In his annual speech at the JCK Las Vegas show, Martin Rapaport, chairman of the Rapaport Group, analyzed the opportunities and challenges in the marketplace.

RAPAPORT... Great changes are taking place in the world around us and they will have a profound and powerful long-term impact on the diamond and jewelry industry. We are not experiencing a short-term crisis that will pass with a return to business as usual. We are witnessing a fundamental shift to a new reality, to a new world of challenges and opportunity.

While initial reactions to the global economic crisis are relatively easy to understand, the long-term implications are much more complex and significant. It may be obvious that if people have less money they will buy less diamonds, but how do you calculate the psychological impact of financial insecurity on the mindset of different consumer demographics? Even if people were to somehow get all their money back, would they buy diamonds the same way? How, when, where, why and what will they buy?

Trying to do business the old way in the new environment may be like trying to sell steak to vegetarians. Furthermore, what about your suppliers? The old diamond distribution system with its financially irresponsible credit/memo programs is bankrupt. Do you have the money to be in the diamond business? What are your priorities?

Now, more than ever, it is vital that firms develop strategic thinking. We need to understand not just what is happening but why it is happening and how it will affect our bottom line. While optimizing existing operations and increasing efficiency is always a good idea, it may not be enough to get you through the challenges ahead. We need to rethink our business models and the way we add value to diamonds rather than just improving our old way of doing business.

At this stage, strategic optimization is more important than operational optimization. Those who embrace change and position themselves properly will seize new opportunities and they will prosper.

Economic Crisis

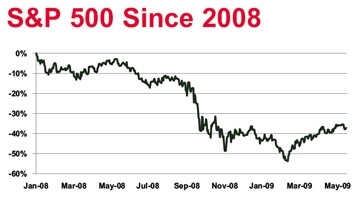

The economic crisis was and is the primary force reshaping our industry. The S&P 500, a bellwether of global wealth, plummeted 55 percent from January 1, 2008, through March 6, 2009. During this period, investors worldwide lost over $31 trillion in the stock markets alone. The massive destruction of wealth hit the wealthy and the middle class the hardest as they were the most invested. They were also the key source of diamond demand during the boom years prior to the collapse.

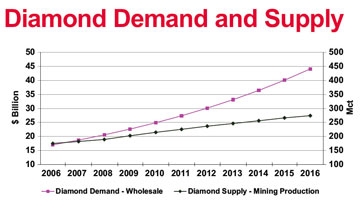

The sharp decline in diamond demand and prices was mirrored on the supply side by the mining companies that shut mines, stockpiled diamonds and — in the case of Russia and Angola — had government entities stockpile diamonds.

As sales volumes and market liquidity deteriorated, the banks ceased financing rough purchases and additional production. Essentially, the diamond industry ground to a halt as hundreds of thousands of cutters in India and elsewhere were laid off.

From a technical economic perspective, there is nothing irrational or unpredictable about the above scenario. All markets go up and down, resulting in shifting demand and price changes and supply-side adjustments. Over time, external economic conditions stabilize, resulting in a new demand, price and supply equilibrium and the world of business goes on.

Theoretically, at some new price level all available diamonds will sell and the trade will once again be busy cutting, dealing and retailing diamonds. From a purely economic perspective one might consider the possibility that, should the S&P 500 continue its upward climb back to January 2008 levels, diamond markets will return to their previous speculative price levels and all will be back to “normal.”

While technical economic analysis provides an important framework for understanding how markets react to events, it often fails at predicting the future because it neglects or misunderstands the behavioral aspects of the marketplace. People, not machines, make decisions in the diamond markets. And these decisions are driven by complex psychological and emotional factors beyond the scope of traditional economic models.

In order to understand what is really going on in the diamond markets we have to go beyond economic analysis and dig into the psyche and mindset of our customers. How has the economic crisis affected their decision making? What are they thinking? How are they feeling?

Money Shock

The simultaneous collapse of the financial, equity and real estate markets was a disaster that terrified hundreds of millions of people. From September through November 2008 the markets were in free fall, driving people crazy with uncertainty. The situation was out of control. Every day brought more bad news and losses. People were shocked by how much money they had lost. They did not know what to do. Until March, no one knew when and where it would end. And even today, when the worst appears over, uncertainty prevails.

People have experienced severe money shock. Most U.S. diamond consumers have lost 20 percent to 40 percent of their wealth. Millions have lost their jobs or fear that they may lose them as the unemployment rate climbs to 10 percent. The strong foundation of financial security that supported irresponsible credit consumerism has been utterly destroyed. Consumers are now afraid to spend money.

From a behavioral perspective, the impact of money shock is that the economic crisis has evolved from an external economic issue to a personal psychological subconscious need for basic financial security. People who have lost a lot of their money in an “out-of-control” free fall are extremely afraid that it may happen again, and if it happens, they will lose big time. They may not be able to send their kids to college. Or worse, if they lose their money and their job they may be also lose their house and not be able to provide for themselves or their family.

We have to understand the relationship people have with money. If you have more than enough to maintain your lifestyle and you feel financially secure, then the extra money is for spending and living the good life. However, if you get to a point where you are afraid that you will not have enough money to support your basic lifestyle needs, then the meaning of money changes. Money is no longer for spending — it is to be saved to meet your fundamental need for security.

Make no mistake about it: Knowing that you have enough money saved away so that you do not ever have to worry about financial security is a luxury. In an uncertain, out-of-control world, financial security is the ultimate new luxury.

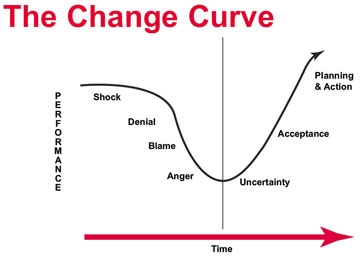

Please review the “Change Curve” diagram. As we experienced the events of the past year, many of us were transitioning through the various stages of shock, denial, blame, anger, uncertainty, acceptance and, finally, planning and action. It is important to recognize that our customers and suppliers are also experiencing these emotions. It has been, and still is, a tough year for everyone.

New Values

The economic crisis and resultant money shock are becoming a catalyst for a fundamental sea change in social values. Having been shocked and frightened, people are now reevaluating what is important in their lives. Since so many have lost so much, society is rethinking its relationship with money. Many Americans now believe that money, wealth and luxury should not be the most important societal zsaving is commendable. Conspicuous consumption is evil, while donating your time or money is spiritually uplifting. Living a responsible lifestyle that includes responsible consumerism is the new cool.

Money shock and the new values that it fosters are empowering and encouraging a new generation of Americans to assert their leadership and influence over societal values. The election of President Obama should not be seen as an isolated event, but as positive evidence of a generational shift of power, similar to what took place when President Kennedy was elected. The dominance of the baby-boomer generation is ending. New younger X and Y generations of multicultural “new-age” Americans will be creating a different society that emphasizes communal values, family, quality of life, creativity, tolerance and diversity. We are defiantly moving from a society whose ultimate value was ME to a society that respects and values WE.

The diamond and jewelry industry must recognize that the role, relevance and value of diamonds are being questioned by a new generation of consumers. We must relate to the changing world of values that will dominate consumer behavior in the years ahead. Security, love and diamonds that reflect long-term emotional commitment are powerful values that transcend generations and geography.

By now it should be obvious that our marketing must be honest and based on identifying with our customers’ values. Your customers are going through a difficult time and they are afraid. When they need a diamond or piece of jewelry they will want a warm, fuzzy relationship with you and expect you to take care of them. It does not matter if your customer is a cutter, dealer, retailer or consumer, they will want a warm, trusting relationship with you.

Essentially, what I am saying here is that “money shock” has created a new situation whereby fearful, financially insecure customers need to create strong trusting relationships with suppliers. Your customers will be subtly communicating to you that they — and your relationship with them — are more important than the product you are trying to sell them. If you honestly identify with their values, they will identify with you.

It is vital that you stop trying to sell the product and focus your attention on getting to know your customers and what they really need. Recognize that the customer and their needs transcend the product. Don’t try to sell them what they do not need or want. Recognize that, for the most part, the diamond business is not about diamonds but about your relationship with your customers and their needs. Meet those needs and earn the honest trust of your customer and you will succeed.

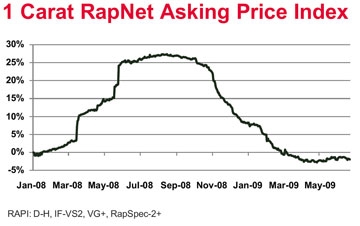

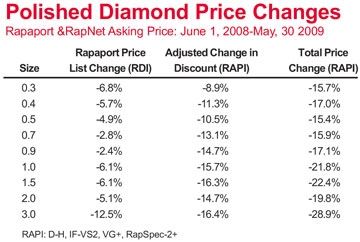

Prices

The history of the diamond industry is such that for many years rough diamonds were controlled by a De Beers monopoly that sought to optimize profits by consistently increasing diamond prices. Since mining costs were relatively stable, every dollar of price increase translated to an extra dollar of profit for the mining company. As rough diamond distribution was highly restricted to select sightholders, it was relatively easy for the mining companies to keep rough prices high relative to polished prices, thereby maintaining persistent pressure on the cutters to constantly increase polished prices.

This system worked for many years. For, even though cutting profits were squeezed or nonexistent, money could be made by holding inventory as prices consistently increased over time. Given the fact that inventory turn at the average retailer is only about once per year, inventories were large and inventory profits substantial. Like one of Pavlov’s dogs, the diamond trade was trained to pay high rough prices and forgo rational diamond cutting profits in return for consistent inventory profits.

Another beneficiary of the system was the banks, which continued to lend money to the diamond industry in anticipation of ever-increasing inventory values. In the past, it had not been unusual for sightholders and major diamond cutters to — one way or the other — finance some 60 percent to 70 percent of their inventory. After all, why shouldn’t banks lend money to cutters if inventory values consistently increase?

The notion of ever-increasing diamond inventory values and easy bank credit also supported the idea of long-term memo and credit programs. If the way to make money was by holding inventory, why not hold more of it in retailer showcases? Especially if the bank would finance it and the inventory profits were greater than interest payments. As an extra bonus, suppliers could charge premium prices and lock out competitive cash sellers who did not have access to long-term financing. Retailers also benefited by not having to pay for diamonds until they sold, while consistently higher prices gave consumers the impression that they were buying diamonds at good prices.

As this game has been going on for decades, it is not surprising that the diamond trade has become addicted to the notion that diamond prices must always be high and increasing. In fact, an entire diamond distribution system with sophisticated memo/credit programs has been built around the “inventory profit” model — a model that increasingly looks like a Ponzi scheme with a “Ring Around the Rosie” theme song.

Bubble Trouble

By now it should be clear that basing your diamond business on price increase speculation is not a sustainable business model. In fact, given the collapse of diamond prices and liquidity over the past year, this business model is a recipe for disaster.

Cutters are warned that restrictive rough distribution systems encourage a high level of competition and may result in unsustainable rough prices that are higher than the value of the resultant polished diamonds. Competing for rough based on rough prices without due consideration of the resultant polished values is a high-risk activity that may result in bankruptcy. While we firmly believe that free market competition is healthy and necessary, we urge cutters not to race their competitors over a cliff. If you want to remain in the diamond business over the long term, slow down and be careful not to overpay for rough. Make sure that you are as good at making profits as you are at making diamonds.

The problem of high diamond prices and resultant low profitability is not limited to rough diamonds. It is absurd and ironic that the diamond trade consistently and persistently tries to increase polished prices, even when it is not in its best interest to do so. It should be clear that high polished prices result in higher rough prices that over the long term solely benefit the diamond mining companies. It’s high time the diamond trade realized that we should be working to increase our profit margins — not diamond prices.

It is vital that the diamond industry transition to rational pricing models that reward each added value component of the supply chain with an appropriate competitive profit margin. Diamond trade profitability should not be held hostage to diamond price levels and speculative inventory appreciation. We must recognize and assert the fact that the fundamental role of the diamond trade is not to hold diamonds but to cut and sell them. We are in the business of creatively adding value to diamonds and we are entitled to be fairly rewarded for our efforts.

The viability of the diamond jewelry category is dependent on the ability of the diamond trade to cut and sell polished diamonds effectively, efficiently and profitably. The trade’s vital contribution to the diamond jewelry sector must not be dependent on the diamond price level, for our work must be accomplished whether or not diamond prices are going up or down. The diamond trade must free itself from price illusions and recognize the fact that the price level of diamonds need not be the determining factor of profitability. The key to our sustainability as an industry is our ability to maintain reasonable profit margins even in markets in which diamond prices are declining. If the diamond business is to prosper during the uncertain and volatile economic periods before us, the trade will need to break the link between prices and profits.

Globalization

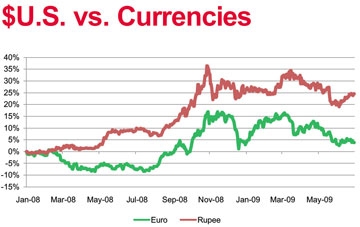

The U.S. economic crisis was not an isolated event, and it has had major ramifications for economies all over the world. Initial concerns focused on the highly interactive global financial sector. American sub-prime debt had been sold to everyone, everywhere. The collapse of Lehman Brothers in September signaled the demise of other banks and international financial institutions. The rapid decline of the U.S. equity and real estate markets along with surging unemployment also caught the attention of the foreign markets and helped erode their share prices.

Of primary concern was the role of America as the consumption capitol of the world. America’s easy consumer credit policies and spend mentality had created a situation wherein U.S. consumers were the driving force fueling production activity in China and other Far East destinations. There was deep concern that as American consumption shut down, these economies would also suffer greatly leading to a major worldwide recession.

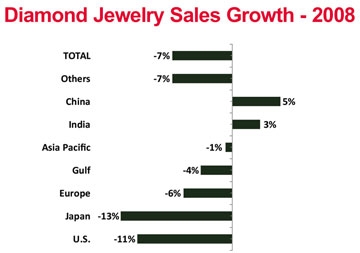

Although diamond production in India did shut down for a few months, throwing some 500,000 people out of work, the massive global slowdown that was feared did not develop. While the U.S. was quickly implementing its bailout and stimulus packages, China and India were successfully figuring out how to stimulate local demand. While 2009 U.S. GDP growth is expected to come in at -2.4 percent, India’s GDP is expected to grow by 4 percent and China’s by 6.5 percent.

The ability of China and India to maintain economic growth in spite of the severe American decline is a sign of financial independence no less important than their political independence.

The two largest countries in the world, with a combined population of over 2.5 billion people, are now running on their own economic engine. Their populations have developed to the extent that they no longer need America to keep their people employed and their economies growing. They have become their own economic powerhouses, and over time they will become tremendous engines for international development and major global consumption powers. Our suppliers have become our customers.

Into The Future

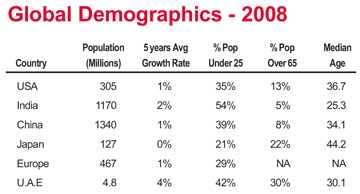

It is hard to underestimate the tremendous consumer demand that India and China will bring to the global economy over the next few years. Consider the amazing demographics: 54 percent of India’s 1.17 billion population and 39 percent of China’s 1.34 billion population are under the age of 25. That’s 632 million young Indians and 532 million young Chinese who will be developing purchasing power over the next two decades. Talk about baby boomers — the entire U.S. population is only 305 million, with 107 million under 25.

Given global demographics and the ability of China and India to generate enough local consumption to keep their economies in growth mode, the long-term outlook for global diamond consumption is highly positive. Frankly, the estimates on our graphs are probably understated. In twenty years, with a bit of inflation, I would be surprised if wholesale diamond demand did not reach $100 billion.

Regarding the short- to medium-term, we must recognize that India and China are still developing countries with large segments of their populations uneducated and living at or below the poverty line. It will take time for a reasonable percentage of these populations to become consumers.

The primary message is that the world is changing and those that wish to prosper must change with it. America will remain an important diamond consumption center, but new demand from India and China will dominate the marketplace. Business is not getting any easier and we can expect an almost endless series of challenges as we head into the future. In fact, the only thing greater than the challenges will be the opportunities.

Article from the Rapaport Magazine - July 2009. To subscribe click here.