on the Singapore Diamond Investment

Exchange (SDiX), the world’s “first” commodity exchange for physically-settled diamonds.

The introduction on May 5 “represents the most significant change in global

diamond trading practices in hundreds of years,” according to SDiX.

The exchange is backed by investors including the Singapore

government’s sovereign wealth fund Temasek Holdings, veteran investor Jim

Rogers and Sun Tongyu, one of the founders of Alibaba.

|

| |

Jewelers Exiting U.S. Trade Soars in 1Q

U.S. jewelry business

closures surged 35% in the first quarter, according to data released by

the Jewelers Board of Trade (JBT).

U.S. jewelry business

closures surged 35% in the first quarter, according to data released by

the Jewelers Board of Trade (JBT).

Of the 380 companies that left the industry, the

maximum number was in the “ceased-operations” category, which is defined as

companies closing down business for reasons other than financial difficulty or

consolidation. The number of such closures soared 34% to 323, data showed.

|

| |

Diamond Slump Hits Botswana’s Growth

Standard & Poor’s

(S&P) cut its outlook for Botswana to negative on concern a slump in the

diamond industry could be structural rather than cyclical.

Standard & Poor’s

(S&P) cut its outlook for Botswana to negative on concern a slump in the

diamond industry could be structural rather than cyclical.

The country is highly exposed to the performance

of the diamond sector as it represents just under a third of Botswana's gross

domestic product, about a third of its fiscal receipts and more than two thirds

of exports, according to an S&P report.

The decision to revise the outlook from stable

comes as data released by the Bank of Botswana showed the nation’s rough

diamond exports slumped 17% year on year to $817.6 million in the first quarter

of 2016.

|

| |

Hong Kong’s 1Q Polished Diamond Imports Slump 13%

Hong Kong’s polished imports

dived in the first quarter after shipments from its key supplier markets –

India, Israel and Belgium – slumped.

Hong Kong’s polished imports

dived in the first quarter after shipments from its key supplier markets –

India, Israel and Belgium – slumped.

Imports of polished stones dropped 13% to $4.23

billion in the three months to March 31 as deliveries from India, Hong Kong’s

largest diamond trade partner, retreated 12% to $1.88 billion. Shipments from

the municipality’s second largest source, Israel, plummeted 18% to $543

million, while imports from Belgium nosedived 21% to $454.4 million.

|

| |

India’s Polished Exports +4% in March

India’s polished diamond

exports increased 4.3% year on year to $1.83 billion in March, according to

provisional data provided by the nation’s Gem & Jewellery Export Promotion

Council (GJEPC). By volume, polished exports surged 25% to 3.5 million carats.

Polished imports slumped 52% to $260.8 million, leaving net polished exports

up 30% to $1.56 billion.

India’s polished diamond

exports increased 4.3% year on year to $1.83 billion in March, according to

provisional data provided by the nation’s Gem & Jewellery Export Promotion

Council (GJEPC). By volume, polished exports surged 25% to 3.5 million carats.

Polished imports slumped 52% to $260.8 million, leaving net polished exports

up 30% to $1.56 billion.

Rough diamond imports fell 5.3% to $1.39 billion

and rough exports increased 0.5% to $156.3 million, leaving net rough imports

6% lower at $1.24 billion.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Blue Nile’s Revenues Fall on Dip in Engagement Sales

Blue Nile’s sales declined 3.2% in the first quarter as the

online retailer suffered from a “challenging environment” and a slump in

engagement sales.

Blue Nile’s sales declined 3.2% in the first quarter as the

online retailer suffered from a “challenging environment” and a slump in

engagement sales.

Sales fell to $103.1 million, with U.S. sales of engagement

jewelry decreasing 7%. However, non-engagement sales increased 4%. Profit fell 9% to $1.1 million.

Separately, Blue Nile said it has stopped shipping to South Dakota in response to a new state law on sales tax that it claims is unconstitutional.

|

| |

U.S. Jewelry & Watch Sales +4% in March

U.S. jewelry and watch sales from all outlets

climbed 4.2% year on year to an estimated $4.65 billion in March, according to

provisional data from the U.S. Department of Commerce.

U.S. jewelry and watch sales from all outlets

climbed 4.2% year on year to an estimated $4.65 billion in March, according to

provisional data from the U.S. Department of Commerce.

Jewelry sales in March increased 4% to $4.11

billion, according to Rapaport News estimates,

marginally below the February growth rate of 4.5%. Watch sales rose 5.3% to an

estimated $545 million. Both categories have now enjoyed 11 months of

successive growth after five consecutive drops in late 2014 and early 2015.

|

| |

Cash America, First Cash in Pawnbroker Merger

Cash America International

and First Cash Financial Services, two leading U.S. pawnshop businesses, have

agreed to merge.

Cash America International

and First Cash Financial Services, two leading U.S. pawnshop businesses, have

agreed to merge.

The combined group, to be known as First Cash,

will be one of the largest retail pawn stores in Latin America and the U.S.,

with more than 2,000 locations across four countries, the companies said.

|

| |

Multi-Million Dollar Diamonds For Sale at Sotheby's Geneva

Sotheby’s unveiled highlights

of its upcoming auction in Geneva that will feature more than 10 diamonds and

gemstones estimated at $1 million or higher.

Sotheby’s unveiled highlights

of its upcoming auction in Geneva that will feature more than 10 diamonds and

gemstones estimated at $1 million or higher.

Headlining the May 17 Magnificent Jewels &

Noble Jewels sale is the ‘Unique

Pink,’ expected to fetch up to $38 million (CHF 36.5

million). In addition, a pear-shaped, 7.32-carat, fancy vivid blue, internally

flawless diamond ring will go under the hammer for an estimated $15 million to $25

million.Other notable gems on offer

include a marquise, 6.64-carat, fancy intense blue, surrounded by other fancy

intense blue and D-color white diamonds, expected to sell for $10 million to

$14 million.

|

| |

Kering’s Luxury Sales Climb 3% in 1Q

Kering, the owner of high-end jewelry brands

Boucheron and Pomellato, reported luxury sales rose in the first quarter on a

stronger retail performance in Western Europe, Japan and emerging markets.

Kering, the owner of high-end jewelry brands

Boucheron and Pomellato, reported luxury sales rose in the first quarter on a

stronger retail performance in Western Europe, Japan and emerging markets.

Revenue from the Paris-based group’s luxury

brands – which also include Gucci and Yves Saint Laurent – advanced 2.8% year

on year to $2.07 billion (EUR 1.8 billion), or an increase of 2.6% assuming

comparable structure and exchange rates. Revenue

growth from jewelry brands was “positive.”

|

| |

Charles & Colvard’s Sales Soar

Charles & Colvard, the creator of diamond

substitute Moissanite, posted its highest quarterly revenue figure for nearly a

decade thanks to a supersized purchase by its biggest customer.

Charles & Colvard, the creator of diamond

substitute Moissanite, posted its highest quarterly revenue figure for nearly a

decade thanks to a supersized purchase by its biggest customer.

Sales soared 62% to $11.4 million in the three

months to March 31 as an undisclosed client bought $6.8 million of “Forever Classic” loose

jewels on top of the $6.4 million the purchaser spent in the whole of 2015. The sale also

strengthened Charles & Colvard’s balance sheet by reducing its inventory

and improving its cash position, the North Carolina-based company said.

|

|

|

|

MINING

|

|

|

|

| |

Producers to Address Sustainability at Dubai Congress

Major diamond miners are expected to share views

on transparency, responsibility and sustainability in producing countries at

this month’s World Diamond Congress.

Major diamond miners are expected to share views

on transparency, responsibility and sustainability in producing countries at

this month’s World Diamond Congress.

A panel discussion on the topic is scheduled for

May 19 at the 37th congress in Dubai. The congress will run from May 16 to 19.

|

| |

Lerala Mine in Botswana Back on Stream

Kimberley Diamonds said production restarted at

its Lerala Diamond Mine in Botswana after nine months of upgrading and

recommissioning.

Kimberley Diamonds said production restarted at

its Lerala Diamond Mine in Botswana after nine months of upgrading and

recommissioning.

First diamond sales are expected in June, the miner said. Production will be ramped up to full

levels “over the next several weeks.”

|

| |

Gemfields Sells Emeralds at Record Average Price

Gemfields achieved a record average price for

“higher-quality” rough emerald at an auction in Lusaka, Zambia.

Gemfields achieved a record average price for

“higher-quality” rough emerald at an auction in Lusaka, Zambia.

The miner sold 470,000 carats for an average of

$70.68 per carat at the sale, which ran from March 30 to April 3. Total revenue

generated was $33.1 million.

Gemfields’ production of emeralds and beryl at

the Kagem mine in Zambia slumped 28% to 7.1 million carats in the first

quarter that ended March 31. Output of ruby and corundum from Montepuez surged

43% to 2 million carats.

|

|

|

|

GENERAL

|

|

|

|

| |

Argyle's Largest Violet Diamond to Lead Rio Tinto Tender

The largest violet diamond recovered from Rio

Tinto’s Argyle mine in Western Australia is to go on sale at a tender this

year.

The largest violet diamond recovered from Rio

Tinto’s Argyle mine in Western Australia is to go on sale at a tender this

year.

Violet diamonds are especially rare, as the mine

has produced only 12 carats of polished violet diamonds for the tender in 32

years, Rio Tinto said.

The oval-shaped, 2.83-carat polished diamond,

known as the ‘Argyle Violet,’ will lead Rio Tinto’s 2016 Argyle Pink Diamonds

Tender. The sale will start with private trade viewings in June and travel to

Copenhagen, Hong Kong and New York.

|

| |

Ex-Vogue Creative Director to Lead Tiffany Ad Campaign

Tiffany & Co. unveiled a

collaboration with the former model and creative director of American

Vogue magazine, Grace

Coddington.

Tiffany & Co. unveiled a

collaboration with the former model and creative director of American

Vogue magazine, Grace

Coddington.

The company, which announced its move through a

cartoon animation on its social media pages, appointed Coddington as its

creative partner and “style visionary.”

Coddigton will direct her first brand

advertising campaign, Tiffany’s “Legendary Style” fall campaign, which will

feature several “iconic” collections.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

There were sweeping losses across the industry this past week. Rockwell Diamonds (-17%) led the decline among miners, with most other stocks falling by smaller margins. U.S. retail stocks mainly fell as market uncertainty continues. Almost every Indian industry stock price fell, headed by Classic Diamond (-11%), with European retailers suffering small losses and Hong Kong-based Chow Sang Sang (+2.9%) proving the only Far East stock to have made a significant gain.

View the detailed industry stock report.

| |

May 5 (12:40 GMT) |

Apr. 27 (09:15 GMT) |

Chng. |

|

| $1 = Euro |

0.87 |

0.88 |

-0.01 |

|

| $1 = Rupee |

66.56 |

66.42 |

0.14 |

|

| $1 = Israel Shekel |

3.78 |

3.77 |

0.01 |

|

| $1 = Rand |

14.97 |

14.41 |

0.56 |

|

| $1 = Canadian Dollar |

1.28 |

1.26 |

0.02 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,277.28 |

$1,246.15 |

$31.13 |

2.5% |

| Platinum |

$1,054.25 |

$1,018.00 |

$36.25 |

3.6% |

| Silver |

$17.38 |

$17.34 |

$0.04 |

0.2% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

25,262.21 |

26,055.58 |

-793.37 |

-3.0% |

| Dow Jones |

17,651.26 |

17,990.32 |

-339.06 |

-1.9% |

| FTSE |

6,111.90 |

6,274.94 |

-163.04 |

-2.6% |

| Hang Seng |

20,449.82 |

21,361.60 |

-911.78 |

-4.3% |

| S&P 500 |

2,051.12 |

2,091.70 |

-40.58 |

-1.9% |

| Yahoo! Jewelry |

1,062.09 |

1,109.20 |

-47.11 |

-4.2% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Polished trading slowing. Dealers anticipate quieter market through May

school vacation period. Sentiment relatively positive with expectations 2016 will

be better than last year. Steady U.S. demand ahead of Las Vegas shows. Chinese

demand stable. Domestic Indian demand improving since jewelers strike ended. Manufacturing

levels stabilizing and rough trading slow as new polished enters the market.

Read the Polished Diamond Trading Report

|

|

|

Advertisements

|

|

|

Advertisements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|