|

|

Certified Diamond Prices Decline 12.5% in 2012

RapNet Diamond Index (RAPI™) Stable in December

Jan 3, 2013 8:00 AM

By Rapaport

|

|

|

RAPAPORT... PRESS RELEASE, January 3, 2013, New York: Certified polished diamond prices fell in 2012 as global economic weakness slowed growth in China and poor government policy fueled further declines in India. Steady U.S. demand sustained the jewelry industry but consumer sentiment softened in December as pending tax hikes reduced holiday retail spending.

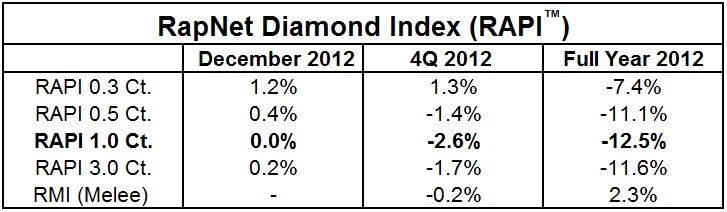

In December, the RapNet Diamond Index (RAPI™) for 1-carat polished diamonds was flat for the month, while other categories rose slightly, representing the first monthly increase since March 2012.

For the full year 2012, RAPI for 1-carat diamonds fell 12.5 percent, while 0.3-carat stones declined 7.4 percent and 0.5-carat diamonds decreased by 11.1 percent. RAPI for 3-carat stones fell 11.6 percent during the year. The Rapaport Melee Index (RMI) increased by 2.3 percent in 2012.

Copyright © 2013 by Martin Rapaport Copyright © 2013 by Martin Rapaport

According to the just-released Rapaport Research Report, “Questionable Stability,” diamond prices stabilized in December as U.S. wholesale buyers closed for the holiday season and Indian manufacturers cautiously resumed operations after Diwali.

Rough trading remained quiet with improved demand for non-De Beers goods, which continued to offer better value than expensive De Beers rough. Manufacturers, who gained slightly better profit margins in December, expressed concern that De Beers and ALROSA might raise rough prices in the first quarter as the mining companies continue to limit supply.

Initial reports from the U.S. holiday season do not justify a rough price hike. While U.S. diamond demand was stable in the fourth quarter, preliminary data reveals mediocre overall U.S. retail sales during December. Prolonged fiscal negotiations in Washington weighed down on consumer sentiment as pending tax hikes on the wealthy impacted spending.

Elsewhere, Indian domestic jewelry sales were stable during the ongoing wedding season but overall caution lingers about the local economy, especially since government taxes, the weak and volatile rupee, and high rupee-based gold prices have taken their toll throughout 2012.

Chinese consumer confidence diminished in 2012 as the weak global economy affected the country’s trade and subsequently lowered domestic consumption and investor confidence. Forecasts point to improved growth in 2013 due to potential stimulus from the new government, raising expectations in the diamond and jewelry trade for better demand during the Chinese New Year season. However, the U.S. debt ceiling negotiations, now postponed to coincide with the Chinese New Year, could impact Far East consumer confidence and spending, much as the European debt crisis did in 2012.

Forecasts for pending diamond price increases are premature and the trade should be careful not to inflate prices by buying diamonds with easy credit. Bank credit that enables firms to buy diamonds at unsustainably, artificially high prices must be stopped.

“Given expectations that the fiscal cliff will reduce demand for luxury products due to higher taxes, increased unemployment and reduced government spending, responsible companies should refuse to buy diamonds at prices that do not allow for healthy profits. Buyers should just say no to high prices. The real value of diamonds must be based on real money from real buyers,” said Martin Rapaport Chairman of the Rapaport Group.

Read the Rapaport Research Report, “Questionable Stability”, at www.diamonds.net/report or email: specialreports@diamonds.net.

Rapaport Media Contacts: media@diamonds.net

International: Shira Topiol +1-702-425-9088 <> U.S.: Sherri Hendricks +1-702-893-9400 <> Mumbai: Manisha Mehta +91-97699-30065 <>

About the Rapaport - RapNet Diamond Index (RAPI™): The RAPI is based on the average asking price in hundred $/ct. for the top 25 quality 1 ct. round diamonds (D-H, IF-VS2, RapSpec-2 and better) with GIA grading reports offered for sale on RapNet – Rapaport Diamond Trading Network. The RAPI is provided for various sizes. www.RAPNET.com has daily listings of over 970,000 diamonds valued over US$6.1 billion and 7400 members in over 80 countries.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added value services that support the development of free, fair and competitive global diamond markets. Established in 1978, the Rapaport Diamond Report is the primary source of diamond prices and market information. Group activities include publishing, research and marketing services, internet information and diamond trading networks, global rough and polished diamond tenders, diamond certification, quality- control, compliance, shipping, and financial services. Major activities of the group include the development of markets for Fair Trade Diamonds and Jewelry as well as the creation of diamond futures markets. Additional information is available at www.Rapaport.com.

Martin Rapaport (Publisher) grants limited permission to use copyrighted data appearing in this press release in and in conjunction with journalistic copy, reporting or articles concerning diamond pricing and information in graph or data presentation format only. The following credit notice must appear alongside, underneath, or in close proximity to any use of the copyrighted data: “Used with permission of Rapaport USA, Inc. Copyright © Martin Rapaport. All rights reserved.”

|

|

|

|

|

|

|

|

|

|

Tags:

Rapaport, Rapaport

RapNet

RAPI

Diamonds

De Beers

ALROSA

RapNet Diamond Index

Diamond prices

|

|

|

|

|

|

|

|

|

|

|

|

|