|

|

Rapaport TradeWire November 10, 2016

Nov 10, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

November 10, 2016

|

|

|

Great

changes in America as Trump victory to have major impact on political, social

and economic conditions. Diamond and jewelry sector will benefit as new

policies create a more prosperous middle class and greater numbers of wealthy

consumers. Indian government cracks down drastically on cash by eliminating 500

and 1,000 rupee notes. Jewelry and gold sales surge as consumers dump currency.

Titan Company 2Q sales +2% to $824M, profit +24% to $27M. Blue Nile to be sold

for $500M to Bain Capital and Bow Street as 3Q sales -4% to $105M, profit -35%

to $1.3M. U.S. Sep. polished imports +33% to $2.2B. Sarine to introduce

automated color and clarity grading next year.

|

|

| Diamonds |

1,271,715 |

| Value |

$7,927,540,066 |

| Carats |

1,350,890 |

| Average Discount |

-30.47% |

www.rapnet.com

|

|

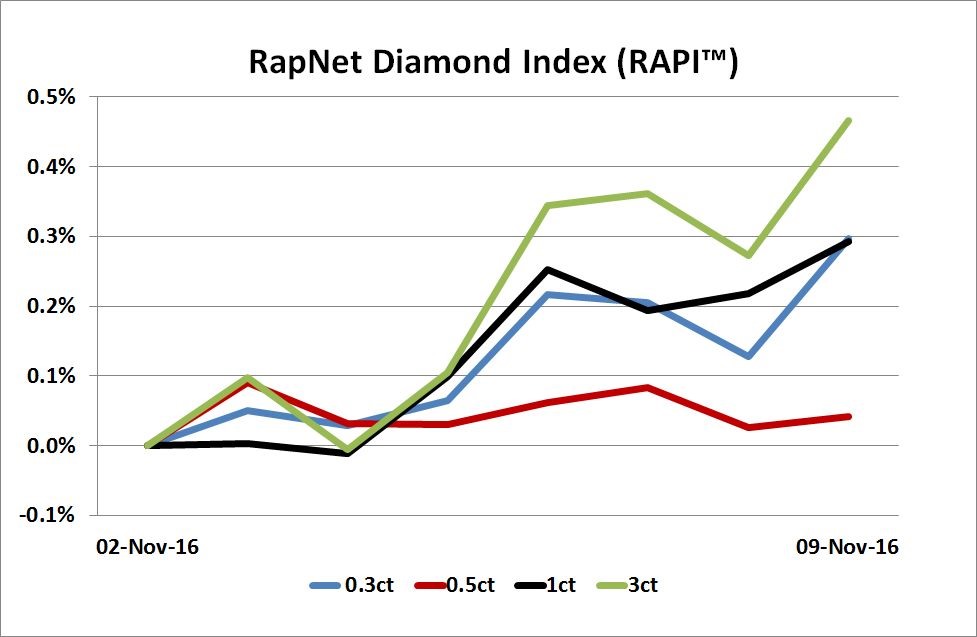

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

Whereas in the past, advertising influenced people, today people influence people.

Whereas in the past, advertising influenced people, today people influence people.

Kent Wong, managing director, Chow Tai Fook

|

|

|

|

MARKETS

|

|

|

|

| |

United

States: Polished trading soft but prices firm for 0.70 to 1.25 ct., H-J, SI,

RapSpec A2+ qualities. Memo suppliers demanding quick returns before

Thanksgiving…

Belgium: Positive mood with steady demand for 0.30 to 0.90 ct., H-J, SI diamonds.

1 ct., H+, VVS+ softer. Fancy shapes stable with improving demand for 1 ct. and

larger Emeralds, Pears and Cushions…

Israel:

Markets stable. Manufacturers challenged by low profits with high rough

prices and scarce supply. Dealer prices firm with steady U.S. demand ahead of

Thanksgiving…

India: Market shocked by new currency regulations as government cracks down on

black markets. Consumer rush to buy gold and jewelry after government cancels

500 and 1,000 rupee notes…

Hong

Kong: Trading

relatively quiet. Dealers filling specific orders with little buying for

inventory. Retailers preparing for Chinese New Year with trading slower than

previous years…

Click here for deeper analysis

|

|

|

|

RAPAPORT STATEMENT

|

|

|

|

| |

Great Change in America

America is moving to a new future based on different values and priorities. Trump’s triumph will have a major impact on political, social and economic conditions. A tidal wave of disruption, filled with challenges and opportunities, is coming our way...

Click here to read statement

|

|

|

|

FIVE-MINUTE INTERVIEW

|

|

|

|

| |

Bringing Personalized Jewelry to the Mass Market

Rapaport’s Avi Krawitz spoke with Kent Wong, managing director of Chow Tai Fook, at the jeweler's Hong Kong headquarters. Wong says the company must tailor its products to adapt to today's consumers...

Click here to read the interview |

|

|

|

INDUSTRY

|

|

|

|

| |

Sarine Develops Automated Color and Clarity Grading

Sarine Technologies unveiled equipment for automated color

and clarity grading of polished diamonds. Sarine Clarity maps inclusions and

flaws and applies a set of algorithms to determine the clarity grade, using

standard grading terminology. It also sorts stones and advises which market the

diamond will sell best in, based on local consumer preferences. Sarine Color has lab-grade accuracy for determining a diamond’s color and is currently

being tested in India. Sarine plans to start marketing the technology in

mid-2017.

Sarine Technologies unveiled equipment for automated color

and clarity grading of polished diamonds. Sarine Clarity maps inclusions and

flaws and applies a set of algorithms to determine the clarity grade, using

standard grading terminology. It also sorts stones and advises which market the

diamond will sell best in, based on local consumer preferences. Sarine Color has lab-grade accuracy for determining a diamond’s color and is currently

being tested in India. Sarine plans to start marketing the technology in

mid-2017. |

| |

De Beers Opens Auction Platform to Polished Stones

De Beers launched an online trading service that enables

third parties to sell polished diamonds to other businesses. The pilot service

is targeted at single stones weighing more than 5 carats or those with a fancy

color. The initiative, open to midstream industry members, represents an

expansion of a rough trading platform De Beers introduced in

June. All sellers must comply with a declaration of integrity and all

diamonds offered on the platform must have evidence of manufacturing history and

be screened for synthetics or treatments.

De Beers launched an online trading service that enables

third parties to sell polished diamonds to other businesses. The pilot service

is targeted at single stones weighing more than 5 carats or those with a fancy

color. The initiative, open to midstream industry members, represents an

expansion of a rough trading platform De Beers introduced in

June. All sellers must comply with a declaration of integrity and all

diamonds offered on the platform must have evidence of manufacturing history and

be screened for synthetics or treatments.

|

| |

Rare Argyle Violet Diamond Sold to L.J. West

New York-based L.J. West Diamonds bought the ‘Argyle

Violet,’ the centerpiece of Rio Tinto’s Argyle Pink Diamonds Tender,

for an undisclosed amount. The stone is the largest violet diamond recovered

from Rio Tinto’s Argyle mine in Western Australia. This year’s tender delivered

the highest average price in the sale’s 32-year history, reflecting strong

global demand for Argyle’s rare pink and red diamond production, Rio Tinto said.

New York-based L.J. West Diamonds bought the ‘Argyle

Violet,’ the centerpiece of Rio Tinto’s Argyle Pink Diamonds Tender,

for an undisclosed amount. The stone is the largest violet diamond recovered

from Rio Tinto’s Argyle mine in Western Australia. This year’s tender delivered

the highest average price in the sale’s 32-year history, reflecting strong

global demand for Argyle’s rare pink and red diamond production, Rio Tinto said. |

| |

U.S. Polished Diamond Imports Grow 33%

U.S. polished diamond imports surged 33% to $2.18 billion

in September. The month was the busiest this year after May, which is propped

up by the JCK Las Vegas show in June. The average price jumped 24% to $2,202

per carat. Polished exports increased 18% to $1.73 billion, which meant

net polished imports more than doubled to $446 million.

U.S. polished diamond imports surged 33% to $2.18 billion

in September. The month was the busiest this year after May, which is propped

up by the JCK Las Vegas show in June. The average price jumped 24% to $2,202

per carat. Polished exports increased 18% to $1.73 billion, which meant

net polished imports more than doubled to $446 million.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Blue Nile to be Sold for $500M

Blue Nile agreed to be acquired for $500 million by an

investor group comprising Bain Capital Private Equity and Bow Street. The deal

value represents a premium of about 34% over Blue Nile’s closing price on

November 4. The news came as the online diamond and jewelry retailer

reported profit plummeted 35% to $1.3 million in the third fiscal quarter to

October 2 with sales down 4.3% to $105.1 million. U.S. engagement net sales

fell 8.5% to $59.5 million.

Blue Nile agreed to be acquired for $500 million by an

investor group comprising Bain Capital Private Equity and Bow Street. The deal

value represents a premium of about 34% over Blue Nile’s closing price on

November 4. The news came as the online diamond and jewelry retailer

reported profit plummeted 35% to $1.3 million in the third fiscal quarter to

October 2 with sales down 4.3% to $105.1 million. U.S. engagement net sales

fell 8.5% to $59.5 million.

|

| |

Diwali Jewelry Sales Rise on Lower Gold Prices

Jewelry sales in India improved during the Diwali

festival as a dip in gold prices helped release months of pent-up demand.

Prices of the metal grew 22% between January and September, compounding the

impact of Indian jewelers’ six-week strike in March and April. But a 3% decline

in October boosted consumer activity. Sales jumped as much as 25% compared to

Diwali last year, G. V. Sreedhar, chairman of the All India Gems &

Jewellery Trade Federation, estimated.

Jewelry sales in India improved during the Diwali

festival as a dip in gold prices helped release months of pent-up demand.

Prices of the metal grew 22% between January and September, compounding the

impact of Indian jewelers’ six-week strike in March and April. But a 3% decline

in October boosted consumer activity. Sales jumped as much as 25% compared to

Diwali last year, G. V. Sreedhar, chairman of the All India Gems &

Jewellery Trade Federation, estimated.

|

| |

Shock Currency Clampdown Boosts Indian Gold Sales

Jewelry and gold sales surged this week in India as

consumers sought ways to get rid of cash following the government’s sudden

announcement to ban 500 and 1,000 rupee notes effective on November 8. The

official gold price remained relatively stable at around INR 31,000 per 10

grams in the two days since the announcement, while the “unofficial” rate

surged to anywhere between INR 40,000 and INR 60,000 per 10 grams, traders estimated.

Government took the measure to curb financing of terrorism and other subversive

activity.

Jewelry and gold sales surged this week in India as

consumers sought ways to get rid of cash following the government’s sudden

announcement to ban 500 and 1,000 rupee notes effective on November 8. The

official gold price remained relatively stable at around INR 31,000 per 10

grams in the two days since the announcement, while the “unofficial” rate

surged to anywhere between INR 40,000 and INR 60,000 per 10 grams, traders estimated.

Government took the measure to curb financing of terrorism and other subversive

activity.

|

| |

Titan Boosted by Steady Diamond Jewelry Sales

Titan Company’s profit grew 23.5% in the second fiscal

quarter as the Indian jewelry retailer benefited from buoyant sales of studded

jewelry. Profit after tax increased to $27.1 million (INR 1.81 billion) on a

standalone basis in the three months that ended September 30, with

diamond-studded jewelry outperforming the plain gold segment. Total sales were

flat at $400.9 million.

Titan Company’s profit grew 23.5% in the second fiscal

quarter as the Indian jewelry retailer benefited from buoyant sales of studded

jewelry. Profit after tax increased to $27.1 million (INR 1.81 billion) on a

standalone basis in the three months that ended September 30, with

diamond-studded jewelry outperforming the plain gold segment. Total sales were

flat at $400.9 million.

|

| |

Richemont Jewelry Sales Show Resilience in Decline

Richemont’s jewelry sales slipped 2% to $2.19 billion

(EUR 1.96 billion) in the first fiscal half that ended September 30.

“Resilient” jewelry demand meant the category declined at a slower pace than

other divisions, the luxury group said. Group revenue was flat at constant

exchange rates. Timepiece sales dived 25% to $2.34 billion, driven by lower

demand for fine watches.

Richemont’s jewelry sales slipped 2% to $2.19 billion

(EUR 1.96 billion) in the first fiscal half that ended September 30.

“Resilient” jewelry demand meant the category declined at a slower pace than

other divisions, the luxury group said. Group revenue was flat at constant

exchange rates. Timepiece sales dived 25% to $2.34 billion, driven by lower

demand for fine watches.

|

|

|

|

MINING

|

|

|

|

| |

Lucara Falls into the Red

Lucara Diamond Corporation slumped to a net loss of $3.8

million in the three months ending September 30 from a profit of $44.2 million

a year ago. Sales plummeted 58% to $38.1 million because only one diamond sale

took place in the quarter versus two in the same period last year – of which

one was an exceptional stone tender, the miner explained. The appreciation

of the Botswanan pula against the dollar also damaged reported results.

Lucara Diamond Corporation slumped to a net loss of $3.8

million in the three months ending September 30 from a profit of $44.2 million

a year ago. Sales plummeted 58% to $38.1 million because only one diamond sale

took place in the quarter versus two in the same period last year – of which

one was an exceptional stone tender, the miner explained. The appreciation

of the Botswanan pula against the dollar also damaged reported results.

|

| |

Letšeng Prices Fall as Large Stone Supply Stumbles

The average selling price of Letšeng production fell in the

third quarter as owner Gem Diamonds sold fewer 100-carat-plus diamonds from the

Lesotho-based asset. The company sold 37,990 carats from Letšeng for a total of

$61.5 million, achieving $1,619 per carat, implying a 31% decline over the

average price reported a year ago. Production at Letšeng slumped

17% to 24,388 carats largely because of poor weather conditions.

The average selling price of Letšeng production fell in the

third quarter as owner Gem Diamonds sold fewer 100-carat-plus diamonds from the

Lesotho-based asset. The company sold 37,990 carats from Letšeng for a total of

$61.5 million, achieving $1,619 per carat, implying a 31% decline over the

average price reported a year ago. Production at Letšeng slumped

17% to 24,388 carats largely because of poor weather conditions.

|

| |

Large Rough Lifts Lulo to Record Sale

Lucapa Diamond Company achieved a record $8.3 million

(AUD 11 million) from a sale of rough diamonds found at its Lulo mine in

Angola. The company sold a parcel of 1,864 carats at an average price of

$4,452 per carat. The total was the largest to date for Lulo diamonds,

excluding the exceptional 404-carat stone that fetched $16 million in

February.

Lucapa Diamond Company achieved a record $8.3 million

(AUD 11 million) from a sale of rough diamonds found at its Lulo mine in

Angola. The company sold a parcel of 1,864 carats at an average price of

$4,452 per carat. The total was the largest to date for Lulo diamonds,

excluding the exceptional 404-carat stone that fetched $16 million in

February.

|

| |

DiamondCorp No Longer Up For Sale

DiamondCorp shelved plans for a sale or merger after

rejecting a cash takeover offer from an undisclosed bidder that it deemed

undervalued the company. DiamondCorp last month said it urgently needs about

$619,075 (GBP 500,000) to meet immediate funding requirements and that a sale

or merger was a possible solution. However, approaches for the company turned

out to be “opportunistic,” the miner said.

DiamondCorp shelved plans for a sale or merger after

rejecting a cash takeover offer from an undisclosed bidder that it deemed

undervalued the company. DiamondCorp last month said it urgently needs about

$619,075 (GBP 500,000) to meet immediate funding requirements and that a sale

or merger was a possible solution. However, approaches for the company turned

out to be “opportunistic,” the miner said.

|

|

|

|

GENERAL

|

|

|

|

| |

KP Eyes Consensus on Rough Diamond Valuation

The Kimberley Process (KP) will hold a forum in Dubai on

November 13 aimed at finding a consensus on the criteria for evaluating rough

diamonds. The meeting will comprise two panel discussions featuring industry

players from across the diamond industry. The event is on the first day of the annual KP plenary,

which will run until November 17 in the emirate. Separately, chairman Ahmed Bin

Sulayem (pictured) met with Mozambique’s President to discuss the country’s compliance and

bid for KP membership.

The Kimberley Process (KP) will hold a forum in Dubai on

November 13 aimed at finding a consensus on the criteria for evaluating rough

diamonds. The meeting will comprise two panel discussions featuring industry

players from across the diamond industry. The event is on the first day of the annual KP plenary,

which will run until November 17 in the emirate. Separately, chairman Ahmed Bin

Sulayem (pictured) met with Mozambique’s President to discuss the country’s compliance and

bid for KP membership. |

| |

Diamonds Direct Acquires Dallas Jeweler

Diamonds Direct bought Dallas-based Diamond Doctor,

continuing its aggressive expansion into the U.S. retail space. Diamonds

Direct, based in Charlotte, North Carolina, was acquired by private equity

firm Blackstone Group last November. Since then it has opened branches in

Oklahoma City, as well as in Charleston and San Antonio, Dallas News reported.

The acquisition gives Diamonds Direct its 10th store and third in Texas.

Diamonds Direct bought Dallas-based Diamond Doctor,

continuing its aggressive expansion into the U.S. retail space. Diamonds

Direct, based in Charlotte, North Carolina, was acquired by private equity

firm Blackstone Group last November. Since then it has opened branches in

Oklahoma City, as well as in Charleston and San Antonio, Dallas News reported.

The acquisition gives Diamonds Direct its 10th store and third in Texas. |

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

U.S. industry stocks were mostly positive this week, staving off fears of a mass sell-off following Donald Trump's surprise election victory. Blue Nile (+18%) led the pack on news of a private equity takeover, while Birks Group (+13%) and Movado Group (+13%) also gained. Far East and European stocks were relatively stable, with Richemont (+6.7%) standing out after announcing a management reshuffle. Mining stocks were mixed, headed by Rio Tinto (+14%), but Lucara Diamond (-10%) slid on disappointing results.

View the detailed industry stock report

| |

Nov 10 (13:22 GMT) |

Nov 3 (12:32 GMT) |

Chng. |

|

| $1 = Euro |

0.92 |

0.90 |

0.01 |

|

| $1 = Rupee |

66.74 |

66.72 |

0.02 |

|

| $1 = Israel Shekel |

3.84 |

3.82 |

0.02 |

|

| $1 = Rand |

13.84 |

13.46 |

0.38 |

|

| $1 = Canadian Dollar |

1.35 |

1.34 |

0.01 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,279.66 |

$1,291.65 |

-$11.99 |

-0.9% |

| Platinum |

$983.00 |

$979.00 |

$4.00 |

0.4% |

| Silver |

$18.59 |

$18.13 |

$0.46 |

2.5% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

27,517.68 |

27,430.28 |

87.40 |

0.3% |

| Dow Jones |

18,589.69 |

17,959.64 |

630.05 |

3.5% |

| FTSE |

6,890.61 |

6,808.69 |

81.92 |

1.2% |

| Hang Seng |

22,839.11 |

22,683.51 |

155.60 |

0.7% |

| S&P 500 |

2,163.26 |

2,097.94 |

65.32 |

3.1% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Market shocked by new currency

regulations as government cracks down on black markets. Consumer rush to buy

gold and jewelry after government cancels 500 and 1,000 rupee notes. Currency

may be deposited in banks until Dec. 31. Trading quiet as businesses slowly

return from Diwali break. Factories still closed with workers expected to

return Nov. 21.

Read the Polished Diamond Trading Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|