|

|

Rapaport TradeWire February 23, 2017

Feb 23, 2017 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

February 23, 2017

|

|

|

High hopes for next week’s Hong Kong show after China jewelry sales improved during the Chinese New Year. Polished prices steady as suppliers await outcome of the show and defend high rough prices. Manufacturing rising with steady rough demand during sight week. De Beers 2016 earnings +159% to $667M, revenue +30% to $6.1B, to raise 2017 production from 27M to 31-33M cts. Lucara 2016 sales +32% to $296M, profit -9% to $71M. Petra Diamonds 1H revenue +48% to $229M, profit of $35M vs. $2M previous year. Dominion 2016 sales -21% to $571M, Ekati production +40% to 5.2M cts. India Jan. polished exports +3% to $1.6B, rough imports +28% to $1.3B. ALROSA CEO Andrey Zharkov to step down. |

|

| Diamonds |

1,235,554 |

| Value |

$7,550,793,072 |

| Carats |

1,322,250 |

| Average Discount |

-30.19% |

www.rapnet.com

|

|

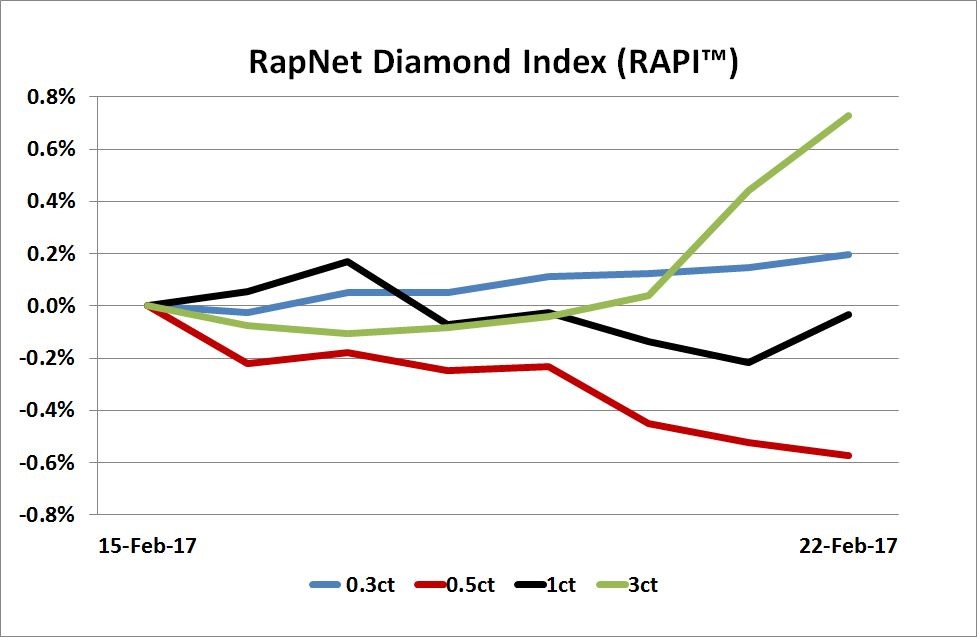

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

They’re probably the oldest thing any of us will ever touch.

They’re probably the oldest thing any of us will ever touch.

De Beers head of strategy Gareth Mostyn on the value of natural diamonds.

|

|

|

|

MARKETS

|

|

|

|

| |

United

States: Polished market stable

with buyers looking for deals and pushing for higher discounts. Steady demand

for 1 to 2.99 ct., D-J, VS1-SI1 diamonds…

Belgium: Sentiment weak as

trading slowed in February. Difficult to find the right goods at the right

price…

Israel:

Trading slowed after

busy International Diamond Week. Rising expectations for Hong Kong show (Feb.

28 to Mar. 4) with large delegation of 83 exhibitors in Israel pavilion…

India: Trading cautious with foreign

buyers looking for bargains and dealers waiting for better prices at the Hong

Kong show…

Hong

Kong: Positive sentiment as

trading improves ahead of the show. Buyers looking for goods as they expect suppliers

to hold prices firm during the show in order to cover exhibition expenses…

Click here for deeper analysis |

|

|

|

RAPAPORT STATEMENT

|

|

|

|

| |

Rapaport Statement on President Trump’s Trade Policy

President Trump’s trade policy is based on his principles of “America First” and “Reciprocity.” America must use its purchasing market power to ensure reciprocal benefits from trade partners...

Click here for the full statement |

|

|

|

FIVE-MINUTE INTERVIEW

|

|

|

|

| |

De Beers Foresees Pleasingly Normal 2017

After diamond inventory levels returned to normal in

2016, De Beers is raising its production and marketing activity to spur growth,

says Gareth Mostyn, head of strategy and corporate affairs...

Click here to continue reading

|

|

|

|

INDUSTRY

|

|

|

|

| |

De Beers Profit Jumps as Diamond Market Stabilizes

Profit more than doubled for De Beers last year as trading

conditions in the diamond-manufacturing sector improved and inventory levels

stabilized. Underlying earnings jumped to $667 million in 2016 from $258

million a year earlier. This came as revenue grew 30% to $6.07 billion,

reflecting a 37% hike in rough-diamond sales to $5.6 billion. The

midstream of the diamond industry returned to buying rough after a 2015 slump

in demand, parent company Anglo American explained.

Profit more than doubled for De Beers last year as trading

conditions in the diamond-manufacturing sector improved and inventory levels

stabilized. Underlying earnings jumped to $667 million in 2016 from $258

million a year earlier. This came as revenue grew 30% to $6.07 billion,

reflecting a 37% hike in rough-diamond sales to $5.6 billion. The

midstream of the diamond industry returned to buying rough after a 2015 slump

in demand, parent company Anglo American explained.

|

| |

ALROSA President Zharkov to Step Down

Andrey Zharkov (pictured) will resign as president of ALROSA, a source close to the Russian diamond miner said. Zharkov’s three-year term as president expires in May 2018, but the timing of his departure is unclear. The Russian government is considering Sergey Ivanov – ex-head of insurer SOGAZ and son of the former head of the Kremlin administration – as Zharkov’s replacement, according to Reuters.

Andrey Zharkov (pictured) will resign as president of ALROSA, a source close to the Russian diamond miner said. Zharkov’s three-year term as president expires in May 2018, but the timing of his departure is unclear. The Russian government is considering Sergey Ivanov – ex-head of insurer SOGAZ and son of the former head of the Kremlin administration – as Zharkov’s replacement, according to Reuters. |

| |

India’s Diamond Trade Bounces Back

Diamond trading in India improved in January, according to data from the

Gem & Jewellery Export Promotion Council (GJEPC), as the country’s

manufacturing sector continues to recover from a liquidity squeeze in the final

months of last year. Imports of rough diamonds, an indicator of demand

from India’s large cutting-and-polishing sector, jumped 28% to $1.26 billion

during the month. Polished exports increased 3% to $1.62 billion.

Diamond trading in India improved in January, according to data from the

Gem & Jewellery Export Promotion Council (GJEPC), as the country’s

manufacturing sector continues to recover from a liquidity squeeze in the final

months of last year. Imports of rough diamonds, an indicator of demand

from India’s large cutting-and-polishing sector, jumped 28% to $1.26 billion

during the month. Polished exports increased 3% to $1.62 billion.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Luxury Veterans Join Tiffany Board

Tiffany & Co. has expanded its board to include three

seasoned retail executives. Roger Farah, a former chief operating officer of

Ralph Lauren, will become an independent director, alongside Francesco Trapani,

who was CEO of Bulgari during its takeover by LVMH Moët Hennessy Louis Vuitton

in 2011. Joining the duo on the board will be James Lillie, who was CEO of

Jarden Corporation until its sale to Newell Brands in April 2016. Tiffany

chairman Michael Kowalski also indicated he planned to step down.

Tiffany & Co. has expanded its board to include three

seasoned retail executives. Roger Farah, a former chief operating officer of

Ralph Lauren, will become an independent director, alongside Francesco Trapani,

who was CEO of Bulgari during its takeover by LVMH Moët Hennessy Louis Vuitton

in 2011. Joining the duo on the board will be James Lillie, who was CEO of

Jarden Corporation until its sale to Newell Brands in April 2016. Tiffany

chairman Michael Kowalski also indicated he planned to step down. |

| |

Forevermark Hits 2,000-Store Milestone

Forevermark has entered its 2,000th retail location

worldwide, eight years after the De Beers-owned diamond brand was born. Forevermark, which

professes to offer only natural, untreated and responsibly sourced diamonds,

has expanded to 25 markets since its launch in 2008, De Beers said. In 2016,

the number of retail doors rose 14%.

Forevermark has entered its 2,000th retail location

worldwide, eight years after the De Beers-owned diamond brand was born. Forevermark, which

professes to offer only natural, untreated and responsibly sourced diamonds,

has expanded to 25 markets since its launch in 2008, De Beers said. In 2016,

the number of retail doors rose 14%. |

| |

Gitanjali Slides on Weak Diamond Sales

Gitanjali Gems’ share price slumped after the Indian jeweler

reported a drop in sales and profit for its fiscal third quarter, which ended

December 31, 2016. The company, one of India’s largest jewelry retailers, said

revenue had fallen 1.4% year on year to $499.9 million (INR 33.53 billion)

during the period. Net profit slid 17% to $8.7 million.

Gitanjali Gems’ share price slumped after the Indian jeweler

reported a drop in sales and profit for its fiscal third quarter, which ended

December 31, 2016. The company, one of India’s largest jewelry retailers, said

revenue had fallen 1.4% year on year to $499.9 million (INR 33.53 billion)

during the period. Net profit slid 17% to $8.7 million. |

| |

Store Growth Drives Michael Hill Sales

Michael Hill’s sales increased 5% to $250.9 million (AUD

327.5 million) during the fiscal first half ending December 31, as it expanded

its store network. Same-store sales crept up 0.8%, while net profit after tax

grew 3.4% to $19.7 million, the Australia-based jeweler reported. The company

operated 305 stores under the Michael Hill brand at the end of December – 12

more than a year earlier. The retailer also added a net 13 stores under its

Emma & Roe brand.

Michael Hill’s sales increased 5% to $250.9 million (AUD

327.5 million) during the fiscal first half ending December 31, as it expanded

its store network. Same-store sales crept up 0.8%, while net profit after tax

grew 3.4% to $19.7 million, the Australia-based jeweler reported. The company

operated 305 stores under the Michael Hill brand at the end of December – 12

more than a year earlier. The retailer also added a net 13 stores under its

Emma & Roe brand.

|

|

|

|

MINING

|

|

|

|

| |

Dominion Sales Fall After Ekati Fire

Sales at Dominion Diamond Corporation slumped 21% to

$570.9 million in the fiscal year that ended January 31, due to a fire at its Ekati mine and sluggish demand for smaller rough stones. Revenue slid 29% in

the third quarter and 27% in the fourth quarter. Ekati closed for three months after the fire in June, while a liquidity crisis in

India also dented demand for smaller stones, the company explained.

Sales at Dominion Diamond Corporation slumped 21% to

$570.9 million in the fiscal year that ended January 31, due to a fire at its Ekati mine and sluggish demand for smaller rough stones. Revenue slid 29% in

the third quarter and 27% in the fourth quarter. Ekati closed for three months after the fire in June, while a liquidity crisis in

India also dented demand for smaller stones, the company explained.

|

| |

Lucara Profit Drops Amid Currency Shift

Lucara Diamond Corp.’s profit declined 9% to $70.7 million

in 2016 as higher taxes and foreign exchange rates worked to the company’s

disadvantage. The company reported a foreign-exchange loss of $11 million

compared with a gain of $15 million a year earlier. Revenue from rough-diamond

sales jumped 32% to $295.5 million, or $824 per carat.

Lucara Diamond Corp.’s profit declined 9% to $70.7 million

in 2016 as higher taxes and foreign exchange rates worked to the company’s

disadvantage. The company reported a foreign-exchange loss of $11 million

compared with a gain of $15 million a year earlier. Revenue from rough-diamond

sales jumped 32% to $295.5 million, or $824 per carat.

|

| |

Petra Cautious After Labor Unrest

Petra Diamonds warned its production may be toward the lower

end of prior projections after labor action caused delays at its Cullinan mine

in South Africa. Output for the fiscal year ending June 30 is still on track to

be within the guidance of about 4.4 to 4.6 million carats, the miner said.

Sales jumped 48% to $228.5 million during the half-year ending December 31.

Petra Diamonds warned its production may be toward the lower

end of prior projections after labor action caused delays at its Cullinan mine

in South Africa. Output for the fiscal year ending June 30 is still on track to

be within the guidance of about 4.4 to 4.6 million carats, the miner said.

Sales jumped 48% to $228.5 million during the half-year ending December 31.

|

| |

Stellar Agrees to Operate Sierra Leone Mine

Stellar Diamonds has entered a subcontracting arrangement to

operate the Tonguma mine in Sierra Leone, after opting out of a deal to acquire

the deposit. Under the arrangement, Stellar will run the mine and sell the

resulting diamonds, paying a percentage of revenues to the project’s owner,

Octea Mining. Stellar, which already owns the adjacent Tongo mine, had

initially been in talks to acquire Tonguma from Octea.

Stellar Diamonds has entered a subcontracting arrangement to

operate the Tonguma mine in Sierra Leone, after opting out of a deal to acquire

the deposit. Under the arrangement, Stellar will run the mine and sell the

resulting diamonds, paying a percentage of revenues to the project’s owner,

Octea Mining. Stellar, which already owns the adjacent Tongo mine, had

initially been in talks to acquire Tonguma from Octea.

|

|

|

|

GENERAL

|

|

|

|

| |

Swiss Watch Exports Continue to Decline

Swiss watch exports fell 6% to $1.42 billion (CHF 1.43

billion) in January, according to the Federation of the Swiss Watch Industry.

The downward trend has flattened out since November but remains negative, the

federation said. Exports to Hong Kong, Switzerland’s largest trade partner for

timepieces, slipped 3.9% to $197.3 million – a

comparatively mild drop after a 25% overall slide for 2016.

Swiss watch exports fell 6% to $1.42 billion (CHF 1.43

billion) in January, according to the Federation of the Swiss Watch Industry.

The downward trend has flattened out since November but remains negative, the

federation said. Exports to Hong Kong, Switzerland’s largest trade partner for

timepieces, slipped 3.9% to $197.3 million – a

comparatively mild drop after a 25% overall slide for 2016.

|

| |

GIA Executive to Head Diamond Empowerment Fund

The Diamond Empowerment Fund (DEF) announced that Anna

Martin would be serving as its new president, succeeding Phyllis Bergman, who

is departing after a five-year term. Martin (pictured) is senior

vice president for global development and beneficiation at the Gemological

Institute of America (GIA).

The Diamond Empowerment Fund (DEF) announced that Anna

Martin would be serving as its new president, succeeding Phyllis Bergman, who

is departing after a five-year term. Martin (pictured) is senior

vice president for global development and beneficiation at the Gemological

Institute of America (GIA).

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Large diamond miners’ stocks had a disappointing week, with Dominion Diamond (-12%) leading the declines after reporting a drop in full-year sales. ALROSA (-4.5%) fell amid uncertainty over who will replace its departing president. Petra Diamonds (-3.7%) also lost ground after issuing cautious production guidance following a mining disruption. In the U.S., Birks Group (-9%) headed the declines in a generally poor week for retail stocks.

View the detailed industry stock report

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Trading cautious with foreign buyers looking for bargains and dealers waiting for better prices at the Hong Kong show. Domestic demand quiet with small independent retailers still acclimatizing to new demonetization rules. Steady demand for 1 ct., G-J, VS-SI diamonds. Manufacturing back to normal levels with shortage of small Indian rough during sight week.

Read the Polished Diamond Trading Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|