|

|

De Beers Dec. Sight Estimated at $580M

Rough Trading Improves as Challenges Persist

Dec 17, 2013 2:31 AM

By Avi Krawitz

|

|

|

RAPAPORT... The De Beers December sight had an estimated value of $580 million with prices and box values kept relatively stable. The sight value was the highest since the first quarter as sightholders took goods that were deferred from November and as they sought to build inventory for their factories. Trading on the secondary market improved following December’s sight.

There was also some ex-plan supplied at the sight, which are goods made available over and above sightholders’ previously applications for goods.

Sightholders noted that they purchased goods that will maintain their operations through the relatively long period, until the next sight, which begins on January 20.

“People don’t have rough and realized that they won’t be getting more De Beers goods until the first week of February, after the next sight. So they bought more than usual last week,” said a Mumbai-based sightholder. “Companies have increased their factory operations after Diwali and there isn’t enough rough in the market.”

Some suggested that tighter bank credit expected to take effect in 2014 also influenced sightholders to buy more goods in December, while they have access to the additional financing. ABN Amro bank confirmed with Rapaport News that it is reducing its financing of rough purchases from all sources from 100 percent to 70 percent effective from January 1. Manufacturers will, therefore, have to finance 30 percent of their purchases from their own capital.

David Johnson, head of midstream communications for De Beers, said that the improvement in rough demand in December resulted from a combination of factors, including: the timing of the next sight, the relatively low rough inventory levels among manufacturers, an increase in manufacturing after Diwali and better polished and diamond jewelry demand during the fourth quarter.

Johnson said he expects polished demand to continue to improve in the first quarter of 2014 as U.S. retailers replenish inventory after Christmas and as the trade shifts its supply focus toward the Far East and the coming Chinese New Year celebration.

As a result, Mike Aggett, the managing director of H. Goldie & Co., a broker for De Beers sightholders, estimated that the level of refusals was fairly low at this sight. [Refusals] were predominantly focused on fancy, small Z/Mb and colored ranges,” Aggett wrote in his blog about the sight. “These goods remain overpriced to the market.”

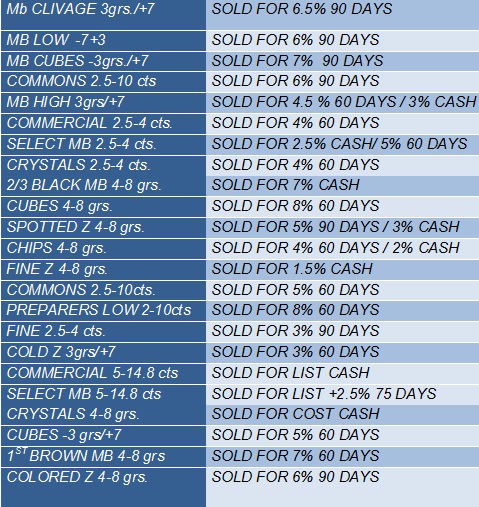

Nurit Rothmann, David Harari and Guy Harari, co-founders of Bluedax, an online rough broker, reported that demand for better-quality rough on the secondary market remained relatively weak with crystals above 4 grainers and colored stones in sizes ranging from 5-carats to 15-carats, selling at cost. Rothmann noted strong demand for 4 grainers to 8 grainers, cubes and blacks, as well as for small sizes as Indian factories replenish inventory.

Rothmann, Aggett and sightholders that spoke with Rapaport News agreed that profitability remains a challenge for manufacturers. “Rough is still expensive relative to polished,” stressed an Israel-based sightholder. “So you either reject the goods or buy and hold it in inventory until polished prices increase. I feel there is room for polished prices to rise, particularly in the 0.30-carat goods.”

Aggett added that most sightholders felt that their margins eroded in the second half of the year, reversing the profitable trend during the first half. “Overall, this year many companies will complete the year with net profit of between 3 percent to 5 percent, at best, which is insufficient given the investment and risk involved,” he said.

De Beers rough diamond sales rose 1.6 percent to approximately $5.59 billion in 2013, according to Rapaport estimates. Full results are scheduled to be published by parent company Anglo American on February 14.

The following table presents rough trading of select De Beers boxes on the secondary market following the December sight. (Research by www.bluedax.com):

C

C

|

|

|

|

|

|

|

|

|

|

Tags:

Avi Krawitz, De Beers, diamonds, Jewelry, Rapaport

|

|

|

|

|

|

|

|

|

|

|

|

|