|

|

Rapaport TradeWire January 14, 2016

Jan 14, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

January 14, 2016

|

|

|

Sentiment improving after

positive U.S. Christmas season but low expectations for Chinese New Year.

Polished prices firm with supply shortages expected to support the market

through 1Q. Manufacturing increasing slightly but still estimated at 30% below

capacity. Rough demand improving with 5-7% price cut expected at next week’s De

Beers sight. Chow Tai Fook 3Q sales -11%. Luk Fook 3Q same-store sales -25%. Richemont

3Q jewelry maisons sales +2% to $1.8B. Birks 3Q same-store sales +3.5%. Michael

Hill 1H revenue +9% to $213M. U.S. Nov. polished imports -15% to $1.6B, polished

exports -16% to $1.4B. Israel 2015 polished exports -20% to $5B, rough imports

-31% to $2.8B.

|

|

| Diamonds |

1,061,512 |

| Value |

$7,911,405,249 |

| Carats |

1,196,450 |

| Average Discount |

-27.74% |

www.rapnet.com

|

|

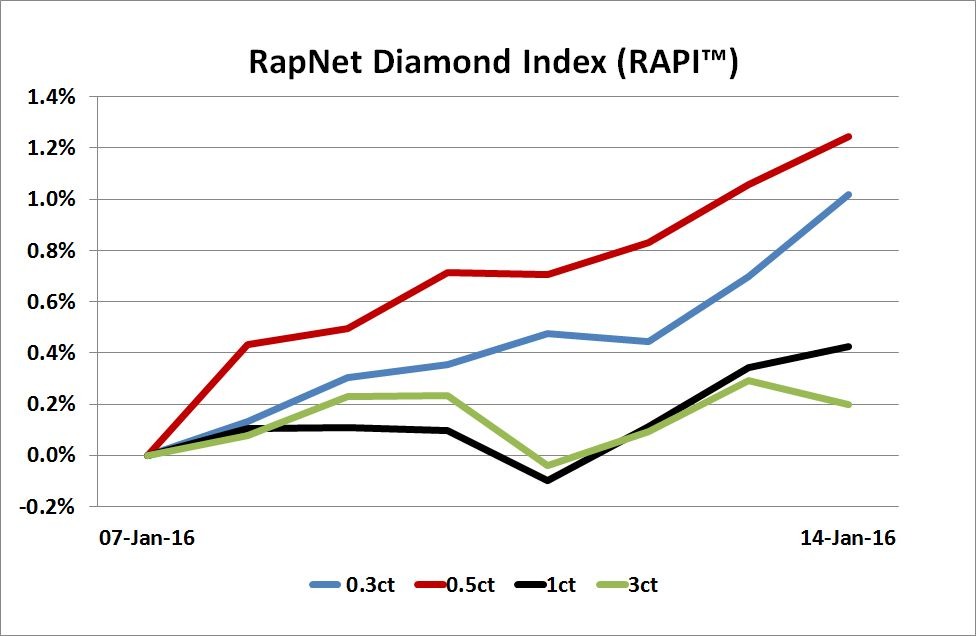

| The RapNet Diamond Index (RAPI) is the average price for the top 25 diamond qualities (D-H, IF-VS2). It is based on the 10 best priced diamonds for each quality. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

Improved living and income standards are likely to be the focus of the [Chinese] government in the coming years as will be increased domestic consumption. So luxury brands can still expect an increase in the number of individuals purchasing luxury items in China, but on average at lower prices.

Improved living and income standards are likely to be the focus of the [Chinese] government in the coming years as will be increased domestic consumption. So luxury brands can still expect an increase in the number of individuals purchasing luxury items in China, but on average at lower prices.

Ken Grant, director at FDKG Insight and publisher of Luxury Insights China for 4Q 2015

|

|

|

|

MARKETS

|

|

|

|

| |

United States: Sentiment improving with

positive reports about jewelry sales over Christmas. Dealers returning to the

market and looking for diamonds but trading limited by shortages...

Belgium: Dealers more optimistic

about the market after solid U.S. Christmas season. Buyers making inquiries to

assess prices rather than place orders...

Hong Kong: Trading is focused on

filling last-minute orders before the wholesale market closes for the Chinese

New Year (Feb. 8)...

India: Polished trading okay

with steady U.S. post-holiday demand but some uncertainty about China...

Israel: Sentiment improving and

dealers gaining confidence to buy. Polished prices firm with shortages limiting

trading for RapSpec A2 (3X, none) diamonds...

Click here to continue reading

|

|

|

|

INSIGHTS

|

|

|

|

| |

Adjusting to China’s New Normal

The diamond industry has a lot riding on the Chinese New Year season and recent events in Shanghai have done little to inspire confidence. As stocks plummeted and the Renminbi depreciated against the dollar, fresh concerns rose about China’s growth prospects, its impact on the global economy and on the diamond and jewelry trade...

Click here to continue reading

|

|

|

|

INDUSTRY

|

|

|

|

| |

U.S. Polished Imports -15% in Nov.

U.S. polished diamond imports fell 15 percent

year on year to $1.62 billion in November. Diamond imports by weight declined

14 percent to 735,561 carats and the average price dipped 0.6 percent to $2,205

per carat. Polished diamond exports, meanwhile, fell 16 percent to $1.37

billion, driving net imports down 9.3 percent to $253 million.

U.S. polished diamond imports fell 15 percent

year on year to $1.62 billion in November. Diamond imports by weight declined

14 percent to 735,561 carats and the average price dipped 0.6 percent to $2,205

per carat. Polished diamond exports, meanwhile, fell 16 percent to $1.37

billion, driving net imports down 9.3 percent to $253 million.

Rough diamond imports soared 37 percent to $31.8

million, while rough exports more than doubled to $18 million, leaving net

rough imports down 9.4 percent to $13.8 million. The net diamond account,

reflecting the difference between net imports and exports, decreased 9.3

percent to $266.8 million.

|

| |

Element Six Takes Legal Action Against Synthetics Firm

Element Six, De Beers'

synthetics business, began legal action January 12 in Singapore against IIa

Technologies, alleging an infringement of patents.

Element Six, De Beers'

synthetics business, began legal action January 12 in Singapore against IIa

Technologies, alleging an infringement of patents.

Some patents for proprietary synthetic diamond

products and their manufacturing method have been infringed, in particular

Singapore patent numbers 115872 and 110508, Element Six claimed in a

statement. The Singapore-based grower of colorless type-IIa gems is “exploiting

Element Six patents for commercial gain,” potentially in both the industrial

and jewelry sectors, the statement alleged.

|

| |

Israel’s 2015 Polished Exports -20%

Israel’s polished diamond

exports slumped 20 percent to $5 billion in 2015 because of a drop in demand in

key markets and a mismatch between the prices of polished and rough gems,

according to the Ministry of Economy.

Israel’s polished diamond

exports slumped 20 percent to $5 billion in 2015 because of a drop in demand in

key markets and a mismatch between the prices of polished and rough gems,

according to the Ministry of Economy.

Polished imports declined 23 percent to $3.48

billion. Net polished exports, representing exports minus imports, fell 13

percent to $1.52 billion.

Rough imports for the year slumped 31 percent to

$2.78 billion and rough exports fell 28 percent to $2.2 billion. Consequently,

net rough imports, representing imports minus exports, slid 39 percent to $585

million. Israel’s net diamond account, the difference between net imports of

rough and net exports of polished, jumped 18 percent to $931 million.

|

| |

IDE Hires Eli Avidar as Managing Director

The Israel Diamond Exchange (IDE) has appointed Eli Avidar as managing director, replacing Moti Besser, who had completed two terms in the role.

The Israel Diamond Exchange (IDE) has appointed Eli Avidar as managing director, replacing Moti Besser, who had completed two terms in the role.

Avidar, managing director of the Israel Diamond Institute Group of Companies (IDI) since January 2007, takes on the new position with immediate effect, according to an IDE statement January 13.

Avidar’s appointment comes after Yoram Dvash was elected president of the IDE in December. Soon after taking office he appointed a new board and committee heads and set up an advisory panel of former presidents.

|

| |

Temple St. Clair, Cartier Win GEM Awards

Temple St. Clair won the

Jewelers of America (JA) GEM Award for Jewelry Design at this year’s ceremony

in New York, which was held January 8.Her design achievements in 2015 included the launch of

her ‘Wings of Desire’ and the debut of her collection ‘Mythical Creatures from

the Golden Menagerie’ at the Musée du Louvre in Paris.

Temple St. Clair won the

Jewelers of America (JA) GEM Award for Jewelry Design at this year’s ceremony

in New York, which was held January 8.Her design achievements in 2015 included the launch of

her ‘Wings of Desire’ and the debut of her collection ‘Mythical Creatures from

the Golden Menagerie’ at the Musée du Louvre in Paris.

Cartier received the GEM Award for Watch Design.

The GEM Award for Media Excellence went to Rob Bates, news director of JCK. Joe

Thompson, editor-in-chief of WatchTime magazine, was the recipient of the 2016

GEM Award for Lifetime Achievement.

|

| |

Diamond-Backed Cryptocurrency to Launch

The companies behind the

world’s first diamond-backed cryptocurrency will start selling the digital

coinage this month. The asset class used is colored diamonds, which the

founders of the PinkCoin claim have not lost value since tracking began in

1959.

The companies behind the

world’s first diamond-backed cryptocurrency will start selling the digital

coinage this month. The asset class used is colored diamonds, which the

founders of the PinkCoin claim have not lost value since tracking began in

1959.

Precious Investments and its subsidiary BitGem

Asset Management (BAM) will launch the PinkCoin crowdsale – a crowdfunding

process in which investors acquire PinkCoin tokens – on January 18.

PinkCoin is based on the

Ethereum cryptocurrency platform and backed by a pool of fixed colored-diamond

assets kept in trust by BAM. The initial crowdsale will comprise 5 million

PinkCoin tokens and the initial diamond asset pool has been valued at $5

million, meaning each token will be worth $1 to begin with. The diamond pool

will be valued on a regular basis.

|

| |

JVC Publishes Quality-Assurance Guide

The Jewelers Vigilance Committee (JVC) has

published a guide that helps jewelers ensure the products they sell comply with

the law.

The Jewelers Vigilance Committee (JVC) has

published a guide that helps jewelers ensure the products they sell comply with

the law.

“Getting It Right – JVC’s Guide to Quality

Programs for Jewelers,” published with a grant from the International

Gemological Institute, provides “simple and useable” tools to implement

quality-assurance programs. The guide aims to increases awareness of elements

that jewelers should address to assure they are following the required

standards.

|

| |

AGS to Run Advert Campaign

The American Gem Society (AGS)

announced plans to launch a campaign in the U.S. to raise customer awareness

about its brand and members and attract younger customers.

The American Gem Society (AGS)

announced plans to launch a campaign in the U.S. to raise customer awareness

about its brand and members and attract younger customers.

“Buy It with Confidence” advertisements will

target men and “Love What You See. And What You Can’t” will be aimed at women.

Print advertisements will run in lifestyle magazines GQ, Glamour and Vogue in the first half of 2016 in

key regional markets to cover Valentine’s Day, Mother’s Day and the bridal

season. A print and digital-media advertisement campaign will run in a wedding

magazine,The Knot, throughout 2016.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Luk Fook’s 3Q Same-Store Sales -25%

Luk Fook reported group

same-store sales from self-operated shops dived 25 percent year on year in the

third quarter that ended December 31 as retail sentiment remained “sluggish.”

Luk Fook reported group

same-store sales from self-operated shops dived 25 percent year on year in the

third quarter that ended December 31 as retail sentiment remained “sluggish.”

Revenue growth in Hong Kong and Macau slumped 26

percent year on year, while mainland-China sales dropped 10 percent. The dip

was from a “relatively higher base” last year.

Sales of gem-set jewelry fell 26 percent and

gold dropped 25 percent.

|

| |

Chow Tai Fook 3Q Sales -11%

Chow

Tai Fook reported group retail sales dropped 11 percent year on year in the

third quarter that ended December 31 as fewer tourists from mainland China

visited Hong Kong and on account of weaker local retail sentiment in Hong Kong

and Macau.

Chow

Tai Fook reported group retail sales dropped 11 percent year on year in the

third quarter that ended December 31 as fewer tourists from mainland China

visited Hong Kong and on account of weaker local retail sentiment in Hong Kong

and Macau.

Same-store sales at the Hong Kong-listed group

dived 15 percent in value terms and slid 13 percent on a volume basis. Hong

Kong and Macau retail sales suffered the steepest decline, falling 20 percent

in total value. Same-store sales in the region plummeted 23 percent by value

and 21 percent by volume.

|

| |

Richemont’s 3Q Sales -4%

Richemont reported revenue – measured at constant exchange rates – declined 4 percent year on year in the third quarter that ended December 31 even as jewelry sales grew in most regions and product categories. Demand for watches was weak.

Richemont reported revenue – measured at constant exchange rates – declined 4 percent year on year in the third quarter that ended December 31 even as jewelry sales grew in most regions and product categories. Demand for watches was weak.

The slowdown reflected weaker trading in Europe than in the previous six months and continued challenging conditions in the Asia-Pacific region.

Total sales at actual rates during the three months increased 3 percent to $3.19 billion (EUR 2.93 billion), the Switzerland-based luxury group said in a statement January 14.

|

| |

Michael Hill’s Sales +9%; Mulls ASX Listing

Michael

Hill reported sales increased 8.7 percent year on year in the first half that

ended December 31.

Michael

Hill reported sales increased 8.7 percent year on year in the first half that

ended December 31.

Revenue grew to $213 million (AUD 306.3

million), while same-store sales advanced 4.8 percent to $201.5 million. The

group opened six new Michael Hill stores during the half year, giving a total

of 293 at the end of December.

The

results come as the jewelry retailer announced it is considering listing shares

on the Australian Securities Exchange (ASX) as the company – founded in New

Zealand – has over time moved its center of gravity to Australia.

|

| |

Birks Group’s 3Q Comparable Sales Rise

Jewelry retailer Birks Group

reported comparable-store sales rose 3.5 percent year on year in the third

quarter, defying difficult market conditions. Total consolidated net

sales – down 6.6 percent on a weaker Canadian dollar – also rose 1.2

percent on an ex-currency basis.

Jewelry retailer Birks Group

reported comparable-store sales rose 3.5 percent year on year in the third

quarter, defying difficult market conditions. Total consolidated net

sales – down 6.6 percent on a weaker Canadian dollar – also rose 1.2

percent on an ex-currency basis.

Comparable-store sales in Canada advanced 5.9

percent and in the U.S. grew 1.4 percent even though a stronger U.S. dollar constrained

tourist spending stateside.

|

| |

Pandora’s Sales +40% in 2015

Pandora

reported preliminary revenue surged 40 percent to $2.44 billion (DKK 16.7

billion) over the year to December 31, in line with its guidance released in November.

Pandora

reported preliminary revenue surged 40 percent to $2.44 billion (DKK 16.7

billion) over the year to December 31, in line with its guidance released in November.

A “tailwind” from foreign-exchange rates of

about 11 percent was one percentage point higher than the previous estimate,

the Denmark-headquartered company said. The company had forecast sales of above

$2.34 billion in 2015.

|

| |

Holiday-Season Mobile Sales +59%

Mobile commerce in the U.S.

soared 59 percent year on year to $12.65 billion in November and December,

according to the latest holiday-season estimates from comScore.

Mobile commerce in the U.S.

soared 59 percent year on year to $12.65 billion in November and December,

according to the latest holiday-season estimates from comScore.

The preliminary figure – sales from smartphones

and tablets – accounts for 18 percent of total digital commerce compared with

13 percent last year, according to a statement January 8. The company had

earlier forecast a 50- to 60-percent surge

in mobile commerce revenues during the same period.

Total digital spend is projected to have risen

13 percent to $69.08 billion, while final data showed online sales from desktop

computers increased 6 percent to $56.43 billion.

|

|

|

|

MINING

|

|

|

|

| |

Dominion Adds Director from Activist Shareholder Group

Dominion Diamond Corporation added two new directors on its board, including one from an institutional investor that had put pressure on the Canada-based miner’s management after a share-price slump in 2015.

Dominion Diamond Corporation added two new directors on its board, including one from an institutional investor that had put pressure on the Canada-based miner’s management after a share-price slump in 2015.

Josef Vejvoda, a portfolio manager at K2 & Associates Investment Management, was appointed after being “identified and proposed to Dominion by a group of shareholders,” according to a Dominion statement January 13. A shareholder group led by K2 “entered into an agreement with Dominion which includes a customary standstill on the part of the group,” the statement added.

Jim Gowans, a former De Beers executive, has also joined the board and will be appointed non-executive chairman by April 30.

|

| |

Rockwell to Close Johannesburg HQ

Rockwell

Diamonds will close its head office in Johannesburg and stop operations at its Saxendrift

mine as part of a strategic review to cut costs and improve cash flow. The

company has also issued all of its employees with retrenchment notices amid a

slump in processing, production and sales figures.

Rockwell

Diamonds will close its head office in Johannesburg and stop operations at its Saxendrift

mine as part of a strategic review to cut costs and improve cash flow. The

company has also issued all of its employees with retrenchment notices amid a

slump in processing, production and sales figures.

The miner will transfer Johannesburg-based key

senior executives to its operations in the country’s Middle Orange River (MOR)

region on a full-time basis, saving about $484,097 (ZAR 7.9 million) per year.

|

| |

Peregrine Unveils Chidliak-Sample Results

Peregrine Diamonds reported an

overall diamond grade of 0.88 carats per tonne from an 814-dry tonne bulk

sample from the Chidliak Diamond Project in Nunavut, Canada. The material was

taken from the CH-7 kimberlite pipe at the mine, which it owns outright.

Peregrine Diamonds reported an

overall diamond grade of 0.88 carats per tonne from an 814-dry tonne bulk

sample from the Chidliak Diamond Project in Nunavut, Canada. The material was

taken from the CH-7 kimberlite pipe at the mine, which it owns outright.

The Toronto-listed exploration company recovered

717.65 carats of commercial-size diamonds, including “53 diamonds one carat or

larger and 183 diamonds over 0.50 carat in size.” The largest individual gem

was a 5.33-carat white octahedron with no inclusions.

Diamond breakage was high, with 75 to 90 percent

of gems damaged, more than double what is typical for large-diameter

reverse-circulation (RC) drilling programs.

|

|

|

|

GENERAL

|

|

|

|

| |

4th India Diamond Week to Begin in New York

The

fourth edition of India Diamond Week will be held in New York from January 18 to

21.

The

fourth edition of India Diamond Week will be held in New York from January 18 to

21.

The event, run by India’s Gem & Jewellery

Export Promotion Council (GJEPC) and New York’s Diamond Dealers Club (DDC),

will host about 15 diamond companies from India at the DDC’s premises. Diamond

wholesalers and dealers who are members of the DDC and trade diamonds in New

York, as well as buyers from Chicago, Los Angeles, Canada and Florida, are

expected to attend the event.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

U.S. stocks were mixed as retailers reported holiday sales, led by Birks Group (+11%). Far-East stocks reflected market turmoil in the region, with Luk Fook (-13.5%) slipping the most on disappointing 3Q sales. Goenka Diamond (+18%) led mixed Indian stocks, while most miners across global markets suffered.

View the detailed industry stock report.

| |

Jan. 14 (11:45 GMT) |

Jan. 7 (10:40 GMT) |

Chng. |

|

| $1 = Euro |

0.91 |

1.09 |

-0.171 |

|

| $1 = Rupee |

67.49 |

66.87 |

0.6 |

|

| $1 = Israel Shekel |

3.94 |

3.94 |

0.00 |

|

| $1 = Rand |

16.62 |

16.06 |

0.56 |

|

| $1 = Canadian Dollar |

1.44 |

1.41 |

0.02 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,092.25 |

$1,096.60 |

-$4.35 |

-0.4% |

| Platinum |

$844.88 |

$868.45 |

-$23.57 |

-2.7% |

| Silver |

$14.09 |

$13.99 |

$0.10 |

0.7% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

24,772.97 |

24,851.83 |

-78.86 |

-0.3% |

| Dow Jones |

16,151.41 |

16,906.51 |

-755.10 |

-4.5% |

| FTSE |

5,842.17 |

5,903.77 |

-61.60 |

-1.0% |

| Hang Seng |

19,817.41 |

20,333.34 |

-515.93 |

-2.5% |

| S&P 500 |

1,890.28 |

1,990.26 |

-99.98 |

-5.0% |

| Yahoo! Jewelry |

981.65 |

974.15 |

7.50 |

0.8% |

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Polished trading okay

with steady U.S. post-holiday demand but some uncertainty about China. Dealers

projecting 2016 will be better than last year as shortages are supporting the

market. Limited supply and firm prices for RapSpec A2 and better diamonds (3X,

none). Still a lot of RapSpec A3 and lower quality diamonds available with

suppliers more flexible on price for these goods. Manufacturing still estimated

30 percent below capacity with little fresh polished supply expected in the

market in 1Q. Rough demand stable ahead of January De Beers sight and ALROSA

sale.

Read the Polished Diamond Trading Report

|

|

|

Advertisements

|

|

|

Advertisements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tags:

Rapaport

|

|

|

|

|

|

|

|

|

|

|

|

|