|

|

India’s Damaging Duty

Editorial

Nov 1, 2013 8:00 AM

By Avi Krawitz

|

|

|

RAPAPORT... Reports that India is considering raising the import duty on polished diamonds from 2 percent to 5 percent is a stunning development. Especially in the context of the difficult year that the local industry has endured, such a move would be shortsighted and damaging to the trade.

The Business Standard broke the story this week citing Vipul Shah, chairman of the Gem and Jewellery Export Promotion Council (GJEPC). Shah explained to the newspaper that increasing the duty would provide relief to small manufacturers who are facing competition from rising polished imports to the country.

As of yet, it is unclear whether the report is an accurate reflection of the government’s intentions. No official statement has been published by GJEPC or the Reserve Bank of India (RBI), the government body that would issue such a decree. Shah could not be reached for further comments at press time.

Sanjay Kothari, former vice-chairman of the GJEPC and a current committee member, dismissed the story to Rapaport News. He said that the council was not lobbying the government to increase the duty as such a move would be counterproductive. Kothari stressed that a duty hike was not planned.

The council therefore appears to be sending mixed messages about the proposed increase and would be well advised to issue a statement clarifying the matter. Because where there’s smoke there’s fire and the local trade has expressed its concern.

For starters, many of the large Indian manufacturers have facilities abroad and would be charged additional duties to bring the goods they manufacture internationally back to India for distribution. Consider that many De Beers sightholders went to great expense to set up factories in Botswana and Namibia as the move assured them of rough supply, and are now being squeezed by the Indian government for doing so. They’re damned if they do [set up facilities abroad] – as they would be penalized with extra Indian import charges – and they’re damned if they don’t – as they wouldn’t get the rough they need.

Furthermore, there have already been issues related to the existing 2 percent duty for the trade, particularly with suppliers being charged on re-imported goods that were sent overseas for certification. A government directive states that customs officials should charge the duty if there is just a 2 millimeter variation in the measurements between the re-imported diamond, compared to when it is first sent out.

Raising the duty therefore serves to further strengthen other trading centers such as Antwerp and Dubai as exporters will simply use those hubs as distribution centers, and a means to avoid the high Indian charges. While India will continue to sell locally-manufactured diamonds, it will not be able to operate as an international diamond trading center offering goods that are not manufactured in India. The country will lose its merchandising and sales position for goods manufactured abroad.

Already, India has lost part of its trading mojo and has evolved into a manufacturing-focused center.

Back in 2011-12, the council lobbied the government to introduce a 2 percent duty on polished imports that was implemented in January 2012. The questionable rationale was that the duty would curb round-tripping that was rampant between 2009 and 2011 – round tripping is the practice of re-importing diamonds and then using them as new export transactions to procure additional bank financing.

Many noted that the move worked as polished imports subsequently declined sharply. Others, including this column, saw the move as an attempt to protect the local trade from foreign competitors operating in the country and generate additional government revenue. Doing so limits India’s competitive edge, and with it, the local industry’s growth opportunities.

The same argument applies today, even if the rationale for increasing the duty is different. This time, the motivation is to protect small manufacturers from polished trading.

The premise is absurd. After all, the reality in 2013 is that polished trading is more profitable than rough diamond manufacturing. Liquidity among cutters has been tight due to low profit margins from high-priced rough. Many small-to-medium-sized manufacturers have shifted their operations to polished trading as a result.

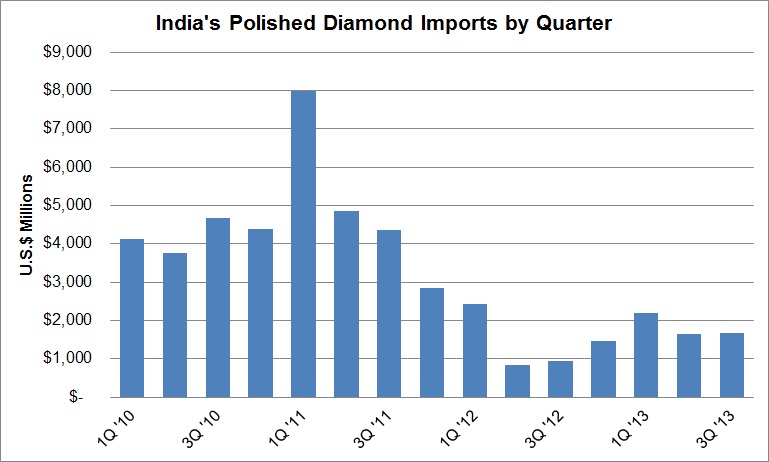

Slowly, India’s polished imports have started to increase again in 2013, albeit compared to their low base in 2012 (see graph). And this during a period when the rupee weakened, making foreign purchases even more expensive.

Rapaport News: Based on monthly data published by GJEPC. Rapaport News: Based on monthly data published by GJEPC.

Therefore, the rising polished trade should not be viewed as competition for smaller manufacturers as in many cases that is what is keeping their businesses afloat. Neither will curbing their inflow rejuvenate manufacturing among those same cutters.

The only way to do that is to tackle the issue of high rough prices, as the council so admiringly did at the beginning of October. In a public memo to the industry, GJEPC called on its members to refrain from buying unprofitable rough. If they refuse unprofitable rough, as sightholders did at the September and October sights, it could force the mining companies to reduce their prices to levels that are viable also for the smaller cutting operations. Next week’s ALROSA sale and the subsequent De Beers sight will show if the same message was received by the mining companies.

But further limiting the polished trade would be counterproductive just when confidence is slowly creeping back in. In context, 2013 was the toughest year in recent times for the Indian diamond industry. The rupee, which started the year at INR 54/$1, plunged more than 20 percent between April and August before recovering to stabilize at its current level of around INR 61/$1. Local banks tightened their lending to the industry making less money available for more expensive rough purchases and a liquidity crisis ensued. Meanwhile, domestic jewelry demand staggered as consumer confidence diminished along with the pace of economic growth.

Raising the import duty on polished diamonds would be the proverbial nail in the coffin. At the very least, it would be an ill-advised Diwali gift to the industry. Instead, GJEPC should be lobbying the government to reduce the duty to encourage a healthy, competitive diamond market. At a minimum, the council should endorse maintaining the status quo in a strong statement to its members to ease their concerns. It would then be doing its bit to ensure a happy Diwali and restore confidence for the year ahead.

The writer can be contacted at avi@diamonds.net.

Follow Avi on Twitter: @AviKrawitz

This article is an excerpt from a market report that is sent to Rapaport members on a weekly basis. To subscribe, go to www.diamonds.net/weeklyreport/ or contact your local Rapaport office.

Copyright © 2013 by Martin Rapaport. All rights reserved. Rapaport USA Inc., Suite 100 133 E. Warm Springs Rd., Las Vegas, Nevada, USA. +1.702.893.9400.

Disclaimer: This Editorial is provided solely for your personal reading pleasure. Nothing published by The Rapaport Group of Companies and contained in this report should be deemed to be considered personalized industry or market advice. Any investment or purchase decisions should only be made after obtaining expert advice. All opinions and estimates contained in this report constitute Rapaport`s considered judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Thank you for respecting our intellectual property rights.

|

|

|

|

|

|

|

|

|

|

Tags:

Avi Krawitz, diamonds, GJEPC, India, Rapaport

|

|

|

|

|

|

|

|

|

|

|

|

|