|

|

Rapaport TradeWire July 21, 2016

Jul 21, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

July 21, 2016

|

|

|

Markets weak during

summer trading lull. Dealers frustrated by sluggish demand, rising inventory

and tight profit. Rough market quiet with lower premiums during ALROSA sale. De

Beers 1H production -15% to 13.3M cts., sales +29% to 17.2M cts., prices -14%

to $177/ct. ALROSA 1H production -16%

to 16.9M cts., sales +21% to 21.7M cts., prices -3% to $117/ct. Rio Tinto 1H

production +2% to 8.96M cts. Letšeng 1H sales flat at $106M, average price -16%

to $1,899/ct.Israel 1H polished exports -14% to $2.6B. Chow Sang

Sang warns 1H profit -50%/-60%. Luk Fook 1Q same-store sales -22%. Morgan

Stanley predicts lab-grown diamonds to capture 15% of melee market, melee

prices under pressure.

|

|

| Diamonds |

1,222,805 |

| Value |

$7,963,113,027 |

| Carats | 1,315,873 |

| Average Discount |

-30.04% |

www.rapnet.com

|

|

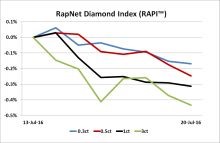

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

Improved technology and economics, and potentially more receptive consumers have propelled lab grown diamonds into a serious potential disruptor of a jewelry category that has existed for more than a century. Diamond miners can contain the threat, but it could be costly.

Improved technology and economics, and potentially more receptive consumers have propelled lab grown diamonds into a serious potential disruptor of a jewelry category that has existed for more than a century. Diamond miners can contain the threat, but it could be costly.

Morgan Stanley analysts on publication of a research note ‘Game of Stones’ about the potential impact of lab-grown diamonds.

|

|

|

|

MARKETS

|

|

|

|

| |

United States: Trading quiet after

dealers returned from vacation. Tough to sell goods that are not typical,

commercial-quality diamonds for engagement ring market…

Belgium: Polished market slow.

Dealers buying only what they need before vacation begins (August 1 to 22)…

Israel: Sentiment weak with July

trading slower than usual. Some suppliers discounting to improve turnover and

increase liquidity…

India: Some U.S. and Chinese

buyers in Mumbai looking for bargains but trading slow and sentiment weak. Quiet

market expected through August…

Hong Kong: Dealer market quiet but

stable during seasonally slow period. Jewelers only buying for specific

customer demand and not for inventory as retail sales contract…

Click here for deeper analysis

|

|

|

|

INDUSTRY

|

|

|

|

| |

De Beers Sales Volume Soars

De Beers sales volume surged

29% from a year ago to 17.2 million carats in the first half as diamond

manufacturers restocked inventory that had depleted toward the end of 2015. Average

realized prices dropped 14% to $177 per carat, while De Beers price index

declined 8% since January. De Beers has scaled back its mining operations in

the weak market conditions, resulting in production declining 15% to 13.314

million carats in the first six months of 2016.

De Beers sales volume surged

29% from a year ago to 17.2 million carats in the first half as diamond

manufacturers restocked inventory that had depleted toward the end of 2015. Average

realized prices dropped 14% to $177 per carat, while De Beers price index

declined 8% since January. De Beers has scaled back its mining operations in

the weak market conditions, resulting in production declining 15% to 13.314

million carats in the first six months of 2016.

|

| |

ALROSA’s Second-Quarter Sales Buoyant

ALROSA’s

rough diamond sales climbed to at least $1.2 billion in the second quarter, up

19% from a year earlier. Sales volume jumped 7% to 9.6 million carats, while

the average price advanced 12% to $127 per carat. Brokers noted demand slowed

at this week’s July sale as the market has started to cool. ALROSA revised down

its production plan for 2016 to 37 million carats, from 39 million carats.

Output dropped 6% to 16.9 million carats in the first half.

ALROSA’s

rough diamond sales climbed to at least $1.2 billion in the second quarter, up

19% from a year earlier. Sales volume jumped 7% to 9.6 million carats, while

the average price advanced 12% to $127 per carat. Brokers noted demand slowed

at this week’s July sale as the market has started to cool. ALROSA revised down

its production plan for 2016 to 37 million carats, from 39 million carats.

Output dropped 6% to 16.9 million carats in the first half.

|

| |

India’s Rough Trade Slows in June

India’s rough imports

plunged 20% to $1.2 billion in June after De Beers reported lower demand

reflected typical seasonal patterns during the month. Rough exports surged 27%

to $130 million. Polished exports from the world’s largest diamond manufacturing

center were flat at $1.85 billion, while polished imports rose 5% to $252

million. India’s net diamond account more than doubled to $519 million, representing

the added value of the diamond trade.

India’s rough imports

plunged 20% to $1.2 billion in June after De Beers reported lower demand

reflected typical seasonal patterns during the month. Rough exports surged 27%

to $130 million. Polished exports from the world’s largest diamond manufacturing

center were flat at $1.85 billion, while polished imports rose 5% to $252

million. India’s net diamond account more than doubled to $519 million, representing

the added value of the diamond trade.

|

| |

Israel’s Diamond Trade Slides amid Weak Sentiment

Israel’s

polished diamond exports fell 14% to $2.61 billion in June as shipments

dropped to the U.S. and Hong Kong, its two largest markets. Polished imports

slid 10% to $1.62 billion. Rough imports were flat at $1.63 billion, while rough

exports increased 2% to $1.39 billion. Israel’s net diamond account declined 23%

to $756 million. Dealers noted a tough trading environment this year as global

demand continues to decline and Israel struggles to maintain its place in the

market.

Israel’s

polished diamond exports fell 14% to $2.61 billion in June as shipments

dropped to the U.S. and Hong Kong, its two largest markets. Polished imports

slid 10% to $1.62 billion. Rough imports were flat at $1.63 billion, while rough

exports increased 2% to $1.39 billion. Israel’s net diamond account declined 23%

to $756 million. Dealers noted a tough trading environment this year as global

demand continues to decline and Israel struggles to maintain its place in the

market.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Chow Sang Sang Issues Profit Warning

Chow Sang Sang warned

profit is expected to plunge 50% to 60% for the first half of 2016 as consumer

sentiment in China and Hong Kong weakened. The jeweler attributed the slump to

a decline in sales turnover and unrealized losses from its gold hedging

activities. The drop in net income would be higher had it not been for a

one-off gain of $31.7 million (HKD 246 million) from a disposal of shares in

Hong Kong Exchanges and Clearing Limited in 2015.

Chow Sang Sang warned

profit is expected to plunge 50% to 60% for the first half of 2016 as consumer

sentiment in China and Hong Kong weakened. The jeweler attributed the slump to

a decline in sales turnover and unrealized losses from its gold hedging

activities. The drop in net income would be higher had it not been for a

one-off gain of $31.7 million (HKD 246 million) from a disposal of shares in

Hong Kong Exchanges and Clearing Limited in 2015.

|

| |

Luk Fook Extends Quarterly Revenue Declines

Luk Fook Holdings

same-store sales at self-operated locations dropped 24% over the three months

that ended March 31. The performance was weighed down by a 26% drop in gold

sales and a 19% slide in gem-set jewelry from a year ago. The company noted sluggish

retail sentiment in Hong Kong and Macau and a steeper drop in Mainland China, where

gem-set jewelry products “started to decline.”

Luk Fook Holdings

same-store sales at self-operated locations dropped 24% over the three months

that ended March 31. The performance was weighed down by a 26% drop in gold

sales and a 19% slide in gem-set jewelry from a year ago. The company noted sluggish

retail sentiment in Hong Kong and Macau and a steeper drop in Mainland China, where

gem-set jewelry products “started to decline.”

|

| |

Swatch having a Tough Time

Swatch Group net income

slumped 52 percent to $266.5 million (CHF 263 million) due to continued global

economic volatility and the impact of an “overvalued” Swiss franc. Sales fell

11% to $3.77 billion (CHF 3.72 billion) weighed by its wholesale

division. Positive sales in Southeast Asia and the Middle East could not

compensate for weakness in Hong Kong and Europe. Swatch singled out the Harry

Winston brand after the high-end jeweler posted a strong half-year and record

month in June.

Swatch Group net income

slumped 52 percent to $266.5 million (CHF 263 million) due to continued global

economic volatility and the impact of an “overvalued” Swiss franc. Sales fell

11% to $3.77 billion (CHF 3.72 billion) weighed by its wholesale

division. Positive sales in Southeast Asia and the Middle East could not

compensate for weakness in Hong Kong and Europe. Swatch singled out the Harry

Winston brand after the high-end jeweler posted a strong half-year and record

month in June.

|

| |

Higher Prices Drive U.S. Jewelry Sales Growth

U.S.

specialty jewelry store sales grew 2% to $2.79 billion in May as jewelry prices

also rose, according to government data. The increase is in line with the

uptrend seen in 2016 as sales at specialty jewelers climbed 2.1% to $11.62

billion during the first five months. Jewelry prices, as measured by the

consumer price index (CPI), advanced 7% in June from a year earlier. The CPI

for jewelry retreated 0.4% month to month in June, after increasing 3.3% in

May.

U.S.

specialty jewelry store sales grew 2% to $2.79 billion in May as jewelry prices

also rose, according to government data. The increase is in line with the

uptrend seen in 2016 as sales at specialty jewelers climbed 2.1% to $11.62

billion during the first five months. Jewelry prices, as measured by the

consumer price index (CPI), advanced 7% in June from a year earlier. The CPI

for jewelry retreated 0.4% month to month in June, after increasing 3.3% in

May.

|

| |

India’s Bluestone Raises $30M to Fund Expansion

Bluestone

closed a $30 million (INR 2 billion) round of fundraising to strengthen its

position in India’s online jewelry market. The funds will be used to expand the

company’s design and manufacturing capacity, and for marketing initiatives.

India’s jewelry market is expected to grow from $60 billion currently to $110

billion in the next five years, with online sales projected at $2

billion to $3 billion, according to Bluestone. The company is targeting a

four-fold increase in revenue to $149 million (INR 10 billion) by 2018.

Bluestone

closed a $30 million (INR 2 billion) round of fundraising to strengthen its

position in India’s online jewelry market. The funds will be used to expand the

company’s design and manufacturing capacity, and for marketing initiatives.

India’s jewelry market is expected to grow from $60 billion currently to $110

billion in the next five years, with online sales projected at $2

billion to $3 billion, according to Bluestone. The company is targeting a

four-fold increase in revenue to $149 million (INR 10 billion) by 2018.

|

|

|

|

MINING

|

|

|

|

| |

Rio Tinto Cuts Full-Year Rough Output Guidance

Rio Tinto

lowered its diamond production forecast for this year following a restructuring

that saw the group merge its diamonds and copper businesses. The company now

expects to recover between 18 and 21 million carats, which is still above last

year’s 17.4 million carats. The group’s diamond production advanced 2% to 8.959

million carats in the first half with output at its Argyle mine up 4% due to a

ramp up of underground operations. Production at the Diavik mine fell 5%.

Rio Tinto

lowered its diamond production forecast for this year following a restructuring

that saw the group merge its diamonds and copper businesses. The company now

expects to recover between 18 and 21 million carats, which is still above last

year’s 17.4 million carats. The group’s diamond production advanced 2% to 8.959

million carats in the first half with output at its Argyle mine up 4% due to a

ramp up of underground operations. Production at the Diavik mine fell 5%.

|

| |

Letšeng Average Prices Slide

Average

prices at the Letšeng mine in Lesotho dropped 16% to $1,899 per carat in the

first half due to a shift in mining to lower-value but higher-grade areas. Mine

operator Gem Diamonds said fewer large diamonds – above 100 carats – were recovered

during the period. Letšeng’s revenue was flat at $106.3 million with the volume

of sales increasing 19% to 55,959 carats during the six months.

Average

prices at the Letšeng mine in Lesotho dropped 16% to $1,899 per carat in the

first half due to a shift in mining to lower-value but higher-grade areas. Mine

operator Gem Diamonds said fewer large diamonds – above 100 carats – were recovered

during the period. Letšeng’s revenue was flat at $106.3 million with the volume

of sales increasing 19% to 55,959 carats during the six months.

|

| |

Stornoway Launches Ore Processing at Renard Mine

Stornoway

Diamond Corporation started processing ore at its flagship Renard mine,

signaling the first diamond production in Canada’s Quebec province. Commercial

production will be achieved once processing has been maintained for 30 days at

60% of the plant’s capacity. The mine is expected to reach full capacity within

nine months and subsequently produce 1.8 million carats per annum in the first

10 years, at an average valuation of $155 per carat.

Stornoway

Diamond Corporation started processing ore at its flagship Renard mine,

signaling the first diamond production in Canada’s Quebec province. Commercial

production will be achieved once processing has been maintained for 30 days at

60% of the plant’s capacity. The mine is expected to reach full capacity within

nine months and subsequently produce 1.8 million carats per annum in the first

10 years, at an average valuation of $155 per carat.

|

| |

Firestone Diamonds Plans First Sale

Firestone

Diamonds expects to host its first sale of rough in January as construction at

the Liqhobong mine in Lesotho continues ahead of schedule. Development of the

mine was 85% complete at the end of June and production is expected to come on

stream in the fourth quarter. The mine will take at least six months to reach

full capacity of 1 million carats per year and is expected to yield between

380,000 and 450,000 carats in the fiscal year ending June 30.

Firestone

Diamonds expects to host its first sale of rough in January as construction at

the Liqhobong mine in Lesotho continues ahead of schedule. Development of the

mine was 85% complete at the end of June and production is expected to come on

stream in the fourth quarter. The mine will take at least six months to reach

full capacity of 1 million carats per year and is expected to yield between

380,000 and 450,000 carats in the fiscal year ending June 30.

|

|

|

|

GENERAL

|

|

|

|

| |

Lab Grown Diamonds Pose Threat to Melee Prices

Lab-grown

diamonds will probably develop into a niche that could take a 15% share of the melee

diamond market, according to research by Morgan Stanley. That would impact

prices and may result in the mined melee market dropping 12% in value, the

analysts said. The research foresees lab-grown diamonds taking a 7.5% share of

the larger-gems space but without impacting prices. Morgan Stanley urged ALROSA

and De Beers to each invest at least $200 million a year in marketing to combat

the threat.

Lab-grown

diamonds will probably develop into a niche that could take a 15% share of the melee

diamond market, according to research by Morgan Stanley. That would impact

prices and may result in the mined melee market dropping 12% in value, the

analysts said. The research foresees lab-grown diamonds taking a 7.5% share of

the larger-gems space but without impacting prices. Morgan Stanley urged ALROSA

and De Beers to each invest at least $200 million a year in marketing to combat

the threat.

|

| |

Tiara Gems Buys Million-Dollar Kimberley Treasure

Rio Tinto

sold its ‘Kimberley Treasure’ gold and diamond coin to Dubai-based Tiara Gems

and Jewellery, a specialist in rare fancy color diamonds and collectibles. The coin,

which is made up of one kilogram of 99.99% fine gold and includes a radiant

cut, 0.54-carat red diamond from the Argyle mine, was snapped up within 48

hours of becoming available for sale. Rio Tinto did not disclose the actual

sale price, but previously put a $762,280 (AUD 1 million) price tag on the

piece.

Rio Tinto

sold its ‘Kimberley Treasure’ gold and diamond coin to Dubai-based Tiara Gems

and Jewellery, a specialist in rare fancy color diamonds and collectibles. The coin,

which is made up of one kilogram of 99.99% fine gold and includes a radiant

cut, 0.54-carat red diamond from the Argyle mine, was snapped up within 48

hours of becoming available for sale. Rio Tinto did not disclose the actual

sale price, but previously put a $762,280 (AUD 1 million) price tag on the

piece.

|

| |

London's Jewelry District to get $3M Makeover

Hatton

Garden business owners approved a $3.3 million (GBP 2.5 million) investment to

carry out improvements in London’s famed jewelry district. A Business Improvement

District (BID) will be set up in October to carry out the upgrade over the next

four-and-a-half years. The development will focus on providing better business

connections and representation for the business community, promoting the area, improving the public facilities, and enhancing the environment.

Hatton

Garden business owners approved a $3.3 million (GBP 2.5 million) investment to

carry out improvements in London’s famed jewelry district. A Business Improvement

District (BID) will be set up in October to carry out the upgrade over the next

four-and-a-half years. The development will focus on providing better business

connections and representation for the business community, promoting the area, improving the public facilities, and enhancing the environment.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

While most of the major indices rose, diamond and jewelry

companies had a mixed week on the stock markets. Gains were led by Firestone

Diamonds (+19.3%) and Stornoway Diamonds (+17.5%), as both are nearing first

production at their respective mine developments. Retailers had a tougher time

with Chow Sang Sang (-8.7%) and Luk Fook (-5.1) noting continued sales declines

in 2016 reflecting a weak consumer environment in Hong Kong. Swatch Group

(-5.8%) noted similar trends as its profit plunged in the first half.

View the detailed industry stock report

| |

July 21 (13:01 GMT) |

Jul 14 (13:01 GMT) |

Chng. |

|

| $1 = Euro |

0.91 |

0.90 |

0.01 |

|

| $1 = Rupee |

67.18 |

66.87 |

0.31 |

|

| $1 = Israel Shekel |

3.85 |

3.85 |

0.00 |

|

| $1 = Rand |

14.29 |

14.25 |

0.04 |

|

| $1 = Canadian Dollar |

1.31 |

1.29 |

0.01 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,319.28 |

$1,321.75 |

-$2.47 |

-0.2% |

| Platinum |

$1,082.50 |

$1,085.55 |

-$3.05 |

-0.3% |

| Silver |

$19.35 |

$20.08 |

-$0.73 |

-3.6% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

27,710.52 |

27,942.11 |

-231.59 |

-0.8% |

| Dow Jones |

18,595.03 |

18,372.12 |

222.91 |

1.2% |

| FTSE |

6,701.39 |

6,699.81 |

1.58 |

0.0% |

| Hang Seng |

22,000.49 |

21,561.06 |

439.43 |

2.0% |

| S&P 500 |

2,173.02 |

2,152.43 |

20.59 |

1.0% |

| Yahoo! Jewelry |

998.19 |

969.25 |

28.94 |

3.0% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Some U.S. and Chinese buyers in Mumbai looking for bargains but trading slow and sentiment weak. Quiet market expected through August. Low expectations for Mumbai show (August 4 to 8) with gold jewelry demand sluggish at high gold prices in rupee. Manufacturing stable with less rough available and slower trading on secondary market ahead of next week’s De Beers sight.

Read the Polished Diamond Trading Report |

|

|

Advertisements

|

|

|

Advertisements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|