|

|

Rapaport TradeWire May 26, 2016

May 26, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

May 26, 2016

|

|

|

Vegas expectations

mixed amid weak consumer demand. Polished markets slow with some traders very

selectively building stock for JCK. Rough markets weak with oversupply concerns

following De Beers $630M of sales in cycle 4 (May). India April polished

exports +9% to $1.8B, rough imports +37% to $1.9B. Dominion 1Q sales -5% to

$178M, Ekati production +34% to 1M cts. Signet 1Q sales +3% to $1.6B, profit +24%

to $147M. Tiffany 1Q Sales -7% to $891M, profit -17% to $87.5M. ALROSA’s Andrey

Polyakov named president of World Diamond Council. |

|

| Diamonds |

1,157,847 |

| Value |

$7,948,739,908 |

| Carats |

1,248,673 |

| Average Discount |

-28.70% |

www.rapnet.com

|

|

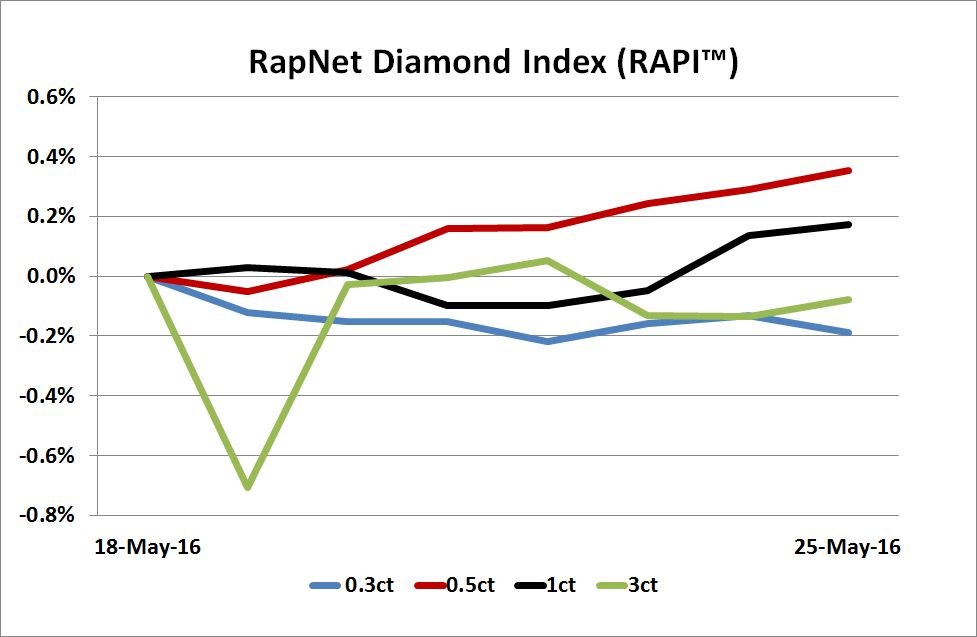

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

We attribute the overall lower sales to softness in domestic customer spending in many U.S. markets, as well as lower spending by foreign tourists of many nationalities in New York and other high-tourism markets.

We attribute the overall lower sales to softness in domestic customer spending in many U.S. markets, as well as lower spending by foreign tourists of many nationalities in New York and other high-tourism markets.

Mark Aaron, VP for investor relations at Tiffany & Co., on the jeweler’s 7% decline in revenue in the first quarter

|

|

|

|

MARKETS

|

|

|

|

| |

United States: Market quiet, demand weak but stable. 3 ct. and

larger soft, except SI category. All eyes on JCK Las Vegas (June 3-6) but

expectations mixed as consumer demand low…

Belgium: Market stable with good demand for 1-2 ct. and

weak demand for 3 ct. + sizes. Faint fluorescent hard to sell with buyers

seeking 3X, non-fluorescent diamonds…

Israel: Trading very slow with low expectations for

Vegas. Weak sentiment on trading floor as reports point to latest diamond

bankruptcy with debts to trade…

India: Market slow with many manufacturers closed for

school vacation or working at reduced production levels. Seasonal lull expected

to last till mid-June…

Hong Kong: Market slow with weak demand from China.

Disappointing sales from May Golden Week and Mother’s Day. Reports of companies

reducing costs. 3-5 cts. slow, 1-1.30 cts. moving better...

Click here for deeper analysis |

|

|

|

INDUSTRY

|

|

|

|

| |

De Beers Sales Drop to $630M

De Beers reported rough sales declined to $630 million in

its fourth sales cycle of the year.

De Beers reported rough sales declined to $630 million in

its fourth sales cycle of the year.

Revenue fell 5.4% in the May cycle from a revised $666 million in April, the

first drop in five months. This follows successive revenue increases in the

four sales cycles from December to April, after a slump in the second half of

2015 to an estimated low of $178 million in November. Sales in the fourth cycle

compare with an estimated $506 million recorded a year ago, according to

Rapaport News records.

|

| |

ALROSA Exec Steps Up to WDC President

Andrey Polyakov, the vice-president of ALROSA, has taken

over as president of the World Diamond Council (WDC).

Andrey Polyakov, the vice-president of ALROSA, has taken

over as president of the World Diamond Council (WDC).

Polyakov has been vice-president of the WDC since 2015 and assumed

the presidency on May 22, succeeding Edward Asscher. Asscher’s two-year term

concluded the same day. Polyakov was elected vice-president of the council in

October.

|

| |

India’s Polished Exports +9% in April

India’s polished diamond exports jumped 8.8% year on year to

$1.78 billion in April, according to provisional data provided by the Gem &

Jewellery Export Promotion Council. By volume, polished exports increased 3.1%

to 2.6 million carats. Polished imports declined 8.6% to $223.1 million,

leaving net polished exports 12% higher at $1.56 billion.

India’s polished diamond exports jumped 8.8% year on year to

$1.78 billion in April, according to provisional data provided by the Gem &

Jewellery Export Promotion Council. By volume, polished exports increased 3.1%

to 2.6 million carats. Polished imports declined 8.6% to $223.1 million,

leaving net polished exports 12% higher at $1.56 billion.

Rough diamond imports surged 37% to $1.88 billion and rough exports slumped 23%

to $86.1 million, leaving net imports 43% higher at $1.79 billion. India’s net

diamond account, the difference between net polished exports and net rough

imports, swung to negative $237.6 million from positive $132.5 million a year

earlier.

|

| |

Asian Star’s Profit Slides

Asian Star, a Mumbai-based diamond manufacturer, reported

profit dropped in the past fiscal year while revenue rose.

Asian Star, a Mumbai-based diamond manufacturer, reported

profit dropped in the past fiscal year while revenue rose.

Net profit declined 11% to $10.7 million (INR 725.5 million) even as sales

edged up 2.5% to $488.7 million in the 12 months to March 31, the company,

which is a De Beers sightholder, said. Revenue from its diamond segment

increased 3.8% to $445.9 million.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Bridal Sales Drive Stronger 1Q for Signet

Signet Jewelers reported sales increased in the first fiscal

quarter mainly driven by a stronger performance in select branded bridal and

diamond fashion jewelry.

Signet Jewelers reported sales increased in the first fiscal

quarter mainly driven by a stronger performance in select branded bridal and

diamond fashion jewelry.

Revenue jumped 3.2% to $1.58 billion in the three

months that ended April 30, the retail jeweler said. Same-store sales increased

2.4%. Total sales at Kay increased 6.4% and in the Zale division

rose 3%. Profit surged 24% to $146.8 million.

|

| |

Tiffany Cuts Forecast as 1Q Sales Fall

Tiffany & Co. reported a

drop in quarterly revenue and profit due to a decline in spending by U.S. customers and foreign tourists.

Tiffany & Co. reported a

drop in quarterly revenue and profit due to a decline in spending by U.S. customers and foreign tourists.

Sales

fell 7.4% to $891.3 million and profit slumped 17% to $87.5

million in the first fiscal quarter that ended April 30.

The

company narrowed its outlook for 2016, predicting a mid-single-digit percentage

drop in full-year earnings per diluted share. It had previously issued a

forecast that ranged from unchanged to a mid-single-digit percentage drop.

|

| |

Record Blue to Lead Christie’s Auction

The largest fancy intense blue diamond ever offered at

auction is to go under the hammer at Christie’s New York next month.

The largest fancy intense blue diamond ever offered at

auction is to go under the hammer at Christie’s New York next month.

The auctioneer expects the cut-cornered rectangular mixed-cut, 24.18-carat, VS2

gem named the ‘Cullinan Dream’ to fetch $23 million to $29 million, or up to

$1.2 million per carat, at the sale at the Rockefeller Center on June 9.

The polished diamond comes from a 122.52-carat blue rough stone discovered by Petra

Diamonds, which retains a 15% share in the polished sale proceeds. |

| |

Jewelry Demand Propels Richemont to Growth

Richemont’s jewelry sales in the past fiscal year jumped

after strong demand outweighed a decline in appetite for watches. Revenue from

the Geneva-based luxury group’s jewelry “maisons” increased 7% to $6.79 billion

(EUR 6.05 billion) in the fiscal year that ended March 31.

Richemont’s jewelry sales in the past fiscal year jumped

after strong demand outweighed a decline in appetite for watches. Revenue from

the Geneva-based luxury group’s jewelry “maisons” increased 7% to $6.79 billion

(EUR 6.05 billion) in the fiscal year that ended March 31.

The maisons – Cartier, Van Cleef & Arpels and Giampiero Bodino – saw “good”

demand for their jewelry collections but watches were negatively affected by a

challenging environment in Asia Pacific and the Americas. |

| |

Warren Buffett’s Jewelry Unit Acquires Nordt

Richline Group, a jewelry company owned by Warren Buffett’s

Berkshire Hathaway, made a second acquisition in less than a month with the

purchase of a precious-metals company, John C. Nordt.

Richline Group, a jewelry company owned by Warren Buffett’s

Berkshire Hathaway, made a second acquisition in less than a month with the

purchase of a precious-metals company, John C. Nordt.

Nordt, a manufacturer for and supplier to the jewelry industry, operates out of Roanoke, Virginia. The deal, effective June 1, comes hot on the

heels of Richline’s purchase of online jewelry seller Gemvara.

|

| |

Tse Sui Luen’s Profit Dives 40%

Tse Sui Luen, a Hong

Kong-based jeweler, reported revenue declined and profit plummeted in the past

fiscal year as fewer tourists from mainland China dampened retail

activity.

Tse Sui Luen, a Hong

Kong-based jeweler, reported revenue declined and profit plummeted in the past

fiscal year as fewer tourists from mainland China dampened retail

activity.

Sales dropped 8.6% to $455.6 million (HKD 3.54 billion) and profit nosedived 40%

to $3.1 million in the 12 months to February 29. Hong Kong

and Macau revenue slumped 24% to $218.3 million, outweighing

a 13% jump in mainland China sales to $231.2 million. |

| |

Graff Diamonds’ Profit Slumps

Graff Diamonds Limited,

the U.K. subsidiary of Graff Diamonds Holdings, reported sales slid 32% to

$500.2 million and profit nosedived 74% to $32.1 million in 2015.

Graff Diamonds Limited,

the U.K. subsidiary of Graff Diamonds Holdings, reported sales slid 32% to

$500.2 million and profit nosedived 74% to $32.1 million in 2015.

Revenue from countries outside the U.K. fell 34% to $464.1 million, outweighing

an 11% jump in domestic sales to $36.1 million. “Emoluments” for the

company’s highest-paid director dived 31% to $6 million. Revenue for Graff Diamonds Holdings, which includes the group’s international businesses, was $723 million.

Graff declined to comment over and above a company report and statement in

which chairman Laurence Graff (pictured, left) claimed the results were "robust." |

|

|

|

MINING

|

|

|

|

| |

Russia Eyes $898M from ALROSA Sale

Russia expects it will get more than $898.4 million (RUB 60

billion) from a sale of shares in ALROSA, Economic Development Minister Alexey Ulyukayev was cited as saying in a television

interview.

Russia expects it will get more than $898.4 million (RUB 60

billion) from a sale of shares in ALROSA, Economic Development Minister Alexey Ulyukayev was cited as saying in a television

interview.

The government is planning to sell a 10.9% stake in the diamond miner this

year.

“Today on the market it is a little more than RUB 60 billion,” Ulyukayev said.

“I do not rule out that by the time the transaction is closed the market

conditions will improve further.”

|

| |

Dominion’s Sales Decline 5% in 1Q

Dominion Diamond Corporation reported sales fell 5% to $178.3 million in the first fiscal quarter that ended April 30.

Dominion Diamond Corporation reported sales fell 5% to $178.3 million in the first fiscal quarter that ended April 30.

Even though the company lowered its prices by 5% in its January sale, in line with the market, the prices recovered “quickly.” Prices ended the quarter about 8% higher on average than the level at which they started the fiscal year, Dominion said.

Separately, production at the Ekati mine in Canada increased 34% in the quarter to 1.1 million carats.

|

| |

ALROSA Finds Largest Diamond in Zarnitsa's History

ALROSA discovered a

207.29-carat rough diamond at its Zarnitsa mine in the Russian republic of

Yakutia.

ALROSA discovered a

207.29-carat rough diamond at its Zarnitsa mine in the Russian republic of

Yakutia.

The

gem-quality diamond measuring 38 х 37 х 18 millimeters is the largest found

since open-pit mining started at the Zarnitsa pipe in 1999. As yet unnamed, the

stone has a “transparent transitional crystal form” and slightly grooved

surface.

|

| |

Dominion Project Jumps Hurdle

Dominion Diamond Corporation received environmental approval

for its Jay project that could extend the lifespan of the Ekati mine in Canada

by more than a decade.

Dominion Diamond Corporation received environmental approval

for its Jay project that could extend the lifespan of the Ekati mine in Canada

by more than a decade.

The miner said the Northwest Territories’ Minister of Lands, Robert McLeod,

accepted the recommendations of the Mackenzie Valley Environmental Impact

Review Board to approve the program, subject to certain measures.

Jay is the most significant undeveloped deposit at Ekati and has the potential

to extend the mine’s life from a projected closure in 2020 to at least 2030,

Dominion said.

|

| |

De Beers to Invest in Canada Exploration

De Beers said it will spend up to $15.6 million (CAD 20.4

million) on hunting for diamonds in an underexplored part of the Canadian

province of Saskatchewan.

De Beers said it will spend up to $15.6 million (CAD 20.4

million) on hunting for diamonds in an underexplored part of the Canadian

province of Saskatchewan.

The miner entered into an agreement with CanAlaska, a company that has staked

claims to kimberlite-style targets in the Northwestern Athabasca basin. The

claims have been “optioned” to De Beers. There is currently little exploration

work in this area of the basin, the companies said.

|

| |

Strong Emerald Auction for Gemfields

Gemfields announced a new record average price for its

lower-quality gemstones sold at an auction of rough emeralds in India last

week.

Gemfields announced a new record average price for its

lower-quality gemstones sold at an auction of rough emeralds in India last

week.

The miner said it sold 2.78 million carats of gems extracted from its Kagem

mine in Zambia for $14.3 million, implying an average price per carat of $5.15.

The auction was held in the north Indian city of Jaipur from May 17 to

20.

|

|

|

|

GENERAL

|

|

|

|

| |

India Tax Changes to Have Mixed Impact

The Indian government reversed a decision to

broaden the application of a 1% tax on jewelry.

The Indian government reversed a decision to

broaden the application of a 1% tax on jewelry.

The tax collected at source will now only apply

to jewelry purchases of $7,422 (INR 500,000) or more. The All India Gems &

Jewellery Trade Federation campaigned against a government move to impose the duty on all

jewelry sales of $2,969 (INR 200,000) or more.

However, new laws requiring customers to present their

permanent account number (PAN) card when making a jewelry purchase of $2,969 or

more will remain in place despite protests.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Anglo American (+13%) led U.K.-based mining stocks this past week on news of strong sales at the fourth De Beers sight of the year. In the U.S., retail stocks were generally higher, headed by Walmart (+12%), with Tiffany (-0.1%) only dipping slightly on disappointing 1Q sales figures. Indian and European industry stocks were mixed while Far East share prices mostly increased.

View the detailed industry stock report.

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Market slow with many manufacturers closed for

school vacation or working at reduced production levels. Seasonal lull expected

to last till mid-June. Weak demand from Far East and Middle East. Focus on

Vegas as traders prepare for show. Fears that $630M De Beers sight could mean

goods flood the market.

Read the Polished Diamond Trading Report

|

|

|

Advertisements

|

|

|

Advertisements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|