|

|

Rapaport TradeWire June 16, 2016

Jun 16, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

June 16, 2016

|

|

|

Diamond markets slow as Las

Vegas shows fail to stimulate stronger demand. Low expectations for next week’s

June Hong Kong show with Chinese buyers cautious amid unsure market conditions.

Stable rough prices with reduced supply expected at ALROSA sale and next week’s

De Beers sight. Liquidity concerns deepen as Standard Chartered to exit “risky”

diamond business and other banks tighten industry credit. Luk Fook warns FY

profit -35%/-45%. Christie’s NY sells $42M (69% by lot) with rectangular, 24.18

ct. fancy intense blue, VS2 ‘Cullinan Dream’ selling for $25.4M ($1.04M/ct.).

RJC elects Wilfried Hoerner as chairman. |

|

| Diamonds |

1,061,512 |

| Value |

$7,911,405,249 |

| Carats |

1,196,450 |

| Average Discount |

-27.74% |

www.rapnet.com

|

|

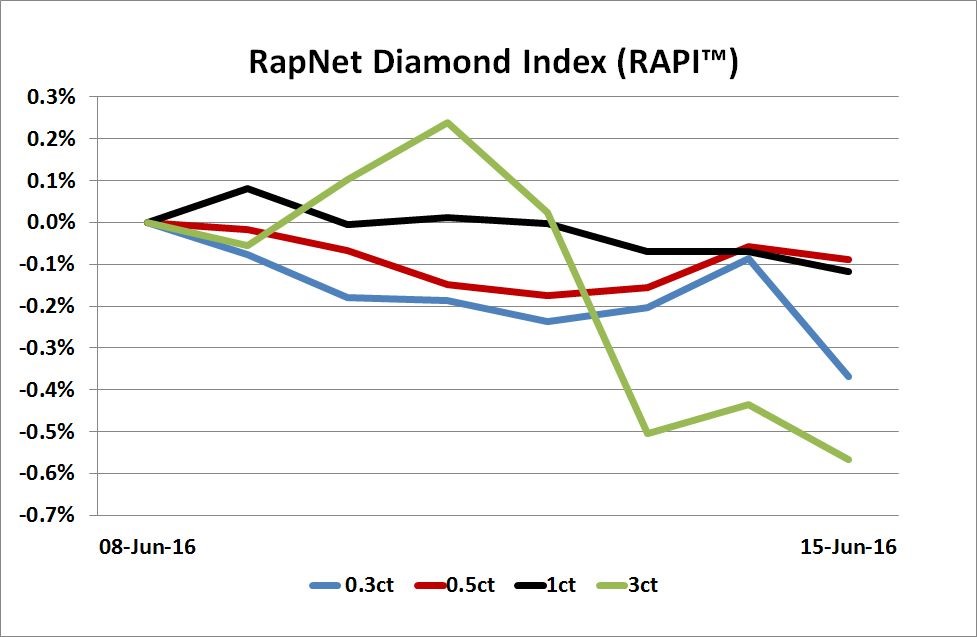

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

We take it personally. We take it seriously when someone is questioning our integrity.

We take it personally. We take it seriously when someone is questioning our integrity.

Mark Light, CEO of Signet Jewelers, defends allegations of 'diamond swapping' at Kay Jewelers in an interview with The Wall Street Journal

|

|

|

|

MARKETS

|

|

|

|

| |

United States: Las Vegas shows just okay. U.S. Jewelry market

stable but diamond demand slow. New York dealers filling orders and sending

goods out on memo…

Belgium: Polished trading slow and sentiment weak.

Dealers returned from Las Vegas with low expectations met. Buyers picky.

Dossiers and 1-carat slowing…

Israel: Dealers back from Las Vegas with mixed reviews

about the show. Demand was very specific with buyers looking to fill existing

orders with narrow specifications. Good demand for SI’s in all categories…

India: Market slow. U.S. demand steady despite

relatively weak Las Vegas shows. Large manufacturers satisfied with demand from

large jewelry chains. Smaller suppliers had a mixed show. Indian domestic

demand cautious…

Hong Kong: Low expectations for next week’s show. Chinese

buyers traveling to the show to assess market conditions rather than buy goods.

Chinese demand slowing with jewelers discounting to attract customers...

Click here for deeper analysis |

|

|

|

INSIGHTS

|

|

|

|

| |

Vegas Shows Reveal Stable, Fast-Changing Market

As a bellwether for the U.S. jewelry market and global diamond industry, this year’s Las Vegas shows met the trade’s conservative expectations. While foot traffic and diamond trading were slightly slower than previous years, jewelry sales were resilient...

Click here to continue reading

|

|

|

|

FIVE-MINUTE INTERVIEW

|

|

|

|

| |

Antwerp’s Pain, Dubai’s Gain

Davy Blommaert, head of diamond lending at Dubai-based National Bank of Fujairah and a former executive of Antwerp Diamond Bank, took time out recently to speak to Rapaport News...

Click here to read the interview |

|

|

|

INDUSTRY

|

|

|

|

| |

Standard Chartered Exits Diamond Business

Standard

Chartered terminated lending to the midstream diamond and jewelry industry having

curbed its exposure to businesses that fail to meet its “new risk profile.”

Standard

Chartered terminated lending to the midstream diamond and jewelry industry having

curbed its exposure to businesses that fail to meet its “new risk profile.”

The

decision comes after the bank tightened its terms of lending to clients in the

diamond sector, requiring manufacturers to secure payment insurance or provide

100% collateral. Standard Chartered has about $2 billion credit

outstanding to the industry, Bloomberg reported.

|

| |

‘Cullinan Dream’ Fetches Record $25M

The ‘Cullinan

Dream’ sold for $25.4 million, or $1.04 million per carat, at Christie’s

Magnificent Jewels auction in New York. The rectangular, 24.18-carat,

fancy intense blue, VS2 diamond fetched a record auction price for its

color category, Christie’s said.

The ‘Cullinan

Dream’ sold for $25.4 million, or $1.04 million per carat, at Christie’s

Magnificent Jewels auction in New York. The rectangular, 24.18-carat,

fancy intense blue, VS2 diamond fetched a record auction price for its

color category, Christie’s said.

The Cullinan

Dream is one of four polished diamonds cut from the 122.52-carat rough

recovered in 2014 at Petra Diamonds’ Cullinan mine in South Africa. Petra sold the

rough into a cutting and polishing partnership for $23.5 million and will

receive a 15% share in the Christie’s sales proceeds.

The Christies

auction had a total value of $42.2 million and was 69% sold by lot.

|

| |

Trump Ring Under the Hammer

An engagement

ring given by Donald Trump to actress and singer Marla Maples will be auctioned

in New York for an estimated $300,000. The emerald-cut, 7.45-carat, Harry

Winston diamond ring will go under the hammer at the Lotte Palace Hotel on June

29.

An engagement

ring given by Donald Trump to actress and singer Marla Maples will be auctioned

in New York for an estimated $300,000. The emerald-cut, 7.45-carat, Harry

Winston diamond ring will go under the hammer at the Lotte Palace Hotel on June

29.

Trump, the

presumptive Republican Party candidate in the U.S. presidential elections this November,

proposed to Maples with the ring in 1991. Following their divorce in 1999,

Maples sold it for $110,000 in June 2000 through an auction by Joseph

DuMouchelle. The same private buyer is returning to the auctioneer for the

resale.

|

| |

RJC Elects Chairman

The

Responsible Jewellery Council (RJC) voted in Wilfried Hoerner, of Switzerland-based precious metals company Argor-Heraeus, as its new chairman. Hoerner replaces interim chair Charles Chaussepied, who held the position since last

July.

The

Responsible Jewellery Council (RJC) voted in Wilfried Hoerner, of Switzerland-based precious metals company Argor-Heraeus, as its new chairman. Hoerner replaces interim chair Charles Chaussepied, who held the position since last

July.

Mark Jenkins

of Signet Jewelers was re-appointed RJC’s honorary secretary at the organization’s

annual general meeting in Las Vegas earlier this month. New board members

include Michael Steinmetz of Leo Schachter Diamonds; Ankur Goyal of MMTC-PAMP

India Pvt Ltd; Jean-Baptiste Dembreville of Baume & Mercier; Bernard Malek

of Cartier; and Harriet Kelsall of Harriet Kelsall Jewellery Design.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Luk Fook Warns on Profit

Luk Fook

warned profit likely slumped 35% to 45% in the fiscal year that ended March 31.

Tourists visiting Hong Kong from mainland China spent less because of a

stronger Hong Kong dollar relative to the Renminbi, the jewelry retailer said.

China’s economic slowdown and an increase in the popularity of other tourist

destinations for luxury purchases also contributed to the slide.

Luk Fook

warned profit likely slumped 35% to 45% in the fiscal year that ended March 31.

Tourists visiting Hong Kong from mainland China spent less because of a

stronger Hong Kong dollar relative to the Renminbi, the jewelry retailer said.

China’s economic slowdown and an increase in the popularity of other tourist

destinations for luxury purchases also contributed to the slide.

|

| |

U.S. Jewelry Store Sales Rise in April

U.S. specialty jewelry store sales increased 3.6% year on

year to $2.29 billion in April, government data showed. Growth matched the

upward trend in U.S. jewelry stores this year which saw revenue from all

outlets advance an estimated

5.4% in April, the sharpest rise in three years. Jewelry

store sales rose 2.1% to $8.83 billion in the first four months of the year.

U.S. specialty jewelry store sales increased 3.6% year on

year to $2.29 billion in April, government data showed. Growth matched the

upward trend in U.S. jewelry stores this year which saw revenue from all

outlets advance an estimated

5.4% in April, the sharpest rise in three years. Jewelry

store sales rose 2.1% to $8.83 billion in the first four months of the year.

|

| |

Signet Under Spotlight Over ‘Swapping’ Allegations

Signet

Jewelers is facing potential class action suits initiated by at least three law firms

which allege the retailer may be in violation of federal securities laws. Signet’s

share price plummeted more than 20% in the past two weeks since allegations

surfaced that staff at its subsidiary Kay Jewelers engaged in “diamond

swapping.”

Signet

Jewelers is facing potential class action suits initiated by at least three law firms

which allege the retailer may be in violation of federal securities laws. Signet’s

share price plummeted more than 20% in the past two weeks since allegations

surfaced that staff at its subsidiary Kay Jewelers engaged in “diamond

swapping.”

Questions

were also raised about its use of credit to boost sales. Signet said there was

“no merit” to the lawyers’ allegations. Short sellers launched a “targeted

attack” to amplify the controversy, Mark Light, Signet’s chief executive

officer, was cited by Bloomberg as saying.

|

|

|

|

MINING

|

|

|

|

| |

RBC Downgrades Dominion

RBC Capital

Markets downgraded Dominion Diamond Corporation to “sector perform” from

“outperform” and reduced its price target for the miner to $11 from $13 per

share.

RBC Capital

Markets downgraded Dominion Diamond Corporation to “sector perform” from

“outperform” and reduced its price target for the miner to $11 from $13 per

share.

The analyst reasoned that rough diamond prices will soften in the summer

before they firm slightly later in the year, while a challenging outlook for

the company's Jay project will also weigh on its performance. The miner recently

announced a two year delay to the Jay project, which is expected to add a

decade to the lifespan of Dominion’s Ekati mine.

|

| |

ALROSA Recovers 241-Ct. Gem

ALROSA found a 241.21-carat rough diamond at its Nyurbinsky mine in Yakutia. The diamond is one of the largest recovered in Russia and the third largest in the company's Nyurba division.

ALROSA found a 241.21-carat rough diamond at its Nyurbinsky mine in Yakutia. The diamond is one of the largest recovered in Russia and the third largest in the company's Nyurba division.

ALROSA also said it has begun

developing the Zarya pipe, a new deposit in its Aikhal Mining and Processing

Division at an estimated initial investment of $149 million (RUB 9.8 billion). The

mine is expected to reach a targeted capacity of 1 million tons of ore per year

by 2021 and have a lifespan of 13 years.

|

| |

Rockwell’s 1Q Sales Spike

Rockwell Diamonds reported rough sales surged 40% year on

year to $9.3

million in the first fiscal quarter that ended

May 31. This followed a restructuring aimed at reversing the recent slump in

the miner’s performance. Sales by volume jumped 11% to 5,191 carats,

while the average price achieved soared 26% to $1,801 per carat.

Rockwell Diamonds reported rough sales surged 40% year on

year to $9.3

million in the first fiscal quarter that ended

May 31. This followed a restructuring aimed at reversing the recent slump in

the miner’s performance. Sales by volume jumped 11% to 5,191 carats,

while the average price achieved soared 26% to $1,801 per carat.

|

| |

Lace Run-of-Mine Goods Sold for $189/Ct.

DiamondCorp

sold two batches of rough diamonds from its Lace mine for $436,597 (ZAR 6.5

million). The 1,838 carats of run-of-mine goods sold for an average price of

$189 per carat, a record high for the company. A separate parcel of 1,679

carats of diamonds from Lace’s tailings operation fetched $53 per carat.

DiamondCorp

sold two batches of rough diamonds from its Lace mine for $436,597 (ZAR 6.5

million). The 1,838 carats of run-of-mine goods sold for an average price of

$189 per carat, a record high for the company. A separate parcel of 1,679

carats of diamonds from Lace’s tailings operation fetched $53 per carat.

|

|

|

|

GENERAL

|

|

|

|

| |

Guinea Greenlights Diamond Bourse

Guinea

approved the opening of a diamond and gold exchange, a joint initiative with

Canadian companies Investissement Royal KSA and Embee Diamond Technologies. The

Diamond and Gold Bourse of Guinea Group (DGBG) will apply for membership of the

World Federation of Diamond Bourses once it becomes operational. Membership of

the DGBG will be open to diamantaires who are audited members of the

Responsible Jewelry Council.

Guinea

approved the opening of a diamond and gold exchange, a joint initiative with

Canadian companies Investissement Royal KSA and Embee Diamond Technologies. The

Diamond and Gold Bourse of Guinea Group (DGBG) will apply for membership of the

World Federation of Diamond Bourses once it becomes operational. Membership of

the DGBG will be open to diamantaires who are audited members of the

Responsible Jewelry Council.

|

| |

De Beers to Divest Stake in Coal Mine

De Beers will

sell its 50% stake in the Morupule Coal Mine in Botswana to the nation’s

government as the miner’s parent Anglo American prunes its commodities

portfolio. The stake will be transferred to the newly formed Minerals

Development Company of Botswana (MDCB), Reuters reported. De Beers holds the

stake through its Debswana Diamond Mining Company subsidiary.

De Beers will

sell its 50% stake in the Morupule Coal Mine in Botswana to the nation’s

government as the miner’s parent Anglo American prunes its commodities

portfolio. The stake will be transferred to the newly formed Minerals

Development Company of Botswana (MDCB), Reuters reported. De Beers holds the

stake through its Debswana Diamond Mining Company subsidiary.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Sotheby’s (-10%) led almost universal declines in U.S.

retail and jewelry stocks this past week, with Signet (-7.1%) continuing its

fall due to “swapping” allegations. Hong Kong-based jewelry stocks also slid as low

sentiment persisted, headed by Chow Sang Sang (-12%). Mining stocks generally

saw a downward trajectory, led by Petra Diamonds (-16%), but Rockwell Diamonds

(+10%) bucked the trend on promising results.

View the detailed industry stock report.

| |

Jun 16 (09:52 GMT) |

Jun 9 (11:19 GMT) |

Chng. |

|

| $1 = Euro |

0.89 |

0.88 |

0.01 |

|

| $1 = Rupee |

67.23 |

66.76 |

0.47 |

|

| $1 = Israel Shekel |

3.87 |

3.85 |

0.02 |

|

| $1 = Rand |

15.34 |

14.85 |

0.49 |

|

| $1 = Canadian Dollar |

1.30 |

1.27 |

0.02 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,304.85 |

$1,259.10 |

$45.75 |

3.6% |

| Platinum |

$984.62 |

$1,001.50 |

-$16.88 |

-1.7% |

| Silver |

$17.72 |

$17.06 |

$0.66 |

3.9% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

26,511.51 |

26,763.46 |

-251.95 |

-0.9% |

| Dow Jones |

17,640.17 |

18,005.05 |

-364.88 |

-2.0% |

| FTSE |

5,929.23 |

6,251.19 |

-321.96 |

-5.2% |

| Hang Seng |

20,038.42 |

21,297.88 |

-1,259.46 |

-5.9% |

| S&P 500 |

2,071.50 |

2,119.12 |

-47.62 |

-2.2% |

| Yahoo! Jewelry |

1,057.70 |

1,068.63 |

-10.93 |

-1.0% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Market slow. U.S. demand steady despite

relatively weak Las Vegas shows. Large manufacturers satisfied with demand from

large jewelry chains. Smaller suppliers had a mixed show. Indian domestic

demand cautious. Asia slow. Local dealers hope June Hong Kong show will keep

the market moving but expectations are low. Polished inventory rising with

stable production levels and sluggish demand. Rough trading stable with muted

expectations for next week’s De Beers sight.

Read the Polished Diamond Trading Report |

|

|

Advertisements

|

|

|

Advertisements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|