Established in 1976, the Rapaport Group is an international network of companies providing added-value services that support the development of ethical, transparent, competitive, and efficient diamond and jewelry markets.

We are a value-based organization that believes that business is about creating a better world – not just making money.

Activities include Rapaport Information Services – the primary source of diamond prices, research, analysis, news, and the Rapaport Magazine; RapNet – the world’s largest online diamond trading network with $9.4 billion of daily listings; Rapaport Auctions and Trading Services – the world’s largest recycler of diamonds; and Rapaport Laboratory Services providing quality control, GIA, HRD, and AGS laboratory grading services in India and Israel.

With over 20,000 clients in 118 countries, the Rapaport Group is an innovative force for positive change. Our information and trading services have revolutionized the diamond industry by creating unprecedented pricing and availability transparency across global markets.

The Rapaport Group takes a strong, proactive role promoting and implementing corporate responsibility programs around the world. We support the rights of artisanal miners, hold annual fair trade conferences, and challenge unethical practices within the diamond industry. We are not afraid of controversy when it comes to doing the right thing.

The group’s in-house compliance team includes experienced lawyers who monitor our activities. We are members of the Responsible Jewelry Council (RJC) and are independently audited to ensure full compliance with all laws, including the RJC Code of Practices, the Kimberley Process, OFAC, International Anti-Money Laundering Regulations, and DeBeers Best Practice Principles.

Please visit our Peace Diamond and Rapaport Social Responsibility websites.

The Rapaport Price List is the primary source of diamond prices. Established in 1978, it provides independent benchmark asking prices used by the global diamond trade to standardize, compare, and negotiate diamond prices. It is a vital source of information that creates transparency for those who trade diamonds responsibly at fair market prices.

RapNet is the largest and most important online market for diamonds. With daily listings of 1.5 million diamonds valued at more than $9.4 Billion and 140,000 daily searches from members in over 92 countries, it is the primary platform for B2B diamond trading.

RapNet provides unprecedented price and availability transparency in a competitive environment. Sophisticated software presents buyers with real-time listings of diamonds that meet their exact specifications. RapNet supports a peer to peer electronic Trade Center that allows buyers and sellers to communicate with each other directly and trade without any commissions or fees. Diamond listings are presented as sorted by price which encourages competition on the network.

RapNet membership is restricted to bona-fide members of the jewelry trade who pay an annual subscription fee. Members are required to meet strict best practice requirements that ensure legal compliance and forbid trading in diamonds involved in human rights abuses. Members must also honor their supply and financial commitments. RapNet reserves the right to suspend or expel members.

RapNet’s primary benefits include access to competitive price and availability information as well as membership in a global community of trusted diamond traders. Members also have access to a broad range of added value services including customized data reports, digital marketing campaigns, strategic consultations, grading, shipping, and international payment services.

Rapaport Auctions provide an efficient, competitive cash market for all types and qualities of diamonds. Specializing in the sale of recycled diamonds from US dealers and consumers, the auctions provide an opportunity for sellers outside the traditional supply chain to sell their diamonds at competitive fair market value prices. The auctions are held in a tender format whereby competing buyers present their bids before a deadline. The seller then has an opportunity to accept or reject the high bid.

Rapaport Auctions are held frequently in diamond trading centers worldwide. Featured locations include New York, Ramat Gan, Dubai, and Hong Kong. Melee Auctions include varied assortments in parcels from 30 to 500 carats. Single Stone Auctions offer thousands of individual diamonds with a broad range of qualities, from commercial to high-quality GIA grades.

Rapaport Trading Services (RTS) offer a broad range of customized trading and brokerage services designed to meet the buy and sell requirements of select accounts. Rapaport maintains international buying offices in New York, Ramat Gan, Surat, and Mumbai. Our Indian buying offices offer buyers an opportunity to source goods from thousands of small to medium size open market manufacturers and dealers. Rapaport provides clients with sourcing connections, quality control, pricing negotiation, shipping and payment services, enabling buyers to effect international transactions in foreign markets.

For information about Rapaport Trading Services, please email: [email protected].

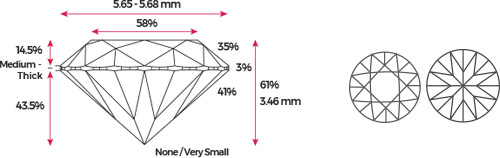

Rapaport Laboratories provide a broad range of quality control services. Parcel services sort, select, synthetic test, and control the quality of parcels in all sizes from 0.01 carat melee to one caraters. We also provide detailed grading reports for single stones from 0.15 to 10 carats and larger.

Our parcel quality control services provide buyers with independent objective grading in Mumbai and Surat. This ensures consistent, standardized Rapaport quality specifications for their purchases. Our Surat teams provide highly cost effective melee sorting services that can include MM measuring, synthetic testing, and customized clarity and color selection.

Rapaport Laboratories also provide three types of grading reports. The RapLab Consultation Card (RCC) provides basic grading information for trading among dealers. The RapLab Grading Report (RGR) is a formal document that provides a complete range of gemological information, including eye-clean, BGM, and color shading. The Rapaport Diamond Certificate (RDC) is our highest report that is only issued for the highest quality investment grade diamonds.

The Rapaport Research Report provides in-depth research and detailed analysis for professionals who require a high-level understanding of the global diamond and jewelry industry. Published monthly, the report covers the entire diamond pipeline from mining to the latest consumer trends.

Global coverage of the rough, polished and retail markets are included as well as a summary of financial results for companies in the diamonds and jewelry industry. It also provides analysis of key issues impacting the market.

The report includes extensive, proprietary data from RapNet, the world’s largest diamond trading platform, with a snapshot of real-world pricing information, inventory levels, and transactional data to help track the market. A focus on pricing and availability includes average prices, discounts, and inventory by country alongside search volume, average time to sale, and transaction volume.

The Rapaport Magazine is the primary source of market information, analysis, and jewelry trends for the diamond and jewelry trade. The magazine covers everything important. Published bi-monthly, in print and online, it includes the Rapaport Price List, market reports from all the major diamond centers, jewelry trends, auction results, special features, and more.

The Rapaport Magazine is the most trusted source of insight and analysis for the diamond, gem, and jewelry trade. We take you inside the market. We not only tell you what is happening, we explain why it is happening and how it will impact your bottom line.

The Rapaport Magazine gives you the information and knowledge you need to make better decisions that will increase your profits.

Rapaport Academy is an online educational resource that raises overall levels of knowledge and productivity for professionals in the diamond and jewelry industry.

Online courses are designed to complement the technical laboratory qualifications and focus on the practical, commercial aspects of the diamond industry. Written and delivered by the Rapaport team and independent industry experts, the Rapaport Academy’s online courses serve as a springboard to career success in the diamond industry.

Rapaport Academy’s online courses are ideal for those new to the diamond and jewelry world and are equally valuable for more experienced professionals wishing to strengthen their knowledge from a fresh perspective. Hundreds of satisfied learners have already joined Rapaport Academy and boosted their skills and career.

www.Rapaport.com

Corporate Website for Rapaport

www.RapNet.com

Buy and Sell Diamonds Online

www.RapaportAuctions.com

World’s Largest Auction House for Recycled Diamonds

www.PeaceDiamond.com

Peace Diamond Development Initiative in Sierra Leone

www.RapLab.com

Rapaport Diamond Grading Services

SR.Rapaport.com

Rapaport Social Responsibility Website

www.RapaportFairTrade.com

Rapaport Fair Trade Diamond and Jewelry Initiative

www.Diamonds.net/Lab

Rapaport LabDirect® GIA Diamond Grading Services

www.Diamonds.com

Rapaport Collection of Fine Quality Jewelry

www.RapaportAcademy.com

Rapaport Online Educational Training

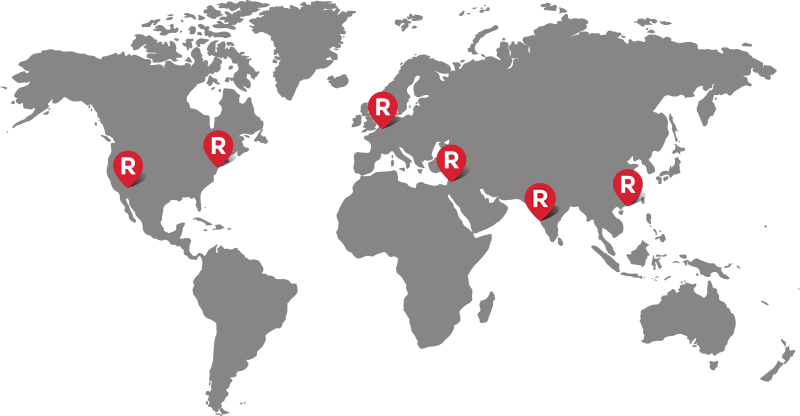

Today, the Rapaport Group continues to help build more ethical, transparent, competitive, and efficient diamond and jewelry markets, and employs over 140 team members in offices in New York, Las Vegas, Ramat Gan, Jerusalem, Dubai, Mumbai, Surat, and Hong Kong, serving over 20,000 clients in 120 countries.

Israel

Diamond Tower

Tuval Street 21, Suite 1362

Ramat Gan 52521, Israel

Tel: +972-3-613-3330

Fax: +972-3-613-3111

Email: [email protected]

India – Mumbai

India Head Office 101, The Capital,

Plot No C-70, BKC, Bandra East,

Mumbai – 400 051, India

Tel: +91-226-628-6500

Fax: +91-226-628-6555

Email: [email protected]

USA – New York

1212 Avenue of Americas Suite 801

New York, NY 10036, USA

Tel: +1-212-354-9100

Fax: +1-646-572-8535

Email: [email protected]

Hong Kong & China

Unit 404-405, Prosperous Building

48-52 Des Voeux Road

Central, Hong Kong

Tel: +852-2-805-2620

Fax: +852-2-805-2605

Email: [email protected]

India – Surat

501-504 C Wing Diamond

World Building Mini Bazar

Mangadh Chowk, Varachha Road

Surat 395 006, India

Tel: +91-261-672-3300

Email: [email protected]

USA – Las Vegas

133 East Warm Springs Road – Suite 100

Las Vegas, NV 89119, USA

Tel: +1-702-893-9400

Fax: +1-702-893-9440

Email: [email protected]

Belgium

Diamond Exchange Building

Hoveniersstraat 53, Box 13

B-2018 Antwerp, Belgium

Tel: +32-3-232-3300

Email: [email protected]

Dubai

Dubai Diamond Exchange

Level 2, Office D06

Almas Tower, Jumeirah Lakes Towers

Dubai, UAE

Tel:+971-4-295-2916

Email: [email protected]

To send us an email

click here. [email protected]