A look at some of the salient stats in the trade for 2022.

$1.75 billion

Total sales at Signet Jewelers came to $1.75 billion for the second quarter of fiscal 2023, which ended July 30, 2022 — down 1.9% year on year, but up 29% from the same period of fiscal 2020. The company, which acquired Blue Nile in August, noted that inflation and changing spending patterns were shifting consumer spending away from jewelry, reflecting pent-up demand for experience-oriented categories.

Source: Signet Jewelers

25%

US sales of platinum jewelry rose 25% year on year in the three months that ended June 30. Platinum retail sales in the US continued to show positive growth, with platinum jewelry partners posting double-digit revenue increases.

Source: Platinum Guild International (PGI)

0.8%

All categories of fancy-colored diamonds rose in price during the second quarter, with an average increase of 0.8%. Notably, Sotheby’s sold the 11.15-carat, fancy-vivid-pink, internally flawless Williamson Pink Star for $57.7 million at its October Hong Kong auction.

Source: The Fancy Color Research Foundation

73%

About 73% of Jewelers Board of Trade (JBT) members believe their businesses will do similarly or better year on year in August 2023, according to a survey the trade body released this past August. Despite inflation, staffing shortages, and economic uncertainty, most members were optimistic about the coming 12 months.

Source: JBT

$18 billion

Swiss watch exports for the first nine months of the year stood at CHF 18.1 billion ($18 billion), up 13% from the same period of 2021. September’s exports came to CHF 2.24 billion ($2.23 billion) — one of the highest values in the sector’s history — thanks to a 19% year-on-year jump.

Source: Federation of the Swiss Watch Industry

$450 million

De Beers’ rough-diamond sales came to $450 million at its ninth sight of 2022, which ran from October 31 to November 4. The result was 3% higher year on year, but 11% lower than the previous sale in September-October. The miner had predicted a seasonal slowdown for the fourth quarter due to Indian cutting factories closing for Diwali.

Source: De Beers

$179 million

Watches of Switzerland group saw its US sales double to GBP 152 million ($179 million) in the first fiscal quarter, which ended July 31. It attributed the growth in part to its acquisition of several businesses, including jeweler Betteridge.

Source: Watches of Switzerland Group

28%

Gold demand in the third quarter climbed 28% year on year, excluding over-the-counter trading. In a return to pre-pandemic levels, year-to-date demand rose 18% compared to the first nine months of 2021.

Source: World Gold Council (WGC)

30%

In March, US President Joe Biden issued an executive order banning the import of “nonindustrial” diamonds originating in Russia, due to its invasion of Ukraine. Russian miner Alrosa supplies some 30% of global rough supply by volume.

Sources: The White House, Rapaport

$209.7 billion

Projections show online US holiday revenue reaching $209.7 billion between November 1 and December 31 — a 2.5% increase over the same period of 2021.

Source: Adobe Analytics

23%

Watch and jewelry revenue at LVMH — which owns Tiffany & Co. — grew 23% in the first nine months of 2022, and jumped 25% year on year to $2.58 billion in the three months that ended September 30. Tiffany in particular enjoyed strong momentum in the United States.

Source: LVMH

8%

Overall US retail sales in September remained virtually unchanged from August, but were up 8% year on year. August saw 0.4% growth over July and 9% year on year.

Source: US Census Bureau

17%-19%

Global luxury sales increased by 17% to 19% year on year in the first quarter. At constant exchange rates, the growth was between 13% and 15%. The figures reflect the robust nature of the luxury market at the start of the year.

Source: Bain & Company

7%

US retail sales for the 2022 holiday season are expected to grow by 7% year on year, excluding the automotive sector and without adjusting for inflation.

Source: Mastercard SpendingPulse

34%

Among consumers aged 23 to 55, 34% would choose lab-grown diamonds over mined ones to save money, and 25% would do it to get a larger stone for their budget, according to a survey from October. Only 23% of respondents said eco-social concerns were a factor.

Source: MVI Marketing

6%-8%

Overall US holiday retail sales in November and December are set to grow between 6% and 8% year on year, totaling $942.6 billion to $960.4 billion, forecasts indicate. Pandemic spending in recent years has accounted for considerable gains, and 2022 looks likely to continue that trend despite recent inflationary challenges.

Source: National Retail Federation

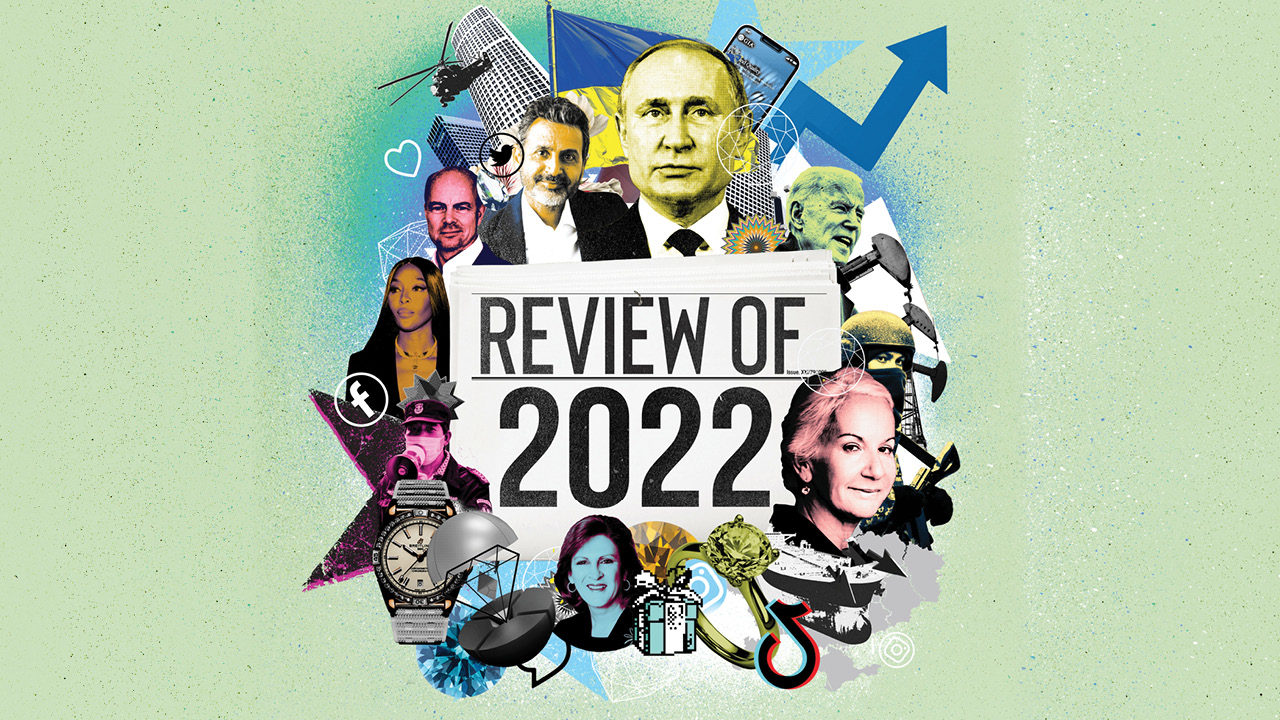

Image: A bespoke digital collage created for Rapaport Magazine to capture the diamond industry in 2022. (Illustrator: Steve Rawlings; Agency: Debut Art)