|

In-Depth

Holidays Saved By The 1%

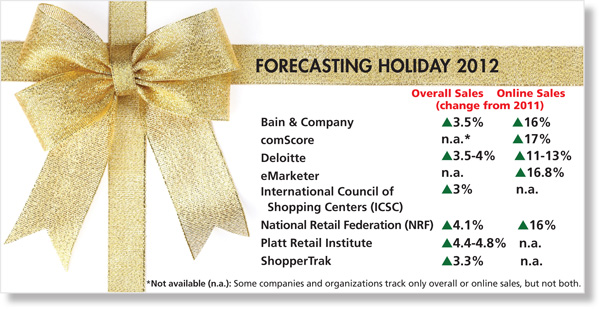

Low-single-digit gains are projected for overall retail sales, with double-digit increases for online sales.

By Karolyn Schuster

The brightest 2012 holiday forecast for the luxury market came courtesy of a survey conducted jointly by American Express Publishing and Harrison Group, a YouGov market research and strategy consulting firm headquartered in Waterbury, Connecticut. The study predicted the top 10 percent of the country’s highest-income households — those with discretionary income of $100,000-plus — would increase their gift spending by 21.9 percent this year. In addition, the top 1 percent, those with $450,000 or more in annual household income, plan to increase their gift spending this holiday by 33.5 percent. And, if that wasn’t encouraging enough for luxury goods retailers, the survey found that The brightest 2012 holiday forecast for the luxury market came courtesy of a survey conducted jointly by American Express Publishing and Harrison Group, a YouGov market research and strategy consulting firm headquartered in Waterbury, Connecticut. The study predicted the top 10 percent of the country’s highest-income households — those with discretionary income of $100,000-plus — would increase their gift spending by 21.9 percent this year. In addition, the top 1 percent, those with $450,000 or more in annual household income, plan to increase their gift spending this holiday by 33.5 percent. And, if that wasn’t encouraging enough for luxury goods retailers, the survey found that

39 percent of those same top 1 percent of households were “looking to splurge on a special holiday gift this year for my spouse or significant other.”

Those holiday spending projections, contained in a broader “2012 Survey of Affluence and Wealth in America,” were released by Cara David of American Express Publishing and Dr. Jim Taylor of Harrison Group. The survey found that, on average, 114.9 million U.S. households across all income categories would be spending $627 on holiday gifts in 2012, for a total expenditure of $66.3 billion.The projected total represents a drop of 3.4 percent from 2011’s $68.6 billion holiday gift-giving budget. That less-than-stellar projection for overall holiday gift sales, however, was offset by the plans of the top 10 percent of households to increase their holiday gift buying to $1,688 each for a total of $19.2 billion in 2012. Of those affluent consumers, 26 percent said they plan to buy jewelry or watches.

Booz & Company reported that one sign consumers are tired of the ongoing “misery index” is that 53 percent of them intend to buy at least one luxury item this year, up from

41 percent. The company said the high number of self-purchases reflects the feeling among consumers that “economic survival” is a great reason for celebrating in 2012. The American Express/Harrison survey also celebrated the self-purchaser. It found that 46 percent of female and 27 percent of male respondents considered themselves “extremely” or “very” likely to buy gifts for themselves this year. The top three product categories in which the females were buying gifts for themselves were apparel/fashion, with 61 percent; jewelry, with 29 percent, and accessories, with 27 percent.

The buoyant holiday spending plans, explained David and Taylor, reflect the fact

that these top-income households are sitting on very healthy balance sheets and an unprecedented amount of cash easily accessible in their savings and checking accounts

(see chart in “Who’s Got The Money?” article). As a group, top-earner households spent the recession paying off debt, including the mortgages on their homes, and building up their cash reserves. At the same time, their invested assets, plunged deep into the red by the recession, have fully recovered their prerecession value, making them feel secure and confident that they have survived the worst and that maybe it’s time to go shopping again. And why shouldn’t they?

Market forecasters analyzing holiday spending for the general population rather than the wealthiest segments are projecting modest low-single-digit gains — but gains nonetheless — in 2012 holiday spending over 2011.

The National Retail Federation (NRF) predicted holiday sales will rise by 4.1 percent to $586.1 billion. That forecast is higher than the ten-year average holiday sales increase of

3.5 percent but short of the

2011 growth of 5.6 percent. Still, Matthew Shay, president and chief executive officer (CEO) of NRF, called it “the most optimistic forecast NRF has released since the recession. In spite of the uncertainties that exist in our economy and among consumers, we believe we’ll see holiday sales growth this year.”

David Wu, luxury analyst for Telsey Advisory Group (TAG), a New York City–based research and brokerage firm that focuses on the consumer market, expects brick-and-mortar jewelry retailers to make healthy gains in single digits this holiday, thanks to solid demand for watches and for colored diamond fashion jewelry. “Strong product innovation in jewelry and watches will drive the market this year,” he said. “It’s all about innovation this holiday.”

Traditional retailers still stand to benefit from the fact that “buying jewelry is a personal experience that requires a certain level of hand-holding,” added Wu. “Consumers buying a piece of jewelry like to touch and feel the product,” Wu said.

While the consensus among most forecasters is for overall single-digit sales gains, online sales are almost universally expected to climb by double

digits, the fourth consecutive year online holiday sales have posted annual growth in the mid-to-high double digits.

Wu attributed some of the online gains for jewelry retailers “to the decline in diamond prices that has improved the value proposition of the internet jeweler, especially for diamond engagement rings. The online players hold virtually zero diamond inventory so when prices come down, online retailers can pass along those new, lower prices in real time,” he said. “A brick-and-mortar retailer whose inventory turns once a year can’t do that.”

In tracking online sales, some analysts admitted that differentiating between online product research and price comparison and the actual sales closed online can be a

slippery slope.

In forecasting ecommerce sales growth of 16 percent this holiday season,

Bain & Company admitted that measuring ecommerce is getting harder. “The lines

between ecommerce and in-store purchases are increasingly blurred,” the company

noted in its retail holiday newsletter. “Consumers research their purchases online

before going to the store, compare products and prices in-store using their mobile devices, order online but pick up in stores, or shop in stores but then order via kiosk for home delivery of out-of-stock items.”

Forrester Research’s path around that slippery slope was to predict that 45 percent

of 2012 retail sales will be “influenced” by digital channels in some way. More than

70 percent of online shoppers responding to a Google & Ipsos/OTX study also said their

in-store shopping was influenced by previous online research. Forrester further reported

that 167 million U.S. consumers made online purchases in 2012 — 78 percent of all

internet users.

Digital metrics firm comScore projected online sales will be up by 17 percent this year and will account for a record 10 percent of total retail sales during the fourth quarter of 2012, up from 8.9 percent year on year. Internet Retailer predicted that mobile devices will generate $11 billion in sales in 2012, more than double the 2011 figure of $5 billion.

In a webinar assessment of online holiday shopping trends, Jeffrey Grau, principal analyst of eMarketer, said the “online channel is operating on all cyclinders.” He noted that the $54.5 in online holiday sales in 2012 — a 16.8 percent increase from 2011 — represents 24.3 percent of the $224 billion in online retail sales for the full year. In 2012, the online numbers will be enhanced, according to Grau, by two significant trends: the extension of both the shopping season and the shopping day and the expanded use of smartphones and tablets in product purchasing decisions.

In an effort to capture additional wallet share, Grau said,

“Black Friday deals have morphed into Black November deals.” He noted that the Hay Group is reporting that

31 percent of retailers are starting promotions earlier, with 42 percent of them starting in October. As a result, by Black Friday, 54 percent of online shoppers will have completed more than 25 percent of their shopping, according to Kantar Media’s Compete. “Halloween is the new Thanksgiving,” said Scot Wingo, chief executive officer (CEO) of ChannelAdvisor, commenting on the earlier holiday start. If the season is starting earlier, it also is ending later. On Christmas Day in 2011, online sales increased 16.4 percent, according to IBM, with sales closed on mobile devices up by a staggering 173 percent year on year. In addition, 39 percent of online shoppers shopped after Christmas, 70 percent of whom, motivated by big deals, were shopping for themselves, according to Yahoo! Surveys. Forecasters are expecting similar patterns in 2012.

Not only is the calendar being stretched for the shopping season but “couch commerce” also has extended the holiday shopping day to facilitate purchases via smartphones, tablets and desktop computers before 9 a.m. and late at night. No time, it appears, is off limits

— or sacred — for the determined shopper. In a prediction that will scandalize holiday purists but delight retailers, Grau said that this year, “people brought smartphones and tablets to Thanksgiving dinner and used mobile devices to shop before and after the Thanksgiving meal. ”

In describing the use of and reliance on smartphones and tablets, Grau said consumers

use mobile devices to compare prices and brands, check availability and access product reviews. Encouraging that use is the recent development of more efficient, sophisticated apps by online and brick-and-mortar retailers, as well as the introduction of third-party comparison-shopping apps.

In 2011, one in four buyers purchased a gift via a “daily deal” on Groupon or

Living Social. “The difference this year is that more daily deals are being offered by the retailers themselves on their own sites or via email,” said Grau. He explained the popular offers are a win for both sides: The seller gets rid of inventory, has an entrée to contact that shopper again and gets an opportunity to generate word-of-mouth buzz for his website — and the customer gets a big discount.

Another eMarketer insight concerns the differences between smartphone and tablet shoppers. “While 77.6 percent use smartphones to research and comparison shop, and smartphones lead to in-store and desktop-computer purchases, the tablet shopper is more

apt to use his tablet to buy,” said Grau. “Tablet shoppers are a coveted group of consumers because their average order value was 20 percent higher than desktop-computer shoppers

in 2011 and tablet buyers spent an average 50 percent more than smartphone shoppers.”

The consensus for the all-important holiday season in 2012 seems to be that everyone

will win, but some more than others. “This is a year, without doubt, in which success in the luxury market will depend on the depth of companies’ relationships with their  customers,” David and Taylor said in releasing their projections. At the same time, brick-and-mortar retailers will benefit from maintaining an online presence that drives traffic to their stores, along with an in-store inventory of the season’s most innovative, attractive jewelry designs. And online sellers will need to combine their price advantages with technology that replicates a face-to-face transaction as closely as possible. customers,” David and Taylor said in releasing their projections. At the same time, brick-and-mortar retailers will benefit from maintaining an online presence that drives traffic to their stores, along with an in-store inventory of the season’s most innovative, attractive jewelry designs. And online sellers will need to combine their price advantages with technology that replicates a face-to-face transaction as closely as possible. Article from the Rapaport Magazine - December 2012. To subscribe click here.

|

|