|

|

Setting India’s Mood

Editorial

Aug 9, 2013 5:00 AM

By Avi Krawitz

|

|

|

RAPAPORT... The India International Jewellery Show (IIJS) tends to be a moody occasion. Scheduled in the heart of monsoon season, the show can be a frustrating experience for newcomers who have to navigate around the show’s poor infrastructure in often very rainy weather. But, given the size and importance of the local market, IIJS has a habit of setting the tone for the global diamond trade and has evolved to rank among the most important trade events in the international diamond calendar.

Mind you, it remains a very local affair as foreign suppliers find India a difficult market to penetrate. But for the uninitiated, India matters because it is by far the largest diamond manufacturing center, where more than 80 percent of the world’s diamonds are cut and polished. It also has a sizable retail market, accounting for an estimated 9 percent of global diamond jewelry demand, and is the largest consumer of gold products, albeit sometimes – and increasingly – falling second to China.

Therefore, all eyes are on IIJS, which began on Thursday, as the show is a microcosm of the local market, with a vast majority of local jewelry wholesalers and most diamond suppliers exhibiting there. The show is timed to offer a significant buying opportunity for retailers preparing for the Diwali festival that takes place in November, and it is an important gauge of diamond trading during the otherwise quiet summer months.

This year, one gets the feeling that more is at stake than usual as it appears that the Indian industry is being battered from all sides.

Unlike previous years when India’s economy was booming, this week’s show takes place in a tough economic and trading environment. High rough prices, declining polished, tight liquidity, cautious Far East demand, unfavorable government policy and a depreciating currency have combined to create the perfect storm for India’s diamond and jewelry trade. It’s little wonder that expectations for the show have diminished.

This week again, the rupee fell to a record low of 61.8 against the dollar, prompting analysts to forecast that the currency is headed toward a 64 settling point. The rupee has declined by 11 percent since mid-May, after a period of relative stability in the first five months of the year. The weak rupee has impacted consumer sentiment and high inflation has widened the gap between India’s rich and poor. Furthermore, the currency’s sharp depreciation since mid-May has caused the price of diamonds in dollars to become much higher in India, crippling domestic demand and pressuring global price levels.

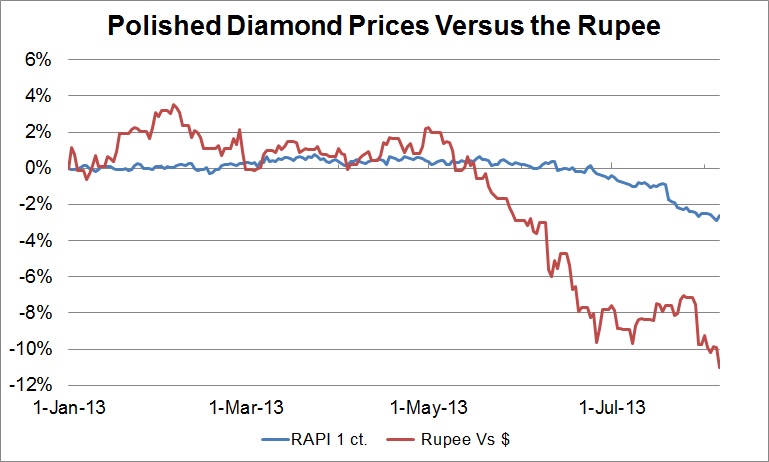

Coincidence or not, polished prices have followed a similar pattern to the rupee this year (see graph below). The RapNet Diamond Index for 1-carat certified polished diamonds was basically stable through the first five months before starting to shift downward in mid-May, around the same time the rupee started to lose value. RAPI is now down 2.5 percent since the beginning of the year, as noted in the recently published Rapaport Monthly Report – August 2013. The research explained that the decline in polished prices was mainly influenced by a slowdown in Chinese demand along with the difficult Indian landscape.

Because when it comes to diamonds, India’s ability to buy rough and sell its polished resonates to the rest of the market.

Indian polished suppliers have illustrated their willingness to drop prices in the past, taking a one-time loss on current inventory to generate a more positive cycle of trading at new prices (see editorial “Trading Down,” published on July 26, 2013). They may be under pressure to spur turnover and cash flow as liquidity remains tight in the manufacturing sector.

Suppliers across the globe suspect that if Indian suppliers lower their prices, they will ultimately have to follow suit. Sensing the downtrend, a sizeable contingent of foreign buyers is expected to attend the show, sniffing out bargains, while it remains unclear the extent to which Indian buyers are currently active in the market in general.

But it’s not just the weak currency and soft diamond prices that is weighing on sentiment in India. The government’s program to curb gold consumption as a means to control its ballooning current account deficit will likely be on jewelry exhibitors’ minds. The Reserve Bank of India (RBI) estimates that gold imports account for about 80 percent of the country’s current account deficit and its attempts to reduce that figure works to the detriment of the jewelry industry.

The government has raised the gold import duty twice this year, with the latest increment from 6 percent to 8 percent taking effect in June. In addition, RBI recently tied gold imports for domestic use to exports, which reportedly cut imports available to the domestic market by 60 percent. Finance minister P. Chidambaram recently said government is hoping to contain gold imports below last year’s level of 845 tonnes and the policy seems to be working as imports fell to 31.5 tonnes in June, from a record 162 tonnes recorded in May.

Such measures send a message that the jewelry industry’s interests are of little consequence to the government’s desire to get its fiscal house in order. Some of the larger jewelry houses, who hold sizeable gold inventory, have lost value in the process and have responded by planning greater diamond content in their product mix. The extent to which diamonds are being more heavily featured in jewelry pieces instead of gold will be made evident in the jewelry section of IIJS.

Those in the diamond pavilion will be hoping that trend holds true. They’ll also be hoping for some surprises that buck the forecasts of a cautious Indian market. After all, there is likely some pent up Indian demand waiting to emerge before Diwali and the relatively strong rainfall experienced this monsoon season should encourage better economic activity from the agricultural sector. Whether that will be enough to restore the jewelry industry’s confidence that has otherwise been squashed by the weak rupee and government policy, remains to be seen.

For now, market conditions suggest that suppliers are not expecting a boom show. Rather, the next few days are projected to reflect India’s challenging environment and the cautious mood that has defined the global industry in the past few months.

It is often said that the market is as resilient as its weakest strong player. There will be plenty of candidates for that title among the diamond suppliers at IIJS. The extent to which they’ll hold prices firm, and hedge the numerous domestic challenges facing them, may well set the tone for the industry, as it has in the past. In so doing, they’ll signal just how moody IIJS, and the Indian market, really is.

The writer can be contacted at avi@diamonds.net.

Follow Avi on Twitter: @AviKrawitz

This article is an excerpt from a market report that is sent to Rapaport members on a weekly basis. To subscribe, go to www.diamonds.net/weeklyreport/ or contact your local Rapaport office.

Copyright © 2013 by Martin Rapaport. All rights reserved. Rapaport USA Inc., Suite 100 133 E. Warm Springs Rd., Las Vegas, Nevada, USA. +1.702.893.9400.

Disclaimer: This Editorial is provided solely for your personal reading pleasure. Nothing published by The Rapaport Group of Companies and contained in this report should be deemed to be considered personalized industry or market advice. Any investment or purchase decisions should only be made after obtaining expert advice. All opinions and estimates contained in this report constitute Rapaport`s considered judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Thank you for respecting our intellectual property rights.

|

|

|

|

|

|

|

|

|

|

Tags:

Avi Krawitz, diamonds, IIJS, India, jewellery, Jewelry, Rupee

|

|

|

|

|

|

|

|

|

|

|

|

|