|

In-Depth

2015 Diamond Price Review

A Challenging Year of Oversupply and Limited Profitability.

By Avi Krawitz

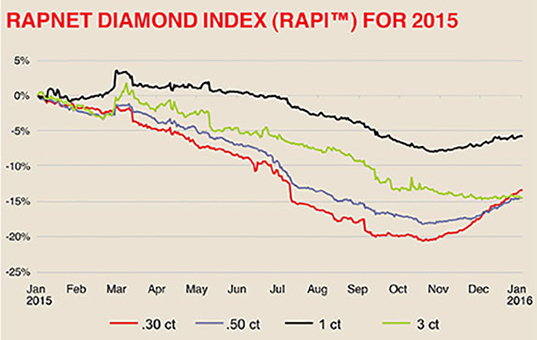

Diamond sector profitability came under the spotlight in 2015 due to sluggish consumer demand in emerging markets and high rough prices relative to the resulting polished. Consequently, the year was one the industry would rather forget as it was characterized by excess supply and consolidation. Polished prices fell as manufacturers held large quantities of diamonds that were difficult to sell. There were simply too many diamonds available for too few buyers. Inventory levels peaked mid-year after goods that were stuck at the Gemological Institute of America (GIA) in 2014 were released to the market in the first half of 2015, while Chinese demand slowed and the dollar strengthened against global currencies. Diamond cutters responded by reducing manufacturing and refusing to buy unprofitable rough — especially in the second half. By year-end, there were polished shortages that supported prices of better-quality RapSpec A2+ (triple EX, none) diamonds during the holiday season. The RapNet Diamond Index (RAPI™) stabilized in the fourth quarter but slumped for the full year, extending the downtrend that has been evident since mid-2011. RAPI for 1-carat GIA-graded diamonds fell 5.8 percent in 2015. RAPI for.30-carat diamonds dropped 13.4 percent, while RAPI for .50-carat diamonds fell 14.5 percent. RAPI for 3-carat diamonds slid 14.5 percent during the year (see chart below).

| | The RapNet Diamond Index (RAPI™) is based on the average asking price in hundred $/ct. of the 10 best priced diamonds, for the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better), which are offered for sale on RapNet - Rapaport Diamond Trading Network. |

While shortages helped elevate prices in the fourth quarter, caution lingered as jewelry sales stagnated in key emerging markets throughout 2015. Jewelry sales in Greater China declined as economic growth slowed and the government’s anticorruption campaign curbed luxury purchases. Jewelers in the region had been aggressive diamond buyers in 2014 and consequently had enough goods to satisfy lower demand in 2015. They also reduced their buying as they cut back their store expansion programs. Meanwhile, wealth was impacted as China’s stock market tumbled in June and the yuan currency devalued by 5 percent against the U.S. dollar. The strong dollar impacted consumption and trading in various markets. The sharp 17 percent depreciation of the Russian ruble against the dollar, along with a 35 percent slump in oil prices and economic sanctions combined to curb spending in Russia. Similarly, spending among high-net-worth individuals in the Middle East was restrained as oil prices affected their wealth. In India, consumer sentiment remained weak as economic growth slowed, the rupee depreciated by 5 percent and the Bombay Stock Exchange slipped by a similar margin in 2015. Therefore, diamantaires once again looked to the U.S. for support. Overall, the U.S. retail market strengthened during the year, although jewelers continued to carefully manage their inventory levels. Diamond buying remained specific and selective, with very few orders to build up inventory. Manufacturers responded by keeping polished production at about 30 percent below capacity after the November Diwali break. They were not willing to raise polished supply at prevailing rough prices.

Manufacturers maintained that rough was too high relative to the resulting polished even as De Beers and ALROSA prices fell 15 percent respectively in 2015. Cutters note that profitability had been squeezed for a number of years, especially in 2014, when rough prices rose 7 percent while polished prices dropped 8.7 percent, as measured by the RAPI. Their predicament finally reached a tipping point and the rough market came to a near standstill in the second half of 2015 as sightholders refused goods that wouldn’t turn a profit. Rapaport called on De Beers to reduce rough prices by 30 percent to 50 percent to inject liquidity and profitability into the diamond trade. De Beers and ALROSA consequently relaxed their supply rules, allowing clients to defer and reject an unprecedented volume of goods. Rough inventory gradually built up in the mining sector and the two major miners ended the year with large volumes of rough in their vaults. ALROSA reported that it was holding over 20 million carats valued at more than $2 billion toward the end of 2015, well above its normal stock of around 12 million carats. Manufacturers were anticipating that rough prices would decline in early 2016, as the mining companies would need to encourage buying in order to reduce that inventory. Therefore, they refused unprofitable rough and delayed their rough purchases in the fourth quarter while hoping for more attractive prices in January.

At the end of 2015, manufacturers were preparing to gradually increase their polished production in order to fill the shortages in the market. However, they remained conservative in their operations. While there was more optimism over the holiday season, dealers acknowledged that profitability was still a challenge, regardless of the prospective January rough price correction. They also recognized an urgent need to boost consumer demand. The trade was encouraged by the resumption of generic advertising in 2015, after a decade-long hiatus, driven by campaigns by De Beers and Signet Jewelers, respectively. It is hoped that the creation of the Diamond Producers Association — a conglomerate of the top seven mining companies, mandated to stir excitement in diamonds among Millennials — will prove to be a significant turning point for the industry. Most in the trade recognized that the industry needs to be proactive to reverse the downtrend. While initial reports were positive about the U.S. holiday season, the trade is still uncertain whether the momentum will continue in the U.S. and concerned that the ongoing challenges in Asia Pacific will further restrain the diamond market. After all, 2015 was the fourth consecutive year of annual polished price declines, as revealed in the following pages of the Rapaport Diamond Price Statistics Annual Report 2015. A careful study of the data suggests that demand was selective throughout the year. Given the challenges of 2015, it became clear that diamantaires must improve their profit margins to ensure a sustainable industry in the long term. Reducing rough prices and boosting consumer demand is a challenge facing the industry that, if achieved, will help restore growth in 2016 and beyond.Article from the Rapaport Magazine - January 2016. To subscribe click here.

|

|