|

|

Okavango Sales

Editorial

Jan 23, 2015 8:00 AM

By Avi Krawitz

|

|

|

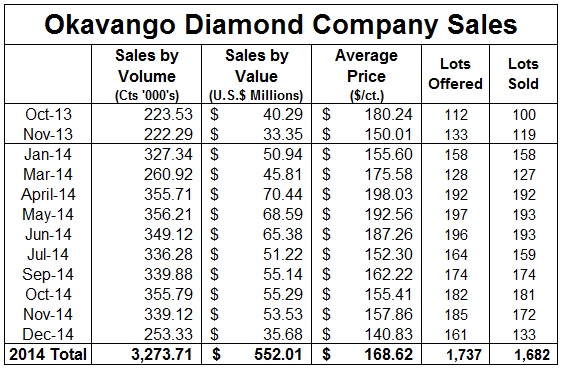

RAPAPORT... Okavango Diamond Company completed a successful first full year in business in 2014. The Botswana parastatal sold approximately 3.27 million carats for revenue of $552 million during the year, management told Rapaport News. That works out to an average price of about $168 per carat as sales were well within expectations.

Having launched its auctions in October 2013, the company is already an important global supplier of rough diamonds and has emerged as a benchmark for rough pricing and demand trends.

Selling its production in an open auction platform, the company is arguably the most transparent seller of rough in the market today, publishing its results after each sale. For the first time, detailed data is being made available about sales from a major diamond producer.

Furthermore, as viewing takes place in Gaborone 10 times a year during the same week as the De Beers sight, the respective sales provide manufacturers with an important contrast between the two companies and their selling methods.

Keith Jefferis, the managing director of Econsult Botswana, a private economic and development consultancy and former deputy governor of the Bank of Botswana, noted that while De Beers has a fixed group of about 90 sightholders coming to Gaborone for each sight, Okavango has some 250 accredited buyers. The company can accommodate 120 buyers in any particular sales period.

“Despite being smaller, it actually packs quite a punch in terms of bringing people to the country and because it’s an auction system it has more of a market determined element to it,” Jefferis said. “The fact that it’s open and competitive as opposed to closed and non-competitive, I think adds an important aspect to the diamond market.”

Certainly, trends in the rough market diverged between contract sales and spot and secondary market trading in 2014. Manufacturers note that De Beers, ALROSA, Rio Tinto and Dominion Diamond Corporation, which sell the majority of their rough via long-term contracts, are able to sustain higher prices than auction sales when the market is in a decline. Their premium comes with the promise of consistent supply. Consequently, the spot auctions and secondary market have been more reflective of the difficult environment that has been the reality for manufacturers in the past few months.

Telling Data

Okavango’s published data is telling as it comes from one of the largest suppliers that does not sell its rough via long-term contracts. While the company is considering introducing contracts in the future, management explained that it doesn’t yet have a sufficient volume of supply to do so. Therefore, the 2014 data signaled that rough demand and prices on the spot market did indeed drop in the second half of the year and particularly in the fourth quarter.

Toby Frears, Okavango’s managing director (pictured), told Rapaport News that the company saw a general softening of rough prices in the second half as sentiment weakened due to high polished inventories, lower polished prices and a growing shortage of liquidity. He added that the majority of rough assortments showed price declines in the fourth quarter, with the exception of -3 grainer gem-quality rough, which, he said, demonstrated greater price stability throughout the year.

The December sale saw the highest number of goods left unsold or withdrawn as the company sold 133 of the 161 lots on offer. The combination of Okavango’s auctions held during the fourth quarter sold 92 percent by lot, compared to 99 percent in the second and third quarters and 100 percent in the first, according to Rapaport calculations from the data.

Simultaneously, Rapaport estimates that the average price of sales fell to $152 per carat in the fourth quarter, from $157 per carat in the third. Okavango had its strongest sales in April and May, selling the most volume at the highest average prices during those months (see table).

Rapaport estimates based on data published by Okavango Diamond Company.

Production Makeup

Operating in a volatile market environment, Okavango can be well pleased with its 2014 results, especially given that it was a settling-in year for the company. Frears said in an earlier interview that the focus for 2014 was to refine its sales proposition, which included developing its IT strategy to support customers, building its customer base and fine-tuning its sales assortments.

Not a simple task given its supply structure. Okavango’s supply comes from Debswana, Botswana’s mining joint venture with De Beers. During 2014, Okavango was entitled to 13 percent of Debswana’s run of mine production, which increased to 14 percent this year and will be capped at 15 percent between 2016 and 2020.

Debswana’s production is first sent to Diamond Trading Company (DTC) Botswana – another government and De Beers joint venture – where it is sorted into separate De Beers and Okavango bespoke assortments. Okavango receives its supply, which is then internally quality assured, valued and blended into its final selling assortments.

Botswana’s Benefit

Whereas De Beers mixes its DTC Botswana supply with its production from South Africa, Namibia and Canada, Okavango’s supply is purely from Botswana.

That has been a coup for the government as it can now independently track the value of its rough from extraction to sale. Okavango is consequently an integral part of the country’s diamond hub program to diversify the local industry, and general economy, away from its reliance on diamond mining. While diamonds still account for about 80 percent of the country’s exports, Jefferis estimated that today the country employs almost as many people in cutting, polishing and trading as it does in diamond mining.

That’s quite an achievement given the country’s high unemployment rate. While a relatively small employer itself, Okavango is further testament to the hub program’s success as it has created a consistent buzz of activity in Gaborone, along with De Beers shifting its sight sales from London. Within a year, Gaborone has emerged as a premium rough buying center.

Therefore, for the government, for now, Okavango is more about creating that buzz than generating revenue. In fact, Jefferis noted that the Okavango sales have had a very minor impact on the government’s budget since most of its diamonds would have been sold through DTC Botswana anyway. With the bulk of Botswana’s production still going to De Beers, and an estimated 80 cents out of each dollar of De Beers sales going to the government, Okavango’s impact on the government’s revenue remains small.

However, Okavango demonstrates the government’s ability to sell diamonds on its own. Who knows how relevant that experience will be for future supply agreements between the government and De Beers? It also provides the government with intelligence about the market, which should prove invaluable to a country so dependent on diamonds. Okavango simply empowers the Botswana government in its own economic growth program and in the global diamond market.

Moving Forward

Jefferis projects that Botswana’s economy grew by about 4.5 percent in 2014 largely on the back of a strong rough diamond market. Furthermore, he observed that the government’s diamond revenue has been strong for the past two to three years, allowing the treasury to build cash reserves which would cushion the effect of a potential slowdown in 2015.

As the industry expects a rough price correction in the first quarter of the year (see editorial Rough Price Correction, published January 16, 2015), the government and the larger diamond market will be watching the Okavango auctions as a reflection of the rough market reality – starting at the January auction that is ongoing this week.

Frears said Okavango’s focus this year will be to continue to consolidate its business and enhance its customer offering, which is likely to include more regular access to significant high value stones in its sales. Access to a greater portion of Debswana production will also help spur growth.

However, the company’s performance will largely depend on the manufacturing sector which remains pressured by high inventory levels, low polished prices and a shortage of liquidity. Diamond manufacturers are consequently scrutinizing the rough market and looking for reasonable new sources of profitable supply. They may have found one.

With a full year of experience behind it, Okavango may be set to become an even more important player moving forward.

The writer can be contacted at avi@diamonds.net.

Follow Avi on Twitter: @AviKrawitz and on LinkedIn.

This article is an excerpt from a market report that is sent to Rapaport members on a weekly basis. To subscribe, go to www.diamonds.net/weeklyreport/ or contact your local Rapaport office.

Copyright © 2015 by Martin Rapaport. All rights reserved. Rapaport USA Inc., Suite 100 133 E. Warm Springs Rd., Las Vegas, Nevada, USA. +1.702.893.9400.

Disclaimer: This Editorial is provided solely for your personal reading pleasure. Nothing published by The Rapaport Group of Companies and contained in this report should be deemed to be considered personalized industry or market advice. Any investment or purchase decisions should only be made after obtaining expert advice. All opinions and estimates contained in this report constitute Rapaport`s considered judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Thank you for respecting our intellectual property rights.

|

|

|

|

|

|

|

|

|

|

Tags:

Avi Krawitz, De Beers, Debswana, diamonds, Okavango, Okavango Diamond Company, Rapaport

|

|

|

|

|

|

|

|

|

|

|

|

|