|

|

Rapaport TradeWire January 28, 2016

Jan 28, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

January 28, 2016

|

|

|

Diamond manufacturers increasing production as

profitability returns due to lower rough prices and firm polished prices due to

shortages. De Beers 2016 first sight period rough sales +118% to $540 from

$248M at Dec. sight period. Reduction in De Beers rough prices estimated at 7-10%.

Polished demand cautious as China prepares for Lunar New Year (Feb. 8). Good

demand for 1ct. RapSpec A2 (3X, none) with large 6-8% premiums for 3X over 3VG.

De Beers 2015 production -12% to 28.7M cts., sales volume -40% to 20.6M cts.

ALROSA 2015 production +6% to 38.3M cts., sales -30% to $3.4B and sales volume

-25% to 30M cts. Petra 1H production +2% to 1.6M cts., sales -28% to $154M.

Swiss watch 2015 exports -3% to $21.2B as Apple boasts record watch sales in

holiday quarter.

|

|

| Diamonds |

1,067,032 |

| Value |

$7,937,845,462 |

| Carats |

1,226,337 |

| Average Discount |

-27.96% |

www.rapnet.com

|

|

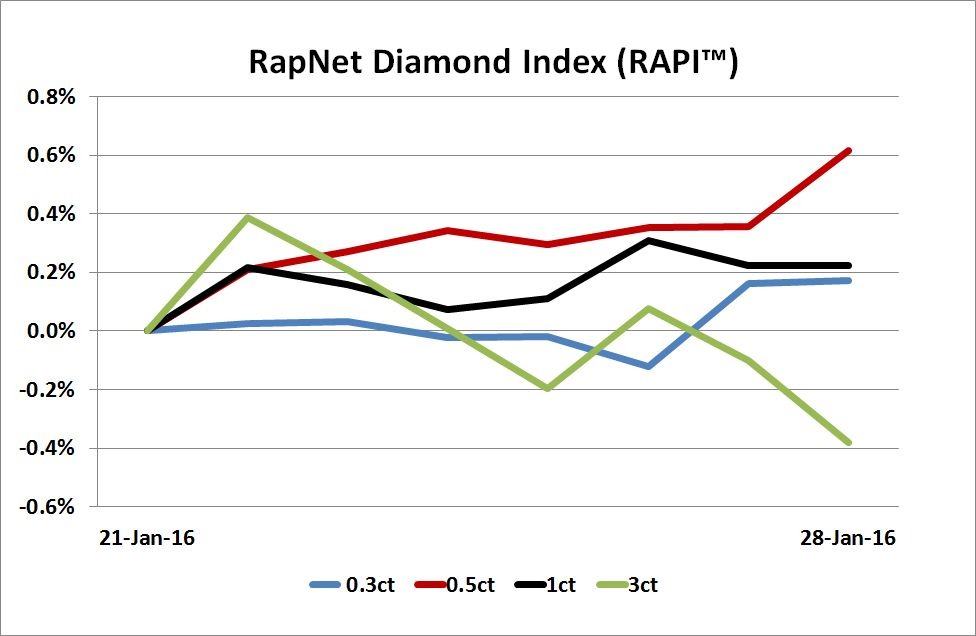

| The RapNet Diamond Index (RAPI) is the average price for the top 25 diamond qualities (D-H, IF-VS2). It is based on the 10 best priced diamonds for each quality. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

We left prices unchanged because we see no reasons right now for them to fall, especially given they even rose slightly at the end of last year.

We left prices unchanged because we see no reasons right now for them to fall, especially given they even rose slightly at the end of last year.

Andrey Zharkov, president of ALROSA, speaking to Interfax about keeping rough prices static at its January contract sale

|

|

|

|

MARKETS

|

|

|

|

| |

United States: Diamond manufacturers increasing production as

profitability returns due to lower rough prices and firm polished prices due to

shortages. De Beers 2016 first sight period rough sales +118% to $540 from

$248M at Dec. sight period...

Belgium: Sentiment improving as

more orders are coming in. U.S. demand sustaining the market. Steady sales to

smaller markets such as Turkey and Scandinavia. Buyers face competition for

select supply as availability is scarce...

Hong Kong: Wholesale trading

improving with firm prices due to shortages. Jewelers are buying to

replenish stock sold during the holiday season with some buying for inventory...

India: Mixed sentiment in Mumbai

as rupee depreciation (-3% in Jan. to 68/$1) weighs on domestic demand. Dealers

more active than before and suppliers getting better prices due to shortages...

Israel: Rising optimism as

trading continues to improve. Steady U.S. orders compensating for weak Chinese

demand. Wholesalers slowly increasing inventory levels as they expect prices to

firm in the coming weeks due to continued shortages...

Click here to continue reading

|

|

|

|

|

|

RAPAPORT STATEMENT

|

|

|

|

| |

The Right Way Forward

De Beers is moving forward in the right direction by reducing rough prices sufficiently to enable increased sales of rough diamonds and a resumption of diamond manufacturing activity. This is evidenced by an increase in De Beers rough diamond sales by 118% from $248 million in the tenth sales cycle of 2015 to $540 million in the first cycle of 2016....

Click here to read the full statement

|

|

|

|

INDUSTRY

|

|

|

|

| |

De Beers January Revenue Jumps to $540M

De Beers sold $540 million worth of rough diamonds in

January signaling a significant rise in demand from December. The company

published the monthly sales results for the first time, adding that its

December sales amounted to $248 million.

De Beers sold $540 million worth of rough diamonds in

January signaling a significant rise in demand from December. The company

published the monthly sales results for the first time, adding that its

December sales amounted to $248 million.

The revenue figure includes sales to sightholders, its auction clients and

internal sales to De Beers government and local partners. The company explained

that demand for rough broadened across the entire product range as cutting and

polishing factories began to ramp up activity.

Sightholders said De Beers reduced prices by more than 5% on average.

The company has reverted to its default deferral policy allowing sightholders

to defer one box every six months after offering more flexibility in the second

half of last year, but has kept a 20% buybacks policy introduced during

that period.

|

| |

De Beers 2015 Sales Volume -40%

De Beers rough diamond sales

slumped 40% to 20.6 million carats in 2015 as market weakness and lower diamond

manufacturing levels took their toll.

De Beers rough diamond sales

slumped 40% to 20.6 million carats in 2015 as market weakness and lower diamond

manufacturing levels took their toll.

The

decline in sales volume coincides with a 12% drop in production to 28.7 million

carats over the previous year as the miner reduced rough output in response to

trading conditions, parent Anglo American said. The result is just shy of

production guidance of about 29 million carats.

The

overall reduction is mainly due to reduced output from Debswana, De Beers

partner in Botswana, where production dropped 16% to 20.4 million carats.

|

| |

ALROSA Keeps Prices Stable

ALROSA kept prices steady at

its January contract sale stressing it sees no reason for prices to fall in

current market conditions.

ALROSA kept prices steady at

its January contract sale stressing it sees no reason for prices to fall in

current market conditions.

“We left

prices unchanged because we see no reasons right now for them to fall,

especially given they even rose slightly at the end of last year,” Andrey

Zharkov, president of the Russia-based miner, was quoted as saying by the

Russian news service Interfax.

Demand

for rough in January was better than expected while supply levels did not

increase, sources close to ALROSA explained to Rapaport News. The miner once again allowed buyers to defer up

to 70 percent of goods at the sale as it did at the previous sale in December.

Clients said all goods were sold at the sale.

|

| |

Six More Arrested in GIA Hacking Case

Six more people have been

arrested in relation to the hacking of Gemological Institute of America (GIA)

diamond-grading reports by outside

parties as the investigation into the case continues. A total of eight arrests

have now been made.

Six more people have been

arrested in relation to the hacking of Gemological Institute of America (GIA)

diamond-grading reports by outside

parties as the investigation into the case continues. A total of eight arrests

have now been made.

The GIA has extended its submission date for the

confirmation service for members of the trade concerned about the validity of

their grading reports by two months to March 31, 2016. Holders of a GIA report originally

issued between November 2014 and October 2015 who are concerned about its

validity may submit the original report and the referenced diamond to any GIA

location at no charge by the new deadline. To date only 297 of 1,042

invalidated reports have been returned.

|

| |

Swiss Watch Exports -4% in December

Swiss watch exports declined 3.8 percent year on year to

$1.71 billion (CHF 1.74 billion) in December as shipments to Hong Kong, the

nation’s largest trade partner for the industry, continued to fall.

Swiss watch exports declined 3.8 percent year on year to

$1.71 billion (CHF 1.74 billion) in December as shipments to Hong Kong, the

nation’s largest trade partner for the industry, continued to fall.

Exports to Hong Kong slumped 21 percent to $244 million, while shipments to the

U.S. fell 5.5 percent to $158.9 million, according to the Federation of the

Swiss Watch Industry.

Wristwatch exports decreased 3.1 percent to $1.63 billion

compared with a year ago, while shipments of other timepieces slumped 17

percent to $82.4 million.

|

| |

Synthetics Firm Lures High-Profile Cutters

Diamond Foundry, a

synthetic-diamond company with financial backing from actor Leonardo DiCaprio and Silicon

Valley entrepreneurs from Princeton and M.I.T, has

made two high-profile appointments, including the inventor of the princess cut.

Diamond Foundry, a

synthetic-diamond company with financial backing from actor Leonardo DiCaprio and Silicon

Valley entrepreneurs from Princeton and M.I.T, has

made two high-profile appointments, including the inventor of the princess cut.

Israel Itzkowitz, who invented the now-popular

diamond style in 1979, has joined the company as Master Cutter. Over the years,

he has crafted designs for De Beers, Tiffany & Co. and Graff Diamonds.

Maarten de Witte, a master diamond cutter and

“brand builder,” formerly known as the ‘Diamond Wizard’ at Hearts On Fire, has

also joined the company.

|

| |

IIa Denies Infringement of Element Six Patents

Lab-grown diamond producer IIa

Technologies denied it infringed on patents owned by De Beers synthetics

company Element Six and vowed to “challenge the validity” of the patents.

Lab-grown diamond producer IIa

Technologies denied it infringed on patents owned by De Beers synthetics

company Element Six and vowed to “challenge the validity” of the patents.

“We believe we are not in any way infringing on

Element Six’s claims,” Vishal Mehta, IIa’s chief executive officer, said in a

statement. “In addition, we will challenge the validity of their patents. IIa

Technologies has entered its appearance in the High Court in Singapore and will

vigorously defend itself.”

IIa was “exploiting Element Six patents for

commercial gain,” potentially in both the industrial and jewelry sectors, the

De Beers subsidiary alleged earlier this month.

|

| |

World Diamond Congress to Focus on Transparency

The World Federation of

Diamond Bourses (WFDB) will hold its 37th World Diamond Congress in Dubai from

May 16 to 19, placing transparency, responsibility and sustainability at the

heart of the summit’s agenda.

The World Federation of

Diamond Bourses (WFDB) will hold its 37th World Diamond Congress in Dubai from

May 16 to 19, placing transparency, responsibility and sustainability at the

heart of the summit’s agenda.

The meeting, a biennial gathering of the WFDB

and the International Diamond Manufacturers Association (IDMA), will be

attended by the WFDB’s 30 presidents and more than 200 industry representatives. The WFDB also aims to use the

forum to galvanize support for generic marketing of diamonds through its World

Diamond Mark initiative and create stronger links with the Diamond Producers

Association.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Tiffany Announces $500M Stock-Buyback Program

Tiffany & Co.’s board of

directors has approved a new stock buyback program under which the jewelry

retailer can repurchase up to $500 million of the company’s common stock.

Tiffany & Co.’s board of

directors has approved a new stock buyback program under which the jewelry

retailer can repurchase up to $500 million of the company’s common stock.

Tiffanys’ announcement comes after it unveiled a 6% drop in total sales in the two months to December 31, with performance hit by a

strong U.S. dollar and lower levels of tourist spending. The company’s share

price slid 7.3% during the week to January 21.

The new repurchase program replaces the

company’s existing stock repurchase program announced in March 2014.

|

| |

PC Jeweller's 3Q Revenue, Profit Soar

India-based PC Jeweller

reported revenue on a standalone basis jumped 20% year on year to $320.3

million (INR 21.8 billion) in the third quarter that ended December 31 mainly

because of surging domestic sales. Net profit for the quarter soared 34% to $21.5 million.

India-based PC Jeweller

reported revenue on a standalone basis jumped 20% year on year to $320.3

million (INR 21.8 billion) in the third quarter that ended December 31 mainly

because of surging domestic sales. Net profit for the quarter soared 34% to $21.5 million.

Revenue

from within India grew 22% to $233 million compared with a year ago,

while exports advanced 13% to $87.4 million, the online jewelry

company said.

|

|

|

|

MINING

|

|

|

|

| |

Petra Diamonds 1H Sales -28%

Petra Diamonds reported revenue slumped 28

percent year on year to $154 million in the first half that ended December 31. Excluding

exceptional precious stones, sales dived 18 percent to $144 million.

Petra Diamonds reported revenue slumped 28

percent year on year to $154 million in the first half that ended December 31. Excluding

exceptional precious stones, sales dived 18 percent to $144 million.

Production rose 2 percent from a year ago to 1.6

million carats, above the company’s target of 1.5 million carats. Petra remains

on track to reach its full-year output guidance of 3.3 to 3.4 million carats to

June 30, 2016, the company said.

|

| |

Lucapa Recovers Largest Lulo Diamond

Lucapa Diamond Company

recovered a 133.4-carat diamond from its Lulo Diamond Project in Angola, the

largest so far from the mine as it eclipsed a previous record of 131.4 carats

set in 2012. The diamond is “not of high quality,” the miner said.

Lucapa Diamond Company

recovered a 133.4-carat diamond from its Lulo Diamond Project in Angola, the

largest so far from the mine as it eclipsed a previous record of 131.4 carats

set in 2012. The diamond is “not of high quality,” the miner said.

The discovery comes after heavy rains restricted

access to the company’s planned mining areas during the fourth quarter to

December 31. Lucapa assigned earth-moving equipment to higher-lying areas of

interest to trial new mining blocks. One of these new areas was Mining Block 6.

In the first few days, Lucapa recovered diamonds weighing 133.4 carats, 29.2

carats, 12.37 carats and 11.1 carats.

|

| |

Murowa Mine Aims to Produce 1M Carats in 2016

Murowa Diamonds, a Zimbabwean

mining business exited by Rio Tinto last year, wants to expand production

fourfold this year, according to a Bloomberg report. The company will inject

$60 million into the mine over the next four years, the report added.

Murowa Diamonds, a Zimbabwean

mining business exited by Rio Tinto last year, wants to expand production

fourfold this year, according to a Bloomberg report. The company will inject

$60 million into the mine over the next four years, the report added.

“Our plan is to produce more than a million

carats this year,” the news agency cited Lovemore Chimuka, a spokesman for the

company, as saying. Production was 250,000 carats in 2015, he said. Rio Tinto sold its 78-percent stake in Murowa

last June.

|

| |

Stellar Finds 55-Carat Diamond at Baoulé Mine

Stellar Diamonds recovered a 55-carat gem at its Baoulé

kimberlite pipe in Guinea, which the company claims as evidence that the mine

is a potential source of large diamonds.

Stellar Diamonds recovered a 55-carat gem at its Baoulé

kimberlite pipe in Guinea, which the company claims as evidence that the mine

is a potential source of large diamonds.

The stone appears to have a ‘boart’ – or fragmented – exterior and a

potentially better-quality diamond on the interior, the West Africa-focused

diamond-development company said.

|

| |

BHP Billiton, Peregrine End Chidliak Royalty Deal

BHP Billiton Canada (BHPB) settled litigation

with Peregrine Diamonds and ended a royalty agreement with the diamond miner

related to the Chidliak project in Canada.

BHP Billiton Canada (BHPB) settled litigation

with Peregrine Diamonds and ended a royalty agreement with the diamond miner

related to the Chidliak project in Canada.

Under the royalty arrangement, Peregrine had

granted BHPB 2% of future mineral production, including diamonds, from the

Chidliak asset. A dispute between the companies arose in May 2015 in regard to

BHPB’s transfer of the royalty to South32, a company formed when BHPB demerged.

|

|

|

|

GENERAL

|

|

|

|

| |

Cindy Edelstein Passes Away

The jewelry world is mourning

the passing of Cindy Edelstein, an entrepreneur, author, editor and long-time

consultant to the industry, who died January 24 at the age of 51. The cause was

heart failure, according to a post on Instoremag.com.

The jewelry world is mourning

the passing of Cindy Edelstein, an entrepreneur, author, editor and long-time

consultant to the industry, who died January 24 at the age of 51. The cause was

heart failure, according to a post on Instoremag.com.

Edelstein began her career at JCK magazine and had a notable

careers as a trade-show consultant and creator and writer and in 1991 founded

the Jeweler's Resource Bureau with her husband, Frank Stankus, to highlight

jewelry designers and their work. She won numerous awards and was a

long-serving member of the board of the Women's Jewelry Association.

|

| |

GIA Opens Expanded Botswana Facility

The Gemological Institute of America (GIA) opened an

expanded laboratory and education facility in Gaborone, Botswana, January 19 to

support its beneficiation efforts in the African nation by bringing value-added

services to gem-producing countries. The expansion includes more classroom

space.

The Gemological Institute of America (GIA) opened an

expanded laboratory and education facility in Gaborone, Botswana, January 19 to

support its beneficiation efforts in the African nation by bringing value-added

services to gem-producing countries. The expansion includes more classroom

space.

The GIA is advancing its goal of making Gaborone the destination for

industry-leading gemological education in Africa, it said.

|

| |

London Bourse Releases Guide to Preventing Investment Scams

The London Diamond Bourse

published consumer advice to prevent the public from becoming victims of

“boiler-room” scams claiming to sell highly lucrative investment diamonds.

The London Diamond Bourse

published consumer advice to prevent the public from becoming victims of

“boiler-room” scams claiming to sell highly lucrative investment diamonds.

The advice, available on the public area of the

London Diamond Bourse website, was developed by the gem exchange and the U.K.’s

Insolvency Service. Simon Rainer, a former chief executive officer of the

British Jewellers Association, was a consultant for the project.

|

| |

7th Antwerp Diamond Trade Fair to Start Jan. 31

The 7th Antwerp Diamond Trade Fair (ADTF) will

be held from January 31 to February 2 in the halls of the Antwerp Diamond

Bourses.

The 7th Antwerp Diamond Trade Fair (ADTF) will

be held from January 31 to February 2 in the halls of the Antwerp Diamond

Bourses.

As part of the three-day event, an “Antwerp

Diamond Night” is scheduled for January 31. Two conferences will also be held:

“Who is afraid of lab-grown diamonds?” organized by the International

Gemological Institute, and another titled “What is luxury?”

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Anglo American (+24%) led mining shares this past week as subsidiary De Beers announced improved diamond sales. Signs of a recovery in the rough market also seem to have aided Stellar (+22%), Gem Diamonds (+20%), Petra (+14%), Mountain Province (+11%) and ALROSA (+8.1%). U.S. retailers were mainly stable or strengthened, led by J.C. Penney (+9.8%), after many had fallen the previous week. There were signs of improvement across Asia and Europe.

View the detailed industry stock report.

| |

Jan. 28 (12:45 GMT) |

Jan. 21 (11:45 GMT) |

Chng. |

|

| $1 = Euro |

0.92 |

0.92 |

0.001 |

|

| $1 = Rupee |

68.20 |

67.99 |

0.2 |

|

| $1 = Israel Shekel |

3.96 |

3.97 |

-0.01 |

|

| $1 = Rand |

16.30 |

16.69 |

-0.39 |

|

| $1 = Canadian Dollar |

1.41 |

1.45 |

-0.04 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,119.68 |

$1,099.25 |

$20.43 |

1.9% |

| Platinum |

$881.23 |

$818.26 |

$62.97 |

7.7% |

| Silver |

$14.38 |

$14.03 |

$0.35 |

2.5% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

24,469.57 |

23,962.21 |

507.36 |

2.1% |

| Dow Jones |

15,944.46 |

15,766.74 |

177.72 |

1.1% |

| FTSE |

5,942.66 |

5,697.07 |

245.59 |

4.3% |

| Hang Seng |

19,195.83 |

18,542.15 |

653.68 |

3.5% |

| S&P 500 |

1,882.95 |

1,859.33 |

23.62 |

1.3% |

| Yahoo! Jewelry |

996.92 |

969.60 |

27.32 |

2.8% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Mixed sentiment in Mumbai

as rupee depreciation (-3% in Jan. to 68/$1) weighs on domestic demand. Dealers

more active than before and suppliers getting better prices due to shortages.

Good demand for 1ct., G-J, VS-SI diamonds. Melee in better qualities slightly

weak with suppliers still holding a lot of inventory. Manufacturers slowly

raising polished production to fill gap in supply. Rough demand improves at De

Beers and ALROSA sales with steady demand on the secondary market as small

manufacturers increase production.

Read the Polished Diamond Trading Report

|

|

|

Advertisements

|

|

|

Advertisements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|