|

|

Canadian Diamonds

Nov 23, 2012 3:00 AM

By Avi Krawitz

|

|

|

RAPAPORT... Arguably, the Canadian diamond industry’s best years have passed. While its flagship Diavik and Ekati mines are aging, the mines being developed are not of the same scale or value. But they are among the more attractive new diamond projects out there and Canada remains a relatively unexplored diamond frontier compared with other countries.

The industry therefore continues to look at Canada with promise.

“We know there is diminishing supply but there are new mines coming on stream and there are people exploring all the time,” said Filip Zimerman, interim chairman of the Diamond Manufacturers Association of Canada (DMAC). “We forget that just 25 years ago no one believed there were any diamonds in Canada. So we’re optimistic and believe there is an untapped potential not only in mining but in developing a manufacturing sector here.”

Harry Winston, a Canada-based company, is emerging as the country’s main rough supplier after agreeing last week to buy the Ekati mine from BHP Billiton for $500 million, supplementing its 40 percent share in Diavik’s production. In addition, Rio Tinto’s future is still unclear after announcing earlier this year that it was reassessing its diamond business. Rumors are abounding regarding its options, especially for its 60 percent stake in Diavik.

Many are expecting the prospective new owners will try to squeeze the most out of both mines helping to maintain Canada’s position in the market.

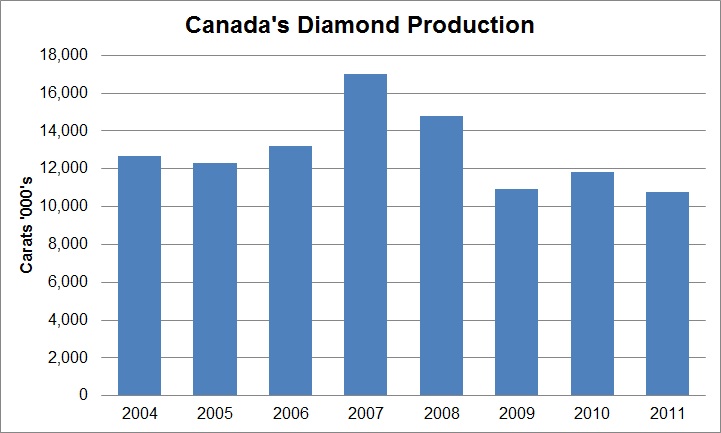

A relative newcomer to the industry, Canada ranks as the fourth largest diamond producer by volume and the third largest by value behind Botswana and Russia. In 2011, the country’s production fell 9 percent year on year to 10.795 million carats while its peak production was at 17 million carats in 2007, according to Kimberley Process (KP) data (see graph below). Since then, production has faded both due to weak market conditions and the diminishing lives at Ekati and Diavik, which together account for about 80 percent of the country’s total diamond output.

Based on Kimberley Process data.

Des Kilalea, an analyst at RBC Capital markets, estimates that the two new mines coming on stream – the Renard project, owned by Stornoway Diamonds, and the Gahcho Kué joint venture of Mountain Province and De Beers – will combine to add about 5 million carats a year when they launch in the next few years. “No other country boasts anything like that so there’s still a lot of life left in Canada,” Kilalea stressed.

But other development projects are further away from production, while other mines have yielded less encouraging results.

The Existing Mines

Besides Ekati and Diavik, Canada hosts the De Beers Snap Lake and Victor mines, which Kilalea notes have not been very economical, particularly Snap Lake. In 2009, De Beers incurred a $696 million impairment cost on its Canadian assets, about a year after launching production at the two mines. De Beers Canada’s production fell 5 percent to 1.66 million carats in 2011. Other mines have had even less success with Shear Diamonds suspending operations at Jericho, which is the northern-most of the country’s mines and remains difficult to operate, especially in weak market conditions.

Therefore, Ekati and Diavik continue to present the industry with the greatest value forecasts, despite their short remaining lifespans. Many in the industry are hoping a prospective change of ownership, and seeming consolidation of the industry, will unleash some latent potential at both mines.

Harry Winston estimates that the current Ekati mine plan calls for another seven years of production, during which the production mix is expected to vary as operations shift between the four existing open pits and the underground operation.

More importantly, Harry Winston notes there are additional resources around Ekati that could become economical with increased diamond prices. Part of the Ekati deal includes $100 million for BHP Billiton’s 58.8 percent stake in a “Buffer Zone” area that contains numerous kimberlite pipes with development and exploration potential, located next to the core mining area. Kilalea notes that at least one of those seems economical.

Diavik, meanwhile, has just completed an $800 million transition to underground mining (pictured: courtesy www.diavik.ca), which is expected to sustain production beyond 2020. Further development will depend on future ownership and rumors surfaced this week that Rio Tinto is planning to spin off its diamond unit, which includes the Argyle mine in Australia and Murowa in Zimbabwe, through a listing on the London Stock Exchange (LSE) while maintaining 40 percent ownership in the new company. A spokesperson for Rio Tinto declined to comment on market speculation.

Harry Winston’s Ekati purchase may support such a rumor as many expected it to buy out the rest of Diavik rather than Ekati. Simultaneously there have also been whispers that Harry Winston is considering selling its retail division to help finance and strengthen its mining position. Harry Winston declined a request for an interview due to its quiet period before its third quarter results are published on December 6.

Next Generation of Mines

Exploration companies are watching Rio Tinto developments with interest.

Tom Peregoodoff, vice president of business development at Peregrine Diamonds, explains that the optimal solution to extracting value at its DO-27 kimberlite, which carries a 18.2 million carat resource, would be to track it to the nearby Diavik mine.

“I think you’ll see some new resources that were marginal before brought into the development plan,” he said. “That’s why we are watching developments at both Ekati and Diavik very closely because we believe there is opportunity to get some real synergies with those mines under new management.

“They’re going to want to keep those operations open for as long as they can and 18.2 million carats is a nice sweetener for someone,” Peregoodoff added. He noted that Peregrine would consider any option to monetize the asset, whether that involves a sell-off or forming a joint venture to operate a prospective mine. Harry Winston is also carrying out exploration around Diavik, independent of its joint venture with Rio Tinto.

Still, most in the industry are looking at other projects for the next generation of mines.

Stornoway Diamonds’ Renard project is expected to launch in 2015 before ramping up to production of around 1.6 million carats a year through its 11-year expected life. Similarly, Gahcho Kué is expected to come on stream in 2015/16 with an 11-year life, producing about 4.5 million carats a year. Shore Gold projects a 2017 start to its Star & Orion projects, which it says contains 34.4 million carats of diamonds and has a 20-year life.

Still the Next Frontier

Peregrine’s management is hoping the success of these mines will rejuvenate investor interest in exploration programs, especially for the very early stage “greenfield” programs, such as its Chidliak project. Brooke Clements, the company’s president, notes that while there was a significant amount of investment in exploration in the late nineties and early 2000’s, due to the successes that were achieved at Ekati and Diavik, funding has dropped more recently.

He attributes the decline to the slow news flow from the exploration sector and to the generally tighter availability of equity. The company therefore recognizes the value in its recent funding of CAD 10 million from Newstar Securities SRL, a company owned by Robert Friedland, and Dundee Corporation. Peregrine also recently closed a CAD 2.5 million option agreement with De Beers to enter a partnership agreement at Chidliak (pictured: courtesy of Peregrine Diamonds), where Clements reports that the company has discovered 61 kimberlites, seven of which exhibit economic diamond mining potential. He notes that partnering with a larger company helps alleviate the inherent risk in exploration.

While Kilalea expects that the amount of money spent on exploration may shrink with the BHP Billiton and a possible Rio Tinto exits, he adds that Canada is still seeing a relatively large proportion of investment dollars in exploration.

“The present downturn is making it difficult for explorers to find the money,” he said. “But it’s also true that Canada is the least explored of the diamond regions because it’s quite difficult to carry out the exploration and proving of kimberlite there.”

Adding Canadian Value

Canada’s diamond manufacturing sector is banking on the long-term success of these projects and is encouraged by the fact that Canadian companies are playing a bigger role in mining.

“Harry Winston is beneficial to us because it’s basically a Canada-based company,” said DMAC’s Zimerman, who is also a founding director of the recently established Diamond Bourse of Canada (DBC). “The larger companies are less inclined to deal with smaller Canadian diamond manufacturers.”

Most of Canada’s rough diamonds are exported and Zimerman indicated that the biggest challenge facing DMAC is procuring enough rough to grow the [diamond manufacturing] industry. While DMAC has just four members employing approximately 50 people, Zimerman estimates there is potential to grow that to 5,000 employees.

“Not enough rough stays in Canada,” Zimerman explained. “We think there is a made-in-Canada solution that would benefit us in the long term.”

He stresses, however, that it will require closer cooperation with the mining sector and acknowledges that part of DMAC’s task involves convincing others that adding value would benefit everyone.

Currently, De Beers sells 10 percent of its Canadian production to two local sightholders, while the remainder is sent to Botswana to be mixed with its other production and distributed to its global clients. Rio Tinto sells its goods to select clients and partly through its auctions, while BHP Billiton has sold it’s rough by open tender in Antwerp, and Harry Winston sells mainly to contracted clients. The Canadian Diamond Bourse, which was established in 2010 and currently has over 100 members, does not facilitate rough trading or tenders.

By procuring more local diamonds for manufacturing, DMAC believes it will gain a competitive advantage over other centers through the country’s strong brand. “The Canadian diamond industry truly has a unique product in that it has the cleanest, most ethically sourced goods, adhering to the highest environmental standards,” Zimerman said. “And we’re close to the U.S., the largest diamond market in the world.”

Furthermore, unlike most other diamond producing countries, the Canadian government does not own a stake in its mines. But neither does it have a legislated beneficiation policy.

Zimerman explains that the jurisdiction over natural resources is based on the local territories, which bodes well for the exploration community.

“We’re trying very hard to develop an inter-provincial national policy toward Canadian resources,” he notes. “But because of the nature in which Canada conducts its business, it does not have a policy of trying to maximize value [further along the supply chain]. Rather, its focus is on trying to open its doors to anyone wanting to explore.”

That’s encouraging for a global diamond industry desperate for new sources of rough, and for those concerned about Canada’s diminishing supply. While the country may be making a final push at Ekati and Diavik, it is still considered the burgeoning new-comer when it comes to diamond mining. And even if it does not expect to replicate the heady early days of finding diamonds, it seems there are yet to be explored opportunities in Canada.

The writer can be contacted at avi@diamonds.net.

Follow Avi on Twitter: @AviKrawitz

This article is an excerpt from a market report that is sent to Rapaport members on a weekly basis. To subscribe, go to www.rapnet.com or contact your local Rapaport office.

Copyright © 2012 by Martin Rapaport. All rights reserved. Rapaport USA Inc., Suite 100 133 E. Warm Springs Rd., Las Vegas, Nevada, USA. +1.702.893.9400.

Disclaimer: This Editorial is provided solely for your personal reading pleasure. Nothing published by The Rapaport Group of Companies and contained in this report should be deemed to be considered personalized industry or market advice. Any investment or purchase decisions should only be made after obtaining expert advice. All opinions and estimates contained in this report constitute Rapaport`s considered judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Thank you for respecting our intellectual property rights.

|

|

|

|

|

|

|

|

|

|

Tags:

Avi Krawitz, Canada

Diamonds

BHP Billiton

Rio Tinto

Harry Winston

Peregrine Diamonds

De Beers

Ekati

Diavi

|

|

|

|

|

|

|

|

Nov 30, 2012 7:03PM

By Ross Fruin

|

|

Awesome write up, Avi. I thought I was up to date on Canadian diamonds but you just blew my mind. It's great to see this industry still flourishing in Canada. Hopefully they continue to be a major player in the industry which should (to some extent) help to further reduce the amount of conflict diamonds being mined (maybe a pipe dream, i know.) Anyways thanks for sharing. Here is a cool infographic on the top as well... http://www.seattlediamonds.com/files/8513/5353/8100/Canadian_Diamonds_Infographic.jpg

|

|

|

|

|

|

|

|

|

|

|