|

|

Rapaport TradeWire November 24, 2016

Nov 24, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

November 24, 2016

|

|

|

Sentiment improves as holiday season starts with early Black Friday sales.

Retailers discounting heavily with Macy’s offering -70% on fine jewelry.

Diamond trading quiet amid tight Indian liquidity due to currency cancellation.

Chinese and Indian demand cautious as U.S. dollar trumps up to 13-year high.

Signet 3Q sales -3% to $1.2B, profit +13% to $17M. Chow Tai Fook 1H revenue

-24% to $2.8B, profit -19% to $164M, opens first U.S. outlet in Macy’s. ALROSA

3Q revenue +70% to $1.1B, profit of $414M vs. loss of $237M. India Oct.

polished exports +37% to $2.5B, rough imports +17% to $1.3B. The Rapaport Group

wishes all our friends a happy Thanksgiving and a successful holiday season. |

|

| Diamonds |

1,277,628 |

| Value |

$7,922,643,671 |

| Carats |

1,365,462 |

| Average Discount |

-30.12% |

www.rapnet.com

|

|

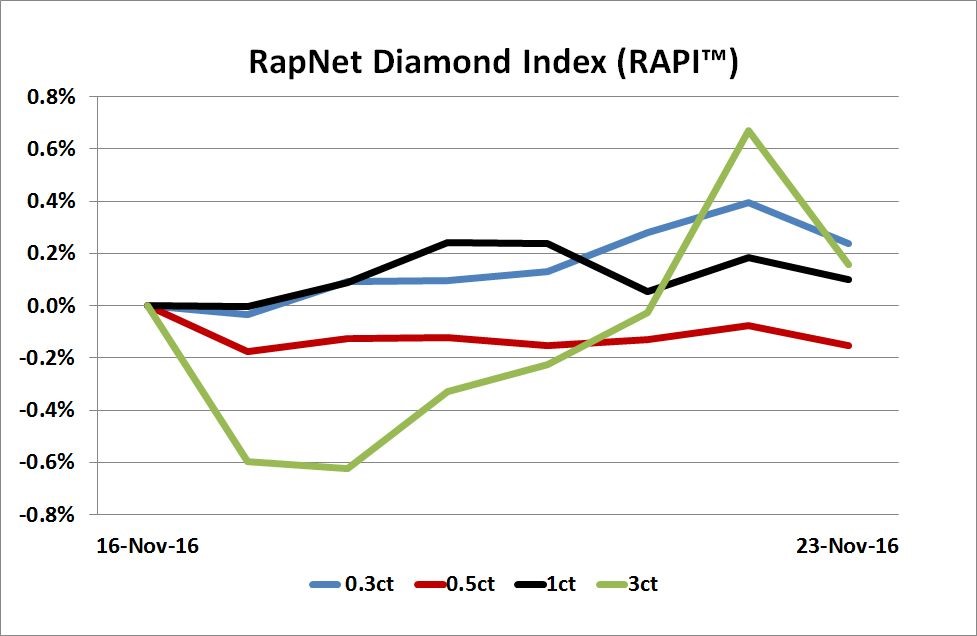

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

The risk for rough prices to be repriced lower because of the increasing supply is higher than at any time in the last 24 months, in the absence of a commensurate decline in supplies from existing producers.

The risk for rough prices to be repriced lower because of the increasing supply is higher than at any time in the last 24 months, in the absence of a commensurate decline in supplies from existing producers.

Kieron Hodgson, an analyst at Panmure Gordon, says rough prices could suffer as three major new mines come on stream.

|

|

|

|

MARKETS

|

|

|

|

| |

United

States: Retail sentiment

positive ahead of Thanksgiving weekend. Good season expected with low

unemployment, improving consumer confidence, and strong dollar raising

likelihood of Dec. interest rate hike…

Belgium: Diamond market cautious

as dealers assess impact of currency cancellation. Local demand for small and

lower quality diamonds plummets…

Israel:

Steady trading with

foreign buyers trying to get better prices in Ramat Gan than elsewhere…

India: Cautious

mood as jewelry demand and diamond trading slows due to government

demonetization program. Lack of liquidity mutes activity…

Hong

Kong: Polished trading slow

with dealers hoping this week’s International Jewelry Manufacturers’ Show will

boost demand…

Click here for deeper analysis

|

|

|

|

FIVE-MINUTE INTERVIEW

|

|

|

|

| |

Luk Fook Adapts Strategy to Restore Growth

Luk Fook continues to report double-digit sales declines as it navigates the economic slowdown in China and drop in tourism to Hong Kong. Executive director Nancy Wong reveals how the company is rethinking its operations to improve its fortunes...

Click here to read the interview |

|

|

|

INDUSTRY

|

|

|

|

| |

Shrenuj De Beers Sight Suspended

Shrenuj

& Co. scaled back its Botswana operations amid continued liquidity pressure, and as the company’s De Beers sight has been suspended. Rising costs, the

weakening of the rupee and stagnation in demand put the Mumbai-based diamond

and jewelry manufacturer under strain, its executive director Vishal Doshi said. Shrenuj is in

talks with De Beers to restore the rough supply deal to enable its Botswana operations

to return to normal, possibly after the holiday season.

Shrenuj

& Co. scaled back its Botswana operations amid continued liquidity pressure, and as the company’s De Beers sight has been suspended. Rising costs, the

weakening of the rupee and stagnation in demand put the Mumbai-based diamond

and jewelry manufacturer under strain, its executive director Vishal Doshi said. Shrenuj is in

talks with De Beers to restore the rough supply deal to enable its Botswana operations

to return to normal, possibly after the holiday season.

|

| |

De Beers Selects More Accredited Buyers

Kiran

Exports received De Beers ‘accredited buyer’ status following its split from

Kiran Gems. That enables the Antwerp-based trading company access to De Beers ‘ex-plan’

goods that becomes available over and above De Beers supply to sightholders.

Kiran Exports recently split as an independent company following a group

restructuring by Kiran Gems earlier this year. Separately, South Africa-based Shimansky

Diamonds said it also gained accredited buyer status.

Kiran

Exports received De Beers ‘accredited buyer’ status following its split from

Kiran Gems. That enables the Antwerp-based trading company access to De Beers ‘ex-plan’

goods that becomes available over and above De Beers supply to sightholders.

Kiran Exports recently split as an independent company following a group

restructuring by Kiran Gems earlier this year. Separately, South Africa-based Shimansky

Diamonds said it also gained accredited buyer status.

|

| |

India's Diamond Trade Sees Substantial Growth

India’s

polished exports jumped 37% year on year to $2.52 billion in October, reported the

Gem & Jewellery Export Promotion Council. Polished imports slumped 31% to

$195.8 million, leaving net polished exports 49% higher at $2.32 billion. Rough

imports grew 17% to $1.26 billion and rough exports advanced 51% to $100.5

million, meaning net rough imports were 15% higher at $1.15 billion. India’s October

net diamond account, the difference between net polished exports and net rough

imports, more than doubled to $1.17 billion.

India’s

polished exports jumped 37% year on year to $2.52 billion in October, reported the

Gem & Jewellery Export Promotion Council. Polished imports slumped 31% to

$195.8 million, leaving net polished exports 49% higher at $2.32 billion. Rough

imports grew 17% to $1.26 billion and rough exports advanced 51% to $100.5

million, meaning net rough imports were 15% higher at $1.15 billion. India’s October

net diamond account, the difference between net polished exports and net rough

imports, more than doubled to $1.17 billion.

|

| |

Analyst Warns of Rough Price Pressure

Increased

supply may force rough prices down in 2017 as three new mines come on stream, cautioned

Kieron Hodgson, an analyst at Panmure Gordon. Production from the Liqhobong,

Renard and Gahcho Kué mines will enter the market, translating to an estimated 7.1

million additional carats next year. That will take its toll if diamond jewelry

sales are weak this holiday season, he said. However, a strong season would

buoy the market and result in a 5% rise in rough prices next year, the analyst added.

Increased

supply may force rough prices down in 2017 as three new mines come on stream, cautioned

Kieron Hodgson, an analyst at Panmure Gordon. Production from the Liqhobong,

Renard and Gahcho Kué mines will enter the market, translating to an estimated 7.1

million additional carats next year. That will take its toll if diamond jewelry

sales are weak this holiday season, he said. However, a strong season would

buoy the market and result in a 5% rise in rough prices next year, the analyst added.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Signet Gives Upbeat Sales Forecast

Signet Jewelers increased its full-year earnings guidance after reporting better than anticipated results for the third fiscal quarter. The company expects earnings to be in the range of $7.03 to $7.25 per share for the fiscal year ending January 2017, compared with a previous forecast of $6.90 to $7.22. The jewelry retailer reported net sales fell 3% to $1.19 billion in the third fiscal quarter that ended October 29, with same-store sales down 2%. Profit jumped 13% to $17 million.

Signet Jewelers increased its full-year earnings guidance after reporting better than anticipated results for the third fiscal quarter. The company expects earnings to be in the range of $7.03 to $7.25 per share for the fiscal year ending January 2017, compared with a previous forecast of $6.90 to $7.22. The jewelry retailer reported net sales fell 3% to $1.19 billion in the third fiscal quarter that ended October 29, with same-store sales down 2%. Profit jumped 13% to $17 million. |

| |

Birks Slides to Loss in Weak Canada Economy

Birks

Group’s sales fell 3% to $129.7 million in the first fiscal half amid tougher

economic conditions in Western Canada. Revenue from Canada slumped 14% to $54.9

million, outweighing a 6% jump to $74.9 million in the U.S. The Montreal-based jeweler

recorded a loss of $2 million versus a profit of $830,000 a year ago.

Birks

Group’s sales fell 3% to $129.7 million in the first fiscal half amid tougher

economic conditions in Western Canada. Revenue from Canada slumped 14% to $54.9

million, outweighing a 6% jump to $74.9 million in the U.S. The Montreal-based jeweler

recorded a loss of $2 million versus a profit of $830,000 a year ago. |

| |

Chow Tai Fook Sales Fall, Enters U.S.

Hong

Kong-based Chow Tai Fook opened its first branded store in the U.S. with the

launch of a shop inside the Macy’s department store in New York’s Flushing

neighborhood. The retailer also reported a 24% slump in group sales to

$2.78 billion (HKD 21.53 billion) in the six months that ended September 30,

weighed by a 5% decline in Hong Kong tourist arrivals from Mainland China.

Profit dived 19% to $163.5 million for the period.

Hong

Kong-based Chow Tai Fook opened its first branded store in the U.S. with the

launch of a shop inside the Macy’s department store in New York’s Flushing

neighborhood. The retailer also reported a 24% slump in group sales to

$2.78 billion (HKD 21.53 billion) in the six months that ended September 30,

weighed by a 5% decline in Hong Kong tourist arrivals from Mainland China.

Profit dived 19% to $163.5 million for the period.

|

| |

Higher Gold Prices Weigh on Luk Fook Sales

Luk

Fook Holdings revenue plunged 22% to $705 million (HKD 5.47 billion) during the

three months that ended September 30 as consumers pulled back from high-priced

gold and tourist arrivals dropped in Hong Kong. Profit declined by just 6% to

$55.9 million (HKD 433.7 million) as a 27% drop in costs mitigated the

detrimental impact of lower sales. A shift to selling more

gem-set jewelry helped lift profit margin.

Luk

Fook Holdings revenue plunged 22% to $705 million (HKD 5.47 billion) during the

three months that ended September 30 as consumers pulled back from high-priced

gold and tourist arrivals dropped in Hong Kong. Profit declined by just 6% to

$55.9 million (HKD 433.7 million) as a 27% drop in costs mitigated the

detrimental impact of lower sales. A shift to selling more

gem-set jewelry helped lift profit margin.

|

|

|

|

MINING

|

|

|

|

| |

ALROSA Turns a Profit in 3Q

ALROSA

reported a profit of $414 million in the third quarter driven by significantly

higher rough diamond demand from last year. The Moscow-based miner had a loss of

$236.6 million a year earlier when demand slumped due to low profitability in

the manufacturing sector. As the market recovered, group revenue jumped 70% to

$1.07 billion in the recent quarter, with diamond sales climbing 83% to $982.2

million.

ALROSA

reported a profit of $414 million in the third quarter driven by significantly

higher rough diamond demand from last year. The Moscow-based miner had a loss of

$236.6 million a year earlier when demand slumped due to low profitability in

the manufacturing sector. As the market recovered, group revenue jumped 70% to

$1.07 billion in the recent quarter, with diamond sales climbing 83% to $982.2

million.

|

| |

Fire Sparks Sales Slump at Dominion

Dominion

Diamond Corporation said sales dived 29% to $102.7 million in the third fiscal

quarter as a fire at the Ekati mine in June forced a shift to lower-value

mining areas. The average price of sales dropped 55% to $83 per carat, while

the volume of rough sales jumped 56% to 1.2 million carats. Sales value was

also negatively impacted by the fact that lower-price diamonds were left over

from the previous quarter and sold during the period.

Dominion

Diamond Corporation said sales dived 29% to $102.7 million in the third fiscal

quarter as a fire at the Ekati mine in June forced a shift to lower-value

mining areas. The average price of sales dropped 55% to $83 per carat, while

the volume of rough sales jumped 56% to 1.2 million carats. Sales value was

also negatively impacted by the fact that lower-price diamonds were left over

from the previous quarter and sold during the period.

|

| |

Indian Liquidity Stress Impacts First Renard Sale

The

first sale of rough diamonds from the Renard mine in Canada garnered $7.6

million and a higher-than-expected average price as smaller stones were

withdrawn because of a lack of liquidity in India. Stornoway Diamond

Corporation, which owns the mine, sold 38,913 carats for an average $195 per

carat at the sale. The elimination of

high-denomination currency in India had a detrimental effect on demand for

small and lower-quality goods, the company said.

The

first sale of rough diamonds from the Renard mine in Canada garnered $7.6

million and a higher-than-expected average price as smaller stones were

withdrawn because of a lack of liquidity in India. Stornoway Diamond

Corporation, which owns the mine, sold 38,913 carats for an average $195 per

carat at the sale. The elimination of

high-denomination currency in India had a detrimental effect on demand for

small and lower-quality goods, the company said.

|

|

|

|

GENERAL

|

|

|

|

| |

EU to Chair Kimberley Process in 2018

The

Kimberley Process (KP) said the European Union (EU) will be its chair in 2018,

meaning the bloc will serve as vice-chair next year. Australia will be in

charge in 2017, represented by Robert Owen-Jones as chair. India will serve as

vice chair in 2018 and take over in full in 2019. Meanwhile, the KP said Venezuela had been re-admitted following an

eight-year pause from diamond exports.

The

Kimberley Process (KP) said the European Union (EU) will be its chair in 2018,

meaning the bloc will serve as vice-chair next year. Australia will be in

charge in 2017, represented by Robert Owen-Jones as chair. India will serve as

vice chair in 2018 and take over in full in 2019. Meanwhile, the KP said Venezuela had been re-admitted following an

eight-year pause from diamond exports.

|

| |

Swiss Watch Export Slump Steepens

Swiss

watch exports dived 16% to $1.66 billion (CHF 1.68 billion) in October, the

heaviest drop this year, as expectations of a third-quarter recovery fell flat.

Orders from Hong Kong plummeted 22% while exports to the U.S. fell 17%. Exports

of precious-metal timepieces tumbled 28%.

Swiss

watch exports dived 16% to $1.66 billion (CHF 1.68 billion) in October, the

heaviest drop this year, as expectations of a third-quarter recovery fell flat.

Orders from Hong Kong plummeted 22% while exports to the U.S. fell 17%. Exports

of precious-metal timepieces tumbled 28%.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

U.S. stocks performed well this past week as the holiday shopping season drew nearer, led by Charles & Colvard (+11.5%). Signet (+3.3%) gained on improved full-year earnings guidance, but Birks Group (-15%) slumped as it posted a 1H loss. In the Far East, Chow Tai Fook (+9.4%) gained as the jeweler reported a gentler profit decline than it had in the past. Indian jewelers continue to suffer from the short-term effects of the government's decision to invalidate high-denomination notes. Declines were headed by Gitanjali Gems (-5.5%).

View the detailed industry stock report

| |

Nov 24 (13:30 GMT) |

Nov 17 (12:00 GMT) |

Chng. |

|

| $1 = Euro |

0.95 |

0.93 |

0.02 |

|

| $1 = Rupee |

68.72 |

67.80 |

0.91 |

|

| $1 = Israel Shekel |

3.88 |

3.85 |

0.02 |

|

| $1 = Rand |

14.23 |

14.27 |

-0.04 |

|

| $1 = Canadian Dollar |

1.35 |

1.34 |

0.01 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,185.20 |

$1,230.57 |

-$45.37 |

-3.7% |

| Platinum |

$916.25 |

$945.50 |

-$29.25 |

-3.1% |

| Silver |

$16.32 |

$17.05 |

-$0.73 |

-4.3% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

25,860.17 |

26,227.62 |

-367.45 |

-1.4% |

| Dow Jones |

19,083.18 |

18,868.14 |

215.04 |

1.1% |

| FTSE |

6,811.33 |

6,769.24 |

42.09 |

0.6% |

| Hang Seng |

22,608.49 |

22,262.88 |

345.61 |

1.6% |

| S&P 500 |

2,204.72 |

2,176.94 |

27.78 |

1.3% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Diamond market cautious

as dealers assess impact of currency cancellation. Local demand for small and

lower quality diamonds plummets. Exporters boosted by weaker rupee versus

dollar (-3% to 68.7/$1 in Nov.). Stable U.S. demand ahead of holiday season.

Manufacturing slowly resuming as workers return from Diwali break. Rough demand

restrained with tight liquidity and low profit margins.

Read the Polished Diamond Trading Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|