|

|

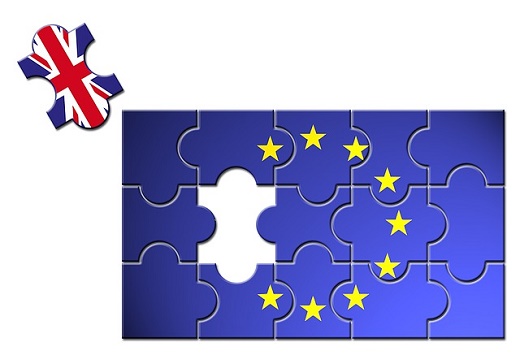

Brexit: Pound's Slump to Hit Jewelry Importers

Jun 26, 2016 7:53 AM

By Rapaport News

|

|

|

RAPAPORT... The U.K.’s National Association of Jewellers (NAJ) warned

the cost of making and importing jewelry in the country will rise, after the

nation voted on Thursday to leave the European Union (EU).

Gold surged 4.7 percent on Comex, according to data compiled

by Bloomberg, and the pound depreciated to

its lowest level in more than 30 years relative to the dollar after results from

the 'Brexit' referendum started trickling early Friday. The euro also slumped 4 percent

as Europe’s second-largest economy snubbed the EU.

“The financial and commodity markets are in turmoil,” said

Michael Rawlinson, chief executive officer of the NAJ (pictured). His pronouncement was

echoed by the Federation of the Swiss

Watch Industry, which also said the result is “bad” for the Swiss watch

industry, according to a report from swissinfo.ch.

“The drop will affect the prices of materials we buy to make

jewelry – metals and gemstones – and also the price of imported jewelry, at

least in the short-term. We need to see what this means in the longer term. We

have a robust industry that has traded successfully when the price of gold was

much higher than it is today.”

Gold, which investors traditionally buy in times of financial uncertainty, looks set to rise even higher, said Marie Owens Thomsen, chief economist at Indosuez Wealth Management, according to a CNBC report.

"Now that the U.K. has voted to leave, we think there's

a higher probability that the $1,350 to $1,360 per ounce level can be breached,

and we're therefore looking for an extended target in the $1,400s,” Owens Thomsen said.

The U.K.’s FTSE 100 index of equities plunged 8.4 percent as it

opened for trading Friday after the result of the vote had been announced,

according to Yahoo Finance. Anglo American, the parent company of De Beers, initially plummeted

17 percent but ended the day about 5 percent down. Gem Diamonds slumped 13 percent and recovered to fall 6.3 percent on Friday.

In the U.S., Signet Jewelers

stock fell 4.1 percent at first and ended the day roughly 5 percent lower. Some 11.3

percent of the retailer’s global sales in the past fiscal year came from its

U.K. jewelry division.

Financial-market volatility and the rise in the price of gold "are unfortunate as they may tend to persuade

consumers not to buy jewelry," said Ernie Blom,

president of the World Federation of Diamond Bourses.

|

|

|

|

|

|

|

|

|

|

Tags:

Brexit, Britain, EU, European Union, Rapaport News, u.k.

|

|

|

|

|

|

|

|

|

|

|