|

|

Rapaport TradeWire February 4, 2016

Feb 4, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

February 4, 2016

|

|

|

All eyes on China as next week’s Spring

Festival sets pace for jewelry sales. Polished trading improving as U.S.

jewelers replenish stock following holiday season. Cutters increasing production

after estimated $1B of rough enters the market in Jan. Concern that new

polished supply may exceed demand. Shortages supporting prices as Jan. 1ct. RAPI

+0.9%. LVMH 2015 jewelry & watch sales +19% to $3.7B, profit +53% to $482M.

Titan 3Q sales +17% to $504M, profit +18% to $33M. Letšeng 4Q rough sales -5%

to $64M, average price -1% to $2,117/ct. Belgium 2015 polished exports -9% to

$13.1B, rough imports -25% to $11.1B.The Rapaport Group wishes all our

friends a happy Chinese New Year.

|

|

| Diamonds |

1,080,600 |

| Value |

$7,955,958,970 |

| Carats |

1,237,170 |

| Average Discount |

-27.81% |

www.rapnet.com

|

|

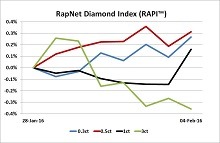

| The RapNet Diamond Index (RAPI) is the average price for the top 25 diamond qualities (D-H, IF-VS2). It is based on the 10 best priced diamonds for each quality. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

The global diamond industry took a beating this year.

The global diamond industry took a beating this year.

Ari Epstein, CEO of the Antwerp World Diamond Centre, on Belgium’s drop in rough and polished exports in 2015

|

|

|

|

MARKETS

|

|

|

|

| |

United States: Jewelry retailers holding

relatively large inventory with a lot of goods on memo. Positive sentiment with

interesting designs at Miami Antique Show, Arizona Centurion Jewelry Show and

AGTA GemFair in Tuscon...

Belgium: Dealers relatively positive

and polished prices firm following De Beers January reduction in rough prices. Short-term

outlook positive but some concern about possible excess supply when new

polished enters the market...

Hong Kong: Diamond dealer and

wholesale jewelry markets quiet with most businesses closed for the Chinese New

Year Spring Festival that begins on Monday (Feb 8). Hong Kong wholesale market

expected to shut down for the week and China for most of February...

India: Polished trading slows slightly

as Hong Kong and Chinese wholesale buyers close for Chinese New Year vacation.

Domestic Indian demand cautious as weak rupee (-2.6% from Jan. 1 to 68/$1)

weighs on sentiment...

Israel: Positive sentiment continues

after relatively good start to the year. Steady demand and shortages for

RapSpec A2+ (3X, none) diamonds...

Click here to continue reading

|

|

|

|

|

|

INSIGHTS

|

|

|

|

| |

Rough Market Enthusiasm

Demand for rough diamonds

improved significantly in January, leaving many to wonder if the sudden upturn

is sustainable. Manufacturers demanded more rough than was available as miners

De Beers and ALROSA limited their respective supplies amid continued

uncertainty in consumer demand…

Click here to continue reading

|

|

|

|

INDUSTRY

|

|

|

|

| |

Polished Diamond Prices Rise in January

Polished diamond prices rose

in January as shortages continue to support the market. U.S. demand is steady

after a reasonably good holiday season, while China’s wholesale market slowed

as the focus shifted to retail for the Chinese New Year Spring Festival

starting on February 8.

Polished diamond prices rose

in January as shortages continue to support the market. U.S. demand is steady

after a reasonably good holiday season, while China’s wholesale market slowed

as the focus shifted to retail for the Chinese New Year Spring Festival

starting on February 8.

The RapNet Diamond Index (RAPI™) for 1-carat,

GIA-graded diamonds rose 0.9% in January. RAPI for 0.30-carat diamonds advanced

4.7% and RAPI for 0.50-carat diamonds grew 4.5%. RAPI for 3-carat diamonds fell

0.5%.

RAPI for 1-carat diamonds fell 4.4% from a year

ago as manufacturers sought to reduce excess inventory in 2015.

|

| |

Belgium’s 2015 Polished Exports -9%

Belgium’s polished diamond

exports dropped 9.4% to $13.07 billion in 2015 as the global trade “took a

beating” during the year, according to the Antwerp World Diamond Centre (AWDC).

By volume, exports fell 7.1% to 6 million carats, while the average price

dipped 2.4% to $2,251 per carat.

Belgium’s polished diamond

exports dropped 9.4% to $13.07 billion in 2015 as the global trade “took a

beating” during the year, according to the Antwerp World Diamond Centre (AWDC).

By volume, exports fell 7.1% to 6 million carats, while the average price

dipped 2.4% to $2,251 per carat.

Total polished imports to Belgium declined 8.4%

to $12.65 billion during the year as net polished exports, representing exports

minus imports, dived 31% to $415.8 million. Rough imports slumped 25% to $11.13

billion and rough exports declined 27% to $11.5 billion. Net rough imports,

representing imports minus exports, went from negative $744.3 million to

negative $371.6 million during the year.

Belgium’s 2015 net diamond account, representing

total polished and rough exports minus total imports, declined 41% to $787.4

million.

|

| |

Forevermark's Lussier Appointed DPA Chairman

Stephen Lussier, chief executive officer of De

Beers Group’s Forevermark brand, has taken over as chairman of the Diamond

Producers Association (DPA) from Jean-Marc Lieberherr.

Stephen Lussier, chief executive officer of De

Beers Group’s Forevermark brand, has taken over as chairman of the Diamond

Producers Association (DPA) from Jean-Marc Lieberherr.

Lieberherr, who until recently was the

managing director of Rio Tinto’s diamond division, became the DPA’s first

chairman in October 2015, shortly after the body was set up. He stepped down

from the role following his departure from Rio Tinto in January.

Lussier, a vice-president of

marketing at De Beers, was the vice-chairman of the DPA under Lieberherr. Jim

Pounds, an executive vice-president at Dominion Diamond Corporation, will

revolve into Lussier’s former role at the DPA.

|

| |

International Grown Diamond Association Launched

More than 10 lab-grown diamond producers, distributors

and retailers have partnered to launch the International Grown Diamond

Association (IGDA), claiming the group is the "first" industry body for the

synthetics sector.

More than 10 lab-grown diamond producers, distributors

and retailers have partnered to launch the International Grown Diamond

Association (IGDA), claiming the group is the "first" industry body for the

synthetics sector.

The association aims to represent the grown diamond

industry, promote it as a new choice and educate consumers about

their qualities and applications.

|

| |

Shmuel Schnitzer Elected IDI Chairman

Former Israel Diamond Exchange

president Shmuel Schnitzer has been elected chairman of the Israel Diamond

Institute Group of Companies (IDI).

Former Israel Diamond Exchange

president Shmuel Schnitzer has been elected chairman of the Israel Diamond

Institute Group of Companies (IDI).

Schnitzer recently completed

his fourth term as IDE president and replaces Moti

Ganz, who served three terms as chairman of the IDI, a non-profit company representing

institutions in the diamond industry.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

U.S. Jewelry Sales +2% in 2015

U.S. jewelry sales from all retail outlets increased 2% to $66.41 billion in 2015. Watch sales advanced 2.6% to $8.72

billion compared with the previous year, according to provisional figures

released by the Bureau of Economic Analysis. Sales of jewelry and

watches combined totaled $75.14 billion, a 2.1% increase over 2014.

U.S. jewelry sales from all retail outlets increased 2% to $66.41 billion in 2015. Watch sales advanced 2.6% to $8.72

billion compared with the previous year, according to provisional figures

released by the Bureau of Economic Analysis. Sales of jewelry and

watches combined totaled $75.14 billion, a 2.1% increase over 2014.

In the final month of 2015, jewelry sales increased 2% year on year to $13.27 billion, according to Rapaport News

estimates. Watch sales increased 2.6% to $1.76 billion. Jewelry and

watch sales combined increased 2.1% to $15.03 billion.

|

| |

LVMH’s 2015 Jewelry Sales +19%

LVMH Moët Hennessy Louis Vuitton reported watch

and jewelry revenue grew 19% to $3.69 billion (EUR 3.31 billion) in 2015

over the previous year on stronger Bulgari results and a successful refocusing

of TAG Heuer. Taking into account exchange-rate fluctuation and with a

“comparable structure,” sales in the jewelry and watch division advanced 8%.

LVMH Moët Hennessy Louis Vuitton reported watch

and jewelry revenue grew 19% to $3.69 billion (EUR 3.31 billion) in 2015

over the previous year on stronger Bulgari results and a successful refocusing

of TAG Heuer. Taking into account exchange-rate fluctuation and with a

“comparable structure,” sales in the jewelry and watch division advanced 8%.

Profit from recurring operations in the watches

and jewelry division surged 53% to $481.8 million while the operating

margin improved by 2.9 percentage points to 13.1%.

|

| |

Christie’s Jewelry Sales Drop

Christie’s jewelry sales from live auctions and

ecommerce slumped to $624.1 million in 2015 from $754.7 million that the

auction house reported in the previous year. Jewelry revenue declined at a

faster rate than the company’s flagship art business.

Christie’s jewelry sales from live auctions and

ecommerce slumped to $624.1 million in 2015 from $754.7 million that the

auction house reported in the previous year. Jewelry revenue declined at a

faster rate than the company’s flagship art business.

Art sales dipped 5% in to $7.4

billion (GBP 4.8 billion) but still achieved the second highest total in

company history.

|

| |

Titan’s 3Q Revenue +17%

India-based jeweler Titan

Company reported revenue increased 17% year on year to $504.6 million (INR

34.26 billion) in the third quarter that ended December 31 as retail sales

improved during the festive season.

India-based jeweler Titan

Company reported revenue increased 17% year on year to $504.6 million (INR

34.26 billion) in the third quarter that ended December 31 as retail sales

improved during the festive season.

The strong result was mainly because of

20% growth in jewelry sales to $415.3 million from a year ago, Titan’s

managing director Bhaskar Bhat explained. Watch sales increased 8.2% to $70.5

million. Profit after tax during the quarter jumped 18% to $33.2 million.

|

| |

Tiffany in Deal to Sell Fragrances

Tiffany & Co. has

announced a licensing deal with global beauty company Coty to sell fragrances

at the jeweler’s stores and other select luxury retailers. The two companies will

develop, produce and distribute Tiffany fragrances for men and women.

Tiffany & Co. has

announced a licensing deal with global beauty company Coty to sell fragrances

at the jeweler’s stores and other select luxury retailers. The two companies will

develop, produce and distribute Tiffany fragrances for men and women.

Founded in Paris in 1904, Coty’s portfolio

includes well-known fragrances, color cosmetics and skin and body care products

sold in more than 130 countries and territories.

|

| |

Richemont Buys Remaining 40% of Roger Dubuis

Switzerland-based luxury group

Richemont acquired the 40% of watchmaker Roger Dubuis it did not already own,

Reuters reported.

Switzerland-based luxury group

Richemont acquired the 40% of watchmaker Roger Dubuis it did not already own,

Reuters reported.

"We now own 100% of Roger Dubuis," the

news agency cited Richemont spokeswoman Sophie Cagnard as saying. Richemont and

Roger Dubuis declined to comment on the sale price, the report said January 22.

Richemont purchased a 60% stake in 2008 for an undisclosed amount.

|

| |

Amazon’s Profit Disappoints

Amazon reported sales surged

22% year on year to $35.7 billion in the fourth quarter that ended December 31.

Excluding the unfavorable impact of exchange-rate fluctuation, sales surged 26%.

Sales were within guidance of $33.5 billion to $36.75 billion issued ahead of

the holiday quarter but profit reportedly fell short of many

analysts’ expectations.

Amazon reported sales surged

22% year on year to $35.7 billion in the fourth quarter that ended December 31.

Excluding the unfavorable impact of exchange-rate fluctuation, sales surged 26%.

Sales were within guidance of $33.5 billion to $36.75 billion issued ahead of

the holiday quarter but profit reportedly fell short of many

analysts’ expectations.

Net income for the quarter more than doubled to

$482 million with diluted earnings per share of $1 compared to 45 cents a year

earlier. Analysts estimated the retailer would earn $1.56 a share during the

quarter, The New York Times reported.

|

| |

BaubleBar Gets $20M Funding

Online jewelry retailer

BaubleBar has raised $20 million of new funding from investors, according to a

report by technology news site TechCrunch.

Online jewelry retailer

BaubleBar has raised $20 million of new funding from investors, according to a

report by technology news site TechCrunch.

The ecommerce outfit, known for its ‘fast

fashion’ approach to jewelry that involves reacting quickly to trends, closed

on funding from existing investors Accel Partners, Greycroft Partners, Burch

Creative Capital and Aspect Ventures and new investors including Hubert Burda

Media and DSW, according to the report.

|

|

|

|

MINING

|

|

|

|

| |

ALROSA’s 2015 Production +6%

ALROSA’s production increased

6% year on year to 38.3 million carats in 2015. The company sold 30 million

carats of diamonds in 2015, which was 24% below the 39.5 million carats sold in

2014, according to Rapaport records. Revenue from rough sales are expected to

be at least $3.4 billion.

ALROSA’s production increased

6% year on year to 38.3 million carats in 2015. The company sold 30 million

carats of diamonds in 2015, which was 24% below the 39.5 million carats sold in

2014, according to Rapaport records. Revenue from rough sales are expected to

be at least $3.4 billion.

In the final quarter of 2015, ALROSA’s

production decreased 18% year on year to 8.6 million carats. The company sold

7.1 million carats during the period, including 4.1 million of gem-quality

diamonds at an average price of $166 per carat.

|

| |

Gem Diamonds’ 4Q Letšeng Sales Drop

Gem Diamonds sold $64.3

million worth of stones from its Letšeng mine in Lesotho in the fourth quarter

that ended December 31. The figure was 5% below the $67.7 million reported by

the company a year earlier. The average price achieved, including carats

extracted at rough value for polishing, fell 1.1% year on year to $2,117 per

carat from two Letšeng tenders held during the period.

Gem Diamonds sold $64.3

million worth of stones from its Letšeng mine in Lesotho in the fourth quarter

that ended December 31. The figure was 5% below the $67.7 million reported by

the company a year earlier. The average price achieved, including carats

extracted at rough value for polishing, fell 1.1% year on year to $2,117 per

carat from two Letšeng tenders held during the period.

The company sold 30,357

carats during the quarter, 4% fewer than a year before. Production from the mine increased 14% to

29,100 carats.

For 2015 as a whole, sales from Letšeng

decreased 15% $236.3 million compared with 2014.

|

| |

BlueRock Approves Acquisition of Diamond Resources

BlueRock Diamonds has approved

the purchase of Diamond Resources from Tawana Resources. Diamond Resources is a

non-trading company which holds the ‘rehabilitation guarantee’ required in

relation to the Kareevlei project in South Africa, which BlueRock acquired from the same

seller in 2013.

BlueRock Diamonds has approved

the purchase of Diamond Resources from Tawana Resources. Diamond Resources is a

non-trading company which holds the ‘rehabilitation guarantee’ required in

relation to the Kareevlei project in South Africa, which BlueRock acquired from the same

seller in 2013.

BlueRock, which is quoted on the Alternative

Investment Market of the London Stock Exchange, also purchased an intercompany

loan of $1.3 million (ZAR 21.5 million) owed by Diamond Resources to Tawana

which is expected to be eliminated on consolidation in the company's accounts. BlueRock

paid $43,556 for the shares in Diamond Resources and the loan, a statement

said.

|

|

|

|

GENERAL

|

|

|

|

| |

Marketing Panel to be Held at IDWI

The Israel Diamond Exchange (IDE) will host a

marketing panel discussion on February 15 at 4 p.m. featuring high-profile figures from the diamond and

jewelry industry at the upcoming International Diamond Week.

The Israel Diamond Exchange (IDE) will host a

marketing panel discussion on February 15 at 4 p.m. featuring high-profile figures from the diamond and

jewelry industry at the upcoming International Diamond Week.

Panelists at the event will be Jean-Marc Lieberherr, former

chairman of the Diamond Producers Association (DPA); Alex Popov, chairman of

the World Diamond Mark Foundation (WDM); Patricia Syvrud, executive director of

the World Diamond Council; and renowned jewelry designer Stephen Webster, who

is also the guest of honor at the International Diamond Week in Israel.

|

| |

Jewelry Industry Summit Unveils Speaker List

The Jewelry Industry Summit has released its

roster of speakers who will participate in the three-day forum on

sustainability and responsible sourcing.

The Jewelry Industry Summit has released its

roster of speakers who will participate in the three-day forum on

sustainability and responsible sourcing.

The event will be held at the Fashion

Institute of Technology in New York from March 11 to 13.

|

| |

DEF Unveils New Officers, Board Members

The Diamond Empowerment

Fund (DEF) has announced a new slate of officers and new board

members.

The Diamond Empowerment

Fund (DEF) has announced a new slate of officers and new board

members.

Phyllis Bergman, chief executive officer of

Mercury Ring, continues as president for 2016. Ed Hrabak, chief operating

officer of Signet Jewelers, has been elected vice president. Yancy Weinrich,

group vice president of JCK, was elected secretary and Rich Slomovitz, chief

financial officer of Rush Communications, remains treasurer.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Mining stocks continued to perform strongly this past week,

led by ALROSA (+11%) and Anglo American (+9.9%). U.S. retail stocks generally

grew in value, headed by J.C. Penney (+11.5%). In the Far East, performances

were mixed, with ValueMax Group (-5.3%), Sarine (-4.8%) and Chow Sang Sang

(-4.5%) all declining. Indian stock mostly had a tough week, with drops led by

Goldiam International (-11.4%).

View the detailed industry stock report.

| |

Feb. 4 (10:40 GMT) |

Jan. 28 (12:45 GMT) |

Chng. |

|

| $1 = Euro |

0.89 |

0.92 |

-0.022 |

|

| $1 = Rupee |

67.69 |

68.20 |

-0.5 |

|

| $1 = Israel Shekel |

3.91 |

3.96 |

-0.05 |

|

| $1 = Rand |

15.86 |

16.30 |

-0.44 |

|

| $1 = Canadian Dollar |

1.37 |

1.41 |

-0.04 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,146.21 |

$1,119.68 |

$26.53 |

2.4% |

| Platinum |

$888.99 |

$881.23 |

$7.76 |

0.9% |

| Silver |

$14.77 |

$14.38 |

$0.39 |

2.7% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

24,338.43 |

24,469.57 |

-131.14 |

-0.5% |

| Dow Jones |

16,336.66 |

15,944.46 |

392.20 |

2.5% |

| FTSE |

5,923.65 |

5,942.66 |

-19.01 |

-0.3% |

| Hang Seng |

19,183.09 |

19,195.83 |

-12.74 |

-0.1% |

| S&P 500 |

1,912.53 |

1,882.95 |

29.58 |

1.6% |

| Yahoo! Jewelry |

993.20 |

996.92 |

-3.72 |

-0.4% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Polished trading slows slightly

as Hong Kong and Chinese wholesale buyers close for Chinese New Year vacation.

Domestic Indian demand cautious as weak rupee (-2.6% from Jan. 1 to 68/$1)

weighs on sentiment. India tops Nielsen global ranking of consumer confidence. Demand

from U.S. and Israeli dealers steady with some inventory buying. Good demand

for 0.30-2ct., D-J, VS-SI, RapSpec A2 (3X, none) diamonds with some shift

toward lower-priced 3VG goods. Shortages supporting prices as new polished

production entering the market at a slow pace. Large Surat factories raising

manufacturing levels and small cutters returning as rough becomes affordable.

Read the Polished Diamond Trading Report

|

|

|

Advertisements

|

|

|

Advertisements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|