|

|

Rapaport TradeWire December 1, 2016

Dec 1, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

December 1, 2016

|

|

|

Holiday season begins with

optimism as stock markets hit record high on Black Friday. Foot traffic flat, average

spend -3% to $289 over Thanksgiving weekend, reports NRF. Millennial shift to online

purchases continues with Cyber Monday sales +13% to $3.5B, according to Adobe Digital Insights. Polished market stable with

buying opportunities in India due to rupee liquidity crisis. Shrenuj nears deal

to ease $450M debt as De Beers sight suspended. Christie’s HK sells $79M (80%

by lot). Tiffany 3Q sales +1% to $949M, profit +5% to $95M. Lukoil 3Q Grib

diamond sales +33% to $62M. Alan Bronstein elected president of Natural Color

Diamond Association.

|

|

| Diamonds |

1,296,155 |

| Value |

$7,964,274,890 |

| Carats |

1,361,974 |

| Average Discount |

-30.33% |

www.rapnet.com

|

|

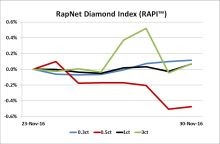

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

The weekend results underline the importance of brands effectively converging digital and physical channels to deliver a single, seamless shopping experience to consumers, particularly during the high-volume holiday season.

The weekend results underline the importance of brands effectively converging digital and physical channels to deliver a single, seamless shopping experience to consumers, particularly during the high-volume holiday season.

Shelley Kohan, vice president of retail consulting at RetailNext, on Black Friday's shift online

|

|

|

|

MARKETS

|

|

|

|

| |

United

States: Positive sentiment as stock market rally and strong dollar lift

expectations for holiday season. Jewelers expect sales bump in coming weeks…

Belgium: Trading quiet with steady low-volume orders for the holiday season. Some

dealers buying bargains (“Metzios”) amid Indian liquidity crisis…

Israel:

Polished trading stable with steady orders from U.S. independent

retailers. Demand from larger chains has slowed. Little inventory buying as

jewelers focus on selling during holiday season…

India: Polished trading quiet with dealers very cautious after rupee currency

cancellation. Domestic demand slow. Opportunistic foreign buyers looking for

bargains during liquidity crunch…

Hong

Kong: Steady traffic at Jewellery Manufacturers Association Show (Nov. 24-27)

but diamond sales weak…

Click here for deeper analysis

|

|

|

|

INDUSTRY

|

|

|

|

| |

Cautious ALROSA Seeks to Steady Rough Prices

ALROSA pledged to keep rough diamond prices stable in an effort to support manufacturers’ profit margins after demand improved this year. Sales jumped 54% in the first nine months of the year with prices generally steady at its monthly sales, chief executive officer Andrey Zharkov said. The miner plans to increase diamond production by 5% to 38.85 million carats next year, Russian news service TASS cited Zharkov as saying.

ALROSA pledged to keep rough diamond prices stable in an effort to support manufacturers’ profit margins after demand improved this year. Sales jumped 54% in the first nine months of the year with prices generally steady at its monthly sales, chief executive officer Andrey Zharkov said. The miner plans to increase diamond production by 5% to 38.85 million carats next year, Russian news service TASS cited Zharkov as saying.

|

| |

Shrenuj Nears Debt Deal to Ease Liquidity Crisis

Shrenuj

& Co. is close to securing at least $100 million in funding to ease its

debt crisis. The Mumbai-based company is in the final stages of preparing the

deal, which it expects to announce in mid-December, sources said. Shrenuj has bank

debts amounting to $450 million, of which $35 million is overdue. A strain on

liquidity has forced the company to scale down its diamond-cutting

operations in Botswana, while its De Beers sightholder status was suspended in July.

Shrenuj

& Co. is close to securing at least $100 million in funding to ease its

debt crisis. The Mumbai-based company is in the final stages of preparing the

deal, which it expects to announce in mid-December, sources said. Shrenuj has bank

debts amounting to $450 million, of which $35 million is overdue. A strain on

liquidity has forced the company to scale down its diamond-cutting

operations in Botswana, while its De Beers sightholder status was suspended in July.

|

| |

Blue Diamond Tops Billing at Christie’s Hong Kong

Christie’s

garnered $79 million (HKD 611 million) at its Hong Kong Magnificent Jewels

auction, selling 80% by lot and 84% by value. The highlight was the sale of a

marquise-cut, 4.29-carat, fancy vivid blue, internally flawless diamond ring

for $11.8 million, or $2.7 million per carat. Christie’s also sold the

oval-shaped, 10.05-carat ‘Ratnaraj’ ruby and diamond ring for $10.2 million, which at just over $1 million per

carat was the third-highest average price on record for a ruby.

Christie’s

garnered $79 million (HKD 611 million) at its Hong Kong Magnificent Jewels

auction, selling 80% by lot and 84% by value. The highlight was the sale of a

marquise-cut, 4.29-carat, fancy vivid blue, internally flawless diamond ring

for $11.8 million, or $2.7 million per carat. Christie’s also sold the

oval-shaped, 10.05-carat ‘Ratnaraj’ ruby and diamond ring for $10.2 million, which at just over $1 million per

carat was the third-highest average price on record for a ruby.

|

| |

Sotheby’s Hong Kong Jewelry Auction Fetches $3.5M

Sotheby’s

notched sales of $3.5 million (HKD 26.8 million) at its Important Jewels and

Jadeite auction in Hong Kong. The most expensive item was an early 20th-century

gem-set and diamond dragon bracelet, which fetched $266,000, double its

pre-sale upper estimate of $103,160. A brilliant-cut round, 6.01-carat,

D-color, internally flawless diamond failed to sell, having had a low-end

pre-sale estimate of $515,800. The auction was sold 56% by lot and 37% by

value.

Sotheby’s

notched sales of $3.5 million (HKD 26.8 million) at its Important Jewels and

Jadeite auction in Hong Kong. The most expensive item was an early 20th-century

gem-set and diamond dragon bracelet, which fetched $266,000, double its

pre-sale upper estimate of $103,160. A brilliant-cut round, 6.01-carat,

D-color, internally flawless diamond failed to sell, having had a low-end

pre-sale estimate of $515,800. The auction was sold 56% by lot and 37% by

value.

|

| |

Sarine Profit Signals Manufacturing Recovery

Sarine

Technologies said third-quarter sales jumped 82% to $17.3 million due to

stronger polished demand in key markets and a recovery in the rough sector. The

company, which supplies equipment to diamond manufacturers, reported a profit

of $4 million versus a loss of $1.4 million a year ago. Sales still lag the

$20.4 million revenue reported two years ago, despite the significant

growth from 2015.

Sarine

Technologies said third-quarter sales jumped 82% to $17.3 million due to

stronger polished demand in key markets and a recovery in the rough sector. The

company, which supplies equipment to diamond manufacturers, reported a profit

of $4 million versus a loss of $1.4 million a year ago. Sales still lag the

$20.4 million revenue reported two years ago, despite the significant

growth from 2015.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Black Friday Sales Decline

Sales

and foot traffic at physical stores in the U.S. fell over the Thanksgiving and

Black Friday weekend as more retail business moved online, initial figures

showed. In-store sales declined 4.2% and traffic fell 4.4%, according to

RetailNext. ShopperTrak said foot traffic was flat on Black Friday and declined

1% across the two days. The average spend fell 3% from last year to $289 over

the weekend, according to the National Retail Federation.

Sales

and foot traffic at physical stores in the U.S. fell over the Thanksgiving and

Black Friday weekend as more retail business moved online, initial figures

showed. In-store sales declined 4.2% and traffic fell 4.4%, according to

RetailNext. ShopperTrak said foot traffic was flat on Black Friday and declined

1% across the two days. The average spend fell 3% from last year to $289 over

the weekend, according to the National Retail Federation.

|

| |

Cyber Monday Pulls Ahead

Online retail activity over Black Friday and Cyber Week increased from last year. Sales from desktop

computers climbed 17% to $1.29 billion on Thanksgiving and jumped 19% to $1.97

billion on Black Friday, ComScore reported. Online sales during Cyber

Monday rose 12% to $3.4 billion with toys and electronics driving ecommerce

spending, according to Adobe Digital Insights.

Online retail activity over Black Friday and Cyber Week increased from last year. Sales from desktop

computers climbed 17% to $1.29 billion on Thanksgiving and jumped 19% to $1.97

billion on Black Friday, ComScore reported. Online sales during Cyber

Monday rose 12% to $3.4 billion with toys and electronics driving ecommerce

spending, according to Adobe Digital Insights.

|

| |

Tiffany Sparkles With Rare Sales Rise

Tiffany

& Co.’s sales increased 1% to $949.3 million in the three months that ended

October 31 marking the jeweler’s first sales rise in two years. An improvement

in fashion jewelry drove growth, partly offsetting flat engagement and wedding

jewelry and weak high-end statement pieces. At constant exchange rates, sales

were flat, while comparable store sales fell 3%. Net earnings increased 5% to

$95.1 million.

Tiffany

& Co.’s sales increased 1% to $949.3 million in the three months that ended

October 31 marking the jeweler’s first sales rise in two years. An improvement

in fashion jewelry drove growth, partly offsetting flat engagement and wedding

jewelry and weak high-end statement pieces. At constant exchange rates, sales

were flat, while comparable store sales fell 3%. Net earnings increased 5% to

$95.1 million.

|

| |

Hearts On Fire Hit by U.S. Challenges

Revenue

generated by the Hearts On Fire jewelry brand declined in the first fiscal half

because of tough conditions in the U.S. retail market, its Hong Kong-based parent Chow Tai Fook reported. Hearts On Fire sales slid 9% to $41.8 million (HKD

324.5 million) in the six months ending September 30, while its operating loss

widened 21% to $8.5 million. The brand’s wholesale revenue slumped 14%, while

its retail revenue increased 12%.

Revenue

generated by the Hearts On Fire jewelry brand declined in the first fiscal half

because of tough conditions in the U.S. retail market, its Hong Kong-based parent Chow Tai Fook reported. Hearts On Fire sales slid 9% to $41.8 million (HKD

324.5 million) in the six months ending September 30, while its operating loss

widened 21% to $8.5 million. The brand’s wholesale revenue slumped 14%, while

its retail revenue increased 12%.

|

|

|

|

MINING

|

|

|

|

| |

Lukoil’s Diamond Mine Sales Jump

Lukoil’s

diamond revenue from its Grib mine in Russia rose 33% to $61.9 million (RUB 4

billion) in the third quarter. Sales more than doubled to $232.3 million in the

first nine months from $108.4 million a year ago. Lukoil, Russia’s largest oil

producer, started recovering rough diamonds at Grib in September 2014 and production

continues to ramp up to full capacity.

Lukoil’s

diamond revenue from its Grib mine in Russia rose 33% to $61.9 million (RUB 4

billion) in the third quarter. Sales more than doubled to $232.3 million in the

first nine months from $108.4 million a year ago. Lukoil, Russia’s largest oil

producer, started recovering rough diamonds at Grib in September 2014 and production

continues to ramp up to full capacity.

|

| |

Lucapa Secures Angola Exploration Permit

Lucapa

Diamond Company received approval to explore the Lulo Diamond Project in Angola

for another five years. Lucapa has already stepped up its kimberlite

exploration program in anticipation of the government approval, with two rigs

drilling the priority kimberlite targets and a third due to arrive in Angola in

December. The Lulo alluvial mine is the source of several large rough diamonds,

including the biggest in Angola’s history that fetched $16 million in

February.

Lucapa

Diamond Company received approval to explore the Lulo Diamond Project in Angola

for another five years. Lucapa has already stepped up its kimberlite

exploration program in anticipation of the government approval, with two rigs

drilling the priority kimberlite targets and a third due to arrive in Angola in

December. The Lulo alluvial mine is the source of several large rough diamonds,

including the biggest in Angola’s history that fetched $16 million in

February.

|

| |

DiamondCorp Battles to Save Lace Mine

Deloitte began talks with stakeholders in the

Lace Diamond Mine (LDM) as parent company DiamondCorp continues to assess the

viability of its troubled South African operation. LDM entered

business rescue earlier this month after torrential rain left the South

African mine flooded, resulting in a suspension of operations for more than 12 weeks.

Deloitte began talks with stakeholders in the

Lace Diamond Mine (LDM) as parent company DiamondCorp continues to assess the

viability of its troubled South African operation. LDM entered

business rescue earlier this month after torrential rain left the South

African mine flooded, resulting in a suspension of operations for more than 12 weeks.

|

| |

Two Diamond Mines for Sale in South Africa

Rockwell

Diamonds placed two of its mines on the selling block in an attempt to turn the

company’s fortunes around. The junior miner started a process to sell the

Remhoogte/Holsloot and Saxendrift mines in South Africa to streamline its

operations. The turnaround plan encompasses measures to accelerate production at

the Wouterspan mine, which includes moving its Holsloot processing plant to the site.

Rockwell

Diamonds placed two of its mines on the selling block in an attempt to turn the

company’s fortunes around. The junior miner started a process to sell the

Remhoogte/Holsloot and Saxendrift mines in South Africa to streamline its

operations. The turnaround plan encompasses measures to accelerate production at

the Wouterspan mine, which includes moving its Holsloot processing plant to the site.

|

|

|

|

GENERAL

|

|

|

|

| |

Cartier Insists Walmart Not Authorized Distributor

Cartier

distanced itself from an

$18,000 diamond watch sold online by Walmart on Black Friday and said the department store is not one of its official retailers.

Walmart listed the Cartier Roadster XL Chrono men’s timepiece on its ecommerce

site with an advertised price roughly 60% off the manufacturer's suggested

retail price of $46,500. Cartier said it had no knowledge or involvement

in selling or marketing the item and could not confirm its authenticity.

Cartier

distanced itself from an

$18,000 diamond watch sold online by Walmart on Black Friday and said the department store is not one of its official retailers.

Walmart listed the Cartier Roadster XL Chrono men’s timepiece on its ecommerce

site with an advertised price roughly 60% off the manufacturer's suggested

retail price of $46,500. Cartier said it had no knowledge or involvement

in selling or marketing the item and could not confirm its authenticity.

|

| |

Richemont to Cut 211 Swiss Watch Jobs

Richemont

is on the cusp of another round of layoffs at its Swiss watchmaking operations

as demand for timepieces sank this year. The company plans to cut 211 jobs at

Piaget and Vacheron Constantin, Swiss trade union Unia said. This follows 300

layoffs across Piaget, Vacheron Constantin and Cartier in May, according to

Unia. Sales at Richemont’s specialist watchmakers slid 17% in the six

months to September 30, mirroring a decline in Swiss watch exports.

Richemont

is on the cusp of another round of layoffs at its Swiss watchmaking operations

as demand for timepieces sank this year. The company plans to cut 211 jobs at

Piaget and Vacheron Constantin, Swiss trade union Unia said. This follows 300

layoffs across Piaget, Vacheron Constantin and Cartier in May, according to

Unia. Sales at Richemont’s specialist watchmakers slid 17% in the six

months to September 30, mirroring a decline in Swiss watch exports.

|

| |

Bronstein to Lead Color Diamond Association

The

Natural Color Diamond Association elected Alan Bronstein of Aurora Gems (pictured) as

president, replacing JFine Inc.’s Jordan Fine in the position. Jose Batista of

Rio Diamond Corp. was voted in as vice-president, sharing the role with Breanne

Wittrock. Scott West of L.J. West Diamonds will take over the roles of

secretary and treasurer from Jeffrey Post of Gem Platinum. All members will start

their new positions in January.

The

Natural Color Diamond Association elected Alan Bronstein of Aurora Gems (pictured) as

president, replacing JFine Inc.’s Jordan Fine in the position. Jose Batista of

Rio Diamond Corp. was voted in as vice-president, sharing the role with Breanne

Wittrock. Scott West of L.J. West Diamonds will take over the roles of

secretary and treasurer from Jeffrey Post of Gem Platinum. All members will start

their new positions in January.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

After the U.S. market hit a record on Black Friday, retail stocks fell as early holiday sales data pointed to a shift away from physical stores to online shopping. Charles & Colvard (-11.4%), Macy's (-6%) and Nordstrom (-4.5%) led the declines, but Tiffany (+4.2%) gained on better-than-expected results. European and Far Eastern luxury stocks were solid, led by Hong Kong-based Chow Sang Sang (+4.5%). Indian industry stocks showed a limited recovery after recent slides following the government's clampdown on cash transactions, led by Gitanjali Gems (+14%). Mining stocks were mixed.

View the detailed industry stock report

| |

Dec 1 (13:54 GMT) |

Nov 24 (13:30 GMT) |

Chng. |

|

| $1 = Euro |

0.94 |

0.95 |

-0.01 |

|

| $1 = Rupee |

68.37 |

68.72 |

-0.34 |

|

| $1 = Israel Shekel |

3.83 |

3.88 |

-0.04 |

|

| $1 = Rand |

14.10 |

14.23 |

-0.13 |

|

| $1 = Canadian Dollar |

1.34 |

1.35 |

-0.01 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,168.52 |

$1,185.20 |

-$16.68 |

-1.4% |

| Platinum |

$904.75 |

$916.25 |

-$11.50 |

-1.3% |

| Silver |

$16.38 |

$16.32 |

$0.06 |

0.4% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

26,559.92 |

25,860.17 |

699.75 |

2.7% |

| Dow Jones |

19,123.58 |

19,083.18 |

40.40 |

0.2% |

| FTSE |

6,708.46 |

6,811.33 |

-102.87 |

-1.5% |

| Hang Seng |

22,878.23 |

22,608.49 |

269.74 |

1.2% |

| S&P 500 |

2,198.81 |

2,204.72 |

-5.91 |

-0.3% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Polished

trading quiet with dealers very cautious after rupee currency cancellation.

Domestic demand slow. Opportunistic foreign buyers looking for bargains during

liquidity crunch. Larger manufacturers with legitimate invoicing relatively

unaffected with steady U.S. orders. Rough demand stable since manufacturers returned

from Diwali break.

Read the Polished Diamond Trading Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|