RAPAPORT... At the halfway point of 2009, the diamond industry can reflect on two very different quarters. While the first three months were marred by declines, the latter quarter saw stabilization and improvement. Consequently, market confidence, which fell to an all-time low in January and February, picked up in subsequent months.

These distinct trends were reflected in average price movements of polished diamonds on RapNet during the two periods. In the first quarter, average price declines ranged from 3 percent to 9 percent, while from April through June, the changes hovered between flat and 1 percent.

Similar developments were evident in the rough market, though far more exaggerated. Mining companies either stopped producing diamonds — De Beers first-quarter production fell 91 percent compared with a year ago — or stockpiled by selling to government agencies, as in the cases of Russia’s ALROSA and Angola’s ENDIAMA. The second quarter saw De Beers mines ramping up production and ALROSA indicating it would soon start selling to the market again.

Hardest hit, however, were manufacturers in India, Israel and Belgium, who faced zero demand from their wholesale and retail counterparts in January, resulting in factory closures and massive job cuts. Still reeling from depressed conditions, diamantaires clung to any sign of market improvement as the year progressed. As their depleted inventory ran out, they started cutting and polishing again in the second quarter, albeit at modest levels, causing their confidence to grow.

Polished Stability - Rough Volatility Evidence of a sluggish polished market could be seen in export data from the major diamond centers through May, the most recently available data at press time. Belgium’s polished exports fell 36 percent in the first quarter, from a year earlier, and by 43 percent and 40 percent in the months that followed. Similarly, India’s polished exports declined 33 percent in the first three months, by 54 percent in April and 31 percent in May, while Israel’s dropped 57 percent in the first quarter, and by 28 and 55 percent in the subsequent two months. Polished imports to the U.S. decreased 52 percent in the first quarter and by 47 percent in April.

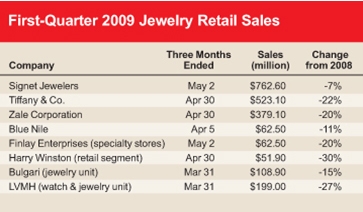

Similar trends were seen in the retail market. While the major jewelry retailers reported some improvements in May, their first quarter performances were far from encouraging, with 20 percent sales declines being the norm.

Indications that the polished market was stabilizing filtered from the March Hong Kong show and from the shortages emerging in the market. In the run up to the June JCK Las Vegas show, the U.S. bridal market kept demand at a somewhat sustainable level and businesses adjusted their inventories accordingly. Nevertheless, expectations for Vegas were low and the level of orders reflected the recessionary environment. There was a clear shift toward lower price points and the show proved difficult for high-end manufacturers. Branded bridal goods proved robust and wholesalers of rounds and princess cuts in 0.50- to 1.50-carat,F to I,SI clarity of fine to ideal makes, who gave higher-than-average discounts, did relatively well.

While the market for polished diamonds has stabilized, the improvements in rough have been significant. Reports from the Diamond Trading Company (DTC) sight in June showed high demand for the De Beers product. The sight estimated at $425 million compared with $250 million in May and around $100 million in January. In addition, prices at the June BHP Billiton tender rose 10 percent to 15 percent from a month earlier, with comparable increases at the Petra Diamonds tenders. Similar price increases were reported in March through May.

These movements have created worrying disparities between the rough and polished markets, culminating in June, when improvements in demand and prices for rough far exceeded that of polished.

Why the Disparity?

The question is why? What is pushing the rough market higher while demand for polished and at retail remains stagnant? Why has demand for De Beers rough more than quadrupled since January, while polished has merely stabilized? De Beers managing director Gareth Penny explained that movements in the market — including through June—were necessary to bring rough and polished into alignment. Penny added that the poor performance at retail in the first quarter was exaggerated and down a more modest 5 percent to 10 percent as a whole from 2008, and that he expects a better Christmas this year. Explaining the surge in demand in June, DTC spokesperson Louise Prior said that the market was being driven by a pull-through of polished in the pipeline where retailers are replacing depleted stock, and by less rough being available on the market.

The latter is certainly true. After next-to-no mining and the unprecedented lull in manufacturing in the first quarter, the shortage of rough is significant enough to stimulate demand in the short term, even without higher polished demand. However, this is not sustainable and the lack of accompanying growth in the retail and polished markets, and in consumer confidence, should be viewed with concern. Penny was correct when he said that, “in the end, it is consumer confidence that will pull us out of this crisis.”However, the market should be cautious of inflated reports about stronger demand at the end of the pipeline.

Indeed, if consumer confidence continues to rise and second-quarter sales at Tiffany, Zale, Blue Nile and the like improve to single-digit declines, further DTC sights of $400 million and above may be justified. If not, the current rush-for-rough will ultimately burn out. Demand for rough will fall, and so will prices—possibly further than before. In such a scenario, the diamond industry could see continued market confidence in the third quarter turn into a dismal Christmas period, telling yet another tale of two vastly different quarters.

Article from the Rapaport Magazine - July 2009. To subscribe click here.