What a difference a month makes! In the May edition of

Rapaport Diamond Report, we described the optimism in the diamond industry being spurred by the chasing bull running down Wall Street. With the Dow Jones Industrial Average (DJIA) at 11,000 and oil prices touching $87 a barrel, we argued then that diamond markets have largely followed financial market trends in steering through the recession.

A month ago, the industry had good reason for its positive outlook. While demand and prices of rough diamonds continued on their buoyant path, polished followed a positive, albeit a more steady, course. These trends remain valid today as the industry looks forward to strong second-half growth set against the deflated numbers of 2009. That overall optimism is reinforced by a string of recent economic reports that the U.S. is entrenched in recovery mode, with more people entering the job market and consumers expressing more confidence. While the theory still holds true that the diamond industry will continue to take its cue from world financial markets in the long term, in the short term that may not always be true. Case in point: During the past month, when a bullish Wall Street turned bear, the diamond market did not follow financial market trends.

The Bear Bites

That was then; this is now. As of this writing, the Dow has dropped 10 percent from its April 26 peak, while oil has fallen to around $70 a barrel (see oil price graph below). Markets around the globe slumped as the European Union (EU) and International Monetary Fund (IMF) saved Greece from bankruptcy with a $146 billion loan, and made $1 trillion available to the region for other bailouts. At the same time, the EU ordered other high-risk countries to make significant budget cuts to prevent the crisis from spreading. Despite the bailout and other efforts to calm the market, investor concerns lingered throughout May — concerns that were reflected in the bear market turns — that the debt crisis would spread through Europe and ultimately stall the global recovery.

For its part, the diamond industry went to the all-important JCK Las Vegas show in June in good spirits and confident that the second half of the year will bring continued growth in the market. Given the mixed messages the industry is hearing from Europe as well as Wall Street, the question lingers: From where should the industry be taking its signals? And how should diamantaires read the current market environment? To answer these questions, we need to consider the state of the diamond market in the run-up to JCK.

Recent Diamond Trends

At the most recent Diamond Trading Company (DTC) sight at the end of April, De Beers raised prices by between 5 percent and 7 percent. DTC spokesperson Louise Prior explained that the rise came due to strong demand seen in the market. “We felt that our prices needed to reflect what’s going on in the market,” she said. BHP Billiton prices rose by a similar rate at its April tender.

Prior noted that there was a large number of applications at the April sight, indicating strong demand and an apparent lack of rough on the market. At the same time, there appeared to be mixed reactions from sightholders regarding the amount of goods that De Beers was supplying to the market. While shortages were apparent, most agreed that sights valued at $700 million — the estimated sight value in April 2008 — would be detrimental to the market.

The April 2010 DTC sight had an estimated value of $470 million, bringing De Beers total supply to sightholders to approximately $2 billion in the first four sights of the year, an increase of 130 percent from 2009, but 23 percent below 2008 levels. ALROSA has sold approximately $1.4 billion in the same period.

Despite the rough price increases (see rough graph above) and high premiums that sightholders can achieve in the secondary market, demand for rough remains strong, mainly emanating from the Indian market. There has been growing concern about a speculative environment being created by larger manufacturers holding onto their rough in anticipation of further increases.

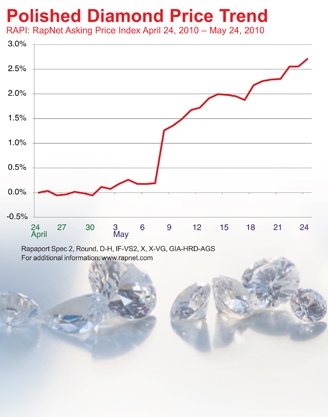

Given the increases, cutters continue to bemoan the low profits they are able to make on manufacturing, especially on better-quality goods, and they were relieved at the increases in polished seen in the past month (see polished price graph below).

Positive U.S. Numbers

Positive U.S. Numbers

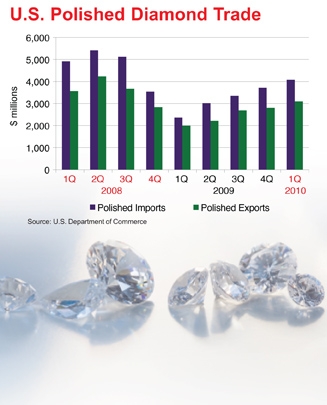

Trade in polished diamonds has steadily increased since the market crashed at the end of 2008, as reflected in U.S. import and export data. Polished imports during the first quarter of the year rose 73 percent, year on year, to $4.1 billion, while exports grew 55 percent to $3.1 billion (see polished trade chart below).

U.S. polished trade has increased as its economy has improved. There are cautions, of course, but the trend is clearly upward. The strongest signal to date that economic activity has improved came in the U.S. Labor Department’s April unemployment report. Despite the headline about the rate increasing from 9.7 percent to 9.9 percent during the month, the report showed that 290,000 net jobs were added to the economy in April, marking the fifth month of positive growth in six months. The rise in the unemployment rate indicates that more people entered the labor market during the month and that could mean growing confidence in the economy. This was backed by a 0.4 percent rise in retail sales in April, representing the seventh consecutive monthly increase, according to the U.S. Commerce Department.

When Europe Sneezes…

However, as stability appears to have crept into the U.S. economy, Europe has been rattled by Greece’s debt crisis, causing investors and political leaders to worry about the impact on global economic growth. The crisis prompted Spain, Portugal, Italy and France to unveil plans to cut public-sector wages and raise taxes to circumvent their own default risks. Speculation also rose that China’s central bank may ease up on its efforts to curb domestic growth in response to the European mess.

Concern that the crisis might spread and entrench itself in Europe caused the euro to slump to multiyear lows against the dollar and sent investors scurrying in search of safe havens for their assets. As a result, gold rose to new highs before scaling back as short-term traders cashed in their profits.

Forecasting the Future

The difference in mood between financial investors and diamond dealers is telling. If, as RDR explained in May, the diamond industry has largely followed trends in financial and commodities markets throughout the recession, should it not now be taking a signal from the current down trend?

The fact is that it isn’t. The industry appears content to follow the positive trends that took shape during the first quarter. In doing so, the industry is basing its assessments on past activity, whereas the slump in financial markets and oil prices represents investor forecasts for the future.

The verdict is still out regarding the full long-term effect of the European crisis. What is certain is that its massive scale has the potential to derail the recovery wherever it is taking hold and precipitate another, even deeper, downturn. While the diamond industry may lag behind markets in its reaction to the gloomier news of the day, the hypothesis remains in place: In the long term, regardless of which way the financial markets trend, the diamond market will inevitably follow.

Article from the Rapaport Magazine - June 2010. To subscribe click here.