|

|

Beautiful Diamonds that Sell in Any Market

Insights

Nov 12, 2015 9:00 AM

By Avi Krawitz

|

|

|

RAPAPORT... The hype surrounding Sotheby’s and Christie’s auctions in Geneva this week created a buzz in the diamond trade that is otherwise starved for excitement.

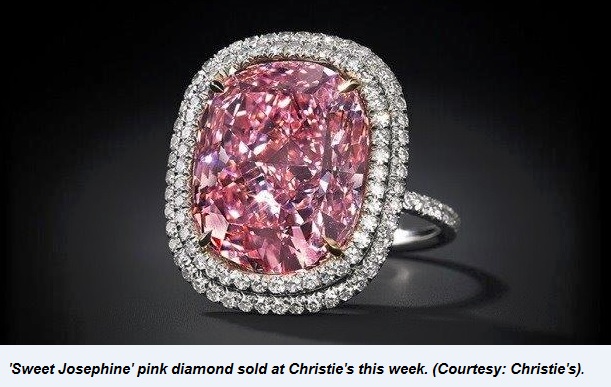

Sotheby’s on Wednesday sold a cushion shape, 12.03-carat, fancy vivid blue, IF diamond for $48.5 million, or $4 million per carat, setting a new record for any diamond, or jewel, sold at auction, according to the auction house. The day before, Christie’s sold a cushion, 16.08-carat, fancy vivid pink, VVS2 diamond for $28.5 million, or $1.8 million per carat, which that auction house said was a world record for a fancy vivid pink diamond sold at auction. Both stones were bought by Hong Kong billionaire Joseph Lau, who named them after his 7 year old daughter Josephine.

The prices are quite remarkable considering the general state of the diamond market. According to David Bennett, chairman of Sotheby’s International Jewellery Division, stones such as the now-named ‘The Blue Moon of Josephine’ are so exceptional that they’re likely to perform well in any market, he said in an email to Rapaport News prior to the sale.

Similarly, Rahul Kadakia, Christie’s International Head of Jewellery, compared the ‘Sweet Josephine’ pink diamond to fine art as collectors seek out such special stones as savvy investments that are “gorged in splendor” and hold the potential to appreciate considerably in value over a relatively short period of time, he wrote in a pre-auction statement.

Flaws in a Flawless Market

That said, not all investment-grade diamonds have enjoyed such appreciation, or even stability, in 2015.

Demand for top-end D-color, internally flawless (IF) colorless diamonds has in fact declined in the past year, said Zvulun Leviev, chief executive officer of manufacturer LLD Diamonds, which also operates high-end diamond jewelry retail outlets. This is largely because wealth has diminished in key markets such as Russia, the Gulf, China and Hong Kong, he explained.

Another supplier of top-quality large diamonds, who wished to remain anonymous, said prices for 5-carat, D, IF diamonds depreciated by about 10 percent this year, while 10-carat, D, IF diamonds have dived 10 percent to 15 percent, and commercial-quality I to K color big stones have slid even more.

“With oil prices dropping and wealth being reduced there’s an incredible psychological factor at play in the uber-wealth segment,” he explained. “If an individual was worth $1 billion a year ago and is now worth $500 million he can still afford a $2 million diamond ring. But he’s naturally going to tighten his belt since half his wealth has been wiped out.”

Potential Arab and Russian buyers have been hit by a slump in oil prices – down 26 percent since the beginning of the year, Leviev noted. Russians have been further inhibited by a sharp depreciation in the ruble and sanctions which put some of their wealth out of reach. Meanwhile, China’s anti-corruption campaign and restrictions on cross-border money transfers have limited spending among its highest earners, Leviev added.

Sliding Investment Demand

Both suppliers stressed the slump in demand for top-end diamonds is being felt at the retail level, and is trickling down to the dealer market.

As investment purchases, buyers of large D, flawless diamonds are looking at prices that haven’t yet floored, explained the anonymous dealer. “There just aren’t any transactions taking place because buyers feel they might be able to get the goods cheaper in a few months,” he said.

Sotheby’s Bennett countered that bidders on the auction scene might be encouraged to look at hard and portable assets such as diamonds as stock markets have turned volatile.

Or, they might be focused on assets such as fancy color diamonds which have held their value and are less prone to speculative buying, said Bruno Scarselli, a partner at Scarselli Diamonds, a supplier of top-quality fancy color diamonds.

Color Holding Value

Prices of fancy color diamonds have held relatively steady in 2015, according to the Fancy Color Research Foundation (FCRF), a non-profit organization that tracks trends in the fancy color diamond market. The foundation last week reported its price index for blue diamonds rose 4 percent during the third quarter, while pinks were relatively stable and yellow diamond prices softened by 2 percent. In contrast, the RapNet Diamond Index for 1-carat, GIA-graded polished colorless diamonds fell 6.3 percent during the same period.

Scarselli, whose company shifted away from more commercial goods toward higher-end fancy colors in response to the current volatile market, said the decision paid off as it recorded one of its best ever years in 2015. That success came on the back of steady demand for very large intense vivid and fancy yellow diamonds, along with the sale of a few intense pinks and blues during the year, he reported.

There’s simply more awareness about color diamonds among consumers as the trade has made more of an effort to educate the public in recent years, Scarselli said. In addition, more color is being seen in venues that influence pop-culture such as on the red carpet and the fashion catwalks.

“Actors are taking more interest in color and there has also been a huge push toward pastel colors among the couture fashion houses,” he explained. “All that makes people more aware and has an impact on the market.”

Creating Euphoria

Perhaps most importantly, the rarity of high-end fancy color diamonds generates interest and supports their value, said Shmulik Polnauer, chief diamond buyer at Leibish & Co., which sells fancy color diamonds primarily online. Polnauer said Rio Tinto’s recent Argyle Pink Diamond Tender demonstrated that such scarcity is driving prices for unique stones higher.

Rio Tinto this year offered just 65 pink and red polished diamonds sourced from its Argyle mine in Australia, considered the primary source of rare pinks despite its diminishing supply. Polnauer estimated that winning bids were significantly higher than what he paid on the dealer market for the Argyle pink diamonds he bought last year.

Polnauer notes that there has already been interest for these goods from dealers and private buyers spanning all markets from Australia to the United States, Europe and Asia. Some of the stones will be re-cut to upgrade their color, he added. Scarselli explained that dealers frequently look at auctions for diamonds they can improve, then bid based on the potential re-cut value rather than the quality presented under the hammer. He added that stones are often presented at auction that are lower quality and have already been dismissed in the dealer market.

For their part, the auction houses can capitalize on the truly special pieces to garner interest in those lesser quality goods and the auction as a whole. Bennett explains that the buzz also helps attract potential new buyers for the unique stones on offer.

After all, as LLD’s Leviev notes, the world of pinks and blues is a different profession altogether with different suppliers to the general market. In fact, Scarselli adds there are only a handful of dealers who can truly appreciate the beauty of these special fancy color diamonds, and very few buyers who can afford them.

“To be able to find a person that would spend $4 million per carat on any beautiful diamond is a challenge. The auction houses need to bring merchandise that will create a euphoria,” Scarselli said. “These sales are not an indication of the overall market but of the value that each stone represents. The reality is that beautiful things sell.”

|

|

|

|

|

|

|

|

|

|

Tags:

Avi Krawitz, Blue Moon, Christie's, josephine, Leviev, Scarselli, Sotheby's

|

|

|

|

|

|

|

|

|

|

|

|

|