|

|

Rapaport TradeWire August 4, 2016

Aug 4, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

August 4, 2016

|

|

|

Diamond

trading quiet. Polished prices soften in July with 1 ct. RAPI -1.7%, 0.30 ct.

-1.8%, 0.50 ct. -0.5%, 3 ct. -1.5%. India IIJS show opens with steady local

traffic but no foreign buyers. Rough demand stable as De Beers sells $520M in

July. Canada’s Gahcho Kué mine begins production that is expected to reach 4.5M

ct. a year. Rio Tinto 1H diamond revenue +3% to $342M, profits -29% to $22M.

Ben Moss to close all 54 stores. Belgium July polished exports -14% to $1.2B,

rough imports +17% to $907M. European Commission approves Antwerp ‘Carat Tax’.

Industry mourns passing of former Dominion Diamond CEO Robert Gannicott.

|

|

| Diamonds |

1,222,355 |

| Value |

$7,954,529,172 |

| Carats |

1,314,815 |

| Average Discount |

-30.04% |

www.rapnet.com

|

|

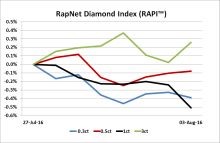

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

The complex and burdensome discussions on the control and valuation of the stock of diamond traders, an annually recurring grievance for many diamond-trading companies, will no longer occur as a result of the Carat Tax.

The complex and burdensome discussions on the control and valuation of the stock of diamond traders, an annually recurring grievance for many diamond-trading companies, will no longer occur as a result of the Carat Tax.

The Antwerp World Diamond Center lends its support to a new, simpler tax regime for Belgium’s diamond trade.

|

|

|

|

MARKETS

|

|

|

|

| |

United

States: Sentiment

weak with quiet polished market. Stable demand for 1 ct., H-I, SI diamonds.

Good demand for 3X as prices softened…

Belgium:

Market at a standstill with the bourses closed from August 1 to 22. New Carat

Tax introduced for 2017 aiming to simplify tax calculation and ease tensions

with banks and authorities…

Israel:

Polished

trading seasonally slow in August. Dealers preparing for vacation before bourse

closes (August 15 to 28). Slight improvement at one-day Blue and White fair

with few overseas participants…

India:

Polished

trading quiet. Jewelers focused on IIJS show (August 4 to 8). Low expectations

for diamond and gold jewelry sales. Very few foreign buyers attending…

Hong

Kong: Jewelry

retailers discounting to clear stock during slow summer typhoon season. General

retail sales declines 11 percent in first half – worst drop in 17 years – due

to slowdown in tourism and economic growth…

Click here for deeper analysis

|

|

|

|

RAPAPORT STATEMENT

|

|

|

|

| |

Diamond Prices Decline in July

Polished

diamond prices softened in July continuing the downtrend in the second quarter.

Diamond markets were seasonally quiet. Overall polished demand remains weak.

The RapNet Diamond Index (RAPI™) for one carat diamonds fell 1.7% in July. RAPI

for 0.30-carat diamonds dropped 1.8% and RAPI for 0.50-carat diamonds declined

0.5%. RAPI for 3-carat diamonds fell 1.5%.

Click

here to read the full statement

|

|

|

|

INDUSTRY

|

|

|

|

| |

European Commission Approves Belgium ‘Carat Tax’

A new tax

system for Belgium’s diamond industry is expected to ease the trade’s tax

calculation even if it will result in a higher bill. Under the proposed ‘Carat

Tax,’ the tax calculation for diamond traders will be based on revenue rather

than profit, meaning that inventory valuations will be taken out of the

equation. The new regime will improve stability and make the industry more

appealing to banks, the Antwerp World Diamond Centre said. The tax still has to

be approved by Belgium’s Parliament and is likely to be adopted into law by

year-end. The European Commission approved it July 29.

A new tax

system for Belgium’s diamond industry is expected to ease the trade’s tax

calculation even if it will result in a higher bill. Under the proposed ‘Carat

Tax,’ the tax calculation for diamond traders will be based on revenue rather

than profit, meaning that inventory valuations will be taken out of the

equation. The new regime will improve stability and make the industry more

appealing to banks, the Antwerp World Diamond Centre said. The tax still has to

be approved by Belgium’s Parliament and is likely to be adopted into law by

year-end. The European Commission approved it July 29.

|

| |

Belgium’s Polished Trading Declines

Belgium’s polished diamond exports fell 14% to $1.02 billion

in July and polished imports slid 17% to $840.4 million. This mirrored a trend

this year that has seen growth in rough shipments but a decline in polished.

Rough imports surged 17% to $907.7 million in July and rough exports jumped 14%

to $1.17 billion.

Belgium’s polished diamond exports fell 14% to $1.02 billion

in July and polished imports slid 17% to $840.4 million. This mirrored a trend

this year that has seen growth in rough shipments but a decline in polished.

Rough imports surged 17% to $907.7 million in July and rough exports jumped 14%

to $1.17 billion.

|

| |

India Could Get Jewelry Park

India’s Gem

& Jewellery Export Promotion Council (GJEPC) is planning to develop the

sector’s first industrial park to improve standards and bring manufacturers under

one roof. The dedicated zone in Mumbai will enable small-scale jewelry industry

members to manufacture plain gold and studded jewelry at a single venue.

India’s Gem

& Jewellery Export Promotion Council (GJEPC) is planning to develop the

sector’s first industrial park to improve standards and bring manufacturers under

one roof. The dedicated zone in Mumbai will enable small-scale jewelry industry

members to manufacture plain gold and studded jewelry at a single venue.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Pawnbrokers’ Pre-Merger Sales Grow

Pawnbrokers First

Cash Financial Services and Cash America International both reported an

increase in second-quarter revenue and raised their earnings guidance ahead of their planned

merger in the third quarter. First Cash sales grew 9.4% to $115.5 million

in the second quarter with record pawn receivable balances in Latin America and

“improving trends” in the U.S. Cash America’s revenue increased 2% to $241.2

million.

Pawnbrokers First

Cash Financial Services and Cash America International both reported an

increase in second-quarter revenue and raised their earnings guidance ahead of their planned

merger in the third quarter. First Cash sales grew 9.4% to $115.5 million

in the second quarter with record pawn receivable balances in Latin America and

“improving trends” in the U.S. Cash America’s revenue increased 2% to $241.2

million.

|

| |

Kering Watch Sales Lag in Tough Market

Kering’s

jewelry brands outperformed watches in the first half as revenue from

timepieces declined in a challenging market environment. Watch and jewelry

sales fell 4.4% from a year ago to an estimated $390 million (EUR 349 million),

according to Rapaport estimates. Revenue increased in each of the

group’s luxury categories except timepieces. Kering’s jewelry and watch brands

include Boucheron, Dodo, Girard-Perregaux, Pomellato and Ulysse Nardin.

Kering’s

jewelry brands outperformed watches in the first half as revenue from

timepieces declined in a challenging market environment. Watch and jewelry

sales fell 4.4% from a year ago to an estimated $390 million (EUR 349 million),

according to Rapaport estimates. Revenue increased in each of the

group’s luxury categories except timepieces. Kering’s jewelry and watch brands

include Boucheron, Dodo, Girard-Perregaux, Pomellato and Ulysse Nardin. |

| |

Canadian Jewelry Chain Ben Moss to Close

Ben Moss

Jewellers will shut all 54 of its stores across Canada after a weak local

currency and the economic slowdown in Western Canada forced the company out of

business. The Winnipeg-based jeweler, which sells mid- to high-priced jewelry,

obtained court protection under the Companies’ Creditors Arrangement Act in

May. Going-out-of-business sales began July 30 at all remaining outlets, with

discounts of up to 40% on all merchandise, including the entire stock of gold

and silver jewelry and diamonds.

Ben Moss

Jewellers will shut all 54 of its stores across Canada after a weak local

currency and the economic slowdown in Western Canada forced the company out of

business. The Winnipeg-based jeweler, which sells mid- to high-priced jewelry,

obtained court protection under the Companies’ Creditors Arrangement Act in

May. Going-out-of-business sales began July 30 at all remaining outlets, with

discounts of up to 40% on all merchandise, including the entire stock of gold

and silver jewelry and diamonds. |

|

|

|

MINING

|

|

|

|

| |

De Beers July Sales Total $520M

De Beers sold

$520 million of rough diamonds in its sixth sales cycle of 2016. Sales declined

sequentially from a revised $564 million in the fifth cycle in

June. The miner reported “positive” sightholder sentiment but maintained a

cautious outlook for the rest of the year. Sales include the July sight in

Gaborone, Botswana, as well as auction revenue and supply to beneficiation and

government partners. Trading of De Beers boxes on the secondary market was stable

during the sight.

De Beers sold

$520 million of rough diamonds in its sixth sales cycle of 2016. Sales declined

sequentially from a revised $564 million in the fifth cycle in

June. The miner reported “positive” sightholder sentiment but maintained a

cautious outlook for the rest of the year. Sales include the July sight in

Gaborone, Botswana, as well as auction revenue and supply to beneficiation and

government partners. Trading of De Beers boxes on the secondary market was stable

during the sight.

|

| |

Gahcho Kué Mine Poised for 1Q Launch

De Beers and Mountain Province started a formal ramp-up of

diamond production at the Gahcho Kué mine in Canada. Commercial operations are on

track to come on stream in the first quarter of 2017. Gahcho Kué is the world’s

largest new diamond mine and is expected to produce an average of 4.5 million

carats per year over a 13-year lifespan. De Beers holds a 51% stake and

Mountain Province owns the balance of shares.

De Beers and Mountain Province started a formal ramp-up of

diamond production at the Gahcho Kué mine in Canada. Commercial operations are on

track to come on stream in the first quarter of 2017. Gahcho Kué is the world’s

largest new diamond mine and is expected to produce an average of 4.5 million

carats per year over a 13-year lifespan. De Beers holds a 51% stake and

Mountain Province owns the balance of shares. |

| |

Rio Tinto Diamond Sales Rise

Rio Tinto’s

diamond revenue increased 3% to $342 million in the first half of 2016. Net

earnings slid 29% to $22 million. The U.S. consumer market was steady but

demand from India and China continued to be slower, while rough prices were

varied across product types, the miner said. Production increased 2.1% to 9

million carats due to a continued ramp-up of underground operations at the

Argyle mine in Australia, which outweighed lower grades at the Diavik mine in

Canada.

Rio Tinto’s

diamond revenue increased 3% to $342 million in the first half of 2016. Net

earnings slid 29% to $22 million. The U.S. consumer market was steady but

demand from India and China continued to be slower, while rough prices were

varied across product types, the miner said. Production increased 2.1% to 9

million carats due to a continued ramp-up of underground operations at the

Argyle mine in Australia, which outweighed lower grades at the Diavik mine in

Canada.

|

| |

Dominion Mourns Death of Former Chairman

Dominion Diamond Corporation announced the death of former

chairman and chief executive officer Robert Gannicott at the age of 69.

Gannicott was chairman from June 2004 until April 2016 and CEO from September

1999 to July 2015. He passed away August 3 after an extended battle with

leukemia.

Dominion Diamond Corporation announced the death of former

chairman and chief executive officer Robert Gannicott at the age of 69.

Gannicott was chairman from June 2004 until April 2016 and CEO from September

1999 to July 2015. He passed away August 3 after an extended battle with

leukemia.

|

| |

Rio Tinto Launches Chain of Custody

Rio Tinto

announced a scheme to track diamonds from its Argyle mine through the supply

chain in response to growing consumer and trade interest in diamond provenance.

The miner will enforce its chain of custody initiative using a trademark and a

suite of marketing materials, including a Certificate of Authenticity, to which

authorized suppliers and retailers will have access. The certificate will

accompany accredited jewelry throughout the supply chain.

Rio Tinto

announced a scheme to track diamonds from its Argyle mine through the supply

chain in response to growing consumer and trade interest in diamond provenance.

The miner will enforce its chain of custody initiative using a trademark and a

suite of marketing materials, including a Certificate of Authenticity, to which

authorized suppliers and retailers will have access. The certificate will

accompany accredited jewelry throughout the supply chain.

|

| |

Gemfields Ramps Up Ruby Output

Gemfields

reported ruby and corundum production from its Montepuez mine in Mozambique jumped

23% to 10.3 million carats in the fiscal year ending June 30. Output was above

the miner’s forecast of 8 million carats. The increase was driven by a 68% surge

in the volume of “higher-quality” rubies recovered. Sales totaled $73.1

million. Emerald and beryl production from the Kagem mine in Zambia was

flat at 30 million carats while sales amounted to $101.3 million.

Gemfields

reported ruby and corundum production from its Montepuez mine in Mozambique jumped

23% to 10.3 million carats in the fiscal year ending June 30. Output was above

the miner’s forecast of 8 million carats. The increase was driven by a 68% surge

in the volume of “higher-quality” rubies recovered. Sales totaled $73.1

million. Emerald and beryl production from the Kagem mine in Zambia was

flat at 30 million carats while sales amounted to $101.3 million.

|

|

|

|

GENERAL

|

|

|

|

| |

GIA Job Fair Draws Large Crowd

The

Gemological Institute of America (GIA) Jewelry Career Fair attracted 600 people

at the Javits Center New York on July 25. Participants included high-profile

industry figures, GIA students and recruiters. Job seekers had the opportunity

to meet 42 companies looking to fill hundreds of positions and synch up with 24

career coaches.

The

Gemological Institute of America (GIA) Jewelry Career Fair attracted 600 people

at the Javits Center New York on July 25. Participants included high-profile

industry figures, GIA students and recruiters. Job seekers had the opportunity

to meet 42 companies looking to fill hundreds of positions and synch up with 24

career coaches.

|

| |

GIA Allocates $2M for Scholarships

The GIA will

offer $2 million of scholarships next year for its Gemology and Jewelry

Manufacturing Arts programs, courses and laboratory programs. Applications are

open on the GIA’s website until September 30. The scholarships are available

for distance e-learning courses and for campus-based programs in

Bangkok, Carlsbad, Hong Kong, London, Mumbai, New York and Taiwan, as well as

at GIA branches in Botswana and Dubai.

The GIA will

offer $2 million of scholarships next year for its Gemology and Jewelry

Manufacturing Arts programs, courses and laboratory programs. Applications are

open on the GIA’s website until September 30. The scholarships are available

for distance e-learning courses and for campus-based programs in

Bangkok, Carlsbad, Hong Kong, London, Mumbai, New York and Taiwan, as well as

at GIA branches in Botswana and Dubai. |

| |

London Bourse Reaches Out to Workshops

The London Diamond

Bourse (LDB) launched a new membership category that enables workshop owners to

maintain a presence in the city’s diamond district after soaring rents have

forced them to leave. The LDB is offering mounters, setters and polishers space

in the bourse to meet customers and letting them use the exchange’s postal

address.

The London Diamond

Bourse (LDB) launched a new membership category that enables workshop owners to

maintain a presence in the city’s diamond district after soaring rents have

forced them to leave. The LDB is offering mounters, setters and polishers space

in the bourse to meet customers and letting them use the exchange’s postal

address.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Stocks suffered globally this past week with the major

indices falling. U.S. retail and jewelry stocks declined almost across the

board. Far East shares also largely lost value, led by Chow Tai Fook (-6.3%) as

Hong Kong retail sales showed their heaviest drop in 17 years. Kering (+6.4%)

outperformed otherwise sluggish European stocks on promising first-half

results. Miners had a mixed week, with Rockwell Diamonds (-14%) falling and

Gemfields (+14%) gaining on higher-than-forecast production figures.

View the detailed industry stock report

| |

Aug 4 (11:25 GMT) |

July 28 (11:36 GMT) |

Chng. |

|

| $1 = Euro |

0.90 |

0.90 |

0.00 |

|

| $1 = Rupee |

66.93 |

67.04 |

-0.12 |

|

| $1 = Israel Shekel |

3.83 |

3.82 |

0.00 |

|

| $1 = Rand |

13.75 |

14.26 |

-0.51 |

|

| $1 = Canadian Dollar |

1.31 |

1.32 |

-0.01 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,360.28 |

$1,341.95 |

$18.33 |

1.4% |

| Platinum |

$1,159.50 |

$1,145.69 |

$13.81 |

1.2% |

| Silver |

$20.40 |

$20.37 |

$0.03 |

0.1% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

27,714.37 |

28,208.62 |

-494.25 |

-1.8% |

| Dow Jones |

18,355.00 |

18,472.17 |

-117.17 |

-0.6% |

| FTSE |

6,720.87 |

6,736.61 |

-15.74 |

-0.2% |

| Hang Seng |

21,832.23 |

22,174.34 |

-342.11 |

-1.5% |

| S&P 500 |

2,163.79 |

2,166.58 |

-2.79 |

-0.1% |

| Yahoo! Jewelry |

997.54 |

1,020.52 |

-22.98 |

-2.3% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Polished

trading quiet. Jewelers focused on IIJS show (August 4 to 8). Low expectations

for diamond and gold jewelry sales. Very few foreign buyers attending. Good

demand for 1 ct., G-J, VS-SI diamonds. U.S demand steady. Chinese and domestic

Indian demand cautious. Rough trading stable after last week’s De Beers sight..

Read the Polished Diamond Trading Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|