|

|

Rapaport TradeWire January 26, 2017

Jan 26, 2017 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

January 26, 2017

|

|

|

Market hoping next week’s

Spring Festival will signal renewed growth in the Chinese jewelry market.

Diamond manufacturing increasing despite sluggish U.S. post-holiday demand.

Profit margins under pressure as rough prices rise at larger-than-expected

$720M De Beers sight. Miners anticipate strong rough market in 2017. ALROSA

plans 2017 production +6% to 39.2M cts. Petra Diamonds 1H sales +48% to $229M,

production +24% to 2M cts. De Beers 2016 sales volume +55% to 32M cts, average

price -10% to $187/ct., production -5% to 27.4M cts. Chow Sang Sang warns 2016

profit fell 30%-40%. Blue Nile unveils diamond buyback scheme. David Block to

replace Uzi Levami as Sarine CEO. |

|

| Diamonds |

1,259,990 |

| Value |

$7,588,402,271 |

| Carats |

1,341,632 |

| Average Discount |

-30.20% |

www.rapnet.com

|

|

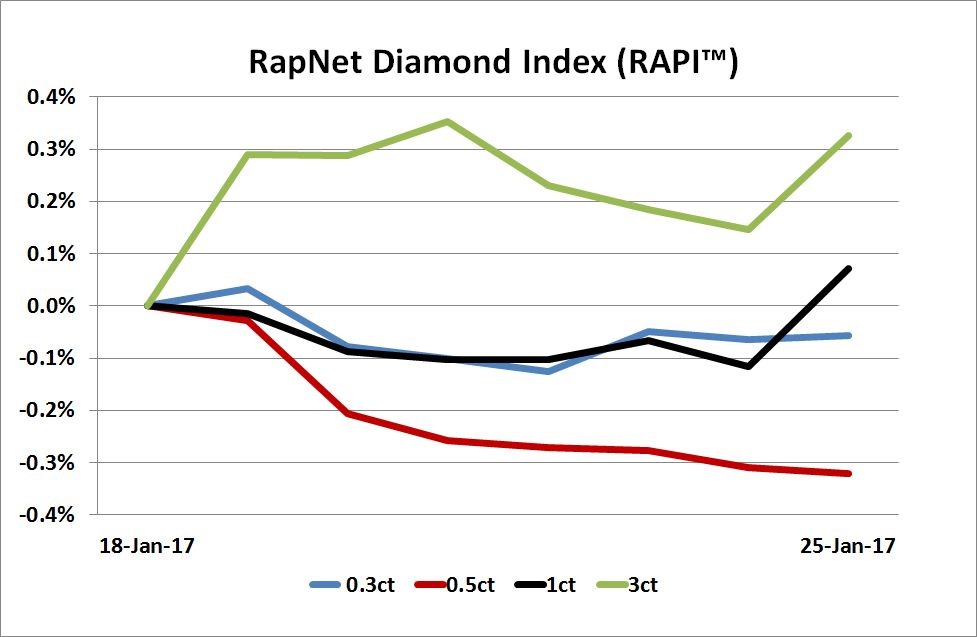

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

Sentiment has changed and continues to change. So luxury is interpreted in a different manner. Luxury is about giving happiness and pleasure but it can’t be ostentatious. It must convey class and style and it must transcend price.

Sentiment has changed and continues to change. So luxury is interpreted in a different manner. Luxury is about giving happiness and pleasure but it can’t be ostentatious. It must convey class and style and it must transcend price.

Roberto Coin, owner of his eponymous company, to Rapaport News at this week’s VicenzaOro fair.

|

|

|

|

MARKETS

|

|

|

|

| |

United

States: Trading relatively slow. Some buzz at India

Diamond Week in New York with dealers assessing available inventory and prices

rather than closing deals…

Belgium: Polished market quiet with rising concerns about

profitability following price increases at De Beers sight…

Israel:

Quiet market as dealer trading has slowed. U.S.

demand is order-specific while suppliers wait for larger post-holiday inventory

requests…

India: Polished trading cautious with buyers uncertain

about prices. Shortages in select categories but large volume of goods are in

production…

Hong

Kong: Dealer and wholesale markets quiet with most

companies on vacation for next week’s Chinese New Year festival (Jan. 28)…

Click here for deeper analysis |

|

|

|

INDUSTRY

|

|

|

|

| |

Rough Market Wakes Up at Large De Beers Sight

De

Beers rough-diamond sales jumped 32% to $720 million in January as

manufacturers restocked following the holiday season. The first sight is

traditionally strong after manufacturing slows during the November Diwali festival. It rises in the first quarter in anticipation retailers will

replenish inventory sold during the festive shopping period. The sight was the

largest sale since July 2014, according to Rapaport records, and prices

reportedly rose.

De

Beers rough-diamond sales jumped 32% to $720 million in January as

manufacturers restocked following the holiday season. The first sight is

traditionally strong after manufacturing slows during the November Diwali festival. It rises in the first quarter in anticipation retailers will

replenish inventory sold during the festive shopping period. The sight was the

largest sale since July 2014, according to Rapaport records, and prices

reportedly rose. |

| |

Blom Diamonds Set for $4M Takeover

Tychean Resources agreed to acquire 74% of Blom

Diamonds Cutting Works and Ernest Blom Diamonds for up to $4.1

million (AUD 5.5 million). Tychean will initially issue shares worth about

$206,352 (AUD 273,800), while additional

shares valued at $1.3 million will be granted in each of the next three years

if the diamond company meets pre-determined profit conditions. Founder Ernie

Blom (pictured), the current president of the World Federation of Diamond Bourses (WFDB),

will become managing director of Tychean when the deal closes.

Tychean Resources agreed to acquire 74% of Blom

Diamonds Cutting Works and Ernest Blom Diamonds for up to $4.1

million (AUD 5.5 million). Tychean will initially issue shares worth about

$206,352 (AUD 273,800), while additional

shares valued at $1.3 million will be granted in each of the next three years

if the diamond company meets pre-determined profit conditions. Founder Ernie

Blom (pictured), the current president of the World Federation of Diamond Bourses (WFDB),

will become managing director of Tychean when the deal closes.

|

| |

Sarine Appoints New CEO to Succeed Levami

Sarine

Technologies named David Block as its new chief executive officer after Uzi

Levami stepped down for personal reasons. Levami, who headed the diamond

technology company for eight years, will continue to serve as an executive

director at Sarine. Block (pictured) will take over on May 1, having served as the group’s

deputy CEO and chief operating officer since 2012. He played a key role in the

rollout of Sarine’s Galaxy inclusion-mapping systems.

Sarine

Technologies named David Block as its new chief executive officer after Uzi

Levami stepped down for personal reasons. Levami, who headed the diamond

technology company for eight years, will continue to serve as an executive

director at Sarine. Block (pictured) will take over on May 1, having served as the group’s

deputy CEO and chief operating officer since 2012. He played a key role in the

rollout of Sarine’s Galaxy inclusion-mapping systems.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Hong Kong’s Chow Sang Sang Warns on Profit

Chow

Sang Sang warned profit slumped 30% to 40% in 2016 due to a drop in

jewelry demand in China and Hong Kong. The company added the decline was

steeper because a one-off gain from a corporate deal inflated the jeweler’s

profit in 2015. Weak consumer sentiment and a drop in Hong Kong tourist

arrivals have dented sales at the region’s top jewelry chains over the

past two years.

Chow

Sang Sang warned profit slumped 30% to 40% in 2016 due to a drop in

jewelry demand in China and Hong Kong. The company added the decline was

steeper because a one-off gain from a corporate deal inflated the jeweler’s

profit in 2015. Weak consumer sentiment and a drop in Hong Kong tourist

arrivals have dented sales at the region’s top jewelry chains over the

past two years.

|

| |

Blue Nile Unveils Diamond Buyback Scheme

Blue

Nile launched a program allowing consumers to sell their diamonds to the online

retailer for cash. The service, developed with ecommerce specialist Mondiamo,

is currently only available in the U.S. and Canada. Mondiamo is using Blue

Nile’s live pricing data for GIA-graded diamonds to create a guaranteed

cash-price range presented to potential sellers. Customers are given a free,

insured shipping kit to submit their diamond jewelry for inspection and

evaluation, after which Blue Nile makes a final cash offer.

Blue

Nile launched a program allowing consumers to sell their diamonds to the online

retailer for cash. The service, developed with ecommerce specialist Mondiamo,

is currently only available in the U.S. and Canada. Mondiamo is using Blue

Nile’s live pricing data for GIA-graded diamonds to create a guaranteed

cash-price range presented to potential sellers. Customers are given a free,

insured shipping kit to submit their diamond jewelry for inspection and

evaluation, after which Blue Nile makes a final cash offer. |

| |

Samuel Aaron Jewelry Plant to Close

Richline

Group is shutting a jewelry-manufacturing plant in New York State following its

acquisition of The Aaron Group this month. The factory, located in Mount

Vernon, will close April 25, with all 42 employees being affected. Layoffs will

occur over 14 days beginning April 12. Richline will spend the next three

months working on plans to integrate employees, departments and facilities

following the merger, a spokesperson said.

Richline

Group is shutting a jewelry-manufacturing plant in New York State following its

acquisition of The Aaron Group this month. The factory, located in Mount

Vernon, will close April 25, with all 42 employees being affected. Layoffs will

occur over 14 days beginning April 12. Richline will spend the next three

months working on plans to integrate employees, departments and facilities

following the merger, a spokesperson said.

|

| |

Birks Inks Deal to Sell Diamonds in Asia

Montreal-based Birks Group has tied up with online

retailer Luxify to sell top-end polished diamonds to consumers in Asia. The

companies will offer rare diamonds of Canadian origin on the Luxify ecommerce

site, headlining the launch with the 35.11-carat, fancy dark yellowish-brown

‘Radiant North,’ described as the country’s largest colored diamond. The

partnership represents a shift into a new market for Birks as it

currently operates 46 jewelry stores across Canada and the U.S.

Montreal-based Birks Group has tied up with online

retailer Luxify to sell top-end polished diamonds to consumers in Asia. The

companies will offer rare diamonds of Canadian origin on the Luxify ecommerce

site, headlining the launch with the 35.11-carat, fancy dark yellowish-brown

‘Radiant North,’ described as the country’s largest colored diamond. The

partnership represents a shift into a new market for Birks as it

currently operates 46 jewelry stores across Canada and the U.S. |

|

|

|

MINING

|

|

|

|

| |

Higher Carat Sales Drive De Beers Growth

De

Beers sales volume grew 55% to 32 million carats in 2016 as lower rough

prices and depleted polished inventories stimulated demand. The increases

reflect improved trading conditions compared to the second half of 2015, De

Beers explained. In 2015, demand plummeted due to oversupply and inflated

prices, resulting in bloated rough-inventory levels at the company. Those were

reduced in 2016 as production fell 5% to 27.3 million carats. The company’s

average sales price dropped 10% to $187 per carat during the year.

De

Beers sales volume grew 55% to 32 million carats in 2016 as lower rough

prices and depleted polished inventories stimulated demand. The increases

reflect improved trading conditions compared to the second half of 2015, De

Beers explained. In 2015, demand plummeted due to oversupply and inflated

prices, resulting in bloated rough-inventory levels at the company. Those were

reduced in 2016 as production fell 5% to 27.3 million carats. The company’s

average sales price dropped 10% to $187 per carat during the year.

|

| |

ALROSA Targets Higher Rough Output

ALROSA is planning to raise production 6% to 39.2

million carats in 2017, underlining greater optimism in the diamond mining

sector. VTB Capital expects robust rough demand in the first half of 2017 will

support revenue-growth momentum at ALROSA. The bank projected the miner’s revenue will

increase 2% to $5.46 billion (RUB 323.33 billion) this year. ALROSA anticipates its production will

rise to 39.9 million in 2018 and peak at 41.5 million in 2019.

ALROSA is planning to raise production 6% to 39.2

million carats in 2017, underlining greater optimism in the diamond mining

sector. VTB Capital expects robust rough demand in the first half of 2017 will

support revenue-growth momentum at ALROSA. The bank projected the miner’s revenue will

increase 2% to $5.46 billion (RUB 323.33 billion) this year. ALROSA anticipates its production will

rise to 39.9 million in 2018 and peak at 41.5 million in 2019.

|

| |

Petra’s Rough Diamond Sales Sparkle

Petra

Diamonds revenue leapt 48% to $228.5 million in the six months that ended

December 31, due to mine expansions and a stable rough market. Sales by

volume jumped 47% to 1.9 million carats while prices on a like-for-like basis

were flat. The miner expects market conditions to remain steady in the current half-year.

Petra’s production jumped 24% to 2 million carats while a new processing plant

at the Cullinan mine will enable group output of up to 4.6 million carats this

fiscal year.

Petra

Diamonds revenue leapt 48% to $228.5 million in the six months that ended

December 31, due to mine expansions and a stable rough market. Sales by

volume jumped 47% to 1.9 million carats while prices on a like-for-like basis

were flat. The miner expects market conditions to remain steady in the current half-year.

Petra’s production jumped 24% to 2 million carats while a new processing plant

at the Cullinan mine will enable group output of up to 4.6 million carats this

fiscal year.

|

|

|

|

GENERAL

|

|

|

|

| |

Tough Year For Timepieces as Swiss Watch Exports Slide

Swiss watch exports slumped 10% to $19.45 billion (CHF

19.41 billion) in 2016 as demand continued to shrink in Hong Kong, the largest

market for the timepieces. The industry saw some improvement in December with

a gentler drop of 4.6% to $1.66 billion (CHF 1.66 billion). The exports were

buoyed by double-digit growth in orders from China and the U.S., the Federation

of the Swiss Watch Industry reported. Hong Kong remained sluggish, with

shipments to the municipality down 16% during the month.

Swiss watch exports slumped 10% to $19.45 billion (CHF

19.41 billion) in 2016 as demand continued to shrink in Hong Kong, the largest

market for the timepieces. The industry saw some improvement in December with

a gentler drop of 4.6% to $1.66 billion (CHF 1.66 billion). The exports were

buoyed by double-digit growth in orders from China and the U.S., the Federation

of the Swiss Watch Industry reported. Hong Kong remained sluggish, with

shipments to the municipality down 16% during the month.

|

| |

Swiss Gem Lab Launches U.S. Operations

Gübelin

Gem Lab, known for its expertise in colored gemstones, opened a lab in New York

as part of its global expansion and to enable greater participation in

U.S. trade fairs. The company has been laying the ground work for the launch

since 2015, and has become a member of the American Gem Trade Association

(AGTA). It will test gemstones on-site for the first time at the AGTA GemFair

in Tucson, which runs from January 31 to February 5.

Gübelin

Gem Lab, known for its expertise in colored gemstones, opened a lab in New York

as part of its global expansion and to enable greater participation in

U.S. trade fairs. The company has been laying the ground work for the launch

since 2015, and has become a member of the American Gem Trade Association

(AGTA). It will test gemstones on-site for the first time at the AGTA GemFair

in Tucson, which runs from January 31 to February 5.

|

| |

Stornoway Seeks New Finance Chief

Robert

Chausse has stepped down as chief financial officer of Stornoway Diamond

Corporation, just two months after the company launched operations at the

Renard mine in Canada. Chausse (pictured) served in the position for less than a year and

is leaving to pursue other career opportunities, Stornoway explained. The miner

intends to appoint a new CFO by March 1.

Robert

Chausse has stepped down as chief financial officer of Stornoway Diamond

Corporation, just two months after the company launched operations at the

Renard mine in Canada. Chausse (pictured) served in the position for less than a year and

is leaving to pursue other career opportunities, Stornoway explained. The miner

intends to appoint a new CFO by March 1.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

U.S. retail stocks gained as the Dow Jones Industrial Average broke the 20,000-point barrier for the first time. Birks Group (+26.5%) led the pack, continuing its rise since reporting strong holiday sales. Resurgent rough-diamond sales boosted De Beers parent company Anglo American (+3.3%), with investors also backing miners such as Lucara Diamond (+8.2%) and Gem Diamonds (+5%). European luxury stocks were mainly higher, headed by Damiani (+2.9%), while markets in India and the Far East were mixed.

View the detailed industry stock report

| |

Jan 26, 2017 (13:30 GMT) |

Jan 19, 2017 (13:05 GMT) |

Chng. |

|

| $1 = Euro |

0.93 |

0.94 |

0.00 |

|

| $1 = Rupee |

68.16 |

68.13 |

0.03 |

|

| $1 = Israel Shekel |

3.79 |

3.81 |

-0.02 |

|

| $1 = Rand |

13.35 |

13.60 |

-0.24 |

|

| $1 = Canadian Dollar |

1.31 |

1.33 |

-0.02 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,190.47 |

$1,204.98 |

-$14.51 |

-1.2% |

| Platinum |

$975.65 |

$966.35 |

$9.30 |

1.0% |

| Silver |

$16.87 |

$17.02 |

-$0.15 |

-0.9% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

27,708.14 |

27,308.60 |

399.54 |

1.5% |

| Dow Jones |

20,068.51 |

19,804.72 |

263.79 |

1.3% |

| FTSE |

7,178.49 |

7,212.14 |

-33.65 |

-0.5% |

| Hang Seng |

23,374.17 |

23,049.96 |

324.21 |

1.4% |

| S&P 500 |

2,298.37 |

2,271.89 |

26.48 |

1.2% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Polished trading cautious with buyers uncertain

about prices. Shortages in select categories but large volume of goods are in

production. Polished inventory projected to rise in time for Hong Kong show

(Feb. 28) after large De Beers sight. Manufacturing profit under pressure.

Market starting to acclimate to demonetization but small businesses still

cautious amid tight liquidity. Steady demand for 0.30 to 3 ct., D-H, SI,

RapSpec A3+ diamonds.

Read the Polished Diamond Trading Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|