|

|

Rapaport TradeWire July 28, 2016

Jul 28, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

July 28, 2016

|

|

|

NY jewelry shows quiet. Better goods stable but

market sentiment weak. Dealers cautious ahead of summer vacations in Belgium

and Israel. Low expectations for next week’s Mumbai show as gold jewelry sales

decline after price surge (+28% in Rupee for 2016). De Beers 1H revenue +8% to

$3.3B, underlying earnings +5% to $379M. Petra FY sales +1% to $431M. LVMH 1H

jewelry & watch sales +4% to $1.8B. U.S. government guarantees Barclays

Bank $125M loan facility for Botswana manufacturing. Chow Tai Fook plans to

supply diamonds to U.S. retailers as China jewelry sales slow. Rapaport to

offer guaranteed 100% natural, untreated, melee diamonds for sale at August

9-18 auction. |

|

| Diamonds |

1,230,307 |

| Value |

$7,987,674,845 |

| Carats |

1,316,444 |

| Average Discount |

-30.20% |

www.rapnet.com

|

|

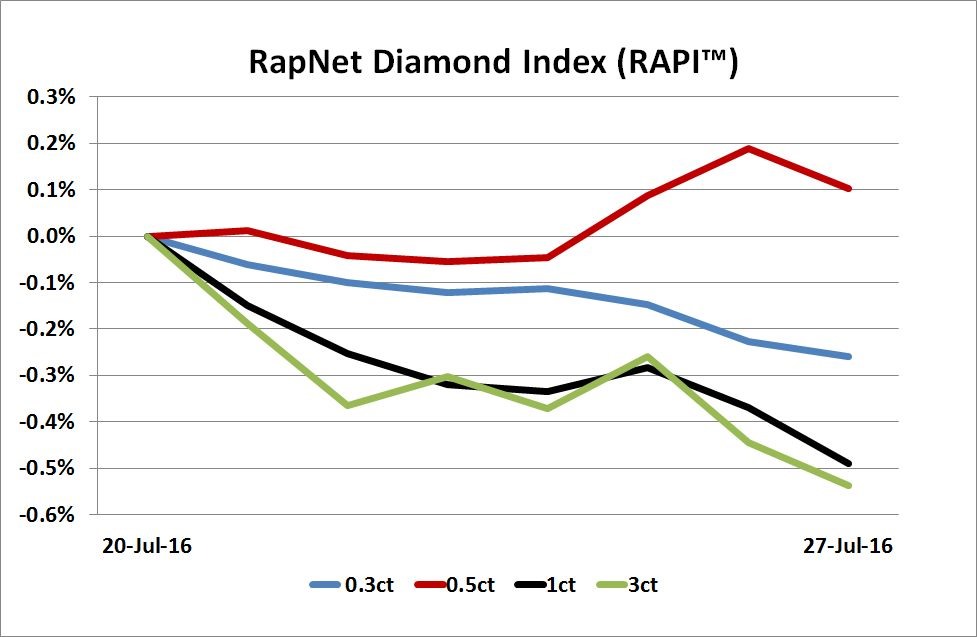

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

In the midstream, caution in rough diamond buying is expected to prevail, as the supplies bought by diamantaires in the first half of 2016 are gradually converted into polished.

In the midstream, caution in rough diamond buying is expected to prevail, as the supplies bought by diamantaires in the first half of 2016 are gradually converted into polished.

Anglo American, the parent company of De Beers, on the outlook for the diamond industry in the second half of 2016

|

|

|

|

MARKETS

|

|

|

|

| |

United States: Focus on NY Jewelry week but activity slow. JA,

Luxury and Antique shows more about networking than trading. Jewelers trying to

differentiate themselves to profit in weak…

Belgium: Polished trading relatively busy with suppliers

closing deals before three week vacation (August 1 to 22). Dealers happy to

take a break as global trading expected to slow until September…

Israel: Polished trading quiet due to summer slowdown

and sluggish global demand. Dealers preparing for vacation with Israel Diamond

Exchange to close August 15 to 28…

India: Polished trading slow. Buyers selective and

uncertain about prices. Few foreign buyers in Mumbai as U.S., Israel and

Belgium seasonally quiet…

Hong Kong: Dealer sentiment mixed with some noting slight

improvement this week. Chinese demand stable. Hong Kong retail sluggish…

Click here for deeper analysis

|

|

|

|

ANNOUNCEMENT

|

|

|

|

| |

Rapaport to offer 100% guaranteed natural, untreated, melee diamonds for sale at August 9-18 auction

"Melee diamond markets

are under pressure due to the unethical behavior of dealers who mix synthetic

diamonds into parcels of natural diamonds. It is vital that we create

legitimate markets for natural diamonds by statistically sample testing melee

parcels and, where possible and practical, testing all diamonds in a parcel to

ensure that buyers have an opportunity to source 100% guaranteed natural

untreated diamonds.

"Rapaport Auctions will be providing thousands of carats of

sample tested melee (99% tolerance and 1% significance levels) as well as

select parcels of 100% tested melee at our upcoming August 9-18 melee auctions.

The diamond trade must protect the promise of diamonds and the integrity of its

people by separating natural diamonds from synthetics," said Ezriel Rapaport,

Director of Rapaport Global Trading.

|

|

|

|

FIVE-MINUTE INTERVIEW

|

|

|

|

| |

Selling Emotion to Luxury Consumers

Rapaport News spoke with Tom Heyman, a principle at high-end jeweler Oscar Heyman, about the company’s approach to operating in its niche within the jewelry and luxury space...

Click here to read the interview |

|

|

|

INDUSTRY

|

|

|

|

| |

U.S. Backs Funding for Botswana Diamond Trade

The U.S.

government’s Overseas Private Investment Corporation (OPIC) guaranteed a $125

million loan to Botswana’s diamond manufacturing sector. Barclays Bank of

Botswana will provide the loan, which is the first tranche of a broader $250

million OPIC loan-guarantee program for Botswana’s diamond industry. Additional

lenders may join the program in the future.

The U.S.

government’s Overseas Private Investment Corporation (OPIC) guaranteed a $125

million loan to Botswana’s diamond manufacturing sector. Barclays Bank of

Botswana will provide the loan, which is the first tranche of a broader $250

million OPIC loan-guarantee program for Botswana’s diamond industry. Additional

lenders may join the program in the future.

|

| |

Botswana Beneficiation Still Viable, Says Minister

Diamond

beneficiation is still a viable project in Botswana despite lower supply to the

country’s manufacturers, Kitso Mokaila, the Minister of Minerals, Energy and

Water Resources, told parliament. The number of diamond factories operating in

Botswana has fallen to 19 factories employing just 2,000 people as market

conditions weakened, Mmegi cited Mokaila as saying. Rough supply to

local manufacturers slumped 46% to $502.2 million in 2015 but sales were “off

to a good start” this year fetching $343 million in the first four sales, according to Mokaila.

Diamond

beneficiation is still a viable project in Botswana despite lower supply to the

country’s manufacturers, Kitso Mokaila, the Minister of Minerals, Energy and

Water Resources, told parliament. The number of diamond factories operating in

Botswana has fallen to 19 factories employing just 2,000 people as market

conditions weakened, Mmegi cited Mokaila as saying. Rough supply to

local manufacturers slumped 46% to $502.2 million in 2015 but sales were “off

to a good start” this year fetching $343 million in the first four sales, according to Mokaila.

|

| |

Fischler Elected VP of World Diamond Council

The World

Diamond Council (WDC) named Stephane Fischler as its vice-president

(VP) to succeed Andrey Polyakov as president in 2018. Fischler (pictured), a

partner in Fischler Diamonds and president of the Antwerp World Diamond Centre,

is also VP of the International Diamond Council and the Diamond Development

Initiative. Ronnie Vanderlinden was reelected treasurer of the WDC for a second

term, while Udi Sheintal will remain its corporate secretary.

The World

Diamond Council (WDC) named Stephane Fischler as its vice-president

(VP) to succeed Andrey Polyakov as president in 2018. Fischler (pictured), a

partner in Fischler Diamonds and president of the Antwerp World Diamond Centre,

is also VP of the International Diamond Council and the Diamond Development

Initiative. Ronnie Vanderlinden was reelected treasurer of the WDC for a second

term, while Udi Sheintal will remain its corporate secretary.

|

| |

Jewelers of America Enlists New Directors

Jewelers

of America (JA) elected Mike Alexander, a vice-president at Jewelers Mutual

Insurance Company (pictured, right), and Ronda Daily, CEO of Bremer Jewelry (left), as board members

until 2019. The new directors were voted in at JA’s semi-annual board meeting

in New York on July 23, replacing outgoing directors Brian Mann of David Mann,

Inc, and Teresa Saldivar of Teresa’s Jewelers.

Jewelers

of America (JA) elected Mike Alexander, a vice-president at Jewelers Mutual

Insurance Company (pictured, right), and Ronda Daily, CEO of Bremer Jewelry (left), as board members

until 2019. The new directors were voted in at JA’s semi-annual board meeting

in New York on July 23, replacing outgoing directors Brian Mann of David Mann,

Inc, and Teresa Saldivar of Teresa’s Jewelers.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Chow Tai Fook Targets U.S. Diamond Sales

Chow Tai

Fook is looking to supply rough and polished diamonds to U.S. retailers as the

jeweler seeks new revenue streams following a sales slump in China and Hong

Kong. The jeweler plans to start the enterprise within a

year and has set up a team to conduct feasibility studies.

Chow Tai

Fook is looking to supply rough and polished diamonds to U.S. retailers as the

jeweler seeks new revenue streams following a sales slump in China and Hong

Kong. The jeweler plans to start the enterprise within a

year and has set up a team to conduct feasibility studies.

|

| |

Bulgari Lifts LVMH Jewelry Sales

Jewelry

and watch sales at LVMH Moët Hennessy Louis Vuitton increased 4% to $1.77 billion

in the first half of 2016. The business unit’s profit from recurring operations

was flat at $225.3 million. Growth was driven by the Bulgari brand which “outperformed”

the market, while TAG Heuer was also singled out as it gained market share in

part due to the success of its 'Connected' smartwatch.

Jewelry

and watch sales at LVMH Moët Hennessy Louis Vuitton increased 4% to $1.77 billion

in the first half of 2016. The business unit’s profit from recurring operations

was flat at $225.3 million. Growth was driven by the Bulgari brand which “outperformed”

the market, while TAG Heuer was also singled out as it gained market share in

part due to the success of its 'Connected' smartwatch.

|

| |

Swiss Watch Exports Continue to Slide

Swiss

watch exports fell 16% to $1.66 billion (CHF 1.64 billion) in June, the

steepest drop this year. Shipments of precious-metal watches dropped 31% to

$497.5 million with all other major categories suffering a decline. Orders from

Hong Kong, Switzerland’s largest trade partner for watches, fell 29% to $187.9

million, the 17th consecutive month of decline. The worst-performing price

category was the $203 (CHF 200) to $506 (CHF 500) range where exports slid 20%.

Swiss

watch exports fell 16% to $1.66 billion (CHF 1.64 billion) in June, the

steepest drop this year. Shipments of precious-metal watches dropped 31% to

$497.5 million with all other major categories suffering a decline. Orders from

Hong Kong, Switzerland’s largest trade partner for watches, fell 29% to $187.9

million, the 17th consecutive month of decline. The worst-performing price

category was the $203 (CHF 200) to $506 (CHF 500) range where exports slid 20%.

|

| |

India Eases Rules on Controversial Excise Tax

The Indian

government relaxed its rules regarding a 1-percent excise duty on jewelry that

led to a six-week strike earlier this year. Under the new terms, businesses

with revenue of up to $2.2 million (INR 150 million) are exempt from the tax,

whereas the previous cut-off was $1.8 million (INR 120 million). The change

comes after the government set up a committee to interact with the jewelry

trade over the tax.

The Indian

government relaxed its rules regarding a 1-percent excise duty on jewelry that

led to a six-week strike earlier this year. Under the new terms, businesses

with revenue of up to $2.2 million (INR 150 million) are exempt from the tax,

whereas the previous cut-off was $1.8 million (INR 120 million). The change

comes after the government set up a committee to interact with the jewelry

trade over the tax.

|

|

|

|

MINING

|

|

|

|

| |

De Beers Earnings Rise

De Beers

reported revenue grew 8% to $3.27 billion and underlying earnings rose 5% to $379

million in the first half of 2016. The miner benefited from stronger rough diamond demand,

tighter cost controls and favorable exchange rates. Rough sales jumped 11% to

$3.1 billion, spurred by a 29% leap in sales volume which outweighed a 14% drop

in average prices. Rough demand improved as manufacturers and dealers

replenished inventories that were reduced in the second half of last year, the

company said.

De Beers

reported revenue grew 8% to $3.27 billion and underlying earnings rose 5% to $379

million in the first half of 2016. The miner benefited from stronger rough diamond demand,

tighter cost controls and favorable exchange rates. Rough sales jumped 11% to

$3.1 billion, spurred by a 29% leap in sales volume which outweighed a 14% drop

in average prices. Rough demand improved as manufacturers and dealers

replenished inventories that were reduced in the second half of last year, the

company said.

|

| |

Snap Lake Mine up for Sale

De Beers is

looking to sell the Snap Lake mine in Canada after suspending operations in

December. The company has hired Bank of Montreal to market the asset which has

failed to make money since production started in 2008, according to Reuters. In

June, De Beers received approval to flood the mine’s tunnels, which would reduce

its maintenance costs. The flooding will likely occur in the fourth quarter if

no buyer is found.

De Beers is

looking to sell the Snap Lake mine in Canada after suspending operations in

December. The company has hired Bank of Montreal to market the asset which has

failed to make money since production started in 2008, according to Reuters. In

June, De Beers received approval to flood the mine’s tunnels, which would reduce

its maintenance costs. The flooding will likely occur in the fourth quarter if

no buyer is found.

|

| |

Petra Sales Rise Despite Depressed Prices

Petra

Diamonds revenue climbed 1.4% to $430.9 million in the fiscal year that ended

June 30 as increased sales volume outweighed a drop in rough prices. Diamond

sales by weight jumped 9% to 3.4 million carats and prices fell 6% during the

year. Production jumped 16% to 3.7 million carats, above the company’s upper guidance

of 3.65 million carats. Petra expects production to rise to between 4.6 million

and 4.8 million carats in fiscal 2017.

Petra

Diamonds revenue climbed 1.4% to $430.9 million in the fiscal year that ended

June 30 as increased sales volume outweighed a drop in rough prices. Diamond

sales by weight jumped 9% to 3.4 million carats and prices fell 6% during the

year. Production jumped 16% to 3.7 million carats, above the company’s upper guidance

of 3.65 million carats. Petra expects production to rise to between 4.6 million

and 4.8 million carats in fiscal 2017.

|

| |

Diamcor Earnings Fall Deeper Into the Red

Diamcor

Mining reported its net loss plummeted 80% to $4.3 million (CAD 5.6 million) in

the fiscal year ending March 31. Sales jumped 52% to $3.5 million (CAD 4.7

million) as plant efficiencies and processing volumes improved. However, operating

expenses rose 53% to $3.7 million as it ramped up operations at the

Krone-Endora at Venetia project in South Africa.

Diamcor

Mining reported its net loss plummeted 80% to $4.3 million (CAD 5.6 million) in

the fiscal year ending March 31. Sales jumped 52% to $3.5 million (CAD 4.7

million) as plant efficiencies and processing volumes improved. However, operating

expenses rose 53% to $3.7 million as it ramped up operations at the

Krone-Endora at Venetia project in South Africa.

|

|

|

|

GENERAL

|

|

|

|

| |

Sarine Pens Deal with Singapore Retailer

Sarine

Technologies struck a deal with Soo Kee Group to provide its digital diamond

display equipment at the Singapore-based jeweler’s Love & Co. stores. The

‘Sarine Profile’ technology will be implemented in the LVC Lovemark diamond

collection at Love & Co. stores in Singapore and Malaysia, marking the

product's first roll out in Asia. The equipment enables jewelers to integrate

Sarine’s digital platform to its inventory and communications systems.

Sarine

Technologies struck a deal with Soo Kee Group to provide its digital diamond

display equipment at the Singapore-based jeweler’s Love & Co. stores. The

‘Sarine Profile’ technology will be implemented in the LVC Lovemark diamond

collection at Love & Co. stores in Singapore and Malaysia, marking the

product's first roll out in Asia. The equipment enables jewelers to integrate

Sarine’s digital platform to its inventory and communications systems.

|

| |

RJC, Miners Advance Work on Responsible Jewelry

The

Responsible Jewellery Council (RJC) and the Alliance for Responsible Mining

(ARM) renewed an agreement to strengthen their collaboration in promoting and

facilitating responsible jewelry supply chains. The two organizations said they

share objectives to promote responsible precious-metals supply chains and will

continue cooperating to ensure their standards and assurance models are

“mutually supportive.” They also aligned aspects of their assurance systems.

The

Responsible Jewellery Council (RJC) and the Alliance for Responsible Mining

(ARM) renewed an agreement to strengthen their collaboration in promoting and

facilitating responsible jewelry supply chains. The two organizations said they

share objectives to promote responsible precious-metals supply chains and will

continue cooperating to ensure their standards and assurance models are

“mutually supportive.” They also aligned aspects of their assurance systems.

|

| |

Pippa Middleton Ring Spurs Asscher Cut Craze

Asscher-cut

diamonds have soared in popularity since Pippa Middleton received an engagement

ring with the fancy shape, according to 77 Diamonds. Middleton, the Duchess of

Cambridge’s younger sister (pictured), got engaged to hedge fund manager James

Matthews last weekend. Matthews proposed with an Asscher-cut diamond

thought to weigh about 4 carats.

Asscher-cut

diamonds have soared in popularity since Pippa Middleton received an engagement

ring with the fancy shape, according to 77 Diamonds. Middleton, the Duchess of

Cambridge’s younger sister (pictured), got engaged to hedge fund manager James

Matthews last weekend. Matthews proposed with an Asscher-cut diamond

thought to weigh about 4 carats.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

U.K.-listed miners had a strong week, led by Stellar

Diamonds (+35%), which gained from a low base on news of joint ventures in Guinea and Liberia. Anglo American (+6.3%) rose as the miner reported a narrower

loss and lower net debt. Mining stocks elsewhere were mixed, with declines

headed by True North Gems (-6.3%). LVMH (+8.2%) led European luxury retail

stocks following solid results.

View the detailed industry stock report

| |

July 28 (11:36 GMT) |

July 21 (13:01 GMT) |

Chng. |

|

| $1 = Euro |

0.90 |

0.91 |

-0.01 |

|

| $1 = Rupee |

67.04 |

67.18 |

-0.14 |

|

| $1 = Israel Shekel |

3.82 |

3.85 |

-0.03 |

|

| $1 = Rand |

14.26 |

14.29 |

-0.03 |

|

| $1 = Canadian Dollar |

1.32 |

1.31 |

0.01 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,341.95 |

$1,319.28 |

$22.67 |

1.7% |

| Platinum |

$1,145.69 |

$1,082.50 |

$63.19 |

5.8% |

| Silver |

$20.37 |

$19.35 |

$1.02 |

5.3% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

28,208.62 |

27,710.52 |

498.10 |

1.8% |

| Dow Jones |

18,472.17 |

18,595.03 |

-122.86 |

-0.7% |

| FTSE |

6,736.61 |

6,701.39 |

35.22 |

0.5% |

| Hang Seng |

22,174.34 |

22,000.49 |

173.85 |

0.8% |

| S&P 500 |

2,166.58 |

2,173.02 |

-6.44 |

-0.3% |

| Yahoo! Jewelry |

1,020.52 |

998.19 |

22.33 |

2.2% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Polished trading slow. Buyers selective and

uncertain about prices. Few foreign buyers in Mumbai as U.S., Israel and

Belgium seasonally quiet. Steady demand from major U.S. retail programs. Low

expectations for IIJS show (August 4 to 8) as gold demand stumbles. Steady

demand for 1 ct., G-H, VS-SI, 3X goods. Stars and melee weak amid concerns

synthetics will have long-term market impact. Rough demand and manufacturing

levels stable.

Read the Polished Diamond Trading Report |

|

|

Advertisements

|

|

|

Advertisements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|