|

|

The HPHT Natural Diamond Opportunity

Editorial

May 30, 2014 1:40 AM

By Avi Krawitz

|

|

|

RAPAPORT... Manufacturers and distributors of High Pressure High Temperature (HPHT) processed natural diamonds are claiming an opportunity for their small, specialized niche. Not to be confused with treatments or synthetics, advocates of HPHT-processed natural diamonds are working to change the perception of their product.

There are two types of HPHT diamonds, explained Gerry Hauser, CEO of Hadar Diamonds, a distributor of HPHT natural diamonds. The first is a lab-grown, or synthetic, diamond that is created using HPHT by simulating the conditions by which a natural diamond is produced. The second is a natural diamond that uses HPHT to change the brownish color of the stone to achieve its full potential.

Paul Kaplan, director of Antwerp operations at Bellataire Diamonds, a subsidiary of Lazare Kaplan that sells branded HPHT natural mined diamonds, stressed that processing natural type IIa diamonds has nothing to do with growing synthetic diamond crystals. He added that these processed natural diamonds should be differentiated from treated stones that have been irradiated or fracture filled, since there is nothing added to, or taken away from their all natural content.

Rather, HPHT processing of type IIa diamonds simply “de-stresses” the diamond, Kaplan noted. While a diamond starts out at the earth’s core as colorless, it passes through substantial heat and pressure as it makes its way up to the earth’s surface. That passage places stress on the stone which causes it to appear brownish.

“We recognized that if we could put the diamond back into that heat and pressure scenario, the diamond could be de-stressed,” he explained. “In a controlled environment it can relax and go back to its original color.”

Lack of Awareness

Both Hauser and Kaplan urge retailers to embrace these goods as an opportunity to sell a high-quality diamond for a significantly lower price than the unprocessed natural equivalent. They estimate that a consumer can save 20 percent to 30 percent by buying an HPHT-processed natural diamond compared to the equivalent unprocessed natural stone.

However, Kaplan admitted that very few consumers are aware of the option to purchase these goods and most retailers do not know much about them. Part of the reason has been the industry’s reluctance to market HPHT natural diamonds. First introduced to the market by General Electric and Lazare Kaplan in early 1999, HPHT-processed diamonds have largely been met with resistance by the diamond trade. Given the trade’s conservative nature, Kaplan explains that there was resistance toward HPHT because the process was new and little was understood about these diamonds at the time.

Another reason for their slow market penetration is that there’s a limited supply. These diamonds come from type IIa rough, which are very rare in nature. Although the great majority of type IIa’s are typically pure internally, it is only those that are of the highest quality that are chosen to go through the process. As a result, Kaplan estimates that the amount of type IIa diamonds that can be processed account for less than 1 percent of all natural diamonds.

David Fisher, principal scientist at De Beers Technologies UK, noted that HPHT processing requires significant investment in costly pressure equipment as well as the know-how to operate it. As a result, the technology has traditionally been confined to locations with a history of research and commercial activity in related areas, notably the U.S., Russia and Japan. However, Fisher added that high pressure technology is becoming more widespread with significant activity in China, Korea and India, where De Beers is aware of a number of groups actively offering HPHT treatments and HPHT treatment services. Still, he estimates that only a few thousand HPHT-processed natural diamonds are being produced each year.

Given the limited supply, Kaplan believes that HPHT natural diamonds don’t have the critical mass to stimulate widespread demand. Some suspect that the larger mining companies have held back supply of type IIa diamonds in order to limit supply and subsequently keep demand for HPHT natural diamonds low. At the same time, Hauser noted that savvy investors, especially in the Far East, have recognized the value potential, stimulating rising interest for these goods.

While no one expects that HPHT-processed natural diamonds will replace demand for unprocessed diamonds, Kaplan maintains that they give retailers the opportunity to offer their customers an important choice to buy the highest-quality natural diamonds at the best value.

Hauser believes there is an aberration in the market that may be short lived. Both he and Kaplan project that prices for HPHT-processed natural diamonds will rise and that the gap between them and the equivalent unprocessed natural diamond will slowly diminish. “The differential is not normal given that the material is the same,” Kaplan explained. “They’re essentially the same diamond.”

Disclosure & Detection

While HPHT-processed natural diamonds contain the same materials and characteristics as unprocessed diamonds, there remain strict guidelines to disclose these goods as HPHT stones and for the laboratories to clearly label them as such on their certificates.

Furthermore, there are concerns about non-disclosed HPHT-processed diamonds being submitted for grading as natural diamonds, particularly since these challenges have become prevalent with regards to Chemical Vapor Deposition (CVD) synthetic diamonds in the past two years.

“The primary concern with HPHT-treated diamonds is that they will be sold undisclosed at any point in the diamond pipeline, but especially to the consumer,” Fisher said. “As with any challenge that has the potential to undermine consumer confidence in natural untreated diamonds, the issue must be taken seriously by all in the trade with proper disclosure and detection measures in place, and sanctions for those who persistently seek to undermine this confidence.”

A spokesperson for the Gemological Institute of America (GIA) stated that all diamonds submitted to GIA for grading are screened for treatments and synthetics, adding that the GIA can confidently detect treatments, including HPHT. Similarly, Ans Anthonis, chief diamond lab and research officer at HRD Antwerp, said that every diamond is screened at HRD, and depending on the diamond type and color, the stones are subjected to further investigation in a sophisticated lab in order to obtain a full identification.

De Beers is also confident it has the capabilities to detect all synthetics and treatments using its DiamondSure and DiamondView machines. Fischer explained that the DiamondSure can also be used to screen type IIa diamonds that are particularly susceptible to HPHT processes or treatments. In addition, DiamondPlus is a miniature version of the machine that refers all HPHT-treated type IIa diamonds for further testing.

Kaplan maintains that the major laboratories can and do differentiate these diamonds and that mandatory inscriptions for HPHT-processed diamonds will help protect dealers and consumers from attempted fraud. He added that the more people are aware of HPHT-processed diamonds, the harder it will become to abuse them.

Part of the challenge is to further educate the diamond trade in order to differentiate HPHT-processed natural goods from lab-grown synthetics and treated diamonds. In Kaplan’s view, HPHT processing is just one more step that natural diamonds go through to become natural gems.

Market Acceptance

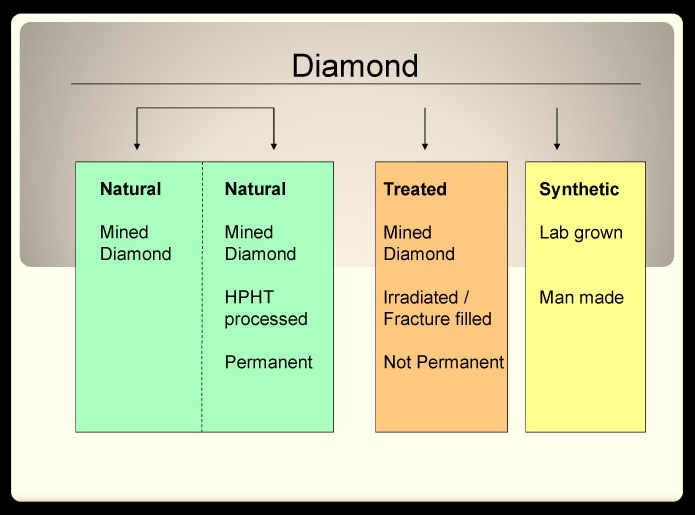

In terms of classifications, mined diamonds are either processed or unprocessed naturals, while treated diamonds are not considered natural, he explained. Furthermore, synthetic lab-grown diamonds are neither natural nor mined diamonds (see chart below). Kaplan is confident that with the correct educational programs, HPHT natural diamonds will eventually become an accepted product like any other natural mined diamond.

The above chart illustrates the various types of natural, treated and synthetic diamond classifications as explained by Bellataire Diamonds . (Courtesy Bellataire Diamonds).

Doing so would certainly provide an interesting option to consumers in their diamond purchase, even as HPHT-processed natural diamonds are likely to remain a small segment of the market with limitations. But there’s no doubt they have earned their place.

Still, HPHT-processed natural diamonds need to be differentiated from unprocessed natural diamonds as well as from HPHT synthetics, CVD synthetics and treated diamonds. As with those processes, there needs to be effective detection, disclosure and documentation for these goods. But with the right structures in place, there’s no reason that consumers shouldn’t consider these diamonds as a valuable alternative to unprocessed natural diamonds. So too should jewelers embrace the opportunity that these stones present to the market, for now.

The writer can be contacted at avi@diamonds.net.

Follow Avi on Twitter: @AviKrawitz and on LinkedIn.

This article is an excerpt from a market report that is sent to Rapaport members on a weekly basis. To subscribe, go to www.diamonds.net/weeklyreport/ or contact your local Rapaport office.

Copyright © 2014 by Martin Rapaport. All rights reserved. Rapaport USA Inc., Suite 100 133 E. Warm Springs Rd., Las Vegas, Nevada, USA. +1.702.893.9400.

Disclaimer: This Editorial is provided solely for your personal reading pleasure. Nothing published by The Rapaport Group of Companies and contained in this report should be deemed to be considered personalized industry or market advice. Any investment or purchase decisions should only be made after obtaining expert advice. All opinions and estimates contained in this report constitute Rapaport`s considered judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Thank you for respecting our intellectual property rights.

|

|

|

|

|

|

|

|

|

|

Tags:

Avi Krawitz, Bellataire, De Beers, diamonds, GIA, HPHT, HRD Antwerp, Rapaport

|

|

|

|

|

|

|

|

|

|

|

|

|