|

|

Polished 1-Ct. Diamond Prices -8.7% in 2014

RapNet Diamond Index Declines in December

Jan 8, 2015 3:10 AM

By Rapaport

|

|

|

RAPAPORT... PRESS RELEASE, January 7, 2014, New York ... Polished diamond prices fell in 2014 as demand slowed in China and liquidity dried up. Reduced bank credit, tight profit margins due to high rough prices, and grading delays at the Gemological Institute of America (GIA) all contributed to squeeze cash flow among manufacturers. Banks reduced their credit to the industry and are demanding more stringent reporting and business practices from the trade.

Inventory levels remained high across the diamond distribution chain in December and polished suppliers lowered their prices in an effort to increase turnover and raise cash.

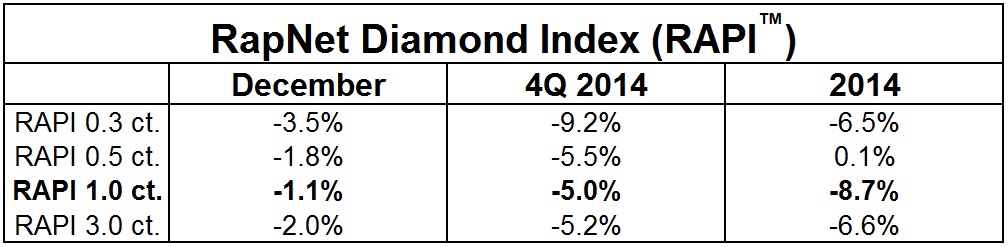

In December, the RapNet Diamond Index (RAPI™) for 1-carat laboratory-graded diamonds fell 1.1 percent. RAPI for 0.30-carat diamonds dropped 3.5 percent, while RAPI for 0.50-carat diamonds declined 1.8 percent. RAPI for 3-carat diamonds fell 2 percent during the month.

For the year 2014, RAPI for 1-carat laboratory-graded diamonds fell 8.7 percent. RAPI for 0.30-carat diamonds declined 6.5 percent, while RAPI for 0.50-carat diamonds increased 0.1 percent. RAPI for 3-carat diamonds dropped 6.6 percent in 2014.

Copyright © by Martin Rapaport

The RapNet Diamond Index (RAPI) is based on the average of the asking prices for Round,D-H, IF-VS2, GIA Graded, Rapaport Specification 2 or better diamonds, which are offered for sale on RapNet – Rapaport Diamond Trading Network.

The Rapaport Monthly Report – January 2015, “High Inventory levels,” noted that there was a correction in prices for 0.30-carat diamonds due to both supply and demand factors. Demand from China softened as economic growth slowed. Retailers in China still held large inventories of 0.30-carat diamonds having bought aggressively and driving up prices in 2013. The GIA also reduced its backlog and released a large amount of 0.30-carat to 0.50-carat diamonds from its laboratories in the fourth quarter, resulting in an oversupply.

Diamond markets were also unstable due to an imbalance between rough and polished prices. Rough prices remained relatively stable at the De Beers December sight, while sightholders rejected an estimated 20 percent of their allocated supply. A greater proportion of lots remained unsold at spot auctions. Rough trading was slow and prices on the secondary market softened in December, even though most boxes were offered at a loss and on generous credit terms.

Market conditions are expected to remain cautious in January as retailers assess their inventory levels following the Christmas shopping season. The diamond trade continues to be supported by the U.S. with robust economic growth, improved unemployment, rising consumer confidence and a strong dollar helping to lift sentiment. India is also showing signs of improvement under the new government.

Activity in China remains cautious ahead of the Chinese New Year on February 19 as economic growth has slowed and the government continues to curb excessive displays of luxury wealth. The major jewelry retailers in the region have reported high inventory levels ahead of the season as their sales slumped in 2014.

Diamantaires are hoping that strong retail sales in China in the coming months combined with a successful Christmas period will stimulate improved trading activity. It remains to be seen whether that will occur in the first quarter of this year as it did in 2014. For now, the trade must tackle the numerous challenges that linger from 2014. Tight liquidity, reduced bank credit, low profit margins and high rough prices need to be addressed to ensure growth in 2015 and beyond.

Read the attached Rapaport Monthly Report, "High Inventory Levels," at www.diamonds.net/report or email: specialreports@diamonds.net.

Rapaport Media Contacts: media@diamonds.net

U.S.: Sherri Hendricks +1-702-893-9400;

International: Lisa Miller +1-718-521-4976;

Mumbai: Manisha Mehta +91-97699-30065

About the Rapaport RapNet Diamond Index (RAPI™): The RAPI is based on the average asking price in hundred $/ct. for the top 25 quality 1 ct. round diamonds (D-H, IF-VS2, RapSpec-2 and better) with GIA grading reports offered for sale on RapNet – Rapaport Diamond Trading Network. The RAPI is provided for various sizes. www.RAPNET.com has daily listings of over 1.568 million diamonds valued over $8. 25 billion and 14,025 members in 88 countries.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added value services that support the development of fair, transparent, efficient, and competitive diamond and jewelry markets. Established in 1978, the Rapaport Magazine is the primary source of diamond price and market information. Group activities include Rapaport Information Services providing research, analysis and news; RapNet – the world's largest diamond trading network; Rapaport Laboratory Services provides GIA gemological services in India, Belgium and Israel; and Rapaport Trading and Auction Services specializing in recycled diamonds and jewelry. The Group supports over 20,000 clients in 118 countries and employs 200 people with offices in New York, Las Vegas, Antwerp, Ramat Gan, Mumbai, Surat, Dubai and Hong Kong. Additional information is available at www.Diamonds.net.

Martin Rapaport (Publisher) grants limited permission to use copyrighted data appearing in this press release in and in conjunction with journalistic copy, reporting or articles concerning diamond pricing and information in graph or data presentation format only. The following credit notice must appear alongside, underneath, or in close proximity to any use of the copyrighted data: “Used with permission of Rapaport USA, Inc. Copyright © Martin Rapaport. All rights reserved.”

|

|

|

|

|

|

|

|

|

|

Tags:

Chinese New Year, De Beers, diamonds, Jewelry, Martin Rapaport, Rapaport, RAPI

|

|

|

|

|

|

|

|

|

|

|

|

|