|

|

Rapaport TradeWire January 19, 2017

Jan 19, 2017 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

January 19, 2017

|

|

|

Sentiment improving as jewelers begin stock

replenishment after mediocre holiday season. Independents outperform majors and

online takes significant market share from physical stores. China waking up for

‘Year of the Rooster’ with rising expectations for Jan. 28 Golden Week. China

doing much better than Hong Kong. Luk Fook 3Q same-store sales -10% with

China +5%, Hong Kong -11%. Rough trading steady with continued weakness in

lower-quality goods due to India demonetization problems. Price-sensitive

buyers moving to HPHT synthetics instead of lower-quality natural diamonds.

India Dec. polished exports +23% to $1.2B, rough imports -5% to $1.5B. Richline

buys The Aaron Group.

|

|

| Diamonds |

1,244,958 |

| Value |

$7,454,575,039 |

| Carats |

1,327,166 |

| Average Discount |

-30.36% |

www.rapnet.com

|

|

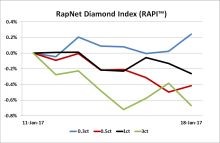

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

Whether it was Iceland at the Euros, Leicester City in the Premier League, the West Indies in the T20 World Cup, Sunrisers Hyderabad in the IPL, the Chicago Cubs in the World Series or the Fiji rugby sevens team in the Olympics, it was proven beyond a shadow of a doubt last year that by working together towards a common objective, you can surpass everyone’s expectations of what’s possible.

Whether it was Iceland at the Euros, Leicester City in the Premier League, the West Indies in the T20 World Cup, Sunrisers Hyderabad in the IPL, the Chicago Cubs in the World Series or the Fiji rugby sevens team in the Olympics, it was proven beyond a shadow of a doubt last year that by working together towards a common objective, you can surpass everyone’s expectations of what’s possible.

De Beers CEO Bruce Cleaver urges the industry to work together in a speech to sightholders.

|

|

|

|

MARKETS

|

|

|

|

| |

United

States: Polished trading improving after quiet holiday

period. New York dealers preparing for India Diamond Week in DDC (Jan. 23 to

26)…

Belgium: Steady activity with dealers gaining confidence

for 2017. U.S. demand stable, Europe weak. Stable demand for 1 ct., G-J, VS-SI,

RapSpec A3+ diamonds. 0.30 ct. to 0.40 ct. improving…

Israel:

Trading quiet. Dealers still assessing holiday

season as memo goods are slowly returned. Buyers shifting to lower price points

with steady U.S. demand for J-K, SI-I1 goods…

India: Trading improving with foreign buyers looking

for bargains in Mumbai. Shortages in select categories as fresh post-Diwali

supply still in production…

Hong

Kong: Dealer market quiet as wholesalers close for the

Chinese New Year. Some last-minute orders with steady holiday demand for 0.30

to 1 ct. E-J, VVS-SI RapSpec A2+ diamonds…

Click here for deeper analysis |

|

|

|

INDUSTRY

|

|

|

|

| |

Diamond Marketing Body Seeks Cash Injection

The Diamond Producers Association (DPA) plans to increase

its annual budget to $60 million from $6 million by asking members for bigger

contributions, Bloomberg reported. The industry’s marketing body is looking to

step up efforts to make diamonds appeal to younger consumers, who are

increasingly spending their cash on electronics and restaurants. The DPA

will approach members such as De Beers and ALROSA to get them to increase their

financial backing, Bloomberg said, citing people familiar with the plans who

asked not to be named.

The Diamond Producers Association (DPA) plans to increase

its annual budget to $60 million from $6 million by asking members for bigger

contributions, Bloomberg reported. The industry’s marketing body is looking to

step up efforts to make diamonds appeal to younger consumers, who are

increasingly spending their cash on electronics and restaurants. The DPA

will approach members such as De Beers and ALROSA to get them to increase their

financial backing, Bloomberg said, citing people familiar with the plans who

asked not to be named.

|

| |

Demonetization Stifles India’s Diamond Imports

India’s rough diamond exports fell 5% to $1.4 billion in

December as demonetization damaged local demand, according to data published by

the Gem and Jewellery Export Promotion Council. Polished exports rose 23% to

$1.48 billion, leaving net polished exports – reflecting the excess of exports

over imports – 32% higher at $1.28 million. India’s December net diamond

account improved 89% to a deficit of $45 million as total imports exceeded

exports.

India’s rough diamond exports fell 5% to $1.4 billion in

December as demonetization damaged local demand, according to data published by

the Gem and Jewellery Export Promotion Council. Polished exports rose 23% to

$1.48 billion, leaving net polished exports – reflecting the excess of exports

over imports – 32% higher at $1.28 million. India’s December net diamond

account improved 89% to a deficit of $45 million as total imports exceeded

exports.

|

| |

Richline Acquires The Aaron Group

Richline Group bought jewelry manufacturer The Aaron Group,

as the Warren Buffett-owned business continues to drive growth through mergers

and acquisitions. The companies did not disclose terms of the deal, which

was the fifth acquisition Richline has made in the last 12 months. The Aaron

Group, founded in 1950, has grown from its New York roots to a manufacturer

with operations in London, Mumbai and China. The takeover will help the

company roll out new designs and collections more rapidly, according to Robert

Kempler, its president.

Richline Group bought jewelry manufacturer The Aaron Group,

as the Warren Buffett-owned business continues to drive growth through mergers

and acquisitions. The companies did not disclose terms of the deal, which

was the fifth acquisition Richline has made in the last 12 months. The Aaron

Group, founded in 1950, has grown from its New York roots to a manufacturer

with operations in London, Mumbai and China. The takeover will help the

company roll out new designs and collections more rapidly, according to Robert

Kempler, its president.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

NRF Reports Some Holiday Cheer

Holiday retail sales rose 4% driven by an accelerated

economic recovery even as certain large chain stores reported lower traffic,

according to separate reports from the National Retail Federation (NRF) and

MasterCard. The NRF said total U.S. sales increased to $658.3 billion in

November and December, with online and non-store sales growing 13% to $122.9

billion. MasterCard also estimated total sales increase at 4% during a slightly

shorter period over November 1 to December 24, with online sales jumping 19%.

Holiday retail sales rose 4% driven by an accelerated

economic recovery even as certain large chain stores reported lower traffic,

according to separate reports from the National Retail Federation (NRF) and

MasterCard. The NRF said total U.S. sales increased to $658.3 billion in

November and December, with online and non-store sales growing 13% to $122.9

billion. MasterCard also estimated total sales increase at 4% during a slightly

shorter period over November 1 to December 24, with online sales jumping 19%.

|

| |

Trump Protests Disrupt Tiffany Holiday Sales

Tiffany & Co. said holiday sales declined 4% to $483

million in the Americas. The drop resulted from weaker consumer spending and post-election protests outside the

jeweler’s flagship New York outlet, which neighbors Trump Tower. Access to the Fifth Avenue store was restricted, with sales slumping 14%, contributing to overall lower U.S.

sales. Worldwide group sales increased 0.5% to $966 million amid growth in

Asia Pacific and Japan.

Tiffany & Co. said holiday sales declined 4% to $483

million in the Americas. The drop resulted from weaker consumer spending and post-election protests outside the

jeweler’s flagship New York outlet, which neighbors Trump Tower. Access to the Fifth Avenue store was restricted, with sales slumping 14%, contributing to overall lower U.S.

sales. Worldwide group sales increased 0.5% to $966 million amid growth in

Asia Pacific and Japan.

Image: Newscast |

| |

Forevermark Holiday Sales Outperform Rest of Trade

Forevermark diamond sales in the U.S. jumped 6.4% during the

holiday season as product launches and marketing campaigns paid off, De Beers

chief executive officer Bruce Cleaver said. Sales of the De Beers-owned brand

grew 7.6% in 2016. The figures are based on a representative survey of jewelers

that stock Forevermark products. By contrast, total jewelry sales edged up 0.7%

in December and increased 0.4% in the full year, according to data from the

Mastercard Spending Pulse cited by Cleaver.

Forevermark diamond sales in the U.S. jumped 6.4% during the

holiday season as product launches and marketing campaigns paid off, De Beers

chief executive officer Bruce Cleaver said. Sales of the De Beers-owned brand

grew 7.6% in 2016. The figures are based on a representative survey of jewelers

that stock Forevermark products. By contrast, total jewelry sales edged up 0.7%

in December and increased 0.4% in the full year, according to data from the

Mastercard Spending Pulse cited by Cleaver.

|

| |

China a Bright Spot as Luk Fook Sales Decline

Luk Fook reported same-store sales fell 10% in the third

fiscal quarter as a continued decline in its Hong Kong business outweighed

improvements in mainland China. Same-store sales slid 11% in Hong Kong versus a

5% increase in mainland China in the three months that ended December 31. The

drop in third-quarter sales was slower than that in the previous three months,

when same-store sales slumped 37%. The figures only include retail sales

at Luk Fook’s self-operated stores.

Luk Fook reported same-store sales fell 10% in the third

fiscal quarter as a continued decline in its Hong Kong business outweighed

improvements in mainland China. Same-store sales slid 11% in Hong Kong versus a

5% increase in mainland China in the three months that ended December 31. The

drop in third-quarter sales was slower than that in the previous three months,

when same-store sales slumped 37%. The figures only include retail sales

at Luk Fook’s self-operated stores.

|

| |

Birks Holiday Sales Defy U.S. Jewelry Dip

Birks Group reported comparable-store sales grew 11% in a

record holiday season for the retailer as the average spend per shopper rose

and a greater proportion of store visits translated into purchases.

Comparable-store sales jumped 16% in the U.S. and rose 3% in Canada between

October 30 and December 31, the jeweler said. All figures were reported at

constant exchange rates. The group’s stronger revenues defy an otherwise

disappointing holiday season for U.S. bricks-and-mortar jewelry retailers.

Birks Group reported comparable-store sales grew 11% in a

record holiday season for the retailer as the average spend per shopper rose

and a greater proportion of store visits translated into purchases.

Comparable-store sales jumped 16% in the U.S. and rose 3% in Canada between

October 30 and December 31, the jeweler said. All figures were reported at

constant exchange rates. The group’s stronger revenues defy an otherwise

disappointing holiday season for U.S. bricks-and-mortar jewelry retailers.

Image: Dllu

|

|

|

|

MINING

|

|

|

|

| |

Rio Tinto Raises Diamond Output

Rio Tinto’s rough-diamond production grew 4% to 18 million

carats in 2016, the lower end of its guidance, as it continued to step up

underground operations at its Argyle mine in Australia. Output at Argyle

increased 4% to 14 million carats. Production at the Diavik mine in Canada

rose by the same proportion, with Rio Tinto's 60% share amounting to 4 million

carats. The miner forecast production will rise to between 19 million and 24

million carats in 2017.

Rio Tinto’s rough-diamond production grew 4% to 18 million

carats in 2016, the lower end of its guidance, as it continued to step up

underground operations at its Argyle mine in Australia. Output at Argyle

increased 4% to 14 million carats. Production at the Diavik mine in Canada

rose by the same proportion, with Rio Tinto's 60% share amounting to 4 million

carats. The miner forecast production will rise to between 19 million and 24

million carats in 2017.

|

| |

Diavik Mine to Escalate Diamond Production

Dominion Diamond Corporation forecast production at the

Diavik mine in Canada will increase by up to 14% this year after output rose in

2016. The miner projected rough-diamond recovery of 7.1 million to 7.6 million

carats in 2017. Production increased 4% to 6.7 million carats in 2016, but was

below the company's forecast.

Dominion Diamond Corporation forecast production at the

Diavik mine in Canada will increase by up to 14% this year after output rose in

2016. The miner projected rough-diamond recovery of 7.1 million to 7.6 million

carats in 2017. Production increased 4% to 6.7 million carats in 2016, but was

below the company's forecast. |

| |

DiamondCorp Insolvency Hinges on Wage Deal

DiamondCorp warned it will likely enter insolvency

proceedings unless an agreement is reached with the mining union over

retrenchment and payment of outstanding wages. The company also announced a share sale to raise $1.2 million

(GBP 1 million) to fund the care and maintenance of its Lace mine in South Africa, after

operations were suspended because of severe flooding in November. Deloitte

& Touche, DiamondCorp's business-rescue practitioner, is in negotiations

with the Association of Mineworkers and Construction Union.

DiamondCorp warned it will likely enter insolvency

proceedings unless an agreement is reached with the mining union over

retrenchment and payment of outstanding wages. The company also announced a share sale to raise $1.2 million

(GBP 1 million) to fund the care and maintenance of its Lace mine in South Africa, after

operations were suspended because of severe flooding in November. Deloitte

& Touche, DiamondCorp's business-rescue practitioner, is in negotiations

with the Association of Mineworkers and Construction Union. |

| |

ALROSA’s Diamond Resources Decline

ALROSA’s rough diamond resources fell 4% to 1.03 billion

carats as at July 1, 2016, the Russia-based miner reported. Back on January 1,

2015, the resources stood at 1.08 billion carats. Both assessments were carried

out in accordance with a code outlined by the Joint Ore Reserves Committee (JORC),

the Australasian guidelines for reporting mineral resources and ore reserves,

according to ALROSA. Mineral reserves, defined as resources whose mining

is economically feasible, declined almost 1% to 653 million carats.

ALROSA’s rough diamond resources fell 4% to 1.03 billion

carats as at July 1, 2016, the Russia-based miner reported. Back on January 1,

2015, the resources stood at 1.08 billion carats. Both assessments were carried

out in accordance with a code outlined by the Joint Ore Reserves Committee (JORC),

the Australasian guidelines for reporting mineral resources and ore reserves,

according to ALROSA. Mineral reserves, defined as resources whose mining

is economically feasible, declined almost 1% to 653 million carats.

|

|

|

|

GENERAL

|

|

|

|

| |

Gold Set to Shine on Stronger Asian Demand

The World Gold Council (WGC) predicted gold prices will

continue to rise in 2017 as growth in Asia and political uncertainty in the

west are expected to support demand. Investment demand in China has grown,

outweighing weakness in the jewelry sector, the WGC said. In India, liquidity

squeeze resulting from the government’s demonetization policy will impact gold

demand in the short term but increased transparency and formalization of the

economy will support growth in the long run.

The World Gold Council (WGC) predicted gold prices will

continue to rise in 2017 as growth in Asia and political uncertainty in the

west are expected to support demand. Investment demand in China has grown,

outweighing weakness in the jewelry sector, the WGC said. In India, liquidity

squeeze resulting from the government’s demonetization policy will impact gold

demand in the short term but increased transparency and formalization of the

economy will support growth in the long run.

|

| |

Diamond Tiara Crowns Fellows Auction

U.K.-based Fellows sold $627,000 (GBP

520,000) worth of jewelry at an auction that was 74% sold by lot and 87%

sold by value. A brilliant round, 6.43-carat, K-color, VVS2-clarity diamond

ring was the most expensive item at the sale, fetching $38,986, or $6,063 per

carat. Fellows also auctioned a Victorian tiara featuring 19 to 20 carats

of J-L color diamonds with clarity ranging from SI2 to “P1,” which is

equivalent to the GIA’s I1 grade. The piece fetched $19,493.

U.K.-based Fellows sold $627,000 (GBP

520,000) worth of jewelry at an auction that was 74% sold by lot and 87%

sold by value. A brilliant round, 6.43-carat, K-color, VVS2-clarity diamond

ring was the most expensive item at the sale, fetching $38,986, or $6,063 per

carat. Fellows also auctioned a Victorian tiara featuring 19 to 20 carats

of J-L color diamonds with clarity ranging from SI2 to “P1,” which is

equivalent to the GIA’s I1 grade. The piece fetched $19,493.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Birks Group (+15%) stood out among U.S. retailers as its holiday sales outperformed the jewelry market. Tiffany (+2.8%) defied disappointing results. Industry stocks were otherwise roughly stable or lower, with Movado Group (-4%) heading the declines. In the Far East, Chow Tai Fook (+4.3%) and Luk Fook (+2.5%) gained as the latter posted improved China sales data. Indian markets showed signs of recovery, with share-price increases led by Lypsa Gems (+8.2%).

View the detailed industry stock report

| |

Jan 19, 2017 (13:05 GMT) |

Jan 12, 2017 (12:53 GMT) |

Chng. |

|

| $1 = Euro |

0.94 |

0.94 |

0.00 |

|

| $1 = Rupee |

68.13 |

67.97 |

0.16 |

|

| $1 = Israel Shekel |

3.81 |

3.82 |

-0.01 |

|

| $1 = Rand |

13.60 |

13.46 |

0.14 |

|

| $1 = Canadian Dollar |

1.33 |

1.31 |

0.02 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,204.98 |

$1,204.73 |

$0.25 |

0.0% |

| Platinum |

$966.35 |

$986.80 |

-$20.45 |

-2.1% |

| Silver |

$17.02 |

$16.92 |

$0.10 |

0.6% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

27,308.60 |

27,247.16 |

61.44 |

0.2% |

| Dow Jones |

19,804.72 |

19,954.28 |

-149.56 |

-0.7% |

| FTSE |

7,212.14 |

7,285.86 |

-73.72 |

-1.0% |

| Hang Seng |

23,049.96 |

22,829.02 |

220.94 |

1.0% |

| S&P 500 |

2,271.89 |

2,275.32 |

-3.43 |

-0.2% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Trading

improving with foreign buyers looking for bargains in Mumbai. Shortages in

select categories as fresh post-Diwali supply still in production. Rough demand

steady as export-focused factories raise production levels. Smaller

manufacturers cautious due to liquidity squeeze.

Read the Polished Diamond Trading Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|