|

|

Rapaport TradeWire December 29, 2016

Dec 29, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

December 29, 2016

|

|

|

U.S.

consumer confidence jumps to 15-year high in December with rising expectations

for 2017. Retail stores struggle with cautious holiday season spending, while mobile

drives strong ecommerce growth. Amazon reports record holiday sales, including

10,451 carats of diamonds. Hong Kong sees Christmas tourist rush but luxury

spending restrained ahead of Jan. 28 Chinese New Year. Diamond trading quiet

with Indian manufacturing slow due to demonetization liquidity crisis. The

Rapaport Group wishes everyone a happy, healthy, prosperous and peaceful New

Year. |

|

| Diamonds |

1,229,589 |

| Value |

$7,595,322,759 |

| Carats |

1,277,454 |

| Average Discount |

-30.60% |

www.rapnet.com

|

|

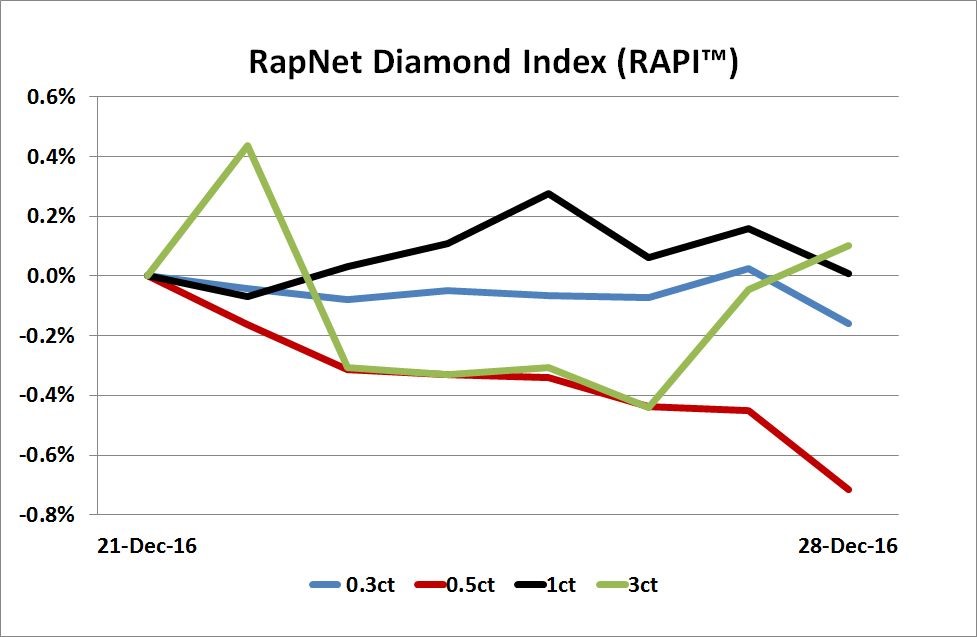

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

Small diamonds are roughly 80% of your production and 20% of your revenue – and the demand for the large diamonds remains robust. The diamond market is fine.

Small diamonds are roughly 80% of your production and 20% of your revenue – and the demand for the large diamonds remains robust. The diamond market is fine.

Patrick Evans, CEO of Mountain Province Diamonds, talks to Reuters about the impact of India’s demonetization policy on the market.

|

|

|

|

MARKETS

|

|

|

|

| |

United

States: Polished

trading quiet as wholesalers and dealers take vacation between Christmas and

New Year. Verdict still out regarding holiday jewelry sales as slow(ish) season

salvaged by last-minute shopping rush…

Belgium: Polished and rough trading very quiet with most dealers

on vacation during the Christmas to New Year period. Antwerp bourses closed

until January 9…

Israel:

Diamond

trading quiet with many dealers taking vacation over 8-day Chanukah holiday.

Businesses focused on structuring finances to meet new tax requirements…

India: Polished

trading slow. Some improvement as Antwerp-based Indian dealers travel to Mumbai

during Belgium vacation period…

Hong

Kong: Retail

relatively busy over Christmas to New Year period. Notable rise in tourist

traffic but Chinese visitors spending less time and money in Hong Kong than

previous years…

Click here for deeper analysis |

|

|

|

HAPPY NEW YEAR

|

|

|

|

|

|

|

THE YEAR IN REVIEW

|

|

|

|

| |

The Year Trust Returned to the Diamond Trade

When considering the most

influential story of 2016, we looked at potential developments as much as those

that occurred in the past 12 months. Among the many milestones, controversies

and inspiring stories that headlined during the year, the most significant will

surely be the one with a lasting influence on the trade...

When considering the most

influential story of 2016, we looked at potential developments as much as those

that occurred in the past 12 months. Among the many milestones, controversies

and inspiring stories that headlined during the year, the most significant will

surely be the one with a lasting influence on the trade...

Click here to continue reading |

| |

Trump Effect: Diamond Trade Optimistic For 2017

As 2016 draws to a close, Rapaport News took the opportunity to speak with leading industry experts about the past year and their expectations for the next 12 months...

As 2016 draws to a close, Rapaport News took the opportunity to speak with leading industry experts about the past year and their expectations for the next 12 months...

Click here to continue reading

|

|

|

|

INDUSTRY

|

|

|

|

| |

Consumers Gain Confidence after U.S. Election

U.S.

Consumer confidence rose 4% in December with a post-election surge in optimism for the economy, jobs and income

prospects, the Conference Board said. The group’s benchmark index

increased from 109.4 in November to 113.7 in December, its highest level since

August 2001, according to Bloomberg. Confidence was driven by higher

expectations for growth that outweighed a weaker view of the present economic

situation, the group explained.

U.S.

Consumer confidence rose 4% in December with a post-election surge in optimism for the economy, jobs and income

prospects, the Conference Board said. The group’s benchmark index

increased from 109.4 in November to 113.7 in December, its highest level since

August 2001, according to Bloomberg. Confidence was driven by higher

expectations for growth that outweighed a weaker view of the present economic

situation, the group explained.

|

| |

Committee to Tackle Misconduct in India

A

new committee has been set up to deal with misconduct in India’s diamond industry.

The Trade Disciplinary Committee will comprise a 21-member panel which will

handle cases of fraud, non-disclosure of synthetics, false inscriptions on gems

and jewelry and other ethical breaches. It will comprise representatives from each of the Gem & Jewellery Export Promotion Council, the

Bharat Diamond Bourse and the Mumbai Diamond Merchants’ Association.

A

new committee has been set up to deal with misconduct in India’s diamond industry.

The Trade Disciplinary Committee will comprise a 21-member panel which will

handle cases of fraud, non-disclosure of synthetics, false inscriptions on gems

and jewelry and other ethical breaches. It will comprise representatives from each of the Gem & Jewellery Export Promotion Council, the

Bharat Diamond Bourse and the Mumbai Diamond Merchants’ Association. |

| |

India’s Cash Policy Delays Surat Jewelry Fair

The

Southern Gujarat Chamber of Commerce and Industry postponed the annual Sparkle

International gem and jewelry exhibition as India’s demonetization policy

prevented visitors from attending the show in December. The 9th edition of the

fair will now take place in Surat from January 19 to 22. The Indian

government’s decision last month to invalidate INR 500 and INR 1,000 currency

notes has sapped liquidity, hitting cash-focused industries such as the gem and

jewelry trade.

The

Southern Gujarat Chamber of Commerce and Industry postponed the annual Sparkle

International gem and jewelry exhibition as India’s demonetization policy

prevented visitors from attending the show in December. The 9th edition of the

fair will now take place in Surat from January 19 to 22. The Indian

government’s decision last month to invalidate INR 500 and INR 1,000 currency

notes has sapped liquidity, hitting cash-focused industries such as the gem and

jewelry trade.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Amazon Diamond Sales Shine this Holiday

Amazon

said it sold 10,451 carats of diamonds this holiday season, equivalent in

volume terms to six and a half of Queen Elizabeth II’s Russian Kokoshnik

tiaras. Customers bought 2.5 million watches, equating to one timepiece every

1.5 seconds, a grizzly bear’s weight in gold and the weight of a rhinoceros in

silver. Amazon did not release sales figures but claimed the season was

its best ever.

Amazon

said it sold 10,451 carats of diamonds this holiday season, equivalent in

volume terms to six and a half of Queen Elizabeth II’s Russian Kokoshnik

tiaras. Customers bought 2.5 million watches, equating to one timepiece every

1.5 seconds, a grizzly bear’s weight in gold and the weight of a rhinoceros in

silver. Amazon did not release sales figures but claimed the season was

its best ever.

|

| |

Chinese Group Buys Italian Luxury Jeweler

Chinese

conglomerate Gangtai Group agreed to acquire an 85% stake in Buccellati from

Italian equity firm Clessidra. The deal valued the Milan-based luxury jeweler at

$282 million (EUR 270 million), or 6.6 times its revenue, Reuters cited a

source as saying. The Buccellati family will retain 15% of the company it

founded in 1919. Buccellati was reportedly previously slated to be bought by

Richemont, owner of the Cartier brand, but a deal was not reached.

Chinese

conglomerate Gangtai Group agreed to acquire an 85% stake in Buccellati from

Italian equity firm Clessidra. The deal valued the Milan-based luxury jeweler at

$282 million (EUR 270 million), or 6.6 times its revenue, Reuters cited a

source as saying. The Buccellati family will retain 15% of the company it

founded in 1919. Buccellati was reportedly previously slated to be bought by

Richemont, owner of the Cartier brand, but a deal was not reached.

|

| |

Luk Fook Targets Asia's Growing Tourism Industry

Hong

Kong-based jeweler Luk Fook opened its first stores in Malaysia to tap into

Southeast Asia’s booming tourism industry. The retailer launched two stores in

popular tourist locations in the capital city Kuala Lumpur. Luk Fook first

entered the Southeast Asian market in 2010 with a store in Singapore. The group

has 1,470 stores in nine countries, with the majority of its portfolio in

Mainland China.

Hong

Kong-based jeweler Luk Fook opened its first stores in Malaysia to tap into

Southeast Asia’s booming tourism industry. The retailer launched two stores in

popular tourist locations in the capital city Kuala Lumpur. Luk Fook first

entered the Southeast Asian market in 2010 with a store in Singapore. The group

has 1,470 stores in nine countries, with the majority of its portfolio in

Mainland China.

|

| |

Birks Credits Strategic Goals in New Deal

Birks

Group has negotiated new credit terms that it says will enable continued

implementation of its growth strategy following a company restructuring. The

Montreal-based jeweler’s $110 million credit facility,

which was due to expire in August 2017, has been extended to November 2021 at a

reduced interest rate. A separate loan has also been

extended. Management said lenders recognized the company’s efforts to improve.

Birks

Group has negotiated new credit terms that it says will enable continued

implementation of its growth strategy following a company restructuring. The

Montreal-based jeweler’s $110 million credit facility,

which was due to expire in August 2017, has been extended to November 2021 at a

reduced interest rate. A separate loan has also been

extended. Management said lenders recognized the company’s efforts to improve.

|

|

|

|

MINING

|

|

|

|

| |

Renard Mine Reaches Commercial Production

Stornoway

Diamond Corporation said it achieved commercial production at the Renard mine

in Canada a month ahead of schedule and within budget. The operation reached an

average processing rate of 4,120 tonnes per day over 30 days, out of a capacity

of 6,000 tonnes per day, breaching the 60% target that constitutes commercial

production. The milestone marks the end of the project’s capital expense

period.

Stornoway

Diamond Corporation said it achieved commercial production at the Renard mine

in Canada a month ahead of schedule and within budget. The operation reached an

average processing rate of 4,120 tonnes per day over 30 days, out of a capacity

of 6,000 tonnes per day, breaching the 60% target that constitutes commercial

production. The milestone marks the end of the project’s capital expense

period.

|

| |

De Beers Puts Snap Lake on Ice

De

Beers will flood its Snap Lake mine in Canada’s Northwest Territories in

January after failing to reach an agreement with potential buyers. The company

plans to preserve the mine until market conditions and technical methods

improve such that it can operate the deposit more economically. De Beers also

pulled out of a joint venture with CanAlaska Uranium to explore for diamonds in

Canada’s Saskatchewan province.

De

Beers will flood its Snap Lake mine in Canada’s Northwest Territories in

January after failing to reach an agreement with potential buyers. The company

plans to preserve the mine until market conditions and technical methods

improve such that it can operate the deposit more economically. De Beers also

pulled out of a joint venture with CanAlaska Uranium to explore for diamonds in

Canada’s Saskatchewan province.

|

| |

Rockwell Implements Overhaul with Mine Sale

Rockwell

Diamonds agreed to sell certain non-core assets to Nelesco 318 Proprietary for

$3.2 million (ZAR 45 million) as part of a strategic overhaul by new chief executive

officer Tjaart Willemse. Rockwell did not say which assets were included in the

agreement. Willemse earlier announced plans to sell the Remhoogte/Holsloot and

Saxendrift mines in South Africa in a downsizing program he initiated when taking

over as CEO in September.

Rockwell

Diamonds agreed to sell certain non-core assets to Nelesco 318 Proprietary for

$3.2 million (ZAR 45 million) as part of a strategic overhaul by new chief executive

officer Tjaart Willemse. Rockwell did not say which assets were included in the

agreement. Willemse earlier announced plans to sell the Remhoogte/Holsloot and

Saxendrift mines in South Africa in a downsizing program he initiated when taking

over as CEO in September.

|

| |

Kimberley Diamonds Gets Delisting Approval

Kimberley

Diamonds, owner of the Lerala mine in Botswana, came closer to being delisted

from the Australian Securities Exchange (ASX), a move it hopes will reduce

costs and facilitate fundraising. Kimberley applied to be removed from the

exchange in November, citing a lack of interest and liquidity in its shares,

which it claimed were undervalued. The exchange approved the company’s request,

leaving shareholders with the final say.

Kimberley

Diamonds, owner of the Lerala mine in Botswana, came closer to being delisted

from the Australian Securities Exchange (ASX), a move it hopes will reduce

costs and facilitate fundraising. Kimberley applied to be removed from the

exchange in November, citing a lack of interest and liquidity in its shares,

which it claimed were undervalued. The exchange approved the company’s request,

leaving shareholders with the final say.

|

|

|

|

GENERAL

|

|

|

|

| |

Kendra Scott Receives Equity Investment

Berkshire

Partners bought a minority stake in Kendra Scott Design, highlighting the

significant growth the jewelry brand has enjoyed since launching in 2002. Details

of the deal were not disclosed but Reuters said it valued the company at $1

billion. Kendra Scott, who founded the company, will remain majority

shareholder and chief executive officer. Norwest Venture Partners will continue

as a minority investor.

Berkshire

Partners bought a minority stake in Kendra Scott Design, highlighting the

significant growth the jewelry brand has enjoyed since launching in 2002. Details

of the deal were not disclosed but Reuters said it valued the company at $1

billion. Kendra Scott, who founded the company, will remain majority

shareholder and chief executive officer. Norwest Venture Partners will continue

as a minority investor.

|

| |

Jewelry Charity Pioneer Clyde Duneier Dies

Clyde

Duneier, founder of family-owned jewelry company Clyde Duneier Inc., passed

away aged 88. Under Duneier’s leadership, the New York-based company established

the Jewelers Charity Fund in 1983. He subsequently worked with Nate Light,

former chief executive officer of Signet Jewelers, to launch the ‘Party with a

Purpose’ annual fundraising event, which led to the formation of Jewelers for

Children.

Clyde

Duneier, founder of family-owned jewelry company Clyde Duneier Inc., passed

away aged 88. Under Duneier’s leadership, the New York-based company established

the Jewelers Charity Fund in 1983. He subsequently worked with Nate Light,

former chief executive officer of Signet Jewelers, to launch the ‘Party with a

Purpose’ annual fundraising event, which led to the formation of Jewelers for

Children.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

U.S. stocks fell slightly from recent highs, with J.C. Penney (-6.4%) leading the declines. Among miners, Rockwell Diamonds' stock gained 50% on news of its sale of non-core assets. The markets were otherwise stable in a quiet week of trading over the holiday period.

View the detailed industry stock report

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Low trading activity with

large export-focused companies doing better than domestic suppliers. U.S.

demand flat with some foreign buyers looking for bargains from distressed Mumbai

dealers. Exporters maintaining firm prices. Domestic demand sluggish with tight

liquidity and continued uncertainty resulting from demonetization policy. Some

shortages expected as manufacturing remains stalled among small- to- medium

size factories.

Read the Polished Diamond Trading Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|