|

|

Anglo or Sightholders

Editorial

Aug 2, 2013 2:08 AM

By Avi Krawitz

|

|

|

RAPAPORT... De Beers is a different company than it was a year ago when Anglo American bought out the Oppenheimer’s stake in the business. The group’s interim results that were published last week, while offering a mixed review of its performance, signaled that De Beers is intent on boosting its profile within the Anglo structure. They also indicated that the company is well positioned to navigate what is expected to be a challenging second half for the diamond industry.

Drawing conclusions from the results is not an easy task. Certainly, among the notable features of the announcement was the fact that De Beers is providing significantly less information than before now that it is part of Anglo. This recent report was offered entirely in the context of the larger conglomerate presenting a different view of the diamond mining company.

Anglo raised its stake in De Beers from 45 percent to 85 percent when it closed its buyout of the Oppenheimer’s shares in August 2012. The Botswana government owns the remaining 15 percent.

Therefore, De Beers no longer provides its full income statement and balance sheet or its cash flow statement, as it did in the past. Sales, production and pretax profit data was provided on a full comparative basis, while underlying earnings were presented according to Anglo’s stake in the company.

The results also came in the context of changes at Anglo itself. The group is under pressure to perform with new management under CEO Mark Cutifani, who has inherited disappointing first-half results and an underperforming share. Anglo shares have lost 27 percent in the past 12 months compared to Rio Tinto and BHP Billiton shares, which are down 2 percent and 1 percent respectively on the London Stock Exchange.

Shareholders are therefore closely watching the contribution of each division within the Anglo structure. And so far, so good for De Beers. The diamond unit contributed 18 percent of Anglo’s underlying profit, up from 7 percent a year earlier, albeit due to Anglo’s larger stake in the company. René Médori, Anglo’s finance director, noted that De Beers was the only business in the group that delivered a year-on-year profit improvement on a 100 percent basis.

Indeed, operating profit rose 3 percent year on year to $571 million. Anglo’s underlying earnings from the diamond division – a separate item hidden on page 76 of the report – were $295 million (representing its 85 percent stake), compared to $172 million a year earlier when it had a 45 percent holding. Spokespersons for De Beers explained that on a full reporting basis, underlying earnings were slightly down from the $385 million reported by the company last year.

But with the benefit of increased operating profit, De Beers CEO Philippe Mellier will be focused on raising the company’s contribution to Anglo’s bottom line moving forward. Essentially, that will involve implementing cost efficiencies and increasing sales.

Already, Cutifani – who was recently appointed De Beers chairman – reported that about $30 to $40 million worth of savings have been facilitated from the De Beers integration, while another $100 million worth are expected in the next few months. A significant rise in depreciation and amortization expense during the period, largely associated with Anglo’s De Beers acquisition, will probably be discounted in the future.

Not insignificantly, Anglo has cleared De Beers $2 billion multi-currency credit facility. Mellier added that De Beers has already been able to obtain cheaper financing as a result of the acquisition.

These factors signal that the Anglo acquisition has lifted many of the financial constraints previously encountered by De Beers management.

They also offer a stern reminder to sightholders where the company’s interests lay. Therefore, their hopes for reduced prices will likely remain just that, wishful thinking, as De Beers will be reluctant to reduce prices at this time in its Anglo juncture.

This despite that De Beers has set itself fairly modest goals for the second half of the year. To better understand this, let’s take a look at the other numbers that were published for the first half.

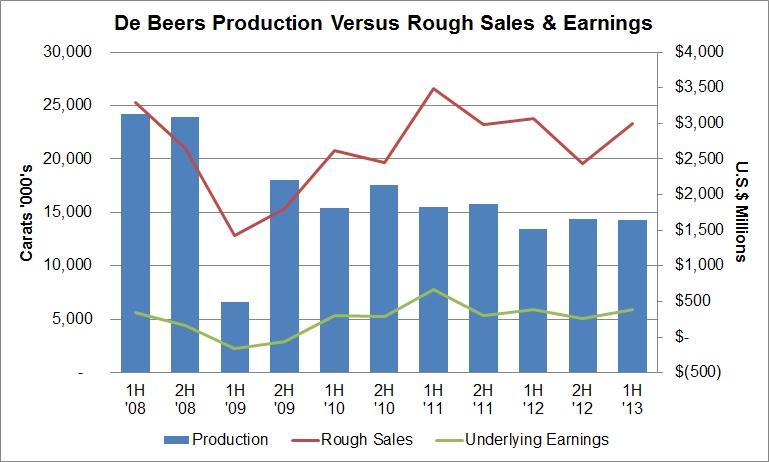

De Beers total sales, including from its Forevermark and Element Six units, were flat at $3.325 billion. Rough diamond sales were flat at $3 billion, which was in line with Rapaport News estimates for the period.

Sales were buoyed by a 6 percent rise in De Beers rough prices during the first half, after prices declined 12 percent in the second half of 2012. The company noted that the average realized price was 2 percent higher than that achieved during the first half of 2012 due mainly to an improved product mix resulting from better ore grades at De Beers two biggest mines, Jwaneng and Orapa. Still, its price index was 6 percent below the level recorded a year ago on June 30.

Meanwhile, production rose 6 percent year on year to 14.295 million carats while the company repeated its stated forecast to keep full-year production in line with 2012. To do so, it requires second-half production of just 13.58 million carats, which would represent a year-on-year decline of 6 percent. Considering that Jwaneng is now ramping back to full production following the slope failure there last year and with flooding at the Venetia mine now drained out, that goal should be relatively easy to achieve.

The greater challenge for De Beers will be to maintain its rough price levels as polished prices are projected to remain under pressure in the third quarter before October, when the market is expected to improve. Therefore, sightholders’ ability to buy rough will be restricted at current price levels as they are losing money on their supply. Already at the July sight, sightholders left goods on the table, even though the sight was relatively large with an estimated value of $600 million.

Continued sightholder refusals should influence De Beers to reduce prices, as it did in the third quarter of 2012. But the refusals would have to be significant.

Regardless of its prospective pricing decisions, De Beers should be able to achieve full-year rough sales that are at least in line with 2012 of $5.5 billion fairly comfortably. If that is the conservative goal, the company would need sales of about $2.5 billion in the second half. Having already sold an estimated $600 million worth in July, sales of just $475 million at each of the four remaining sights of the year is all it would take. De Beers did not provide a sales forecast for the year.

Sales will also be boosted by the launch of auctions by Botswana’s Okavango Diamond Company in the fourth quarter. Okavango is entitled to 12 percent of production of Debswana, De Beers mining joint venture with the Botswana government, which accounts for about two-thirds of De Beers total production. De Beers 50 percent portion of that supply will be reflected in the rough sales number, De Beers spokespersons confirmed.

If De Beers can afford to hold relatively modest sights for the rest of the year in order to achieve last year’s sales levels, and considering that its production targets are comfortably within reach, the company is essentially not under pressure to reduce prices. It may adjust here and there in areas where the market is extremely soft, but De Beers overall price index is expected to remain flat through the weak third quarter, with possible increases projected in the fourth quarter when conditions improve.

While that may not bode well for sightholders, it will help boost De Beers contribution to Anglo’s bottom line in a tough market. And that’s really the lesson learned: Cutifani’s team will be watching those numbers as it seeks to bring good news to Anglo’s frustrated shareholders and plays catch-up with its peers in the mining space. Mellier, meanwhile, will walk a fine line between pleasing his Anglo employers and his sightholder customers. If the past year is anything to go by, it will become increasingly difficult for him to do both.

The writer can be contacted at avi@diamonds.net.

Follow Avi on Twitter: @AviKrawitz

This article is an excerpt from a market report that is sent to Rapaport members on a weekly basis. To subscribe, go to www.diamonds.net/weeklyreport/ or contact your local Rapaport office.

Copyright © 2013 by Martin Rapaport. All rights reserved. Rapaport USA Inc., Suite 100 133 E. Warm Springs Rd., Las Vegas, Nevada, USA. +1.702.893.9400.

Disclaimer: This Editorial is provided solely for your personal reading pleasure. Nothing published by The Rapaport Group of Companies and contained in this report should be deemed to be considered personalized industry or market advice. Any investment or purchase decisions should only be made after obtaining expert advice. All opinions and estimates contained in this report constitute Rapaport`s considered judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Thank you for respecting our intellectual property rights.

|

|

|

|

|

|

|

|

|

|

Tags:

Anglo American, Avi Krawitz, De Beers, diamonds, Mark Cutifani, Philippe Mellier, Rapaport

|

|

|

|

|

|

|

|

|

|

|

|

|