|

|

Diamond Prices Firm Slightly with U.S. Optimism

Dec 6, 2016 5:00 AM

By Rapaport

|

|

|

RAPAPORT... PRESS RELEASE, December 6, 2016, New York … Diamond trading slowed in November as Indian liquidity dried up and manufacturing shut down for Diwali. U.S. jewelers completed their inventory purchases and focused on selling during the holiday season rather than buying from overseas suppliers.

Sentiment improved as the season began. Stock markets rallied to record highs on Thanksgiving weekend and the dollar strengthened after the surprise election of Donald Trump as U.S. President. Polished prices firmed despite slow dealer trading.

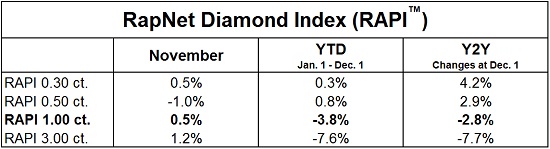

The RapNet Diamond Index (RAPI™) for 1-carat, RapSpec A3+ diamonds gained 0.5% in November. The index dropped 3.8% in the first 11 months of the year.

RapNet Diamond Index (RAPI™)

Copyright © 2016, Rapaport USA Inc.

According to the Rapaport Monthly Report – December 2016, India’s diamond industry came under pressure with a severe liquidity crisis after the government drastically reduced money supply by invalidating 500 and 1,000 rupee notes. Indian jewelry sales slumped and the slowdown is expected to continue as new currency gradually enters circulation. Diamond demand fell for lower-quality goods typically traded in rupee.

Rough trading was seasonally quiet with De Beers $470 million sight the smallest of the year. The major miners are controlling supply to avoid another 2015 rough bubble bust experience. De Beers rough sales increased 34% year to date and are projected to exceed $5.6 billion for the full year, from $4.1 billion in 2015.

Trading is shifting to the Far East ahead of the Chinese New Year with cautious demand after the yuan currency depreciated -2% to 6.88/$ in November. Buying is restrained as Hong Kong jewelry sales plunged and China remains weak with jewelers requiring less inventory. U.S. retailers are also managing with lower stock as pre-season third-quarter inventory was below last year’s levels.

With relatively positive expectations for the holiday period, retail inventory is projected to diminish in December. That should prompt stronger first-quarter trading as retailers replenish stock sold during the season. The trade must focus on profit rather than turnover as the jewelry retail sector continues to consolidate and jewelers are managing with less inventory.

The Rapaport Monthly Report can be purchased at store.rapaport.com/monthly-report

Rapaport Media Contacts: media@diamonds.net

U.S.: Sherri Hendricks +1-702-893-9400;

International: Gabriella Laster +1-718-521-4976;

Mumbai: Manisha Mehta +91-97699-30065

# # #

About the Rapaport RapNet Diamond Index (RAPI™): The RAPI is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. www.RapNet.com has daily listings of over 1.2 million diamonds valued at approximately $8 billion. Additional information is available at www.Diamonds.net.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added value services that support the development of fair, transparent, competitive and efficient diamond and jewelry markets. Established in 1978, the Rapaport Price List is the primary source of diamond price and market information. Group activities include Rapaport Information Services, Rapaport Magazine, and Diamonds.net, providing research, analysis and news; RapNet – the world’s largest diamond trading network; Rapaport Laboratory Services provides GIA gemological services in India, Belgium and Israel; and Rapaport Trading and Auction Services specializing in recycled diamonds and jewelry. The Group supports over 20,000 clients in over 120 countries and has offices in New York, Las Vegas, Antwerp, Ramat Gan, Mumbai, Surat, Dubai and Hong Kong. Additional information is available at www.Diamonds.net.

Martin Rapaport grants limited permission to use copyrighted data appearing in this press release in and in conjunction with journalistic copy, reporting or articles concerning diamond pricing and information in graph or data presentation format only. The following credit notice must appear alongside, underneath, or in close proximity to any use of the copyrighted data: “Used with permission of Rapaport USA, Inc. Copyright © 2016 Rapaport USA Inc. All rights reserved.” |

|

|

|

|

|

|

|

|

|

Tags:

Chow Tai Fook, De Beers, Demonetization, diamonds, India, Jewelry, Martin Rapaport, Rapaport, RAPI, RapNet, Rupee, Signet, Tiffany

|

|

|

|

|

|

|

|

|

|

|

|

|