|

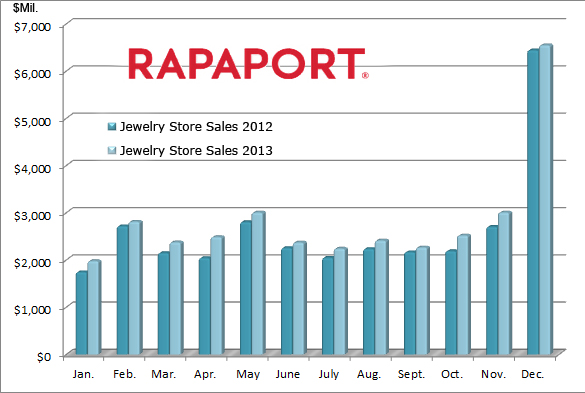

RAPAPORT... U.S. jewelry store sales rose 1.6 percent year on year to $6.545 billion in December, according to government calculations. While the increase was the weakest for jewelry stores of any month in 2013, at least the consumer price index (CPI) for jewelry recorded a decline of 0.7 percent. Jewelry store sales surged 15.1 percent in October, followed by an equally strong increase of 11.1 percent in November.

As reported earlier by Rapaport News, total U.S. jewelry and watch sales in December increased 6.4 percent year on year to $16.585 billion.

Despite the lackluster sales growth rate for the most important retailing month of the year, jewelry store sales increased 8 percent to $34.01 billion in 2013, while the CPI for jewelry was flat and it rose 2.8 percent for watches. Comparatively, preliminary sales for jewelry in 2013 rose 7.7 percent to $71.3 billion and watch sales improved 8.1 percent to $9.5 billion. (Story continues after the chart.)

In addition to the robust gains in October and November, jewelry store sales also experienced double-digit increases in January, March and April. Likewise, the jewelry and watch sector, across all sales channels, including from department stores and online, recorded strong growth in January, March, April, June, October and November.

Jewelry sales and store sales performed extremely well during the year when compared with department store chains, where sales for December fell 3.3 percent year on year to $24.638 billion and full year sales declined 4.7 percent to $174.7 billion.

Advanced estimates for department store sales in January continued to show weakness as revenue declined 3.9 percent year on year to $11.232 billion. However, total retail sales in the U.S. during January improved 2.6 percent to $427.8 billion, while retail trade sales also rose 2.6 percent. Nonstore retail sales jumped 6.5 percent compared with January 2013.

Reflecting on January's retail sales trends, Lindsey Piegza, the chief economist for Sterne Agee, said that consumers continued to lose momentum and poor weather conditions in some parts of the country did not help.

''In the long run, positive spending patterns can only be supported by underlying growth in jobs and income. We have seen the quantity of jobs continue to increase - although at a disappointing pace as of late - however, we have not seen quality job creation leading to income growth, as the vast majority of the jobs created have been in part-time or low wage sectors,'' Piegza wrote in a client note.

''Consumers were able to spend through the fourth quarter thanks in part to temporary factors like energy price reprieve and a lingering wealth effect from rising equity markets luring consumers out to spend and draw down their savings. But going forward, with rising energy prices expected to cost the average consumer an extra $500 to $1,000 more this winter season to heat their home and fill up the family car, without income growth, consumption will remain under pressure. Also this morning, initial jobless claims rose 8,000 to 339,000 in the week ending February 8. On a four week moving average claims rose from 333,000 to 337,000 still remaining with the tight range of the past year,'' Piegza said.

|