|

|

Rapaport TradeWire June 9, 2016

Jun 9, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

June 9, 2016

|

|

|

JCK Las Vegas show

traffic slower than previous years but meets conservative expectations. Exhibitors

concerned about sluggish demand, synthetics, marketing to millennials, and U.S.

election uncertainty. Upbeat Antique show signals improving demand for branded

estate jewelry. May 1 ct. RAPI flat, 0.30 ct. -1.1%. Signet shares plunge 20%

as Kay Jewelers defends ‘diamond swapping’ claims. Chow Tai Fook FY revenue

-12% to $7.3B, profit -46% to $384M. U.S. April polished imports +3% to $1.9B.

Belgium May polished exports +5% to $1.1B, rough imports +18% to $1.3B. Stuller

joins Int’l Grown Diamond Association. DPA unveils marketing slogan: ‘Real

is Rare. Real is a Diamond.’ |

|

| Diamonds |

1,190,337 |

| Value |

$8,123,979,876 |

| Carats |

1,281,014 |

| Average Discount |

-28.61% |

www.rapnet.com

|

|

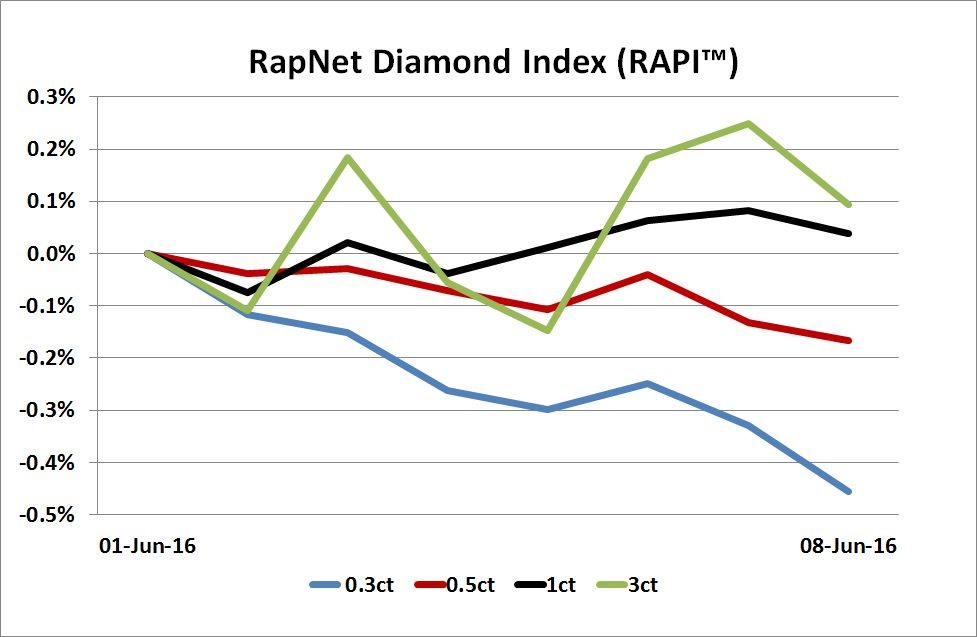

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

Our aim is to make millennials as passionate about diamonds as the baby boomers.

Our aim is to make millennials as passionate about diamonds as the baby boomers.

Stephen Lussier, chairman of the Diamond Producers Association, on a new slogan for diamonds

|

|

|

|

MARKETS

|

|

|

|

| |

United States: Mixed sentiment at Las

Vegas shows. Buyers looking for specific items and not purchasing for inventory.

Suppliers with the right stock and who were willing to compromise a bit on

price made sales…

Belgium: Polished trading slowly

improving after quiet May. Fewer Antwerp-based exhibitors at JCK Las Vegas than

previous years…

Israel: Trading in the bourse

quiet with many dealers at Las Vegas shows. Sentiment relatively positive even

as JCK show fell short of expectations. Inventory levels rising…

India: Activity back to normal

after May summer break with foreign buyers looking for goods in Mumbai. Dealers

at Las Vegas shows note stable U.S. demand but concerned about consumer

sentiment…

Hong Kong: Diamond trading quiet

with dealers interested in Las Vegas. Suppliers preparing for June Hong Kong

show (June 23 to 26), the smallest of the three annual Hong Kong fairs...

Click here for deeper analysis |

|

|

|

INDUSTRY

|

|

|

|

| |

Diamond Prices Soften in May

Polished diamond prices declined in May with buyers waiting

for the Las Vegas shows. U.S. demand was steady and the country remains

the best market for dealers. However, weaker economic trends in a

contentious election year is impacting sentiment in the diamond and jewelry

trade.

Polished diamond prices declined in May with buyers waiting

for the Las Vegas shows. U.S. demand was steady and the country remains

the best market for dealers. However, weaker economic trends in a

contentious election year is impacting sentiment in the diamond and jewelry

trade.

The RapNet Diamond Index (RAPI™) for 1-carat,

GIA-graded diamonds was flat in May. RAPI for 0.30-carat diamonds fell 1.1% and

RAPI for 0.50-carat diamonds slid 0.3%. RAPI for 3-carat diamonds dropped 1.1%.

During the first five months of the year, RAPI for 1-carat diamonds rose 1.2%

but was 4.9% below its level from a year ago.

|

| |

JCK Las Vegas Meets Low Expectations

Trading at the JCK Las Vegas show, which took place June 3 to

6, was relatively weak with traffic slower than previous years. Sentiment was mixed as dealers expressed

confidence in the U.S. market despite the sluggish activity in Las Vegas.

Trading at the JCK Las Vegas show, which took place June 3 to

6, was relatively weak with traffic slower than previous years. Sentiment was mixed as dealers expressed

confidence in the U.S. market despite the sluggish activity in Las Vegas.

Demand was specific and

buyers shopped around for higher discounts. There was good demand for

bread-and-butter American goods, particularly for off-size 1 ct., G-J, SI-I2

diamonds, while bridal remains the mainstay of the jewelry trade. Dealers were

satisfied that the first half of 2016 was better than last year and expect

continued stability in the second half.

|

| |

DPA Unveils Campaign Slogan

The Diamond Producers Association (DPA) has tapped

millennials’ desire for authenticity in its campaign slogan unveiled at the JCK

Las Vegas show.

The Diamond Producers Association (DPA) has tapped

millennials’ desire for authenticity in its campaign slogan unveiled at the JCK

Las Vegas show.

The DPA said the new slogan “Real is Rare, Real

is a Diamond” urges millennials to think of diamonds as a symbol of a real

connection rather than as a superfluous luxury product. The DPA’s research

revealed millennials are skeptical about diamonds but also identify with the

diamond story.

|

| |

Sotheby’s Shares Ownership of ‘$72M’ Pink

Sotheby’s teamed up with Diacore and Mellen Inc. to collectively own the Pink Star diamond.

Sotheby’s teamed up with Diacore and Mellen Inc. to collectively own the Pink Star diamond.

The oval mixed cut, 59.60-carat, fancy vivid pink, internally flawless stone was sold to diamond cutter Isaac Wolf in November 2013 for a world auction record of $83.2 million in Geneva. However, the gem was returned to Sotheby’s after Wolf defaulted. The auction house subsequently valued the diamond at about $72 million in its inventory where it is currently being held.

|

| |

U.S. Polished Imports Rise in April

U.S.

polished diamond imports rose 3% year on year to $1.85 billion in a seasonally

quiet April. Diamond imports by volume edged up 0.6% to 793,939 carats and the

average price grew 2.3% to $2,324 per carat.

U.S.

polished diamond imports rose 3% year on year to $1.85 billion in a seasonally

quiet April. Diamond imports by volume edged up 0.6% to 793,939 carats and the

average price grew 2.3% to $2,324 per carat.

Polished diamond exports, meanwhile, jumped 9.8% to $1.33 billion, driving net

polished imports down 12% to $513 million. The U.S. April net diamond

account dropped 13% to $507 million.

|

| |

Belgium’s Polished Trading Jumps

Belgium’s

polished diamond exports rose 4.5% year on year to $1.11 billion in May, the

first increase since June last year. Spokespersons for the Antwerp World

Diamond Centre maintained caution saying the data does not yet signal a

turnaround.

Belgium’s

polished diamond exports rose 4.5% year on year to $1.11 billion in May, the

first increase since June last year. Spokespersons for the Antwerp World

Diamond Centre maintained caution saying the data does not yet signal a

turnaround.

Polished imports recorded their first advance since March last year, up 6.8% to

$922.5 million. Net polished exports, representing exports minus imports, declined

5.6% to $186.1 million. Rough imports soared 18% to $1.3 billion and rough

exports surged 21% to $1.28 billion.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Signet Refutes Allegations of ‘Diamond Swapping’

Signet Jewelers denied allegations that its employees systematically

switch more expensive diamonds for lower-quality gems following claims the

jeweler repeatedly engaged in diamond “swapping.”

Signet Jewelers denied allegations that its employees systematically

switch more expensive diamonds for lower-quality gems following claims the

jeweler repeatedly engaged in diamond “swapping.”

“We strongly object to recent allegations on

social media, republished and grossly amplified, that our team members

systematically mishandle customers’ jewelry repairs or engage in diamond

swapping,” the company said. Signet shares plunged in the aftermath of

the allegations.

|

| |

De Beers Embraces 'Ever Us'

Forevermark is adopting Signet’s

‘Ever Us’ two-stone ring concept for its 2016 holiday advertising campaign. The two companies will run separate campaigns

aiming to create momentum for the two-stone ring concept following last

year’s launch by Signet.

Forevermark is adopting Signet’s

‘Ever Us’ two-stone ring concept for its 2016 holiday advertising campaign. The two companies will run separate campaigns

aiming to create momentum for the two-stone ring concept following last

year’s launch by Signet.

Forevermark will run its ‘Ever

Us’ advertising on national television, digital and print media, featuring its

own line of two-stone jewelry including rings, pendants and earrings. Forevermark will also continue ’The One’

theme from last year, featuring its ‘A Diamond is Forever’ tagline and will re-run

the ‘Seize the Day’ campaign urging men to buy diamonds this Christmas.

|

| |

U.S. Jewelry Sales Continue Growth Spurt

U.S. jewelry and watch revenue from all retail outlets recorded

the biggest jump in three years in April as sales rose for a 12th consecutive

month.

U.S. jewelry and watch revenue from all retail outlets recorded

the biggest jump in three years in April as sales rose for a 12th consecutive

month.

Revenue advanced 5.4% year on year to an

estimated $5.53 billion, provisional government figures showed. This was the

steepest growth since a 7.3% jump in April 2013, according to Rapaport News records. Jewelry sales increased 5.3%

to $4.88 billion in April, while watch sales advanced 6.4% to an estimated $647

million.

|

| |

Chow Tai Fook’s Profit Dives 46%

Chow Tai Fook’s profit tumbled in the past fiscal year as

fewer tourists visited Hong Kong and consumer spending slowed in Greater China.

Chow Tai Fook’s profit tumbled in the past fiscal year as

fewer tourists visited Hong Kong and consumer spending slowed in Greater China.

Profit slumped 46% to $383.6 million (HKD 2.98

billion) in the 12 months that ended March 31. Revenue slid 12% to $7.3

billion. Jewelry sales in mainland China dropped 11% and in Hong Kong and Macau they declined 15%.

|

| |

Buffett’s Richline Acquires Viawear

Richline Group continued its recent string of acquisitions

with the purchase of Viawear, a provider of wearable technology for jewelry

brands.

Richline Group continued its recent string of acquisitions

with the purchase of Viawear, a provider of wearable technology for jewelry

brands.

Viawear has developed

bracelets that filter mobile notifications so wearers receive important alerts

without having to check if they missed something. Richline, a subsidiary of Warren

Buffett’s Berkshire Hathaway, in April acquired

jewelry website Gemvara and in June bought precious-metals company John C.

Nordt.

|

|

|

|

MINING

|

|

|

|

| |

ALROSA Anticipates Stable Rough Prices

ALROSA expects to hold rough diamond prices steady for the

rest of 2016 as the miner anticipates a stable year.

ALROSA expects to hold rough diamond prices steady for the

rest of 2016 as the miner anticipates a stable year.

“Regarding our pricing

outlook for 2016, we remain cautious, but do not expect any significant falls

in pricing generally,” said Igor Kulichik, ALROSA’s chief financial officer (pictured).

The Russia-based

miner’s revenue soared 37% in the first three months of the year helping reduce its

rough inventory by 4 million carats through the quarter. Profit more than

doubled.

|

| |

Dominion Swings to 1Q Loss

Dominion Diamond Corporation

announced a quarterly loss as a lower-value product mix from its Ekati mine in

Canada resulted in a 62% decline in the average price of rough sold.

Dominion Diamond Corporation

announced a quarterly loss as a lower-value product mix from its Ekati mine in

Canada resulted in a 62% decline in the average price of rough sold.

The miner reported a loss of $1 million in the first

fiscal quarter that ended April 30 versus a profit of $12 million a year ago. Sales declined 5% to $178.3 million as rough prices

fell year on year. The average price at

Ekati fell to $68 per carat compared to $180 a carat a year earlier. Dominion

also owns 40% of the Diavik mine in Canada.

|

| |

Lukoil’s 1Q Diamond Sales Rise

Lukoil reported diamond sales

increased fourfold in the first quarter as the company increased production

from its Grib mine in Russia.

Lukoil reported diamond sales

increased fourfold in the first quarter as the company increased production

from its Grib mine in Russia.

Sales jumped to $124 million (RUB 8 billion) in the

three months that ended March 31 from $31 million a year ago. The Russia-based

miner started production at Grib, its only diamond asset, in September 2014 and

was expected to increase annual

production to

4.5 million carats from a targeted

2 million carats in 2015.

|

|

|

|

GENERAL

|

|

|

|

| |

Stuller Joins Lab-Grown Diamond Body

Stuller, a U.S.-based jewelry manufacturer, has become the latest member of the International Grown Diamond Association (IGDA) after it started offering synthetic diamonds earlier this year.

Stuller, a U.S.-based jewelry manufacturer, has become the latest member of the International Grown Diamond Association (IGDA) after it started offering synthetic diamonds earlier this year.

IGDA was set up in February to represent synthetics producers. Its members include companies based in the U.S., China, Singapore, India, Philippines, Russia, Canada and Hong Kong.

|

| |

KP and Civil Society Lock Horns

The Kimberley Process (KP) Civil Society Coalition hit back against comments by KP chair Ahmed Bin Sulayem criticizing the non-profit alliance for not engaging with the organization. The association last year boycotted the KP when the United Arab Emirates was appointed as its 2016 chairman.

The Kimberley Process (KP) Civil Society Coalition hit back against comments by KP chair Ahmed Bin Sulayem criticizing the non-profit alliance for not engaging with the organization. The association last year boycotted the KP when the United Arab Emirates was appointed as its 2016 chairman.

Addressing the recent KP intersessional meeting in Dubai, Bin Sulayem (pictured) attacked Alan Martin, director of research at Partnership Africa Canada, for not taking part in mediation aimed at bringing the coalition back into the fold. The coalition argued that none of the industry reforms it had requested from the KP chair had been made.

|

| |

Rio Tinto Unveils Highlights of Pink Tender

Rio Tinto revealed five lead gems of this year’s tender of polished colored diamonds from its Argyle mine as the company kicked off the sales process.

Rio Tinto revealed five lead gems of this year’s tender of polished colored diamonds from its Argyle mine as the company kicked off the sales process.

The centerpiece of the 2016 Argyle Pink Diamonds Tender is the ‘Argyle Violet,’ an oval, 2.83-carat violet diamond. The other highlights are the ‘Argyle Ultra,’ a pear-shaped, 1.11-carat violet diamond; the ‘Argyle Viva,’ a pear-shaped, 1.21-carat vivid purple-pink diamond; the ‘Argyle Thea,’ a radiant-cut, 2.24-carat vivid purplish pink diamond; and the ‘Argyle Aria,’ an oval, 1.09-carat fancy red diamond.

|

| |

Antwerp Gears Up for Rough Diamond Days

Antwerp’s rough diamond bourse, the Antwerpsche Diamantkring, will host the summer edition of the Antwerp Rough Diamond Days later this month.

Antwerp’s rough diamond bourse, the Antwerpsche Diamantkring, will host the summer edition of the Antwerp Rough Diamond Days later this month.

The fair will take place from June 21 to 22 in the Diamantkring’s trading hall. It is open to all members of exchanges affiliated to the World Federation of Diamond Bourses, the organization said.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Signet (-9.5%) fell on allegations in the media of "diamond swapping" at its stores. U.S. retail stocks were otherwise mainly stronger, led by JCPenney (+10%). Mining stocks mostly increased, led by Rockwell Diamonds (+18%) as it recovered from a decline last week. Chow Tai Fook (+3%) was up despite reporting a heavy profit slump.

View the detailed industry stock report.

| |

Jun 9 (11:19 GMT) |

Jun 2 (11:33 GMT) |

Chng. |

|

| $1 = Euro |

0.88 |

0.89 |

-0.01 |

|

| $1 = Rupee |

66.76 |

67.29 |

-0.53 |

|

| $1 = Israel Shekel |

3.85 |

3.86 |

-0.01 |

|

| $1 = Rand |

14.85 |

15.58 |

-0.73 |

|

| $1 = Canadian Dollar |

1.27 |

1.31 |

-0.04 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,259.10 |

$1,215.35 |

$43.75 |

3.6% |

| Platinum |

$1,001.50 |

$972.40 |

$29.10 |

3.0% |

| Silver |

$17.06 |

$15.96 |

$1.10 |

6.9% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

26,763.46 |

26,843.14 |

-79.68 |

-0.3% |

| Dow Jones |

18,005.05 |

17,789.67 |

215.38 |

1.2% |

| FTSE |

6,251.19 |

6,215.09 |

36.10 |

0.6% |

| Hang Seng |

21,297.88 |

20,859.22 |

438.66 |

2.1% |

| S&P 500 |

2,119.12 |

2,099.33 |

19.79 |

0.9% |

| Yahoo! Jewelry |

1,068.63 |

1,014.80 |

53.83 |

5.3% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Activity back to normal

after May summer break with foreign buyers looking for goods in Mumbai. Dealers

at Las Vegas shows note stable U.S. demand but concerned about consumer

sentiment. Small goods weak at the show. Steady demand for dossiers. Rough

trading quiet after relatively large De Beers and ALROSA May sales.

Manufacturing levels stable again after summer vacation with polished inventory

expected to rise in coming months.

Read the Polished Diamond Trading Report

|

|

|

Advertisements

|

|

|

Advertisements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|